Strengths

- The best performing precious metal for the week was platinum, though still off 1.76%, as speculators flip back to net short this week. Shipments of gold from Europe’s key refining hub rose to 127.0 tons last month with U.S. shipments jumping by 2,303% to 81.5 tons. Russian gold imports into Switzerland fell to zero for the first time in a decade with sanctions choking their access.

- Exchange-traded funds (ETFs) added 37,967 troy ounces of gold to their holdings in the last trading session, bringing this year's net purchases to 9.19 million ounces, according to data compiled by Bloomberg. This was the sixth straight day of growth. The purchases were equivalent to $73.3 million at the previous spot price. Total gold held by ETFs rose 9.4% this year to 107 million ounces, the highest level since February 5, 2021.

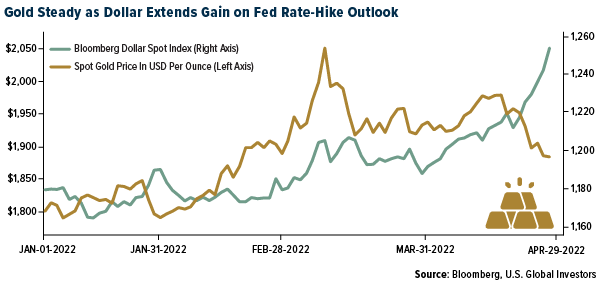

- Although gold dropped to its lowest level since February as the dollar’s rally continues, the yellow metal managed to remain little changed as we close out the week, reports Bloomberg. Following the U.S. economy contracting in the first quarter of 2022, gold pushed back into positive territory, attracting some new bullish momentum, writes Kitco News.

Weaknesses

- The worst performing precious metal for the week was palladium, off 6.99% as speculators push their net short position to a three-month high. Raymond James slightly reduced its earnings per share (EPS) for Newmont for 2022, from $3.41 to $3.33. Newmont’s 2022 attributable gold production forecast is still 6.2 million ounces at cash costs of $1,050 per ounce. However, given first quarter operating challenges, the mining company did indicate it could lose as much as 100,000 ounces (mostly Ahafo) of production. In addition, the company continues to experience inflationary pressures, so costs could be higher than forecast.

- Trevali Mining Corporation provided an update on search and rescue efforts for eight missing workers, as well as progress made on mine rehabilitation and dewatering at the Perkoa Mine in Burkina Faso (following intense rainfall that occurred in the early morning of April 16, resulting in flooding of the mine). The eight workers remain unaccounted for following the evacuation of the underground area of the mine and the Company is collaborating closely with Burkinabe authorities as search and rescue efforts continue. Mining and milling operations at Perkoa will remain suspended for the near future as the Company investigates the cause of the flood event.

- Gold’s slide amid China’s worsening COVID outbreak indicates that energy matters more than yields right now. The yellow metal is down, even though real yields are lower again, after briefly turning positive last week. Lower real yields historically lead to higher gold prices, as they represent the opportunity cost of holding a non-interest-bearing asset like bullion. Though the dollar’s rally on risk-off sentiment partly explains why gold is lower, one should not discount the effect of the slump in other commodities like oil.

Opportunities

- On April 25, Kinross Gold announced it sold its 90% stake in the Chirano mine for $225 million to Asante Gold. The $225 million total consideration consists of $115 million cash and $50 million Asante shares upfront, and $60 million in deferred cash over two years. Kevin MacKenzie of Canaccord Genuity initiated coverage of Asante on April 14 and summaries the pending transaction as well as the positive outlook he sees for a new producer in West Africa with a proven management team.

- The yen’s swift collapse to a two-decade low, plus a resilient showing from gold, have combined to lift bullion prices in the Japanese currency to an all-time high. The traditional haven now costs almost a quarter-of-a-million yen per ounce, up 18% this year. “In the past, Japanese investors have taken advantage of higher gold prices, selling to lock in profits,” said Andrew Naylor, regional chief executive officer for APAC, ex-China, and Public Policy at the World Gold Council. “This is especially the case for older investors.”

- The first ever exchange-traded product combining Bitcoin and gold has launched in Europe, writes Mining.com, offering the twin prospect of long-term returns and inflation protection, at least in theory. The novel fund aims to bring together “the best of the old and new worlds of finance” by betting on the portfolio hedging power of gold along with the “strong” returns of the most well- known crypto token, the issuing parties said in a statement. The physically backed index product is known as 21Shares ByteTree BOLD ETP (ticker: BOLD).

Threats

- Polymetal International Plc, a London-listed gold miner operating in Russia, said it is avoiding selling to the country’s banks as they will only buy at a discount. While sanctions on state-run lenders have already choked off Polymetal’s traditional sales routes, the company is able to sell to non-sanctioned banks. Yet those institutions are now only purchasing gold at a discount to international prices, pushing the miner toward shipments abroad.

- Palladium traded lower at $2,101.24 an ounce toward the end of the week, after earlier dropping to the lowest level since March 29. “It’s not a palladium-specific move,” said Nicky Shiels, head of metals strategy at MKS PAMP. “It’s just playing catchup to the broader commodities selloff as demand fears ramp up.”

- MAG Silver continues to wait on approval for the final grid power tie-in from the Mexican energy regulator, which could be delayed. Production is still expected to be at 85-90% capacity at the Juanicipio JV by the end of the year. However, one must be cautious about this timeline given that Fresnillo's Saucito operation is experiencing similar delays which have persisted for more than a year.