The Captain’s daily gold chart.

The Captain’s daily gold chart.

The Captain’s weekly chart.

The Captain’s weekly chart.

Analysis:

Gold generally moved sideways this past week, closing just marginally lower at 4001.10.

Our current long-term gold count, starting from the 35.20 low made back in 1971, which remains incomplete, is as follows:

1 = 1920.80.

2 = 1046.20.

3:

i = 2073.40.

ii = 1614.40.

iii:

(i) = 2073.30.

(ii) = 1810.10.

(iii):

-i- = 2790.40.

-ii- = 2539.90.

-iii- = 3500.30.

-iv- = 3280.60.

-v- = 4381.40, to complete all of wave (iii).

We are now falling in a multi-month wave (iv) correction that has the following retracement levels:

23.6% = 3774.60.

38.2% = 3399.20.

Within wave (iv), we likely completed wave -a- at the 3886.50 low, and if that is the case, we are now moving higher in wave -b-. It is still too early to determine which form wave (iv) will take but based on the formation of wave (ii)…

We should expect wave (iv) to become either a bullish triangle, flat, or irregular type correction, where in the latter formation gold will make another all-time high in wave -b-, before it falls again into our suggested retracement zone.

A projection for the end of wave iii is:

iii = 4.236i = 5965.60.

Projections for the end of wave 3 are:

3 = 2.618(1) = 5936.00.

3 = 4.236(1) = 9033.60.

Active Positions: Flat!

US Dollar:

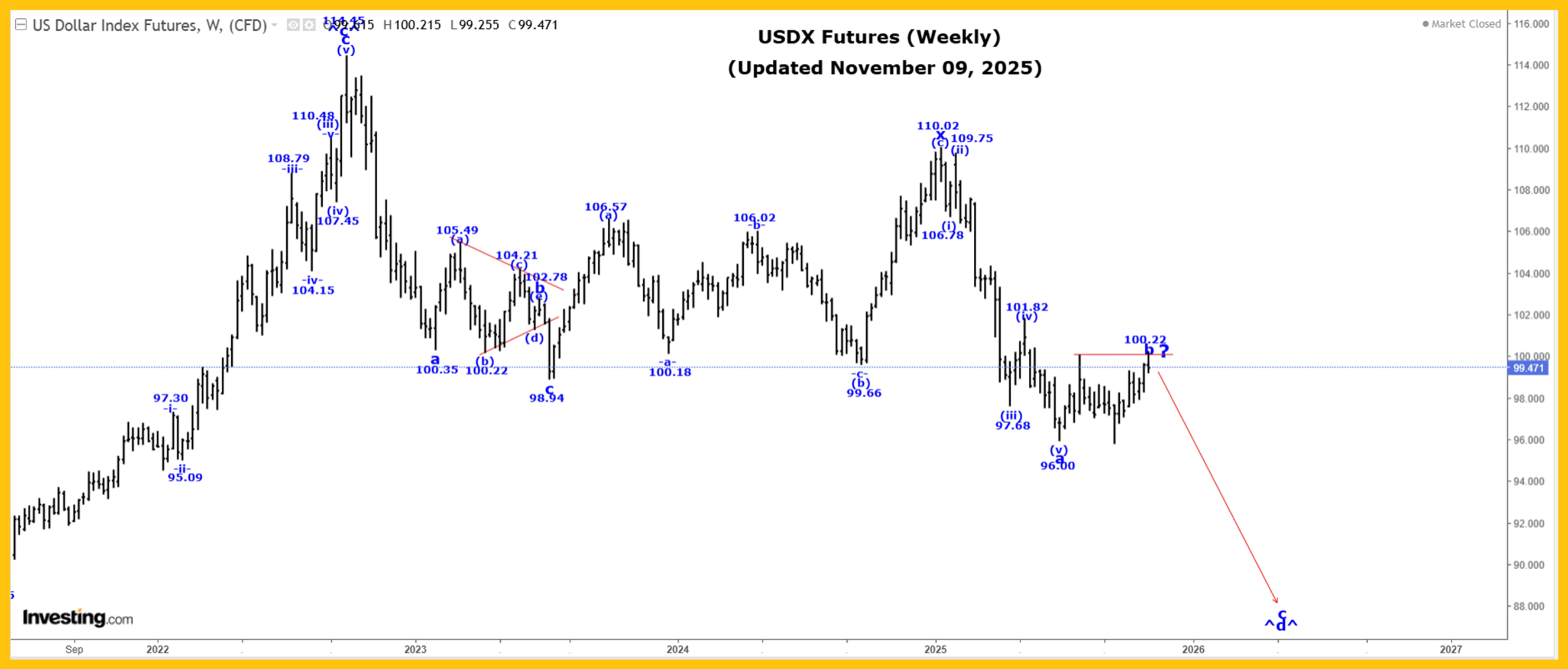

The weekly chart.

Analysis:

All of wave ^c^ is complete at the 114.75 high, and we are now falling in wave ^d^. Within wave ^d^, we have now updated our internal wave count to suggest that it has become a double three wave pattern as follows:

a = 100.68.

b triangle = 103.28.

c = 99.22.

x = 110.02.

a = 96.00

b = 100.22, if complete.

c drop after wave b ends.

It looks like wave b has become a double three wave corrective pattern as shown on our Daily USDX Chart. The first three wave pattern ran from 96.00 to 100.06, which was followed by a wave (x) drop that ended at the 95.85 low.

Our second three wave rally is still underway, which has a minimum target of 100.06, although it may now be complete at the 100.22 high.

Our retracement levels for all of wave b are:

50% = 103.01.

61.8% = 104.66

After our second wave b ends, we expect a drop lower in wave c to complete all of wave ^d^.

Trading Recommendation: Short risking to 105.00!

Active Positions: Short risking to 105.00!

Thank-you,

Captain Ewave & Crew