- The best performing precious metal for the week was palladium, up 5.67% on strong industrial demand and ongoing supply disruptions. TD Securities wrote that it expects palladium to be a positive catalyst for platinum group metals (PGMs) continuing into 2022. Sandstorm Gold Ltd. raised its production outlook following the performance of a gold stream and royalty agreement, and the purchase of a royalty package on a piece of Vale S.A.'s operations. With the addition of the royalties, Sandstorm is forecasting attributable gold equivalent production between 62,000 to 69,000 ounces in 2021. In addition, Maverix has acquired a portfolio of six royalties from Pan American Silver in exchange for 491,071 common shares of Maverix and a cash payment of $7,000,000. Royal Gold has entered a gold streaming deal on Ero Copper's NX Gold Mine in Brazil. Royal Gold will make a $100 million payment in return for 25% of the gold produced from the NX Gold Mine until the delivery of 93,000 ounces, and 10% thereafter. Royal Gold will pay 20% of the spot gold price for each ounce delivered until the delivery of 49,000 ounces, and 40% of the spot gold price thereafter.

- Prime Mining reported initial drill results from the Mina 20/21 area, 1.3 kilometers northeast of Guadalupe East, at its Los Reyes project. The headline result of 4.4 grams per ton silver and 1,060 grams per ton silver provides an early indication that the company may have discovered an additional underground deposit.

- The ratio of the S&P 500 to gold is nearing a 15-year high, implying that gold is cheap. The reason why this ratio is moving adversely, is due to improving economic fundamentals. However, recent economic data points have been worse than high expectations, implying that this ratio could be close to peaking.

Weaknesses

- The worst performing precious metal for the week was platinum, down 1.53% despite the positive TD Securities report. Gold has been hammered by a growing list of headwinds from the Federal Reserve, signaling it is preparing to slow stimulus to rising risk appetite. Prices are set for their worst month since November 2016 after U.S. central bank officials pulled forward their forecasts for interest rate hikes. Also, the dollar is strengthening due to concerns about the delta virus strain of COVID-19 outside of the U.S.

- Golden Star Resources Ltd. on Monday slashed its 2021 production guidance after flagging a delay in the commissioning process for the new paste fill plant at its Wassa gold mine in Ghana. The company now expects gold production in the range of 145,000 to 155,000 ounces at an all-in sustaining cost of U.S. $1,150 to U.S. $1,250 per ounce. This compares with the initial target of 165,000 ounces to 175,000 ounces at U.S. $1,000 to U.S. $1,075 per ounce.

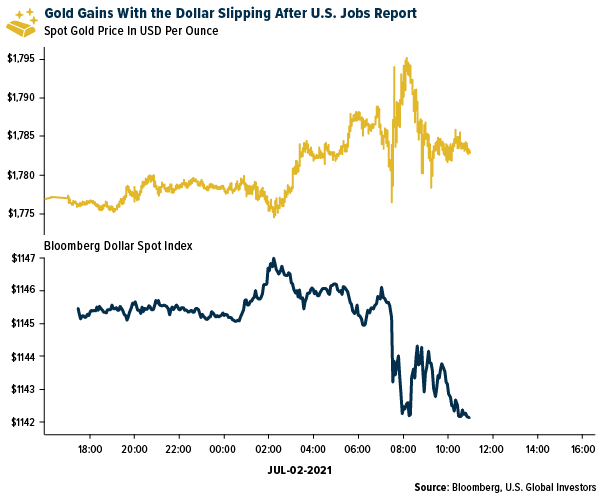

- Gold continues to be sold by ETFs, with the Thursday trading sessions witnessing their largest redemptions for the week. On a year-to-date basis, gold ETFs have reduced their holdings by nearly 6%. Gold bounced back to positive territory for the week with the nonfarm payrolls number adding more jobs than expected but unemployment still edged up, implying the Federal Reserve can wait longer, perhaps.

Opportunities

- Karora Resources on Monday said it expects to nearly double its gold production over the next three years on an expansion of its Beta Hunt mine in Australia. The company plans to produce around 195,000 ounces of gold in 2024, up from its expected output of about 110,000 ounces this year. Karora said the increase will come as it raises the output of its Beta Hunt underground operations to 2 million tons annually from 0.8 million tons and expands its Higginsville mill.

- Aya Gold & Silver Inc. said that it has been granted seven new exploration permits in Morocco. The Canadian miner said the permits were granted by the country's Ministry of Energy, Mines and Environment, and would increase its position within its Zgounder Regional and Azegour area properties by about 40%. There are also showings of copper mineralization on the ground controlled by Aya, which need to be followed up on.

- Silver Tiger reported high-grade assays from drilling, stepping out 900 meters south along the Sooy vein. The company is ramping up to 5 drills on the property to accelerate work on the extensive, high-grade system.

Threats

- Gold Road reported that it expects second quarter production (100% basis, GOR 50%) to be lower at 52,000 to 55,000 ounces (a 24% drop) due to disruptions in the processing plant relating to a torn mill feed conveyor belt and failed ball mill coupling. Additionally, maintenance costs are expected to be higher as well.

- The relationship of B2Gold with the Malian government could be strained. B2Gold announces the commencement of international arbitration proceedings, regarding the refusal of the Menankoto exploration permit. This comes after the denial of the expected permit renewal in March of this year, to which the company believes it is entitled to a further one-year extension under the 2012 Malian Mining Code.

- Jake Lloyd-Smith, writing for Bloomberg, writes “gold is about to lose more of its shine.” Federal Reserve watching is likely to get more attention as we head into the next two Fed meetings in July and September. If investors start to believe the focus on tapering to be more eminent, yields could be bid up and lead to a stronger dollar.