- The best performing precious metal for the week was palladium, up 0.60% as auto sales are expected to rise with the vaccination rollout. Silver ETFs caught a bid this week despite massive gold outflows. ETFs added 1.02 million troy ounces of silver on Thursday, bringing total net purchases to 66.7 million ounces.

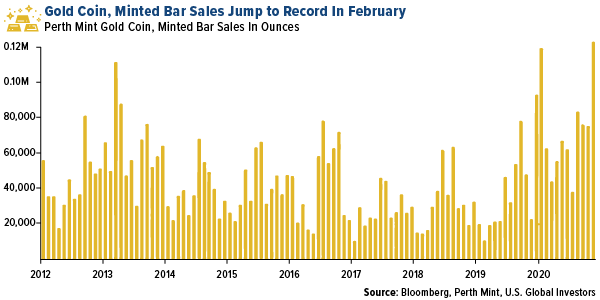

- The Perth Mint reported gold coin and minted bar sales rose 441% year-over-year in February to 124,104 ounces as investors took advantage of lower gold prices. Spot gold fell 6.2% in February, and Perth Mint saw gold product sales 63% higher than in January. The U.S. Mint also reported strong sales in February. Sales of American Eagle silver coins totaled 3.19 million ounces last month and gold coin sales rose to 125,000 ounces.

- According to Bloomberg, dividend annual forecasts for Bloomberg Intelligence industry groups, gold miners are expected to more than double dividends this year, outpacing the 75% dividend hike of copper producers. Gold producers have done a solid job of rewarding shareholders with dividend hikes the past couple years, thanks to their ability to generate excess cash from higher gold prices.

Weaknesses

- The worst performing precious metal for the week was silver, down 5.33% which followed gold lower this week. Gold fell to a nine-month low below $1,700 an ounce as rising U.S. Treasury yields remain a headwind, along with optimism of an economic recovery. Bullion is now down 11% so far in 2021.

- According to Bloomberg data, holdings in gold-backed ETFs fell more than 14 metric tons on Monday, the most in three months. Thursday was the 14th straight session of outflows – the longest streak since December 2016. “Gold’s reputation appears to have been tarnished considerably by the heavy losses of recent weeks, as evidenced by the ongoing outflows from gold ETFs,” said Commerzbank AG analyst Carsten Fritsche in a note.

- Rhodium’s surge to 27,000 an ounce is driving a surge in thefts of catalytic converters, reports Bloomberg. The byproduct of platinum and palladium production, rhodium is known for its ability to remove the most toxic pollutants from vehicle exhaust. Lara Smith, founder of mining market research group Core Consultant, says "there are certain metals that don't follow fundamental supply and demand dynamics because nobody is going to set up a mine just for the rhodium. Rhodium will always be mined or not mined because of the platinum."

Opportunities

- One opportunity thanks to lower bullion prices: stronger retail purchases. Benchmark gold futures in India are down 20% from a record in August last year, and imports rose 412% in February from a year earlier to the highest since November 2019. “The festival and wedding season looks good,” said Ashish Pethe, chairman of the All India Gem & Jewellery Domestic

Council. India is the world’s second largest consumer of the precious metal and demand historically picks up ahead of holidays and celebrations. - Analysts at Goldman Sachs led by Jeffrey Currie said now is the beginning of a structural bull market in commodities driven by demand. "Lockdowns have driven a wedge between the consumption of services and goods, generating additional demand from both households and governments looking to stimulate activity while minimizing the virus spread.” The report continued to say “commodities are the crucial link between growing demand, a weaker

dollar and inflation, which is why they have been statistically the best hedge

against inflation.” This boost the case for investing in physical precious metals. - Citigroup head of commodities research Ed Morse said in a Bloomberg TV interview that gold could get a boost from emerging market central bank purchases. “We expect Emerging Markets central banks will buy more gold in part because of increasing concerns about where the dollar

goes.” Citigroup expects gold to hit a bottom and be supported by traditional buyers due to the change in the macro environment.

Threats

- The VanEck Vectors Junior Gold Miners (GDXJ) exchange-traded fund relative to the SPDR S&P

500 ETF Trust has broken below four Fibonacci support levels, write Bloomberg Intelligence’s Anthony Feld and Mike McGlone. This is a bearish signal and shows gold stocks aren’t acting like the inflation hedge that they’ve historically served. Like the rapid sell off with the nationwide lockdowns back in March of 2020, risk parity trades had to be unwound. Gold is often held alongside these trading strategies but when markets are stressed, gold positions also get liquidated as the risk parity trade is taken off. Gold rallied very strongly out of the market bottom, finishing the year strongly. - Gold’s biggest threat remains rising bond yields. The 10-year Treasury yield continues to surge, hitting 1.6% Friday morning after a stronger-than-expected jobs report. Gold and bond yields historically share a strong inverse relationship.

- U.S. oil futures rose above $65 a barrel on Friday and Brent rose toward $70. Higher oil prices are a headwind for precious metal miners who use the fuel at operations. Oil has recovered globally as producer work to keep supply limited while demand increases post-lockdown.