Strengths

- The best performing precious metal for the week was palladium, up 0.49% despite hedge funds raising their net short position to a 12-week high.

- Yamana Gold, which operates mines in four countries including Canada and Argentina, is seeking better terms from lenders including Bank of Nova Scotia and Citigroup Inc. after earning an upgrade from S&P Global Ratings. “We’ll definitely make sure it is being respected and acknowledged in all of our lending facilities,” Chief Financial Officer Jason Leblanc said in an interview. “We have ongoing discussions with them.”

- De Beers signed two mineral investment contracts with the government of Angola for license areas in northeastern Angola, according to a statement. The contracts are for the award and exercise of mineral rights covering all stages of diamond resource development and span a period of 35 years.

Weaknesses

- The worst performing precious metal for the week was platinum, down 7.02% with hedge fund managers flipping from net short to net long the metal with prices dropping. Gold slipped the most in three weeks as U.S. Treasury yields surged following stronger-than-expected U.S. housing data. New U.S. home construction rose unexpectedly in March to the highest level since 2006, boosted by multifamily projects as builders seek to replenish housing inventory.

- Diamond buyers across Dubai and Antwerp and processing centers for finished diamond in India are trying to understand how U.S. with war sanctions on Alrosa PJSC, the world’s biggest diamond miner, is going to affect trade in the gemstone market. Tiffany and Signet Jewelers have publicly stated they will stop buying diamonds mined in Russia. However, retailers in China, India and the Middle East are still open to purchases.

- Iamgold is down about 8%, on pace for its biggest decline since July, after BMO’s Jackie Przybylowski cut her recommendation on the miner to “market perform” from “outperform.” While the downgrade is primarily due to an elevated valuation, the analyst also expects a review of the Cote Gold project in Canada expected later this quarter to be negative, according to a note out premarket on Monday. BMO estimates nearly $2 billion in project spending for the project and sees a risk that the budget could increase more and/or the startup timeline could slip beyond early 2024.

Opportunities

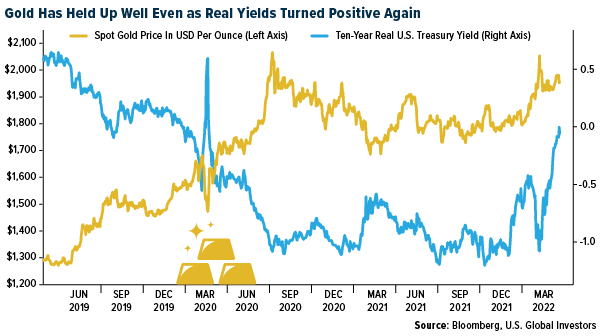

- Gold is proving remarkably resilient, gaining almost 7% this year as investors shrug off surging real yields and strengthening dollar to focus on political and economic risks. While traditional yield and currency drivers suggest bullion is overvalued, demand for the haven asset remains strong. That’s because gold buyers piling into exchange-traded funds (ETFs) are taking a pessimistic view of the U.S. Federal Reserve’s ability to cool decades-high inflation without hurting the economy. For them, gold is a hedge against soaring prices and low growth.

- According to Credit Suisse, investors are more constructive on gold, despite still expecting higher interest rates. This is because of expectations of sticky high inflation, and the potential for Fed policy. A conservative approach by the Fed could lead to protracted high inflation, while an aggressive approach could cause a recession; either scenario would be positive for gold. Credit Suisse, assuming gold prices stay flat, also believes producers will be generating more free cash flow in the second half of 2022, at which point there may be announcements of higher dividends. Energy prices have increased significantly. Therefore, updated commentary on cost sensitivities at different oil prices, diesel hedges and the potential for overall cost per ounce to be at the high end/above guidance. As a reminder, energy is typically 5% to 10% of cash costs for gold miners.

- Bank of America reiterated its bullish view on gold from February and sees prices advancing to $2,175 per ounce, according to technical strategist Paul Ciana. That is a 9.9% jump from Monday’s closing price and would be a new all-time high. “We think the daily, weekly and monthly timeframes still indicate higher gold prices this year,” Ciana says in a note.

Threats

- Fed Chair Jerome Powell outlined his most aggressive approach to lowering inflation by letting the market know that a 50 basis point hike in its benchmark rate is on the table for next week’s meeting. Not to be outdone, Fed colleague James Bullard opened the door further with potentially debating a 75 bp increase to tame inflation. Obviously, the Fed is showing concern and yields have now surged such that a full 200 bp is factored in prices now, marking four raises of 50 bp. The last time the Fed raised rates by 50 bp was in May 2000.

- According to Raymond James, the first quarter of 2022 is expected to be one of the weaker operating quarters of the year for several producers for a variety of factors, ranging from weather and pandemic issues impacting mining operations, expected mine sequencing of lower grade and ramp ups at various sites expected to benefit production later in the year.

- Dickie Hodges of Nomura Asset Management is calling a top for inflation expectations that he believes on both sides of the Atlantic are starting to be overdone. The Nomura Global Dynamic Bond Fund has entered into swaps that stand to gain in value is market gauges of inflation fall over the next 10 years. He thinks bottlenecks in the supply chain will sort themselves out, but the European economy may go into recession from the fallout of the Russian invasion of Ukraine. Dickie rates in the top 2% of performance among its peer group over the last five years.