This week spot gold closed at $1,788.39, down $82.60 per ounce, or 4.41%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 4.18%. The S&P/TSX Venture Index came in up 0.50%. The U.S. Trade-Weighted Dollar fell 0.61%.

- The best performing precious metal for the week was palladium, up 4.26%, perhaps on optimism for a stronger economy. Gold rose for the first time in three days on Wednesday, before ending the week lower. Applications for jobless benefits unexpectedly rose, demonstrating the new surge in virus cases in spurring more layoffs, writes Bloomberg’s Yvonne Yue Li.

- Bullion looks relatively cheap, according to Goldman Sachs. Analysts including Mikhail Sprogis and Jeffrey Currie wrote in a report that the recent gold correction is a “churn versus a turn” and prices should climb when more evidence of inflation emerges. “If we look at the ratio of value of mined gold supply to EM dollar GDP, which is our preferred measure of wealth, we see that the most recent move makes gold look relatively cheap.”

- Polyus shares rose as much as 3.7% in Moscow trading on Tuesday after announcing the repurchase of as much as $343 million in shares. Elemental Royalties Corp, a gold-focused royalty company, doubled in size after an agreement to acquire three gold royalties and one non-gold royalty in Australia from a subsidiary of South32 Limited.

Weaknesses

- The worst performing precious metal for the week was silver, down 6.63%, to be expected with the weak gold tape.

- Gold tumbled to just above $1,800 an ounce as the Dow Jones hit 30,000 for the first time on Tuesday. Ole Hansen, head of commodity strategy at Saxo Bank, says that with vaccine news occupying the headlines and other positive economic data, gold is “likely to struggle.” Bullion then fell below the key $1,800 level on Friday.

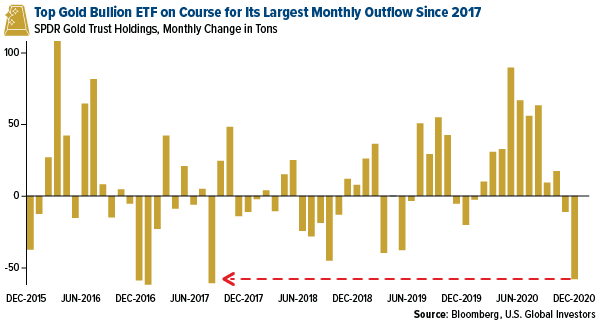

- The largest gold-backed ETF, the SPDR Gold Trust, is headed for its largest monthly outflow since 2017. The ETF has already lost over 50 tons of bullion so far in November. Gold is heading for a fourth straight monthly decline and ETFs are set for the first month of outflows this year, after holdings hit a record in October.

Opportunities

- Credit Suisse wrote that the gold selloff after positive vaccine news is just “a bump in the road” as fundamentals are still intact to support the precious metal. Analyst Fahad Tariq said the factors in place include a weakening U.S. dollar, accommodative monetary and fiscal policy and lower real rates. Canaccord analyst Carey MacRury writes that gold’s selloff is just a “price correction rather than the start of a bear market.” MacRury added that reinflation will be the key driver of bullion over the next six to 12 months and recommends buying on the dips.

- World Gold Council (WGC) chief market strategist John Reade said at a conference this week that the virus vaccine will not cure the economy and that a recovery will take time and further monetary action. Reade emphasizes that a combination of risks, low interest rates and positive price momentum are among the factors supporting gold investment demand. “We continue to advocate that gold should make a strategic component for portfolios, even more so after the recent correction.”

- President-elect Joe Biden’s choice of former Fed chair Janet Yellen as Treasury secretary could set up another big round of stimulus for the U.S. economy. This spending and lower-for-longer interest rates could be a big boon for gold.

Threats

- According to research from International Crisis Group, more than $1.5 billion worth of gold is smuggled out of Zimbabwe each year, depriving the stricken economy of crucial foreign-exchange revenue. The report noted how gold is illegally shipped from small-scale miners to Dubai. Zimbabwean law requires miners to sell their gold to the central bank, paying 70% in dollars and the rest in local currency, which is worthless outside the country and is below black-market rates. Payments to these miners are “considerably lower” than the spot price of gold, prompting sellers to look for more lucrative markets.

- Iamgold is preparing to temporarily lay off 70% of its underground workforce at its Westwood gold mine after a seismic event disrupted operations. Bloomberg reports the cause of the seismic event is unknown and under investigation.

- Gold bull Eddie van der Walt published a bearish macro view on gold and is looking for a price collapse of more than 9%. Bloomberg’s Mark Cudmore notes that gold has lost one of its biggest supporters. The bearish views come amid a lack of demand for usual sources - in this case the outflows from gold-backed ETFs.