- The best-performing precious metal of the week was silver, up 11.80%. Prices set a fresh record, closing above $80 per troy ounce for the first time. Gold and silver miners raised the most cash through share sales in more than a decade last year, led by smaller players as prices rallied. More than $6.2 billion was raised by companies listed in the U.S. and Canada, according to Bloomberg.

- Central banks bought nearly as much gold in late 2025 as they did in the first eight months of the year, surpassing ETF purchases and signaling continued support for bullion in 2026 despite high prices. The World Gold Council reported net purchases of 45 tons in November alone, bringing total buying for September through November to 137 tons, just below the 142 tons purchased from January through August 2025, according to Bloomberg.

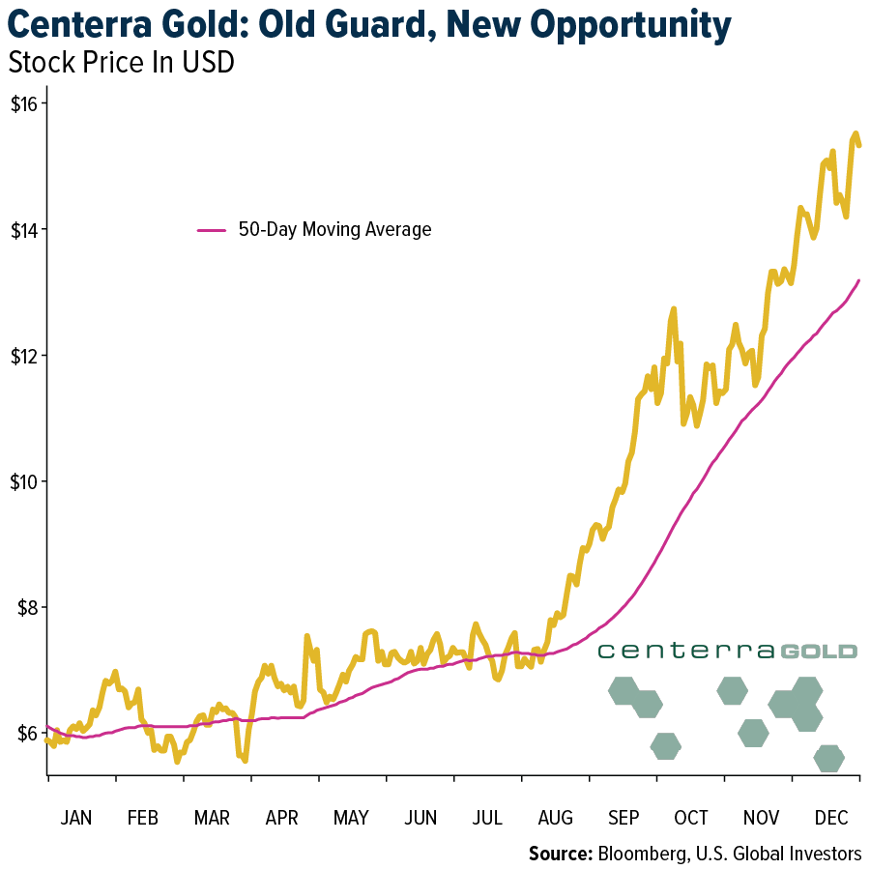

- Centerra Gold Inc., a bellwether producer focused on organic and inorganic growth, reinforced its exploration optionality by exercising its top-up right in Dryden Gold Corp., funding district-scale drilling while maintaining a 9.99% stake. The move comes ahead of Centerra’s fourth-quarter 2025 results and 2026 guidance on February 19, positioning Dryden as a leveraged exploration opportunity within a well-capitalized senior producer heading into a catalyst-rich 2026.

Weaknesses

- The weakest-performing precious metal of the week was gold, though it still gained 3.89%. Gold posted a modest advance, trading up to $4,514 per ounce as mixed U.S. jobs data tempered expectations for an immediate Federal Reserve rate cut. Traders continue to price in two cuts for 2026, while geopolitical tensions and central bank buying remain supportive, reinforcing gold’s role as a safe-haven asset.

- Newmont reported damage from bushfires to a portion of the water supply infrastructure at its Boddington operations in Western Australia. The company expects the infrastructure to be fully restored by February, with an estimated impact of 60,000 ounces of gold production in the first quarter of 2026, according to Bloomberg.

- Endeavour Silver reported fourth-quarter 2025 silver production of 3.8 million ounces, below its estimate of 4.2 million ounces. Lower-than-expected output from its Mexican mines, Terronera, Guanaceví, and Bolañitos, more than offset a strong quarter at the Kolpa mine in Peru, according to Raymond James.

Opportunities

- Silver has become a strategic commodity under China’s tightening export controls, with the Ministry of Commerce now requiring two-year special licenses for exports of silver, tungsten, and antimony. While supply restrictions support prices after last year’s strong rally, the outlook is complicated by China’s solar industry shifting toward silver-light and silver-free photovoltaic technology, as manufacturers substitute base metals to relieve margin pressure from overcapacity.

- According to Bank of America, with gold prices at record highs, a substitution of just 1 percent of gold jewelry demand could increase the platinum deficit by nearly one million ounces, or about 10 percent of annual supply. In the second half of 2025, the launch of physically backed platinum and palladium futures contracts by the Guangzhou Futures Exchange has provided additional price support.

- Gold should continue to rally as the purchasing power of paper currencies weakens, according to Evy Hambro, BlackRock’s global head of thematic investing, speaking on Bloomberg TV. He noted that accelerating currency depreciation, combined with rising geopolitical risks, is likely to support gold and other precious metals.

Threats

- From a fundamental perspective, Bank of America expects total gold production in 2026E to be 2% lower, at 19.2 million ounces, across the 13 North American precious metals stocks in its coverage. The firm believes consensus estimates are about 2% too high for 2026E production, creating a near-term headwind. For these 13 stocks, Bank of America forecasts average all-in sustaining costs rising 3% to $1,600 per ounce in 2026E.

- As silver prices reach multi-decade highs, a senior mining analyst is warning against rising investor exuberance, particularly in the junior mining space. Speaking on the Resource Talks podcast on Saturday, Joe Mazumdar, a senior mining analyst at Exploration Insights, said he has become increasingly uneasy with how some investors are valuing silver companies, citing what he described as overly simplistic assumptions.

- Donald Trump’s latest threats toward Mexico, framed around cartel crackdowns and potential unilateral action, are rattling business leaders and raising concerns about economic disruption across North America. Mexico is the world’s largest silver producer and home to many U.S.- and Canadian-listed miners, making any deterioration in U.S.-Mexico relations a direct risk to supply chains and investor confidence. Tariff threats and geopolitical tension could strain the United States-Mexico-Canada Agreement framework, amplify trade uncertainty, and inject volatility into silver markets, where restricted supply and elevated demand have already driven sharp price moves.