Ticker: $GXS (TSXV), $GXSFF (OTC)

52-Week High-Low: C$1.90-$0.90/share

Shares Out: 52.2m (Basic), 63.38m (F/D)

Goldsource Mines is a Canadian-based exploration and development company focused on advancing its Eagle project in Guyana. Guyana is a mining-friendly country in South America that remains underexplored. Over the last twenty years, there have been some exciting discoveries made in the country, with the most recent attention-grabbing headline being the acquisition of Gold-X mines ($GLDX) and its Toroparu project by Gran Colombia Gold ($GCM).

Although the share structure was a bit sloppy, the company completed a 10:1 reverse split on June 4, giving the company approx. 52.2m shares out (Basic) and 63.38m (F/D). As of April 27, 2021, the company had a C$3.1m net cash position followed by the announcement of what turned out to be a C$12.65m equity financing (inclusive of the over-allotment option, which was exercised in full). Less the commission paid to the underwriters; the company currently has approx. C$15m in net cash, although this excludes any additional expenditures on exploration beyond April. This should fund the company until much later in the year, if not next.

There is moderate insider ownership with management holding a 3.90% interest and strategic investor Eric Sprott owning a 7.10% interest, and the Donald Smith Value Fund holding a 9.80% interest. These numbers are before the recent financing, so they have likely been diluted.

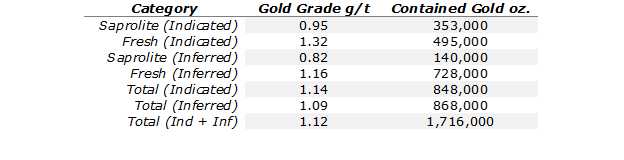

Eagle Mountain (Development, Guyana): Eagle Mountain comprises two gold deposits, Eagle Mountain and Salbora, and a handful of exploration targets. The two deposits at Eagle Mountain are structurally controlled and affected by a zone of saprolite weathering up to 50m thick. It is a simple and straightforward development project (from a technical point of view). Gold mineralization starts at surface in saprolite (soft-rock, cheaper to process relative to fresh rock) and extends into the underlying fresh rock. The project is similar to those projects being advanced by Minera Alamos in Mexico in that it is a technically straightforward open-pit deposit. The company has done a good job of slowly defining gold resources, which currently stand at 848k oz. Au (Indicated) and 868k oz. Au (Inferred).

The shallow deposit is highlighted by a low-strip ratio, which looks likes it won’t be overly capital intensive with fair operating costs. Metallurgy has proven robust, with recovery rates of approx 95%. Based on the 22 saprolite samples, the average recovery rates were 96.50% (24% via gravity and the rest through cyanidation. There is a favorable coarse grind size/recovery relationship is through a standard gravity CIP (carbon-in-pulp) plant. There is the potential for 45% of the saprolite feed to bypass grinding completely, aided by the coarse grind/recovery relationship and friable nature of saprolite.

The Eagle Mountain deposit is a series of tabular, shallow, dip-slop shear zones, with Zone 1 being the shallowest, which outcrops at surface across a large portion of the deposit. The Salbora deposit is a series of north to northwest trending, steeply dipping structures.

In 2021, exploration will focus on the existing MRE outline, targeting a 75% resource conversion rate (Inferred à Indicated). It will also be focused on expansion drilling outside the MRE at extensional targets at Eagle Mountain and new targets along the Salbora-Powis trend. Lastly, the 2021 drill program will be focused on greenfield exploration to add new targets, principally testing targets along the Salbora-Powis trend. There were five new discoveries in 2019/2020, with 16,322m drilled in 2020 and 2021 planned drilling totaling 16,500m. Exploration targets in 2021 include Ounce Hill (Eagle Mountain), which has illustrated the highest-grade x thickness intercepts to date, including 34m @ 20.38 g/t Au, announced on February 8, 2021. Another opportunity lies in the expansion to the west and southwest via step-out drilling at Baboon (Eagle Mountain). Other targets include Montgomery, Toucan, and Ann (along the Salbora-Powis Trend), all recent discoveries.

The updated MRE in 2021 illustrated greater than a three-fold increase in Indicated resources while also increasing Inferred relative to the 2014 MRE, from which the initial preliminary economic assessment (PEA) was based upon.

Following the cut-off date for the most recent MRE, there have been a few news releases regarding exploration results, which will be included in the next MRE. Highlights from these news releases include:

- 44m @ 2.02 g/t Au (Ounce Hill)

- 34m @ 20.38 g/t Au (Ounce Hill)

- 24m @ 3.41 g/t Au (Ounce Hill)

- 22.5m @ 2.69 g/t Au (Ounce Hill)

- 24m @ 0.76 g/t Au (Ounce Hill)

- 6m @ 3.06 g/t Au (Baboon Area)

- 12m @ 6.91 g/t Au (Kilroy Area)

- 3m @ 5.40 g/t Au (Minnehaha Area)

- 11.50m @ 3.37 g/t Au (Minnehaha Area)

- 28.5m @ 2.03 g/t Au (Salbora)

- 39m @ 1.55 g/t Au (Eagle Mountain)

- 36.5m @ 1.83 g/t Au (Eagle Mountain)

- 6m @ 3.81 g/t Au (Montgomery)

- 3m @ 3.69 g/t Au (Montgomery)

- 1.5m @ 20.5 g/t Au (Montgomery)

Valuation:

Given all the drilling that has taken place following the initial preliminary economic assessment, it is outdated to use it whatsoever regarding valuation; however, the 2022 pre-feasibility study will shine a light on how economical the Eagle Mountain project will be.

We view Eagle Mountain similarly to Minera Alamos Gold’s Santana and La Fortuna projects, all of which are simple, technically straightforward projects. Goldsource is trading with an Enterprise Value/ounce (EV/oz) under $30, while Minera Alamos is trading with an approximate EV/oz. of approx. $250. Granted, Minera Alamos is nearing completion of its Santana mine build and rapidly advancing two other projects. So Minera Alamos warrants higher multiples, but this big of a discrepancy isn't justified. There are several potential stock price catalysts over the next 12-months, including an updated resource estimate, updated technical report (PFS), and exploration results.

Disclosure: The author holds no position in Goldsource Mines. Goldseek Employees do have a position in Goldsource.