Strengths

- The best performing precious metal for the week was spot gold, up 1.30%. The State Street SPDR Gold MiniShares fund added a net $163 million on December 7, bringing total assets up by 4.7% to 3.62 billion. Bloomberg notes the fund has attracted net inflows of $2.11 billion in the past 12 months.

- Zambia’s central bank signed gold purchase deals with a local unit of First Quantum Minerals, which produces gold as a byproduct at its copper mine in the country. The bank also signed a deal with a state-owned mining investment company that buys gold from small-scale producers, reports Bloomberg. The southern African nation plans to hold gold for the first time since 1995 to bolster foreign exchange reserves after defaulting earlier this year.

- Wheaton Precious Metals announced it will pay Capstone Mining $150 million for 50% of its silver production up to 10 million ounces. The royalty and streaming company will use its $2 billion revolving credit facility to fund the transaction, reports Kitco News. Wheaton is also in talks regarding a potential gold stream from Capstone. In its five-year outlook starting in 2021, the company said attributable silver produce is forecast to average 820,000 ounces per year.

Weaknesses

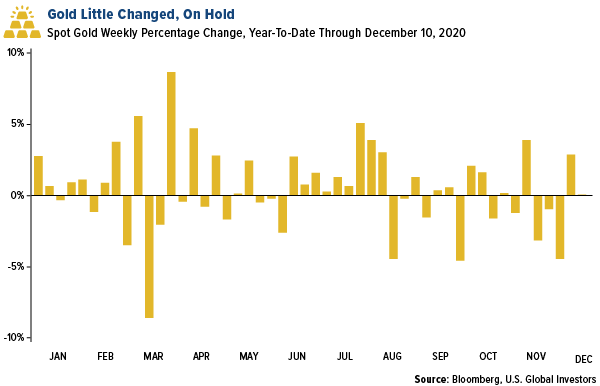

- The worst performing precious metal for the week was platinum, down 3.38% after a stellar 9.59% jump the previous week. Anglo American Platinum also announced its production level would return back to normal levels in 2021 following repairs at their refinery. Gold dropped from a two-week high on Wednesday as investors assessed renewed concerns over the progress of stimulus negotiations among U.S. lawmakers, reports Bloomberg. Spot gold fell to $1,840, while silver fell 2% and platinum and palladium also fell.

- ETFs backed by gold cut 45,912 troy ounces from holdings on December 7, marking the 11th straight day of declines, and bringing 2020 net purchases to 23.8 million ounces. According to Bloomberg data, total gold held by ETFs has still risen 29% so far this year to 106.7 million ounces.

- Morgan Stanley said in a note this week that it expects gold and other precious metals to come under pressure in 2021 as markets normalize and the yield curve steepens. The eventual tapering of U.S. monetary stimulus could weigh on gold and analysts see it trading in the $1,800s range for much of the year before moving lower in 2022.

Opportunities

- HSBC Securities says there’s still support from accommodative monetary and fiscal policies, as well as geopolitical risks, for gold’s rally next year. “The financial, economic, and health uncertainties generated by the Covid-19 pandemic and its aftermath are still likely to continue to support gold in 2021 and even 2022, albeit at a reduced level,” James Steel, chief precious metals analyst, said in a note this week.

- Although commodities could enter a “period of pause” this winter, Citigroup says the outlook across the complex looks robust in 2021 due to tightening market conditions across industrial metals. The bank predicts a gold rebound next year and says silver, palladium and platinum may end the year higher than current prices. Citigroup’s three-month gold price target is $1,850 an ounce and expects strong buying support on dips below $1,800.

- Morgan Stanley is bearish on gold in 2021, but it is bullish on silver. The bank expects silver to continue to outperform gold in the coming year due to strong growth in electronics and solar power.

Threats

- JPMorgan says the rise of cryptocurrencies into mainstream finance is coming at the expense of gold. Eddie Spence of Bloomberg writes that money has poured into Bitcoin funds and out of gold funds since October and believes the trend will only continue in the long run as more institutional investors take positions in cryptocurrencies. The Grayscale Bitcoin Trust has seen inflows of almost $2 billion since October, compared with outflows of $7 billion for exchange-traded funds backed by gold, according to JPMorgan.

- South Africa’s mining production in October fell 6.3% from a year ago and comes after a 3.4% drop in September. The median estimate in a Bloomberg survey was for a 4.7% contraction. Gold production dropped 3.9% and 1.1% in September. Production in what was once the world’s top producer has declined steadily for years. Platinum-group metals production did rise 2.4% in October after a 0.4% decline in September.

- Bloomberg reports that foreigners are using a gold ETF to pull cash out of Nigeria amid a dollar shortage. Portfolio managers buy the Newgold Issuer Ltd. ETF listed in Lagos, then transfer holdings to the fund’s primary listing in South Africa to sell for rands. According to Jolomi Odongharo, head of research at Cordros Capital, fear of devaluation and the opportunity cost of keeping money in Nigeria means investors are willing to take the loss when selling out.