Strengths

- The best performing precious metal for the week was gold, but still off 3.19%. Pasofino Gold published an updated mineral resource estimate for its Dugbe project in Liberia that includes an M&I and inferred resource of 3.9 million ounces of gold. CEO Ian Stalker commented that the robust higher-grade core of 2.88 million ounces grading 1.58 g/t should have good economics around it and that there is still room to grow the resources with potential grade surprises.

- South Africa ruled out challenging a High Court ruling that struck down some key changes to mining rules, specifically that govern black ownership targets, in a move that could potentially revive investor interest in the industry. In September, the High Court struck down some key provisions introduced to the mining charter in 2018 by Mines Minister Gwede Mantashe. It included a rule stipulating that an ownership target of 26% for black investors in South African mining companies would remain in perpetuity. That meant miners that had previously met the threshold would need to find new black shareholders if the original ones exited their holdings.

- Anglo American on Wednesday reported sales by its majority owned De Beers. De Beers sold $430 million of diamonds in the ninth sales cycle of 2021, compared with $492 million at the prior sale and $462 million a year earlier. “Sentiment continues to be positive on the back of strong demand for diamond jewelry from U.S. consumers and this was reflected in the demand we saw for rough diamonds during Cycle 9,” said CEO Bruce Cleaver.

Weaknesses

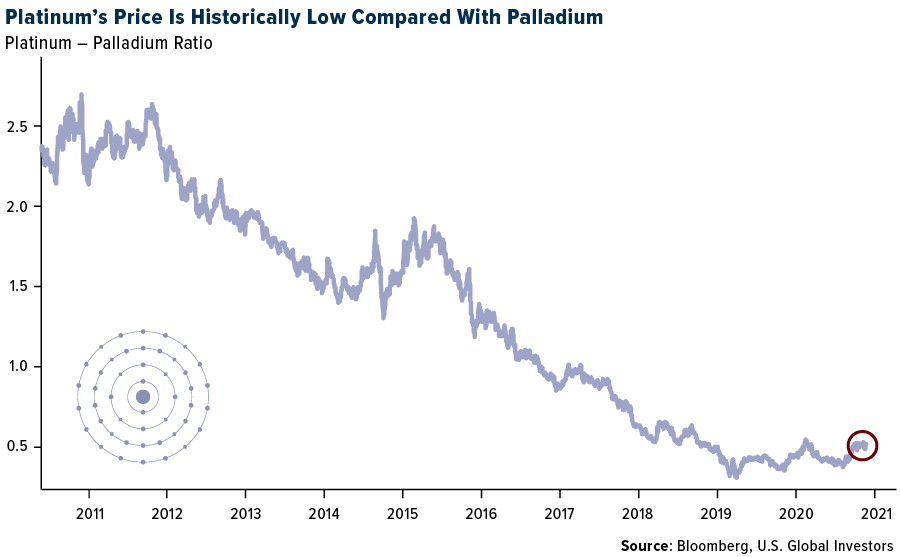

- The worst performing precious metal for the week was palladium, down 14.49%, largely on headlines stating that platinum demand from the car sector was expected to rise as they substitute the cheaper metal for palladium. Hochschild Mining plunged 34% on Monday after reports that Peru will no longer approve additional mining or exploration activities in a region with two of the company’s mines on environmental grounds. Peruvian Prime Minister Mirtha Vasquez said four mines that have been the subject of community protests will be closed as soon as possible. Analysts at Bank of America say those two mines represent 70% of Hochschild’s EBITDA.

- Gold extended its decline after the White House announced that President Joe Biden selected Jerome Powell for a second four-year term as Federal Reserve Chair while elevating Governor Lael Brainard to Vice Chairman. The move is keeping consistency at the U.S. central bank as the nation grapples with the fastest inflation in decades along with the lingering effects of COVID-10. The dollar strengthened in response while Treasury yields extended gains, weighing on bullion’s appeal to investors.

- MAG Silver announced a $40 million equity raise at $17.15per share, following a $40 million credit agreement last week. The additional liquidity needed is due to escalating initial capex requirements for Juanicipio (44% MAG/ 54% Fresnillo) and anticipated delays in returning profits from the JV to MAG’s balance sheet. Additional capital may be needed over the next several years as well.

Opportunities

- China’s gold imports spiked to the highest level in almost two years while imports of steel and copper scrap fell, according to the country’s customs data. Gold purchases totaled 122,659 kilograms in October, up 46% from a month earlier and the highest since December 2019.

- Silver Lake Resources has acquired credit facilities provided by BNP Paribas to Harte Gold. The facilities comprise a $41.3 million non-revolving term facility and a $22 million revolving facility, each of which are fully drawn, with outstanding interest of $2.32 million. The transaction was funded out of Silver Lake’s cash reserves. The consideration did not exceed the outstanding principal and interest balance. Silver Lake intends to work cooperatively with Harte Gold and its stakeholders to deliver an outcome that will provide the best opportunity to realize the full potential of the Sugar Zone mine and the associated land package. In the prior week, Silvercorp announced it had taken a 5.1% interest in Australian listed Chesser Resources which recently posted a resource update. Mark Connelly is the Chairman of Chesser and previously was the CEO of Papillion Resources, which was taken over by B2Gold to gain control of the Fekola gold project.

- Platinum is the rebound trade on a normalization of chip shortages in the auto industry; substitution from palladium should also help. Platinum demand from the auto sector is set to jump next year as makers of pollution-cutting auto catalysts switch to a cheaper alternative to palladium, according to the World Platinum Investment Council (WPIC). Platinum demand from the car industry is expected to climb 20% to 3.24 million ounces next year, the most since 2017, the WPIC said in a quarterly report.

Threats

- According to Credit Suisse, investors are more concerned on reserve replacement this year versus last year, as last year most companies were unable to achieve planned exploration drilling due to COVID-related shutdowns. This year, however, with more normalized exploration budgets and activity, there is a greater expectation to at least replace depletion, i.e., to maintain average mine life. Taking a step back, reserve replacement has become more challenging over the years as discovery grades are generally declining. This is also one of the reasons more gold companies are looking to M&As to grow reserves.

- B2Gold revealed it is considering investing in assets in Zimbabwe, which desperately needs new investment in the country and mining industry. B2Gold said it would consider buying operation assets in the country or a joint venture, perhaps even a milling facility. Currently, U.S.-listed Caledonia Mining is in operation in Zimbabwe successfully, showing good returns on invested capital and paying a quarterly dividend with an indicated yield of 4.38%.

- According to Morgan Stanley, the frequency of protests around the Peruvian mining industry has increased. The group counted three protests targeting the mining industry in Peru in October, some of which turned violent. This raises the question of whether such protest activity could result in mine supply disruptions, potentially impacting global supply/demand dynamics for metal markets.