Strengths

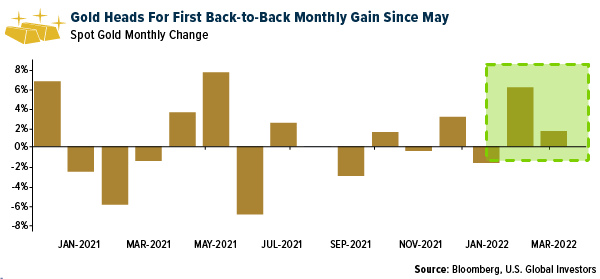

- The best performing precious metal for the week was gold, but still off 1.70%. As seen in the chart below, gold is heading for its first back-to-back monthly gain since May 2021. Seven out of the top 10 gold producers beat analysts' normalized earnings per share (EPS) expectations for fourth quarter 2021, according to an assessment by S&P Global Market Intelligence. The best quarterly performer among 10 selected top gold miners was Saudi Arabian Mining Company, with actual fourth-quarter 2021 EPS 33.9% higher than S&P Capital IQ mean consensus estimates. Saudi Arabia's state miner reported a record net profit of 5.23 billion riyals for 2021, after two years of losses.

- Total known ETF holdings of gold surged 5.30% in March to over 105.7 million ounces with the onset of the Russian invasion of Ukraine and are up 8.06% in total for the first quarter of 2022. Sales by the U.S. Mint of American Eagle gold coins surged 74% to 155,500 ounces in March compared to February and noted annual year-over-year sales were up 3.5% in the first quarter.

- Polyus Finance PLC, the U.K. finance arm of Russian gold miner Polyus PJSC, said on Wednesday that the Bank of New York Mellon confirmed the release of the payment of the main amount and coupon for Eurobond due March 28, reports MarketWatch. The Russian gold miner said it has the intention to comply with its debt obligation in time.

Weaknesses

- The worst performing precious metal for the week was palladium, down 5.07% and back to pre-Ukraine invasion levels. Pure Gold Mining Inc. said that it is seeking additional financing in the next 30 days to fund operations and service interest on its debt, and that it requires around $50 million in external financing over the next six months. The company said that if the additional financing were not received in the short term, it would not be able to meet its obligations, resulting in a default.

- St. Barbara (SBM) dropped as much as 4% after its fiscal year 2022 gold guidance for its Simberi operations in Papua New Guinea missed analysts’ expectations. SBM sees full year gold production of 275,000 to 290,000 ounces. The miner expects Simberi to produce 25-30,000 ounces of gold at an AISC A$3,200-A$3,600 per ounce. The target falls short of consensus expectations for 38,000 ounces at A$1,886 per ounce.

- Sibanye Stillwater slid as much as 8.6%, the most in over a month, as platinum and palladium prices dropped. The stock was downgraded to “hold” by HSBC as a result.

Opportunities

- Negotiations with the Kyrgyz government over Kumtor continue to move forward, following reports over the last several months; however, a final agreement is not done yet. Any deal may include the cancellation of 77 million Centerra Gold shares (26%) that the Kyrgyz government controls.

- Although a sharp slowdown in global growth would be a temporary headwind for mining equities, the commodity cycle will not die until supply growth comes, and that is years away, Jefferies says. The U.S. bank expects the mining sector to continue to materially outperform the market, driven by an expansion of what are currently extremely low price-to-earnings ratios. "Our base case assumption is that commodity markets will enter a demand soft patch soon, but we believe the risk to this is increasingly to the upside. The best idea, in our view, is to stay long and ignore the volatility, if possible," Jefferies says.

- The gold industry is betting that the blockchain will help to keep illicit bullion bars out of the international market. The London Bullion Market Association (LBMA) and World Gold Council (WGC) are developing a digital system to track gold through the supply chain, the organizations said in a joint statement on Monday. Using a blockchain-backed ledger, the Gold Bar Integrity Program will capture the transaction history of bullion from mine to vault, they said.

Threats

- Global mining capital expenditure is at prior recessionary levels when adjusted for the size of the industry today and remains far below the peak levels of 2011-2013 despite record-high prices for most mined commodities and strong balance sheets, Jefferies says. The U.S. bank attributes this to geopolitical risks, a rising cost of capital, ESG constraints, a lack of quality projects, the recognition that supply growth kills prices and pressure from shareholders to use cash for capital returns.

- Traders have priced in a full 200 basis points (bps) of additional interest rate hikes in 2022. According to Bloomberg, the shift came after an economist at Citigroup predicted that multi-decade high inflation would trigger the Federal Reserve to boost its rate hikes to 50 bps at each of the next four meetings. Consumers’ long-run inflation expectations were last at 3% in March, as measured by the University of Michigan, relative to current one year inflation expectations of 5.4%.

- Kinross previously reported the suspension of its Russian operations on March 2. The potential monetization of this portfolio may enable the company to realize economic value and provide closure to Kinross’ uncertain long-term business outlook in-country. According to The Fly, Kinross is in exclusive talks with Fortiana Holdings, but it is unclear what risks and challenges may be associated with this divestiture plan under current sanction conditions, and Kinross notes that any divestiture agreement would require Russian government approval.