This week spot gold closed at $1,843.43, up $12.19 per ounce, or 0.67%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 1.07%. However, the S&P/TSX Venture Index came in off 2.47%. The U.S. Trade-Weighted Dollar rose 0.10%.

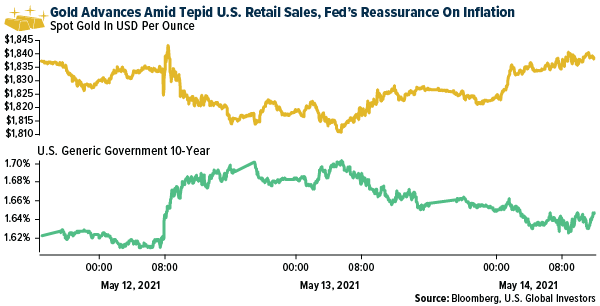

- The best performing precious metal for the week was gold, up 0.67%. Gold is near its highest level in three months. Bond market expectations for the pace of inflation over the next five years surged on Monday to the highest since 2006. The recent consumer price index (CPI) data, which was much higher than expected, only bolstered this argument. Weaker-than-expected jobs data supports the case for dovish monetary policy. The U.S. dollar fell on the news, which also supported the gold price. April retail sales were reported on Friday and came in weaker than expectations, bolstering gold as yields and the dollar sank.

- Palladium continues to do well and should be undersupplied by about 1 million ounces per year, which is 9.5% of 2021 demand, according to UBS. 2021 supply has been reduced by 545,000 ounces due to some recent mine disruptions in Russia. UBS continues to see the metal going to $3,100 per ounce in the next few months. Additionally, comments by Sibaneye Stillwater CEO Neal Froneman indicates that mining companies have become more restrained on new project spending compared to 10 years ago, which may keep the market tight.

- Endeavor Mining reported a strong first quarter of $0.50 per share, above the $0.42 per share consensus. Production was 347,000 ounces of gold, compared to the 310,000-ounce consensus. Torex Gold also beat earnings forecasts by reporting earnings per share of $0.66 in the first quarter, above the $0.46 consensus. Cash costs were 10% below consensus, at $580 per ounce.

Weaknesses

- The worst performing precious metal for the week was platinum, down 2.11% on light news, falling with financial markets in general. Harmony Gold reported a weak fiscal third quarter, with volumes down 12% quarter-to-quarter. The weak volumes are related to COVID-related production issues. Cash costs rose 11% quarter-to-quarter due to lower volumes. The company’s Hidden Valley mine also had lower grades being mined. The next quarter will include significant plant maintenance.

- For the second consecutive year, purchases of gold on Akshaya Tritiya, considered to bring luck and prosperity, have been shuttered with the current COVID-19 wave running nearly out of control. The chairman of the All-Indian Gem and Jewelry Domestic Council noted that about 80% of the country is on lockdown, and while some sales will take place online, they will again be impacted as in the prior year.

- Fortuna Silver missed on first-quarter results and finished the week off by close to 3% with its peers off less than 0.5%. Fortuna’s share price weakness also pulled Roxgold’s share price lower on its all-stock bid to acquire Roxgold. While the C$40 million break fee is high, it reduces the value accretion to the new buyer to a gain of 31% versus 37%.

Opportunities

- Coeur Mining has announced its intent to acquire 17.8% of the outstanding shares of Victoria Gold at a price of C$13.20 per share. Additionally, Orion will receive about 5% of the shares of Coeur Mining and achieve a liquidity even. Orion also agreed to vote in favor of Coeur Mining acquiring more than 50% of the shares of Victoria if that ever occurred. It’s significant that we have seen another transaction in the junior mining space where a more senior peer is finding value in production more accretive than exploration currently.

- Investment Bank Liberum wrote recently that the diamond market looks to be in better condition after a rocky few years. Major producers have reduced inventories significantly without lowering pricing, thus implying demand has been robust. There are a limited number of diamond producers to invest in. Diamond exploration is much riskier while the macro lift in diamond markets could most directly be played through the producers.

- Montage Gold reported initial results on its drilling program at the Kone Gold Project, which were the best to date. There was high gold quality grade, which could lead to higher production (about 200,000 ounces per year) during the first five to seven years of the mine life. The preliminary economic assessment is expected in two weeks.

Threats

- Barrons highlighted that the gasoline lines we saw this week have to remind you of the 70s inflationary period. But Barrons points out that during the decade of the 1970s, investors had money market funds with high yields to try to keep up with inflation. With such a historic descent in interest rates, there are few ways to protect your wealth through cash substitutes. Barrons notes that TIPs and gold could play a role in investors’ portfolios today.

- The Western Electricity Coordinating Council (WECC), which monitors electric grids in the western U.S. and Canada, estimates that without imports, Nevada, Utah and Colorado could be short power during hundreds of hours this year, or equivalent to 34 days. New Mexico and Arizona fare a little better with being short only 17 days, under worst-case scenarios this year. The WECC’s Jordon White said: “It’s no longer necessarily a California problem or a Phenix problem. Everyone is chasing the same number off megawatts.” Miners included!

- AngloGold Ashanti and Barrick Gold continue to trade with little premium for management with the Democratic Republic of the Congo still not repatriating their profits back to the companies this year. Plus, the state-owned Congolese mining company SOKIMO has lodged a claim against Kibali Goldmines for $1.114 billion for unpaid dividends and other funds.