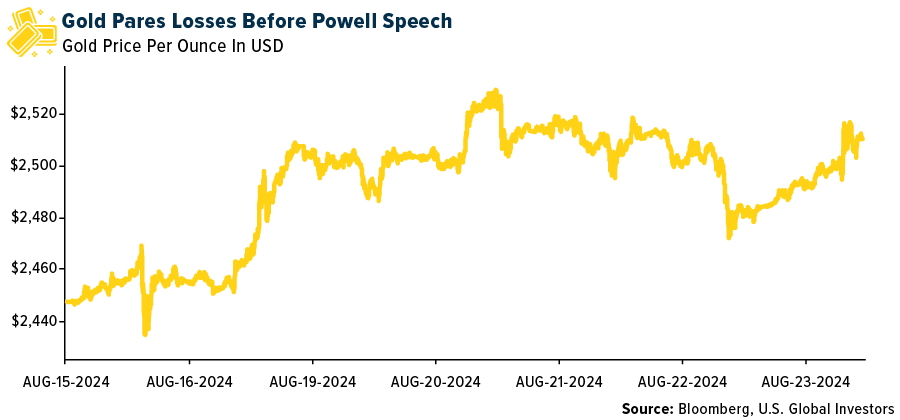

- The best-performing precious metal for the week was silver, up 3.52% on expectations of stronger demand, with India nearly doubling solar imports this year, cites Bloomberg. Gold climbed back above $2,500 per ounce after Federal Reserve Chair Jerome Powel signaled that the time has come for interest-rate cuts. TD Securities Bart Melek, global head of commodity strategy, expects bullion to rise further to more than $2,700 in the coming quarters.

- For the first time ever, a bar of gold is worth a cool one million dollars. The milestone was reached when the precious metal’s spot price surpassed $2,500 per troy ounce, an all-time high. With gold bars typically weighing about 400 ounces, that would make each one worth more than $1 million, according to Bloomberg.

- According to BMO, Lucara Diamond reported that it has recovered a 2,492-carat diamond from its Karowe mine in Botswana. It is too early to comment on its value. Depending on the value of the diamond, the potential sale proceeds could provide much-needed balance sheet flexibility and surplus cash flow for the company's ongoing underground expansion project.

Weaknesses

- The worst-performing precious metal for the week was palladium, but still up 0.52%. SSR Mining’s Anagold Madencilik announced an employment reduction due to the long-term impact of the February 2024 landslide at their Copler gold mine, according to Bloomberg. A spokesman tells Bloomberg that 187 out of 610 employees have been terminated.

- Gold Fields fell the most in 10 weeks after cutting its production guidance for a second time in three months. Operational challenges in Chili with severe weather at their open pit mine, high in the Andes Mountains above 4,000 meters (13,000 feet), has slowed operations, and challenges at their South Deep Mine in South Africa were headwinds. The company noted their all-in-costs rose by almost 50% to $2,060 per ounce in the first half, as reported by Bloomberg.

- Regis Resources has announced that a declaration of protection under Section 10 of the Aboriginal and Torres Strait Islander Heritage Protection Act 1984 has been made over part of the McPhillamys Gold Project by the Federal Minister for Environment and Water. They advised that the declaration, which impacts a critical area of the Project being the proposed tailings storage facility (TSF) location, means the McPhillamys Gold Project is not viable, according to Canaccord.

Opportunities

- According to BMO, Reuters reported that the People’s Bank of China (PBOC) has issued new gold import quotas to several Chinese banks, according to BMO. The PBOC has held off on new import quotas for several months now, mainly due to low demand for the metal from the Chinese banking sector; however, this move could be a sign of stronger anticipated buying interest following the August quiet period.

- Allied Gold announced the signing of a power purchase agreement with Ethiopian Electric Power, marking an important de-risking event. The agreement is expected to be in effect for 20 years with power rates (of 4c/kW-hr) in line with projected rates, supporting all-in sustaining costs (AISC) of <$950 per ounce, according to Stifel.

- RBC highlights the potential addition of G Mining Ventures, Abra Silver, and FireFly Metals to the VanEck Vectors Junior Gold Mines ETF (GDXJ) this quarter. They also view the potential addition of Northern Star to the top of the GDXJ as it now falls within the junior investable universe.

Threats

- According to BMO, Endeavour Silver has resumed processing at Guanacevi after a mill failure was reported last week. The mill is operating at 400 tons per day (tpd) with potential to increase to 500 tpd. Endeavor estimates the repair of the primary ball mill will take 16 weeks from last week's shutdown, with an estimated cost of the replacement trunnion at $0.5M. Production guidance has been lowered by 1 million ounces of silver, and cost guidance suspended. This could be an opportunity to reenter the name with expectations reset.

- There has been a sharp decline in new gold deposit discoveries over the past few decades. Between 1990-1999, gold discoveries averaged 18 annually. This number fell in the 2000s to 12 discoveries annually, and then further declined to just four in the 2010s. Between 2020 and 2023, there have only been five major discoveries despite an increase in exploration spending, according to Bank of America.

- Chinese consumers continued to pull back on gold purchases last month, as record prices and a sustained economic slowdown curbed demand in the world’s biggest bullion-buying nation. Gold imports in July fell 24% to 44.6 tons, the lowest in more than two years, according to customs data released on Tuesday.