Strengths

- The best performing precious metal for the week was gold, up just 0.08%. Gold headed for a weekly gain as investors turned to the haven asset amid concerns over the delta coronavirus variant and weaker economic data. A gauge of New York State manufacturing moderated in August after expanding at an unprecedented pace a month earlier, while a measure of selling prices advanced to a fresh record. Chinese retail sales and industrial output data showed activity slowed due to fresh lockdowns to contain the Covid-19 outbreak there. The data underscored broader concerns over threats to the global recovery from rising prices and virus cases, boosting bullion as a haven asset. Treasury yields and inflation-adjusted real yields also fell, increasing the metal’s appeal.

- Newcrest Mining Ltd., Australia’s largest gold producer, said annual profit rose 55% from a year earlier, with earnings driven by increased production and higher prices. Underlying profit rose to $1.16 billion in the year to June 30 from $750 million a year earlier. This was higher than the consensus of $1.1 billion.

- Aluminum in Shanghai surged to the highest close since 2008 after China’s pledge to cut energy intensity exacerbated supply concerns. China, which accounts for more than half of the world’s supply, is urging local governments to adopt strong measures to meet this year’s goal to reduce energy intensity, the National Development and Reform Commission said. The pledge came after 19 provinces including Qinghai, Ningxia and Guangxi missed their targets in the first half.

Weaknesses

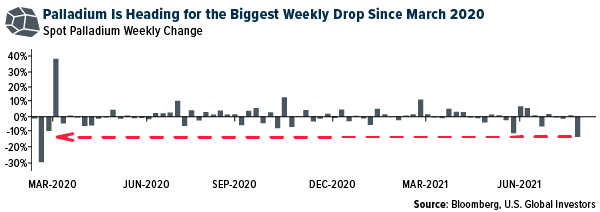

- The worst performing precious metal for the week was palladium, down 14.09%. Palladium headed for its biggest weekly decline since March 2020 as a shortage of automotive chips weighed on demand from carmakers. The metal, 85% of which goes into catalytic converters, was down about 13% this week.

- Gold shipments from Europe’s key refining hub fell to 94.1 tons last month from 125.9 tons in June, according to the Swiss Federal Customs. Swiss gold imports fell 16% to 141.2 tons. Exchange-traded funds continue to sell, bringing this year's net sales to 6.79 million ounces, according to data compiled by Bloomberg. The sales were equivalent to $177.2 million at the previous spot price. Total gold held by ETFs fell 6.3 percent this year to 100.3 million ounces.

- India’s new purity standards for gold could hurt demand from the second-biggest consumer just as demand is expected to rebound. Jewelers may find it difficult to fulfill orders during the peak festival season starting next month, as they are facing delays in getting their goods certified under the country’s new hallmarking standards.

Opportunities

- Palantir Technologies said it’s preparing for another “black swan event” by stockpiling gold bars and inviting customers to pay for its data analysis software in gold. The company spent $50.7 million this month on gold, part of an unusual investment strategy that also includes startups, blank-check companies and possibly Bitcoin. Palantir had previously said it would accept Bitcoin as a form of payment before adding precious metals more recently. This could set a trend where CIOs of companies may consider some excess cash in bullion as a way to hedge against broad risks in the economy and inflation gains relative to no real returns on cash or the volatility of cryptocurrencies.

- Gold Fields Ltd. is looking at acquiring assets to replace depleting mines as the company’s new chief executive officer seeks to ensure that output doesn’t decline from a projected peak in three years. A new Chilean operation starting in 2023 plus increasing production from its last South African mine will help the Johannesburg-based producer lift output to 2.7 million ounces by 2024. Gold Field’s dilemma is how to find an asset that the market has not priced correctly. Gold Fields has operations in Africa, South America and Australia and may consider these jurisdictions first.

- Rio2 Limited and Sixth Wave Innovations Inc. entered a contract for further testing of Sixth Wave’s patented IXOS purification polymer to replace carbon in a traditional Carbon-In-Leach (CIL) circuit for recovering the gold. These engineered polymer beads can be reused multiple times whereas the carbon has a shorter recycling life. This IXOS polymer beads can potentially works better by faster absorption efficiency, quicker elution times, and overall absorption kinetics.

Threats

- Teck Resources is suspending its Highland Valley mine in south-central British Columbia due to the wildfire evacuation order. National Bank’s Shane Nagle said the mine contributes 9% to the company’s net-asset-value estimates and the news is a “modest negative” for the stock.

- American Gold & Silver continues to be beset by delays. Relief Canyon continues to struggle with carboniferous ore on the pad, producing only 1,200 ounces in the quarter. To conserve capital, the company is suspending operations until a new path forward can be determined. The Cosalá operation remains under a blockade, and there may not be a restart of operations until 2022.

- Dominic Schnider, head of commodities at UBS Wealth Management, thinks gold and silver could drop closer to $1,600 and $22 an ounce, respectively, in an improving global outlook. Schnider cited the precious metal platinum as a better investment due to industrial demand. In contrast, Goldman Sachs forecasts $2,000 and $30 per ounce for gold and silver, respectively, by year-end.