Strengths

- The best performing precious metal for the week was gold, but still down 4.58 percent. Gold took a hit this week from a stronger dollar and investors bought the dip. The SPDR Gold Shares saw an inflow of more than 30 tons on Monday. Gold-backed ETFs had the biggest day of inflows in 2020 collectively on Monday of 1.2 million ounces. This shows confidence in the metal despite prices swings. With this past week also being one of the bigger gold mining industry investor conferences, the rush to flush the gold miner’s positive message of free cash flow and rising dividends by gold bears didn’t resonate for long.

- Great Dyke Investments, owned by Russia’s Vi Holding and Zimbabwean investors, cleared a hurdle to develop Zimbabwe’s biggest platinum mine. The African Export-Import Bank completed a due diligence study allowing the company to proceed with a $500 million syndicated funding program. Once complete, the project is expected to produce 860,000 ounces of platinum group metals and gold a year and would significantly boost the country’s economy.

- Maverix Metals is acquiring a portfolio of 11 gold royalties from Newmont for upfront consideration of $75 million and contingent payments of up to $15 million. Ghana plans to list its gold royalty fund Agyapa Royalties on the London Stock Exchange in October and plans to raise $400 to $500 million from the IPO, Reuters reports. The fund share will also be listed on the Ghanian Stock Exchange.

Weaknesses

- The worst performing precious metal for the week was silver, down 14.55 percent as expected with the selloff in gold. Silver is back in a bear market. After approaching $30 an ounce in mid-March, silver suffered severe losses this week on a resurgent U.S. dollar and concerns about growth. The metal traded below its 50-day moving average for the first time since May.

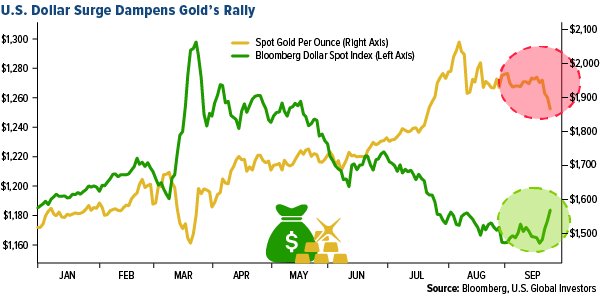

- The key driver of gold prices right now is the U.S. dollar – and it’s making a comeback. The two assets historically trade in the opposite direction. The dollar’s vigor is linked to fading hopes of another stimulus package from the U.S., but it shouldn’t last since Federal Reserve policy will remain expansionary for years.

- Fresnillo Plc, one of the world’s biggest silver producers, took the rare step of locking in gains from the silver’s almost 50 percent rally this year, reports Bloomberg. The Mexican-focused mine said it has hedged 7 percent of next year’s output with a floor of $20 an ounce and a ceiling of $50 an ounce. Hedging has been shunned by investors who in the past spent at least $10 billion unwinding unprofitable forward sales when prices surged.

Opportunities

- According to Citigroup, gold could hit a new record before the year-end aided in part by the risks surrounding the U.S. presidential election. Analysts including Aakash Doshi said in a quarterly commodities outlook that uncertainty over election results could “be under-appreciated by precious metal markets.” Bloomberg notes the bank implies a surge of more than $200 for bullion futures from current levels.

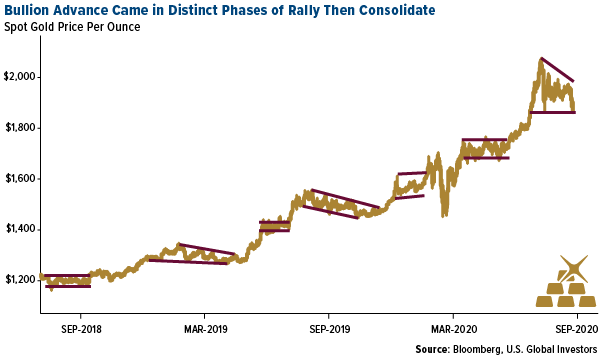

- Even though gold is trading lower, that doesn’t mean the rally is over, writes Bloomberg’s Eddie van der Walt. Gold’s move that started below $1,230 in 2018 has been filled with pauses. Gold is trading at the lower end of its pennant-range and the “path of least resistance is higher.” Bullion hit its new record high just last month above $2,075 due to global stimulus, negative real rates and a weaker dollar.

- After announcing a surprise 3.5-fold mining extraction tax increase in Russia last week, the government slightly reversed course. Silver mining will be excluded from the tax and new mining projects will also be shielded. Canada’s Wheaton Precious Metals is planning to list of the London Stock Exchange by the end of this year, said CEO Randy Smallwood. The royalty and streaming company hopes to tap into investor demand for streaming deals.

Threats

- In an open letter to the mining industry, a coalition of prominent gold investors and money managers said performance of mining companies “continues to fall short.” The investors were targeting issues such as executive compensation and directors who own few shares of the companies they represent. “Though the performance of gold mining stocks has been noteworthy recently, we believe that performance continues to fall short in the areas of corporate governance, alignment of incentives and strategic vision & communication with investors,” the group said in the letter released Sunday, the first day of the annual Denver Gold Group Americas conference.

- Two precious metals dealers and their firms are the target of a joint civil enforcement action filed in a Texas court by the Commodity Futures Trading Commission (CFTC) and 30 state regulators, reports Bloomberg. Metals.com, Barrick Capital and its principals have a complaint against them charging the defendants “with executing an ongoing nationwide fraud that solicited and received more than $185 million in investor funds to purchase fraudulently overpriced gold and silver bullion.”

- Gold fell to a two-month low as the dollar extended gains and hopes for further U.S. fiscal stimulus faded, writes Bloomberg. “If global growth concerns continue to push up the U.S. dollar, like we have seen this week, we could see some near-term headwinds for the precious metal,” Vivek Dhar, commodities analyst with Commonwealth Bank of Australia said.