- The best performing precious metal for the week was spot gold, but still off 1.22 percent. UBS raised its price forecast for palladium to $2,500 an ounce by the end of December, up from $2,400 an ounce. Analysts at the bank say palladium imports from China have hit a record high on strong domestic car sales and tighter emission standards. Spot prices are up nearly 22 percent year-to-date. Impala Platinum says demand for platinum-group metals has remained strong as its output rose in the third quarter, reports Bloomberg. Platinum output from the top producer totaled 408,000 ounces compared with 281,000 ounces the same quarter last year.

- Newmont reported all-time high revenue of $3.17 billion in the third quarter, thanks to record high gold prices. CEO Tom Palmer said, “I am confident that our world-class portfolio is best positioned to generate industry-leading value and returns for our shareholders.”

- Brixton Metals and High Power Exploration agreed to a joint venture of $44.5 million for exploration at the Hog Heaven silver-gold-copper-lead-zinc deposit in Montana. High Power is a privately-owned mineral exploration company led by Ivanhoe Mines founder Robert Friedland.

Weaknesses

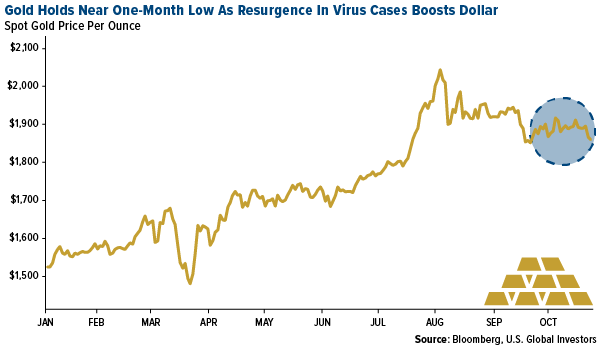

- The worst performing precious metal for the week was palladium, down 7.59 percent on no specific news, although palladium has been the biggest gainer in prior weeks. Gold fell this week on worsening coronavirus outbreaks and a stronger U.S. dollar. The yellow metal is set for a third consecutive monthly drop – its longest run of declines since early 2019 – as investors continue to favor the U.S. dollar as a haven ahead of the presidential election.

- Gold-backed ETFs had two consecutive weekly outflows for the first time this year, reports Bloomberg, with 145,533 ounces in withdrawals. Analysts say investors could be taking profits before next week’s presidential election.

- Central banks were net sellers of gold for the first time since 2010 in the third quarter. Net sales totaled 12.1 tons, compared with purchases of 141.9 tons a year earlier, according to World Gold Council (WGC) data. Countries are taking advantage of record high gold prices to soften the blow from the economic impact of the coronavirus.

Opportunities

- Demand for gold in China, the world’s top consumer, could continue to rebound as the country recovers economically from the coronavirus. WGC data shows China’s jewelry demand fell 25 percent year-over-year in the third quarter but was up 31 percent from the prior quarter. Gold bar and coin demand rose 35 percent year-over-year in the quarter to 57.8 tons.

- Suki Cooper, precious metals analyst at Standard Chartered Bank, said in a report dated October 23 that the macro backdrop is favorable for gold, and there could be more upside if a “blue wave” occurs. “Even though polls continue to indicate a Biden victory and a Democratic Senate, gold price action has stalled, despite this election scenario potentially posing the greatest upside risk for the metal,” she said. Copper added that negative real rates, expectations for a weaker dollar and stimulus package are all bullish for the yellow metal.

- Jake Klein, executive chairman of Evolution Mining, says now is the best environment for gold in the past 15 years. In a Bloomberg TV interview, Klein said due to massive money printing “fiat currencies generally are on the decline against a hard asset like gold.” Klein notes gold has been trading range-bound and could see a pop after the U.S. presidential election.

Threats

- Gold jewelry demand in India usually picks up in the last three months of the year during festival and wedding seasons. This year due to coronavirus and weak economic growth, sales are likely to fall below last year’s 194 tons to the lowest quarterly numbers since 2008, according to Metals Focus. WGC data shows purchases of gold jewelry, coin and bars fell by half from a year earlier in the first nine months through September.

- The fate of oil drilling in the Arctic and the Pebble gold mine in Alaska hang in the balance of the presidential election, writes Bloomberg Green. Trump is pushing for development of the region while Biden has pledged to protect the natural resources. For the Pebble gold mine project in particular, the Trump administration has scrapped Obama administration pollution restrictions blocking the mine and Biden has promised to block the project if he wins, calling the area “no place for a mine.”

- Although the S&P 500 Index is trading near historic highs, all might not be well with the market. Bloomberg reports that through the third quarter, 25 companies in the index reported liabilities exceeding assets, the most in 25 years. This is more than double the high of 12 companies with negative equities during the Great Recession.