Strengths

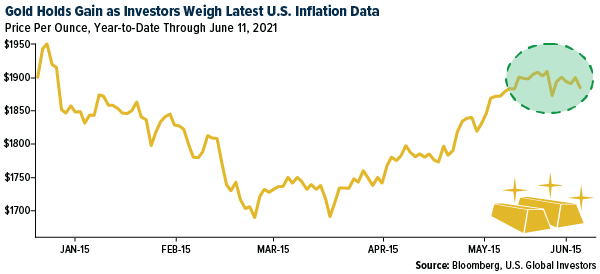

- The best performing precious metal for the week was silver, up 0.45%, but still finding resistance trying find a level above $28 to hold for the last month. De Beers has raised some rough-diamond prices by about 10%, as the world’s top producer cashes in on rampant demand from cutters and polishers. The global palladium market is expected to be in deficit on a rebound in the auto industry, tougher pollution controls and an unexpected tightening of supply after the world’s largest producer said flooding at its Arctic mines will curb output. Gold prices are increasing as comments by Treasury Secretary Janet Yellen on inflation raised expectations for inflation, which is positive for gold. Recently reported CPI data indicated a surge in inflation in May. Demand should also be strong, as one in five central banks intend to increase reserves over the next year, according to the World Gold Council (WGC). One in three central banks in emerging markets are likely to increase gold holdings in the next year.

- SSR Mining Inc. announced that it has amended its existing undrawn revolving credit facility on favorable terms, increasing the Facility size from $75 million to $200 million. The term of the Facility has been extended by four years to June 8, 2025.

- A junior Australian miner is confident that its gold discovery in the nation’s Pilbara region – more commonly known as the world’s premier iron ore province – will propel the company into the ranks of the nation’s top bullion producers. De Grey Mining Ltd. has seen its market value surge to A$1.9 billion ($1.5 billion) from just over A$45 million in about 18 months because of optimism surrounding its Mallina project. The company has set itself the goal of becoming a top 10 producer in Australia with output seen at over 300,000 ounces a year for at least a decade.

- The worst performing precious metal for the week was palladium, down 2.41%, perhaps on news that a project in Russia has received funding that is projected to produce 4.2 million palladium ounces per year. Fed up with years of political dysfunction and wracked by the world's worst per capita COVID death toll, Peruvians have made a radical new choice for president. The results of Sunday's runoff appear to show that Pedro Castillo, a Marxist-leaning former schoolteacher, has edged out Keiko Fujimori, the authoritarian-minded daughter of the country's former dictator. Castillo has ambitious policy proposals, which his supporters say most Peruvians want: rewrite the constitution, spend 10% of GDP on education and health, and redistribute mining profits to fund social programs.

- Centerra Gold’s Kumtor Gold Company Chapter 11 hearings have started. The company’s strategy is to pursue Ontario Superior Court proceedings against former CG Director Tengiz Bolturuk by seeking to prevent him from having any direct or indirect contact with Kumtor Mine management. They want to start international arbitration in Stockholm as provided for in the 2009 Investment Agreement. Additionally, the Chapter 11 bankruptcy proceedings are seeking a Worldwide Automatic Stay in the Southern District of New York.

- A drive by mining companies to hire more women has lost momentum, leaving the industry as one of the world's most male-dominated professions. In the U.S., 14.3% of people employed in mining in 2020 were women, only 0.3 percentage point higher than in 2015. In other news, gold imports by India plummeted in May. This is due to the recent surge of COVID in India and restricted mobility. Only 11.3 tons of gold were imported, compared to 70.3 tons in April.

Opportunities

- Endeavor Mining recently had an analyst meeting with several positive developments. The company highlighted balancing near-term growth projects Sabodala-Massawa Phase 2 and Fetekro, as well as exploration, and returning more capital to shareholders via dividends and opportunistic buybacks. Endeavour expects to achieve its targeted $250M net cash position in the near-term. The company expects annual production to average 1.4-1.5 million ounces thorough 2023, before increasing to 1.5 million ounces in 2024 and 1.6 million ounces in 2025. Endeavour is targeting 30% lower emissions by 2030, and net zero by 2050. To achieve this, a focus area is implementing solar power at the mines. The company has identified potential to add up to 150MW solar power across its portfolio.

- Aya Gold & Silver reported very positive drilling results. The results were 6,437 grams/ton Ag over 6.5m incl 24,613 grams/ton over 0.5m, 12,775 grams/ton over 0.5m and 11,483 grams/ton over 0.5m. This newly discovered high grade zone is only 35m from surface and 75m east of the current resource.

- Newcore Gold announced the positive results of an updated independent Preliminary Economic Assessment completed for the Company’s 100%-owned Enchi Gold Project in Ghana. Average annual gold production in years two through five may be 104,171 ounces gold, with 983,296 ounces gold recovered over an 11-year life of the mine. Operating costs are estimated at $923 per ounce of gold, with cash costs estimated at $1,043 per ounce of gold.

Threats

- Gold will surge to fresh highs next year, but investors seeking currency alternatives as global debt balloons should look to Bitcoin, according to a $7.5 billion hedge fund, SkyBridge Capital. Former Treasury Secretary Lawrence Summers says cryptocurrencies could stay a feature of global markets as a form of digital gold.

- Royalty company streaming business models in part rely upon incorporation in U.S. and Canada, while receiving production and profits in a low-taxation jurisdiction. The risk of increased minimum corporate taxation applied to G7 countries could affect the streaming business’s offshore taxation structure, which has the potential to affect existing streaming transactions in place and the pricing of future transactions. The nature of implementation and timing of potential changes are not yet clear, and various key questions are outstanding, including how deductions for stream deposits will be implemented and whether a corporate tax rate >15% will be sufficient to avoid this taxation being applicable.

- Sarah House and Shannon Seery of Wells Fargo & Co. note that inflationary pressures may not be as short-lived as the Fed contemplates. Core inflation over the last three months has increased to 5.2%, the largest jump since 1991. If the Fed starts raising interest rates too early in this recovery, that could hurt gold’s chances to make further gains.