Strengths

- The best-performing precious metal for the past week was silver, up 5.23%, in what seems like a precious metals market beginning to get real traction. Barrick Gold shares rose as much as 7.1% in early Monday trading, its biggest intraday gain since March 2023, after the gold miner’s second-quarter adjusted earnings per share beat the average analyst estimate, according to Bloomberg.

- Pandora lifted its organic revenue guidance for the full year and reiterated its EBIT (earnings before interest and taxes) margin target for 2026 despite higher silver prices. Analysts say the jewelry maker’s revised 2024 outlook is to a degree offset by unfavorable forex spending and is unlikely to see significant changes to consensus, according to Bloomberg.

- According to JP Morgan, Evolution Mining’s EBITDA was 8% ahead of consensus and underlying net profit beat by 14%. The final dividend of $0.05 per share was lighter than their $0.07 expectation, and net debt was 5% ahead of their forecast.

Weaknesses

- The worst-performing precious metal for the past week was gold, but still up 2.96%. Endeavour Silver shares plummeted as much as 17% after the company said it expects a failure at the Guanacevi mill to impact annual production and cost guidance. TD Cowen forecasts the announcement will cause concerns over liquidity.

- Lucara Diamond announced its second-quarter results with production from its open-pit Karowe mine (Botswana), a miss due to slight differences in ore throughput. Earnings (and revenues) were also a miss due to lower-than-expected diamonds sold, according to Bloomberg.

- Franco Nevada’s adjusted earnings per share (EPS) of $0.75 was lower than consensus of $0.81; adjusted EBITDA came in at $222 million, 7% lower than Scotia’s consensus estimate of $239 million on lower revenue.

Opportunities

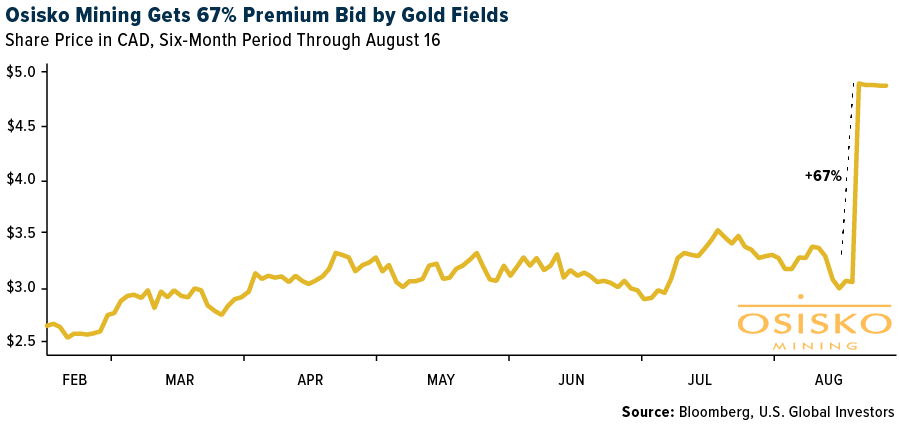

- Gold Fields has announced that it will acquire 100% of TSX-listed Osisko Mining for an all-cash consideration of $1.6 billion. Upon transaction completion (subject to 2/3 Osisko shareholder approval), Gold Fields will consolidate its existing ownership in the Windfall project (Quebec) and eliminate obligations comprised of a C$300 million deferred cash payment and a $75 million exploration obligation. The deal is expected to close in the fourth quarter and will be funded with existing cash reserves, debt facilities plus a new $500 million committed bank facility, according to JP Morgan.

- Orla Mining is raising its full-year production guidance to 120,000-130,000 ounces gold from 110,000-120,000 ounces previously. It’s also decreasing its all-in sustain costs (AISC) guidance to $800-$900 per ounce from $875-$975 previously, according to Scotia.

- Pandora’s chief executive officer expects it will take less than 10 years before consumers buy more lab-grown diamonds than mined stones because they increasingly weigh up costs and climate impact when buying jewelry, according to Bloomberg.

Threats

- Based on the price performance during previous recessions, while gold outperformed other commodities before and during recessions, stocks tended to act differently. World metals & mining stocks on average rallied by 9% three months before a recession started but corrected by 20% during the recession, according to JP Morgan.

- Yukon Premier Ranj Pillai said his government is not prepared to halt all mining activity on the First Nation of Na-Cho Nyäk Dun’s (FNNND) traditional territory, though it is willing to grant some of the First Nation’s requests. This was in response to the First Nation releasing a statement on July 3 demanding the government stop all exploration and mining activities in its traditional territory, according to BMO.

- Regarding the acquisition of Osisko Mining, investors will look at the fact that Gold Fields has given up a significant portion of the expected cash flows over the next 12-24 months while undertaking development and execution risk. This transaction puts even more emphasis on Salares Norte (Chile) ramp-up, which has not gone smoothly yet, according to BMO.