Strengths

- The best performing precious metal for the week was palladium, but still off 0.17%. The average risk score for Scotia’s coverage list of gold companies has improved over the last decade from 56 (out of 100) in 2011 to 64 (out of 100) today. Despite the companies entering new jurisdictions over this timeframe, portfolios have been upgraded with an increasing number of asset acquisitions and mine builds in lower-risk jurisdictions (and asset sales in higher-risk jurisdictions). Lower-risk jurisdictions now make up 40% of NAV, while higher-risk jurisdictions make up only 36% of NAV.

- The central bank of Tanzania has already bought and refined 418 kilograms of gold, according to an emailed statement. The bank is buying the precious metal from artisans, mid-sized and large-scale miners.

- Ghana’s central bank has bought about 13.7 tons of gold, as part of metals buying for reserves and to support oil imports, Bank of Ghana Governor Ernest Addison told reporters in the capital, Accra.

Weaknesses

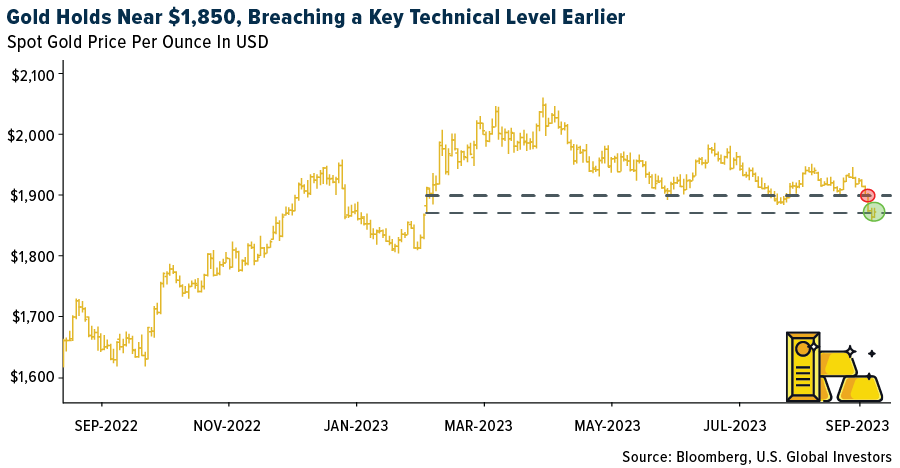

- The worst performing precious metal for the week was silver, down 6.12%, as expected, with the fall in gold. The yellow metal experienced its biggest weekly decline in more than a year as the dollar rallied and bond yields gained amid speculation that central banks will keep interest rates elevated for longer to rein in inflation. A gauge of greenback strength rose for a fourth day, soaring to the highest level this year, while a selloff in the bond market saw 10-year Treasury yields hitting the highest level since October 2007.

- ETFs backed by gold are now on track for the biggest weekly outflow since June. According to Bloomberg, Blackrock Inc.’s iShares Gold Trust saw a particularly large outflow of 13 tons of gold this week. In contrast to some investors leaving gold ETFs, reports from Bloomberg show that Costco is now selling 1 ounce gold bars. The retailer limits their member purchase to just two bars, but the company’s CFO says they typically sell out “within a few hours,” upon delivery.

- According to RBC, Sandstorm announced a restructuring of its two Mercedes stream agreements with the operator, Bear Creek Mining. Combined, these streams represent 5% of SAND’s NAV and 12% of EBITDA. Revised terms are negative to SAND and reduce the company’s projected cash flow for debt repayment, partially offset by improved Mercedes clarity and financial positioning for the operator. RBC’s analysis outlines that revised terms could reduce SAND NAV by 2% and 2024E/25E corporate EBITDA by 10%.

Opportunities

- JPMorgan forecast global mined silver production growing by just 0.8% year-over-year in 2023, marking a second consecutive year of around 1% year-over-year growth. Amid this relatively constrained supply backdrop, the bank expects silver demand to outpace supply for the third consecutive year in 2023. Overall growth in industrial applications of silver this year has been insulated by continued strong demand from photovoltaics.

- K92 Mining has secured a $100 million loan from commodities trader Trafigura and amended a deal for the copper and gold concentrates

produced at K92's Kainantu mine in Papua New Guinea. The loan will have a four-year term from the data when the first advance of funds is made, includes competitive interest rates and a one-year interest-only repayment grace period. The loan from Trafigura will be secured by, among other things, a charge over the assets of K92 Mining's Papua New

Guinea subsidiary and a pledge of shares, the company said. - According to Stifel, current precious metal company valuations (especially junior names) are near record lows and present a compelling entry point for investors looking to capture long-term value. The GDXJ is 4 standard deviations below the level implied by a 10-year daily regression with the gold price primed for a re-rate as precious metals come back into vogue through the next part of the market cycle.

Threats

- Through year-end, shifting JPMorgan views of higher-for-longer U.S. real yields and a supported dollar will likely continue to keep gold prices subdued. Yet, as the bank ultimately expects the Fed to remain on hold, it believes gold will remain resilient as its reduced sensitivity to higher yields and a stronger dollar continues to insulate it from significant and sustained bearish pressure in the near-term.

- Gold has been holding up relatively well in the face of rising bond yields and dollar strength, but that may not last if Chinese investors slow purchases of the metal. Demand in China has been strong enough to lift prices in Shanghai well above those for gold in London or New York. Domestic sales of gold bars and coins increased 30% from a year ago, which suggests investment is the main purpose of the buying. Meanwhile, holdings of gold in ETFs have been sliding since June, which has undermined the spot price.

- According to BMO, Lucara’s CEO, William Lamb, has announced the company’s first big decision was exercising the right to terminate the HB Antwerp agreement citing material breach of financial commitments. The HB Antwerp agreement termination, in their opinion, is one of the first in several strategic decisions that they expect from the company under Mr. Lamb who was appointed on the back of the cost escalation and schedule delay with the Karowe underground project. While Mr. Lamb brings strong experience and familiarity with the Karowe operation, the underground development presents a new challenge alongside rebuilding confidence among investors and lenders.