Strengths

- The best performing precious metal for the week was palladium, up 2.40%, recovering some of its 14% drop in the prior week. Singapore increased its gold reserves by about 20% in a largely under-the-radar move that saw holdings expand for the first time in decades. The purchases totaled about 26.3 tons, according to data from the Monetary Authority of Singapore’s International Reserves and Foreign Currency.

- Osisko Mining announced that it has signed an agreement for a private placement of $154 million in a convertible senior unsecured debenture due December 1, 2025, with Northern Star Resources Limited. The debenture bears interest at a rate of 4.75% per annum payable semi-annually in arrears, which may be accrued at the option of Northern Star. In addition, Osisko and Northern Star have agreed to negotiate the terms of a joint venture on up to a 50% interest in Osisko’s Windfall Project.

- Credit Suisse has previously written extensively about gold’s role as an inflation hedge, which is particularly relevant in the current inflationary environment (6.2% inflation in the U.S.; 4.7% in Canada), but it is also important to note gold’s role as a defensive asset, especially when there are renewed concerns about COVID-19. Historically, when investors are “risk-off” they seem to gravitate toward gold.

Weaknesses

- The worst performing precious metal for the week was silver, down 2.67%, along with gold and platinum. Newmont Mining has provided clear expectations for 2022 guidance revisions, outlining lower production, a large increase to costs, and relatively stable capital spending. Management indications for 2022 outline production of 6.2 million ounces, stable costs year-over-year of $1,050 per ounce. In December 2021, Newmont guided to 2022 output of 6.2-6.7 million ounces at AISC of $850-$950 per ounce. Long-term budget prices of $1,200 per ounce have been guided to remain unchanged. Industry cost inflation is also guided to have had a positive 5% impact, while interim productivity challenges due to COVID could represent an additional factor in the near-term.

- As posted to the Mining Journal, Hummingbird Resources has taken its Yanfolila gold mine in Mali offline after political unrest. “In recent days there has been unrest and illegal roadblocks in the region,” Hummingbird said. “This activity has impacted the company’s ability to safely continue operations at the mine and as such Yanfolila is temporarily offline until conditions allow.” Yanfolila is located in southern Mali, near the border of Guinea. Hummingbird said the situation on site “remains calm and orderly with all employees and contractors safe and accounted for,” adding that “the current illegal action is from a small minority and not representative of the communities where the company operates and is damaging for all concerned.” The gold miner said it had escalated the issue to the national government, who it said were “in the process of working through the situation and resolving it”. As are result of the suspension, 2021 production is now expected to miss previous guidance of 100,000 – 110,000 ounces.

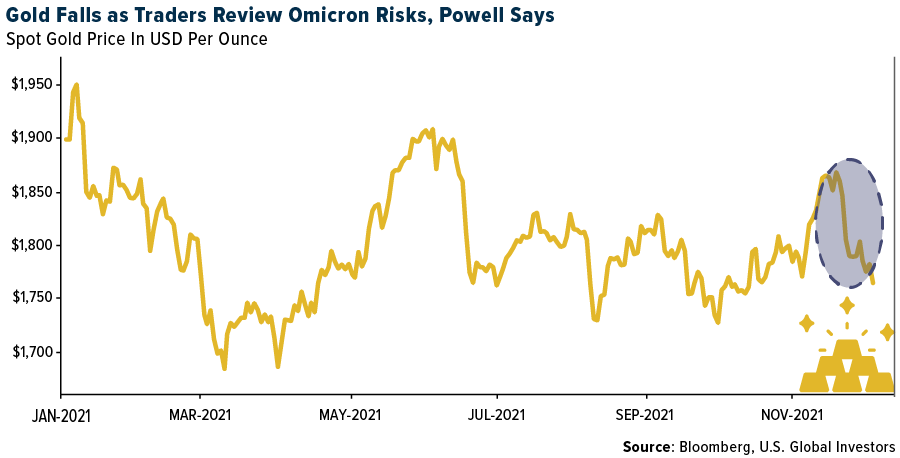

- Gold fell to the lowest in a month with bond yields rebounding as traders continue to assess the threat of the Omicron variant to the economic recovery. Bullion has been whipsawed recently by statements from health authorities and vaccine makers on the level of risk posed by the new variant, as well as more hawkish comments from Federal Reserve Chair Jerome Powell.

Opportunities

- Impala Platinum Holdings revived its pursuit of Royal Bafokeng Platinum Ltd., seeking control of the smaller South African miner in an escalating battle with Northam Platinum Holdings Ltd. Implats, as the miner is known, offered 150 rand in cash and shares to RBPlat shareholders, valuing the company at about 43.4 billion rand ($2.7 billion). That comes after Northam Platinum Holdings earlier this month agreed to pay 180 rand a share for a 32.8% stake in RBPlat, thwarting Implats’ initial approach.

- Kirkland Lake Gold and Agnico Eagle Mines said shareholders approved the proposed merger of the two companies. Earlier this month, proxy advisory firm Glass Lewis & Co. LLC recommended shareholders of the two companies to vote in favor of the proposal, which is expected to create the largest gold producer in Canada. Under the proposal, Agnico will acquire all of the issued and outstanding shares of Kirkland Lake. Each Kirkland Lake share is equal to 0.7935 Agnico Eagle share. The merger is expected to be completed in the first quarter of 2022, pending final order by the Ontario Superior Court of Justice, approval of the Australian Foreign Investment Review Board, and the satisfaction of other conditions.

- Amarillo Gold Corporation has entered into an agreement with Hochschild Mining PLC, whereby Hochschild will acquire all of the outstanding shares of Amarillo by way of a plan of arrangement under the Business Corporations Act (British Columbia). Pursuant to the arrangement, each share of Amarillo will be exchanged for cash consideration of C$0.40 and one share of a new Brazil-focused exploration company, Lavras Gold Corp., based in Toronto, Ontario.

Threats

- The London Bullion Market Association canceled its annual dinner this week over concerns about the new coronavirus variant, signaling the potential for wider disruption to the corporate events calendar. The black-tie event for gold bankers, refiners and traders was due to take place at London’s Natural History Museum. Instead, an online seminar will be held, replacing an in-person version that was to precede the dinner.

- Impala Platinum Holdings Ltd. said three of five workers who went missing on Sunday after a mud rush at one of its mines in Rustenburg have died. South Africa’s mines ministry said that 58 workers died in industry accidents so far this year due to a deterioration in safety. The rising fatalities indicate that miners’ safety is worsening for a second year, after 60 deaths in 2020, according to Minerals Council South Africa, an industry lobby group.

- A top Swiss gold trader is targeting industrial clients as banks back away from the precious metals business. MKS PAMP Group said it was merging its refining and trading operations. The company plans to lure more customers from the electronics and industrial sectors — offering hedging services and supply contracts — after banks cut back or withdrew from precious metals in recent years.