- The best performing metal for the week was silver, up 7.13 percent, again outpacing gold on recent gains. Spot gold broke its record high this week and could soon hit $2,000 an ounce. Bullion rose as high as $1,983.36 on Friday and is up 10 percent for July – its best month in four years. Precious metals producers are soaring thanks to gold and silver’s gains. The NYSE Arca Gold Bugs Index rose 108 percent from a March 13 low through July 24. The Solactive Global Silver Miners Index rose 117 percent over the same period.

- The real yield on 10-year Treasuries closed at its lowest level ever of negative 0.9277 percent on Tuesday. This greatly boosts gold’s appeal since it does not offer interest like government bonds usually do. Germany became the biggest retail buyer of gold bars and coins by the end of the second quarter, taking the top spot from China, according to the World Gold Council (WGC).

- The number of gold bulls is growing. Bank of America is sticking by its forecast for $3,000 an ounce gold over the next 18 months. Citigroup said that the current gold cycle is unique and prices could “stay in a higher range for longer.” Goldman raised its 12-month price forecast to $2,300. Miners are also bullish. Agnico Eagle Mines CEO Sean Boyd said, “we would not be surprised to see $2,500 within the next two years because there’s still so much uncertainty out there.”

Weaknesses

- The worst performing metal for the week was palladium, down 6.12 percent even though hedge funds boosted their net long position to a 21-week high, however, Nornickel announce a 32 percent quarter-over-quarter growth in its production of palladium taking some of the enthusiasm out of the price. Gold retreated on Wednesday after rallying for nine straight days that led to its record price. Investors weighted impending U.S. GDP data and second-quarter corporate earnings.

- The U.S. Mint said it has reduced the volume of gold and silver coins for distribution as the pandemic slows production. A document obtained by Bloomberg says that the Mint’s West Point complex in New York will probably slow coin production for 12 to 18 months as it implements measures to prevent the virus spreading among employees.

- JPMorgan says the gold rally could start to lose steam in the second half of this year. Analysts said in a report that “gold will likely see one last hurrah before prices turn lower into year-end.” Some believe that the gold rally is overdone and will correct soon after rising 29 percent so far this year.

Opportunities

- Gold’s new record price is winning over a wider fan base of pension funds, insurance companies and private wealth specialists, reports Bloomberg. Government bonds have been a traditional safe haven asset, but with bonds yielding next to nothing in the era of near-zero interest rates, the appeal for gold, which does not pay interest, rises. “We need to diversify our diversifier and look for safe haven beyond government bonds,” said Geraldine Sundstom of Pacific Investment Management Co.

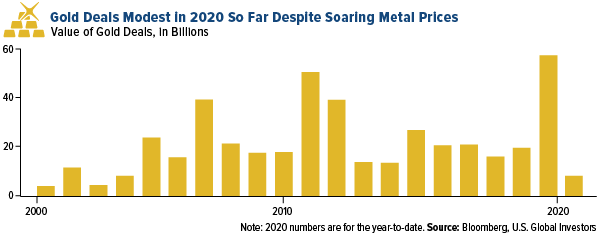

- Gold mining stocks are set to be massive beneficiaries of bullion’s rally, creating a “fat pitch”. However, miners are known for overspending and destroying shareholder value in previous cycles. So long as miners don’t repeat the mistakes of previous rallies, they should attract a surge in money flows. Gold deals are modest in 2020 despite higher metal prices, but the opportunity is there.

|

Threats

- Plummeting gold demand out of India could continue for longer than expected. Consumption fell in the first half of this year by 56 percent from a year earlier to 165.6 tons, according to the World Gold Council (WGC). “For gold demand to survive, the economy has to do well” and India’s economy has been hit severely by Covid-19 lockdowns, says P.R. Somasundaram of the WGC. However, if the economy were to surge back to life then demand could skyrocket.

- Billionaire investor Ray Dalio is warning of a “capital war” between the U.S. and China that could push the dollar down and lose its status as the world currency. “There’s a trade war, there’s a technology war, there is a geopolitical war and there could be a capital war,” Dalio said on Fox TV over the weekend. Although gold historically moves in the opposition direction of the U.S. dollar and would likely benefit from it going lower, this is still negative overall for the U.S.

- AngloGold Ashanti, the world’s third largest gold producer, announced that CEO Kelvin Dushnisky is stepping down after two years on the job. According to people familiar with the matter, shareholders pushed Dushnisky to leave after asking for further investigation into a bonus payment made by his previous employer Barrick that wasn’t initially disclosed. Bloomberg reports that before working at AngloGold, Dushnisky agreed to a signing bonus to made up for a Barrick payment that he would lose out on. However, Barrick’s annual report showed that he did in fact receive the bonus and was asked by the board to repay it.