- There are three big price drivers currently at work in the gold market: The rise of inflation, the huge bull continuation pattern on the weekly price chart, and the war cycle.

- There are numerous other factors in play, but they are related to the (fundamental, technical, and cyclical) “big three”.

- Please click here now. Not surprisingly, the Fed takes credit for the inflation that has appeared on the streets of America… credit that belongs with the Trump administration and to simple supply chain blockage.

- The Fed can take credit for creating “creep state inflation”, because that’s what it created with its vile money printing program: inflation in stock, bond, and real estate markets.

- Main Street inflation never began to surge until the US government issued money directly to citizens… and did so at the same time as the Corona crisis created substantial supply chain issues.

- As expected, US Democrats have failed to follow through with any further direct payments to struggling citizens, but they have told a lot of wonderful “We’re here to help the people!” stories.

- At the same time, some of the supply chain blockages (especially lumber) have cleared. The bottom line: Inflation has temporarily peaked, but it hasn’t waned.

- It appears to be consolidating.

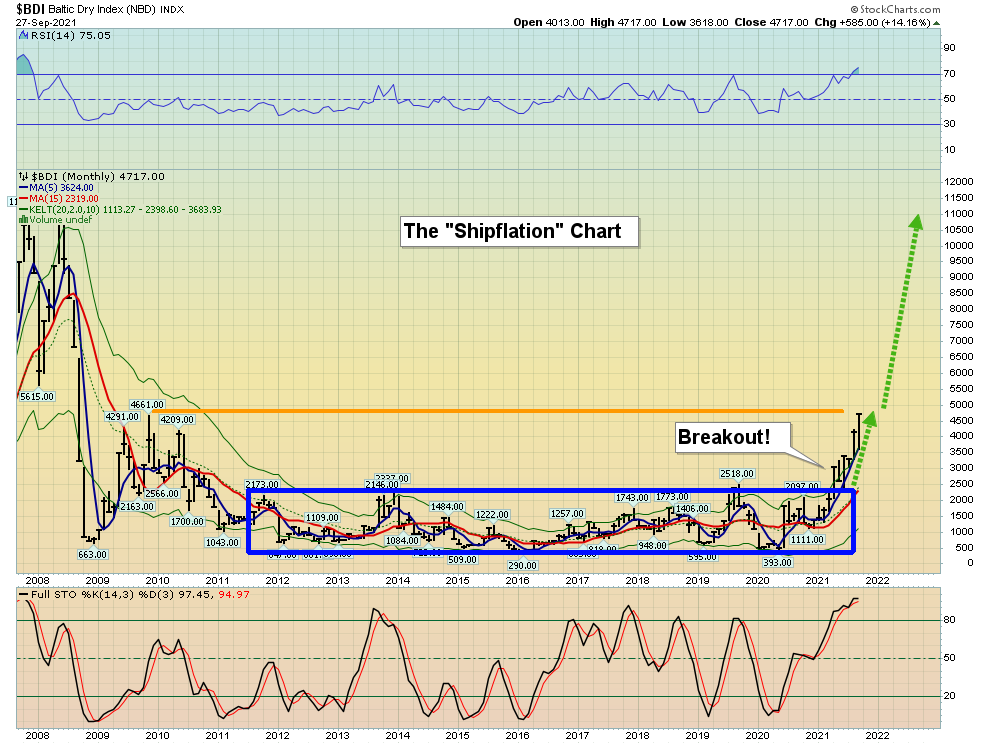

Click to enlarge this stunning “shipflation” chart.

Click to enlarge this stunning “shipflation” chart.- I urge gold bugs to get a grip on the stages of inflation in the dying American empire. First, there is Main Street deflation. Then comes “growflation”, and finally there is stagflation.

- Please click here now. Double-click to enlarge this spectacular BDRY shipping costs ETF chart. An ascending triangle breakout is clearly in play.

- During the growflation stage of inflation, investors will see substantial profits in these types of investments, which is why I recommended BDRY before and during the breakout stage.

- Please click here now. Double-click to enlarge this long-term chart for gold. Note the enormous bull continuation pattern (an inverse H&S).

- The right shoulder is still forming, and it’s likely to be completed as the Fed’s QE welfare program is reduced or eliminated.

- Please click here now. Double-click to enlarge this disturbing stock market chart. As debt-fuelled GDP growth fades, the stock market will swoon, and the winds of stagflation will begin to blow.

- Please click here now. The governments of dying empires can’t resist meddling in the affairs of faraway lands, and they use borrowed and printed money to do it. The 2021-2025 period is a war cycle, and 2021 is only the start of it. By the time of the 2025 “crescendo”, this war cycle could make the virus cycle of 2020-2021 look small.

- Please click here now. Double-click to enlarge. This chart highlights the price action during the formation of the huge right shoulder on the long-term gold chart.

- Investors need to look for “green shoots”, and there have been some, but until there is more fundamental evidence of imminent stagflation, the right shoulder formation is likely to continue.

- Back in 2014-2019, I talked about the coming rally to $2000, and the need for investors to be prepared for a substantial right shoulder build process that would probably see gold pull back from $2000 to around $1500.

- That’s exactly what has occurred. At this point, a yawn is more useful than a prediction; it’s all about waiting for the shoulder to be completed.

- The huge $1566-$1450 support zone is in the $1500 target area. It’s also my “all gold bug hands on mining stock deck” buy zone of champions!

- Please click here now. Double-click to enlarge. I call this the GDXJ money train chart, but for investors who ignore the big support and resistance zones for gold, it can become a truly macabre money drain chart.

- There are a couple of green shoots now; the 14,7,7 Stochastics oscillator is finally oversold and a positive RSI non-confirmation with price is also in play.

- A close over $43 would be the next green shoot to look for. My mantra for investors is this: sit tight and wait for gold and the miners… to begin their magnificent right shoulder bull era flight!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates