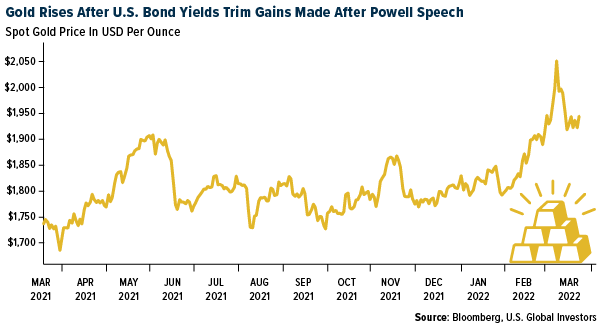

- The best performing precious metal for the week was silver, up 2.10% on the strong gold move. Gold advanced this week as bond yields eased after gaining on growing calls from Federal Reserve officials to raise interest rates faster. The yellow metal rose as much as 1.4% after dropping Tuesday when benchmark Treasury yields climbed to their highest since May 2019. Global bond markets have suffered as central banks, including the Fed, look to tighten policy, putting pressure on non-interest-bearing gold.

- GoGold Resources announced strong drilling results at its Mololoa deposit within Los Ricos North this week. “Mololoa continues to contribute strong results with high grade intercepts in addition to wider intercepts of potentially bulk mineable material,” said Brad Langille, President and CEO. “We believe these results will contribute to our goal of aggressively expanding our mineral resources at Los Ricos in 2022.”

- Gold producers are claiming a new defense against the challenge from cryptocurrencies: the metal is better for the climate. Alberto Calderon, chief executive officer of AngloGold Ashanti Ltd., made the point in a speech in Melbourne on Tuesday that mining for gold -- which is being challenged by cryptocurrencies as a global store of value -- is less carbon intensive than its digital rival. He also reckons the precious metal makes a bigger contribution to society. The listed global gold sector emits 78 million tons of carbon dioxide equivalent a year, Calderon said. That compares with 114 million tons for Bitcoin alone, before you add the cohort of rival tokens.

Weaknesses

- The worst performing precious metal for the week was palladium, down 6.82% as hedge funds continue to cut their net long positions. Northam Platinum released a trading statement guiding to first half 2022 headline earnings per share increasing 55-65% year-over-year to R9.32-9.92, and missing consensus headline earnings per share (HEPS) of R24.77. The miss appears to be primarily driven by a combination of lower-than-forecast sales volumes and higher-than-forecast unit cost inflation, translating into a 41% miss on EBITDA at R6.4bn, which reflects a 44% EBITDA margin versus consensus of 55%.

- Gold exchange-traded funds (ETFs) are one of this year’s hottest investments, with war, inflation and stock-market volatility sending people scrambling for safe havens. But those buying physical gold ETFs may face an unexpected tax burden, explains Bloomberg. Funds that invest in precious metals like gold and silver are treated like collectibles for U.S. tax purposes, meaning long-term capital gains from those funds will be taxed at a top rate of 28%, compared with a maximum rate of 20% for stocks.

- Zimbabwe’s biggest miner of rough diamonds sees Russia’s invasion of Ukraine triggering far-reaching consequences for the global gem industry, reports Bloomberg, and lifting demand for its own stones. Russia’s Alrosa is the world’s biggest diamond producer by volume at 30% and the slightest disruption to its ability to supply distorts the market, according to Zimbabwe Consolidated Diamond Co. Chief Executive Officer Mark Mabhudhu. “It may end up creating the supply gap that may drive demand for our product, as well as that of other players,” he said in an interview Monday. “However, we don’t wish for the worst case, but if it happens, we will be able to sell our production.” Both Signet and Tiffany announced they would stop buying Russian diamonds for their stores.

Opportunities

- Nano One Materials Corp. updated the market on the growing demand for localized and diversified battery supply chain in North America, Europe and India where materials can be sourced domestically. Lithium iron phosphate (LFP) batteries could serve that purpose as there is no nickel or cobalt needed to power these battery cells. LFP is also the safest, longest lasting and most affordable lithium-ion battery making them ideal for mass market applications. The recent additions of Mr Denis Geoffroy as commercialization lead and Dr. Yuan Gao as cathode technology advisor, brought decades of LFP experience to Nano One and its shareholders.

- Barrick Gold has reached an agreement-in-principle with the governments of Pakistan and Balochistan to bring back the Reko Diq copper-gold project into the picture. Under the proposed new agreement to restart the project, Reko Diq will be held 50% by Barrick, as the operator, and 50% by Pakistan stakeholders. Reko Diq is one of the largest, undeveloped copper-gold projects in the world. Development activities were suspended in 2011. There is a big prize at Reko Diq and this serves as a first step on the path to bring back this large copper-gold project into the picture, but there are several de-risking events that need to happen.

- Barrick Gold announced today that it has entered into a purchase and sale agreement to which Barrick agreed to sell, and the Dealer agreed to purchase, 8,831,250 common shares of Skeena Resources Ltd. for resale on a bought deal basis. The gross consideration for the common shares consists of cash in the aggregate amount of C$132,468,750.

Threats

- UBS initiates coverage of Gold Fields with a Sell rating and R210/share price target. The bank views Gold Fields as the quality play in the South Africa-listed gold space and believes its counter-cyclical investment approach has secured an attractive medium-term environment for the group with near-term earnings momentum remaining positive. However, given Gold Fields' recent re-rating, UBS finds the company's average free cash flow (FCF) yield of 9% over the next five years uncompelling in the context of its short-life international assets of 10 years. While management's strong track record of resource conversion bodes well for further life extensions, UBS believes this requires higher capital spend, which will weigh on the group's medium-term cash generation potential.

- UBS initiates coverage of AngloGold with a Neutral rating and R400 share price target. Falling production, rising unit costs, ongoing cash lockups and project delays have weighed on AngloGold's share price, in the bank’s view, with it materially underperforming its major SA listed peer Gold Fields by 65% over the past 12 months on a total return basis. While UBS is not overly confident of a material turnaround, its analysts believe the expected ramp-up at Obuasi coupled with incremental improvements at some of its other operations (Tropicana, Geita, Siguiri, Iduapriem, Serra Grande and AGA) and improved cash conversion could provide some easy near-term wins.

- Through the first quarter, fuel consumption has been an area of emphasis for investors given the surge in energy prices this year. Producers have been faced with margin compression as energy costs outpace the stronger gold price, with fuel (primarily in the form of diesel) comprising 55% of total mine-site energy requirements. Given the rapid increase in energy prices, there is the potential for cost guidance to come under review should inflation pressures continue to persist. This comes despite budgeted considerations for gold producers with average AISC guidance increase of $100/ounce year to year vs 2021 costs. Based on average fuel consumption, there is an impact of $35/ounce Au solely attributed to higher energy prices to date; this represents 35% of the total budgeted AISC increase (which includes capital stripping programs and mine sequencing) before consideration of additional inflationary elements related to labor, power, and consumables.