- The best performing precious metal for the week was platinum, up 4.03%, perhaps on the prospects of supply disruptions from Russia. Barrick Gold Corp. exceeded its earnings estimates, raised dividends, and unveiled a share buyback program, writes Bloomberg. The Toronto-based miner capped a 10th straight quarterly earnings beat, increased its regular quarterly cash dividend by 11% and said its board authorized the repurchase of as much as $1 billion in common shares over the next 12 months.

- Royal Gold reported fourth quarter adjusted EPS of $1.05 versus consensus of $0.91. Cash flow from operations came in at $119 million versus consensus of $108 million with adjusted EBITDA at $135 million versus consensus of $129 million. The beat versus consensus was on higher royalty revenues, which came in at $57.9 million, with total revenues in the quarter at $168.5 million.

- Spot gold’s 50-day moving average climbed above the 200-day moving average after forming a golden cross last week. Tensions over Russia’s military buildup near Ukraine is buoying the yellow metal and palladium amid demand for havens and concerns over potential supply disruptions.

- The worst performing precious metal for the week was silver, but still up 1.43% on little news. Sibanye Stillwater’s biggest mining union voted to strike at the company’s gold operations until their wage demands are met, one of the groups said after a meeting. Members of the National Union of Mineworkers, the Association of Mineworkers and Construction Union, UASA and Solidarity, met in Carletonville, about 49 miles southwest of Johannesburg to discuss pay negotiations. The members rejected Sibanye’s offer to increase monthly wages by 700 rand ($46) in each of the next three years and are demanding 1,000 rand for the same period, said NUM spokesperson Livhuwani Mammburu.

- Pure Gold recently closed a C$31 million equity financing, which included AngloGold Ashanti raising its stake to 19.9% (from 14.9%) for a C$17 million contribution. The net impact of the transaction was dilutive with the additional cash offset by the increased shareholder dilution resulting in a 5% lower NAV per share.

- Osisko Gold Royalties and Northern Star Resources have agreed to terminate joint venture negotiations with respect to Osisko's Windfall Project. Osisko has determined that development of the Windfall Project on an independent basis would be optimal for the shareholders of Osisko. Some shareholders were expecting a transaction to materialize out of the negotiations, thus the share price slide.

Opportunities

- After more than a decade, Gold Fields Ltd. said a turnaround at its giant South Deep Mine is starting to pay off. South Deep is the third-biggest known body of gold-bearing ore and helped Gold Fields triple the net cash it generated in 2021 as production rose at the mine. Production from South Deep is expected to climb another 30%, reports Bloomberg.

- Demand for havens due to the tension between Russia and the West over Ukraine has put gold on the cusp of a bullish technical breakout. Bullion is now testing the upper end of a so-called contracting triangle pattern, and a break above a prior high of $1,877 an ounce would for some signal more strength ahead. Gold has also been boosted by inflation worries and is up about 4% in the past six months, a period when global stocks, Treasuries and Bitcoin -- touted by some as a digital alternative to the precious metal -- all fell.

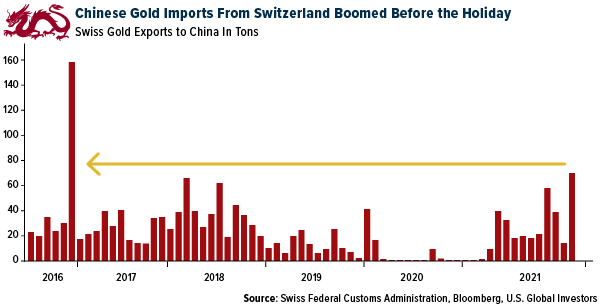

- Gold may be getting an extra boost from post-COVID buying as Swiss imports into China were the highest last year since 2016. Indian buyers nearly doubled their purchases in 2021 to 611 metric tons. A long-standing rule of thumb in India was that buying stopped at 30,000 rupees per 10 grams of gold; that now seems to be in the rear-view mirror as prices are hovering closer to 50,000 rupees per 10 grams. Unleashing the wave of suppressed buying has flipped the normally negative correlation between U.S. 10-year Treasury yields and gold to positive. Bloomberg columnist, David Ficking, noted that it is far from obvious that this rise in gold demand has played out. Retail sales of jewelry in China grew at the fastest rate since 2013 but are still below pre-COVID levels.

Threats

- French troops are pulling out of Mali trying to send a strong message to the military leaders who have been slow to restore civilian rule. French troops have been in Mali the past decade fighting Islamist militants. Bloomberg reports the power vacuum is being filled by a private Russian force that has been deployed to Mali in recent months. Mali is home to some major gold mines. Some have speculated that China may have played a role in the coup.

- Brazil's President Jair Bolsonaro has issued two decrees to drive gold prospecting with a focus on the Amazon rainforest, according to the texts published Monday in the official gazette. The Program to Support Development of Artisanal and Small- Scale Mining created by one decree aims to strengthen policies and stimulate best practices, according to the text. The Amazon “will be the priority region for the development of works,” it says. While the decree sounds job creating, these small-scale miners are typically not very well regulated and historically have used mercury to recover the gold.

- Kinross Gold provided its 2022 outlook, with production coming in slightly below consensus (and below the company's prior 2022 outlook), but the biggest delta is higher costs driven partly by inflation and lower production. Round Mountain's optimization program has encountered additional challenges at the Phase W west-wall, after pit-wall movement was detected in the first quarter of 2021. Longer term implications on Round Mountain remain unclear, with the optimization study now expected in the second half of 2022. In addition, future capital costs to build a mine to capitalize on the recent Great Bear transaction could see construction costs escalate.