Strengths

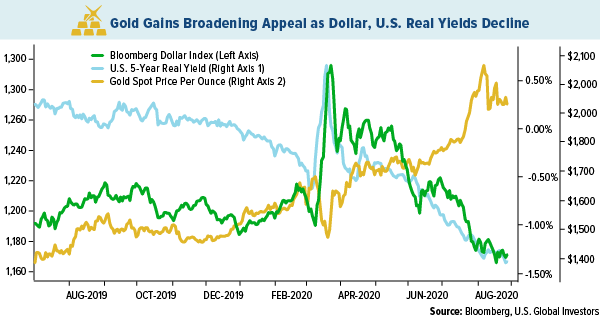

- The best performing precious metal for the week was silver, up 2.66 percent as money managers raised their bullish positions to a five-week high in the futures market this past week. Gold and silver recovered on Friday after a volatile Thursday. Traders appear to be following the “inflation trade” that was reignited following Fed Chairman Jerome Powell’s dovish speech on monetary policy. The Fed is targeting inflation that averages 2 percent over time and won’t hesitate to act if consumer prices rise considerably above its goals. As seen in the chart below, gold has gained over the last 12 months as both the dollar and the yield on five-year Treasuries have declined.

- The biggest Indian jeweler IPO could be in the works. Kalyan Jewellers India Ltd., a Warburg Pincus-backed company, said it plans to raise $235 million or 17.5 billion rupees. The company is remaining bullish on Indian gold jewelry demand even in the face of weakened consumption during the pandemic. Kalyan said about 10 million weddings take place annually in India, which creates demand for as much as 400 tons of gold in the form of jewelry. Turkey is set for a record year of gold output that the country’s central bank will likely buy in its entirety. Production is set to increase 16 percent to 44 tons, according to the Turkey’s Gold Miners Association. Bloomberg notes that legislation introduced in 2017 gives the central bank the right of first refusal to buy gold mined locally at prevailing market prices.

- Sibanye Stillwater said it will pay an interim dividend of $79 million, its first in three years, after a surge in precious metal prices, reports Bloomberg. CEO Neal Froneman said “with restriction on economic activity relaxing globally, the outlook for precious metals prices is constructive.” Shandong Gold reported net income for the first half of 2020 of 1.15 billion yuan – a whopping 98 percent increase year-over-year. Revenue for the first six months was 33.1 billion yuan.

Weaknesses

- The worst performing precious metal for the week was platinum, but still up 1.14 percent. Despite hedge fund managers cutting their bullish positioning to a six-week low, investors have been adding significantly to the exchange listed physical platinum ETFs over the course of the summer months. Gold fell on Wednesday after the surge in U.S. new home sales and decreased U.S.-China trade tensions outweighed inflation expectations, reports Bloomberg. The metal had a wild trading day on Thursday with prices $30 higher at one point and down $25 at other, reports Kitco, after Fed Chairman Powell’s comment about letting inflation run hotter, however the metal shortly slumped on recognition the Fed provided no credible plan on how they would lift inflation.

- India’s gold jewelry and retail investment demand will slump to just 350 to 400 tons in fiscal year 2021, according to UBS Group. The second-largest gold consuming nation is likely facing its worst ever recession due to the pandemic and consumption is unlikely to record to normal levels anytime soon. The UBS report says India consumed 633 tons in 2020.

- De Beers, the world’s top diamond producer, has decided to cut the price of its gems in hopes of sparking sales amid the paralyzed industry. Bloomberg reports that De Beers cut the price of rough diamonds bigger than one carat, a size that would usually yield a polished gem of about 0.3 carat size. Largest stones had price cuts of almost 10 percent. Russian diamond miner Alrosa PJSC is also cutting prices, but the billing system has changed so buyers can’t tell which stones are discounted or by how much.

Opportunities

- Nomad Royalty is buying Coral Gold Resources in a deal valued at $45.8 million. Nomad also announced this week that it is acquiring a cash flowing royalty on the Moss gold mine in Arizona through the acquisition of Valkyrie Royalty Inc for $7.6 million. Brixton Metals Corp is acquiring a 100 percent interest in the Metla mineral claim group from Stuhini Exploration in Canada – expanding its existing Thorn project.

- Mint Innovation, a New Zealand start-up company, plans to open a refinery in the U.K. for extracting precious metals from electronic waste. Bloomberg reports this would be the world’s first commercial operation to use bacteria rather than cyanide-based processes to recycle precious metals from electronics. A United Nations report found that at least $10 billion of gold, platinum and others were thrown away every year in e-waste.

- Nicholas Johnson, portfolio manager at Pacific Management Co., says gold still has room to run. “Despite the recent run-up in gold prices, we believe gold remains attractively valued – one might even say cheap – in the context of historically low real interest rates.” Johnson says that with yields on 10-year Treasuries below zero, it strengthens the value on non-yielding bullion.

Threats

- Russian gold miner Polymetal said operations at its hub in Omolon have been suspended temporarily due to the virus as one-third of workers tested positive. This serves as a reminder that the pandemic remains a threat globally. Despite that negative headline, the company reported H1 revenue up 21 percent and is on track to meet its 2020 production guidance of 1.5 million ounces.

- Ghana’s former President John Dramani Mahama said he will reverse the establishment of the country’s gold royalty fund if he regains power in the country’s December election. Mahama said the fund is a “very shady deal” and the fund would benefit just a few people.

- More businesses are facing the grim reality of having to let employees go during the pandemic. MGM Resorts is laying off 18,000 of its 62,000 furloughed workers. Coca-Cola is offering buyouts to 4,000 employees and noted layoffs could be coming. Capital One Financial is cutting borrowing limits on credit cards, limiting its exposure as the U.S. reduces support for millions of unemployed Americans. Five months after Peru reported its first Covid-19 it overtook Belgium as the nation with the most deaths. Their Deputy Health Minister noted the number of deaths is probably closer to 50,000 versus the official tally of 25,648 on Thursday.