Strengths

- The best performing precious metal for the week was palladium, up 7.10%. Gold advanced this week to its highest level since late August, actually firming its price trajectory in the face of another super-sized rate hike in September. However, dollar weakness surfaced this week as the Bank of Japan governor held a meeting with the Prime Minister over a fall in the yen, which has dropped even further against the dollar than the euro. Gold coin and bar sales by the Perth Mint rose 7.2% in August to 84,976 ounces.

- Aya Gold & Silver reported initial drill results from its brownfield Boumadine property in the Kingdom of Morocco. Preliminary results indicate the mineralization from holes drilled between the Central Zone and the South Zone now link the precious metals over a 2.7-kilometer strike. President and CEO Benoit La Salle noted the excitement with these new high-grade holes that expands the potential for the company’s next leg of growth.

- Reunion Gold reported significant gold intersections from its Oko West Project in Guyana. Hole D22-135 intersected 5.19 grams per ton (g/t) over 52.50 meters. Hole D22-124 intersected 4.12 g/t over 49.80 meters, and Hole D22-127 clipped 3.18 g/t over 48.50 meters. Given the success so far in drilling, Reunion plans to aggressively grow the size of the deposit with the addition of two higher capacity diamond rigs, bringing the total number of drills up to five on the property. Reunion Gold continues to advance its way through the permitting process and expand its ground position.

Weaknesses

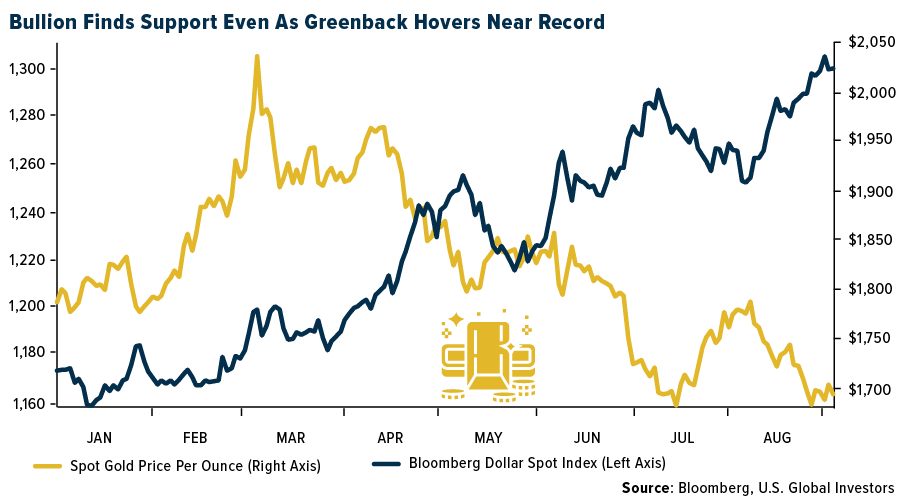

- The worst performing precious metal for the week was gold, but still up 0.49%. Technical analyst Nour Al Ali at Bloomberg noted this week that the statistical relationship between gold and the dollar is shifting again, with the inverse correlation to the U.S. Dollar Index approaching -0.6, while a month back the relationship was more in the -0.2 to -0.3 range. Regardless, bullion is finding support even as the greenback hovers near a record.

- For the third time in three years, protests at the Los Filos mine in Mexico have shut down operations for Equinox Gold’s biggest mine. The company’s share price sunk as much as 8% intraday on the news, but still closed the week with a net price gain.

- Anglo American Platinum announced a cut in output forecast for the year as the rebuild of the Polokwane smelter, north of Johannesburg, will be delayed another two months, knocking 5% off of its price. The reduction of anticipated production could boost overall PGM prices.

Opportunities

- Platinum supply concerns could re-emerge as buyers seek to avoid Russian sourced metal, according to the World Platinum Investment Council (WPIC). Companies with current contracts in force to purchase may not renew the contracts with Russian counterparties, according to WPIC. Russia supplies about 11% of the world output, making it the second biggest producer outside of South Africa. WPIC forecasts PGM demand to rise 14% in 2022, perhaps pushing prices higher.

- B2Gold gained over 16% for the week on speculation of a potential takeover with its current share price weakness. Earlier terrorist attacks in Mali over the summer has weighed on many of the West African producers. B2Gold’s flagship Fekola Mine in Mali would be an enviable target.

- EMX Royalty Corporation has received is initial royalty payment on gold production from the Gediktepe Mine in western Turkey and operated by a private Turkish company. EMX has a 10% net smelter return (NSR) on the oxide gold production. The $1.84 million is inclusive of $281,052 in Value Added Tax (VAT) for which EMX has credits to recover. The payments were based on sales from production for June and July. EMX also has a 2% NSR royalty on production from an underlying polymetallic copper, zinc, lead and gold deposit that is scheduled for future development. The junior royalty space could be an area for consolidation.

Threats

- Well known senior editor for markets at Bloomberg, John Authors, wrote an opinion piece titled “Nothing Will Stop the Dollar from Getting Stronger”, due to the extraordinary strength our currency is showing. John notes that only once before this century has the dollar traded so high above its 200-day moving average. This last occurred in 2015 as foreign exchange markets adjusted to the epic fall in oil prices that had started the previous year. The oil price crash in 2014 came as OPEC discipline broke down but was equally matched by a strengthening dollar. Over the last 12 months, the typically inverse relationship of oil price and the U.S. dollar has broken down. Now, both the dollar and the price of oil are rising, which is stressing currency markets around the world.

- The government of Finland is proposing tighter regulations of the mining industry, including improved environmental controls and additional fees, reports Bloomberg. It’s been a decade since Finland has updated its regulations and has been criticized for being too lax on environmental damage from mining and not allowing enough locals to have a voice in how a mine site is developed. Economy Minister Mika Lintila noted that the country needs critical minerals to be mined to support the transition to a more sustainable future.

- Recent research published by the Federal Reserve Bank of Cleveland argues that central banks facing a surprise drop in available workers should take a cautious, rather than an aggressive, approach to monetary tightening even though this will still subject us to a period of higher inflation. They argue that while tighter policy will cool demand for products and labor, an even smaller workforce would push up wage growth and inflation more than it would have been under “optimal” policy. Meanwhile, Fed officials are rapidly raising interest rates to cool the hottest inflation in nearly four decades.