Call me cynical, but it looks either inept or manipulated when the government jobs data get revised every single month in the same direction, especially when putting out higher numbers to hit the headlines and then revising them down later allows the Biden administration to shine its best.

Few people, including investors, pay any attention to the job revisions. They are concerned about what is happening now, not what happened back in history. So, massage the data like a geisha to make it look like you’ve engineered a strong economy, then revise it down to reality in the background the next month to keep your accumulating data from getting further and further off the mark. Pick up an extra bonus when you revise the past month down because it makes the new month look even better. It keeps your earlier book cooking to the positive from making it harder for the new month to keep up.

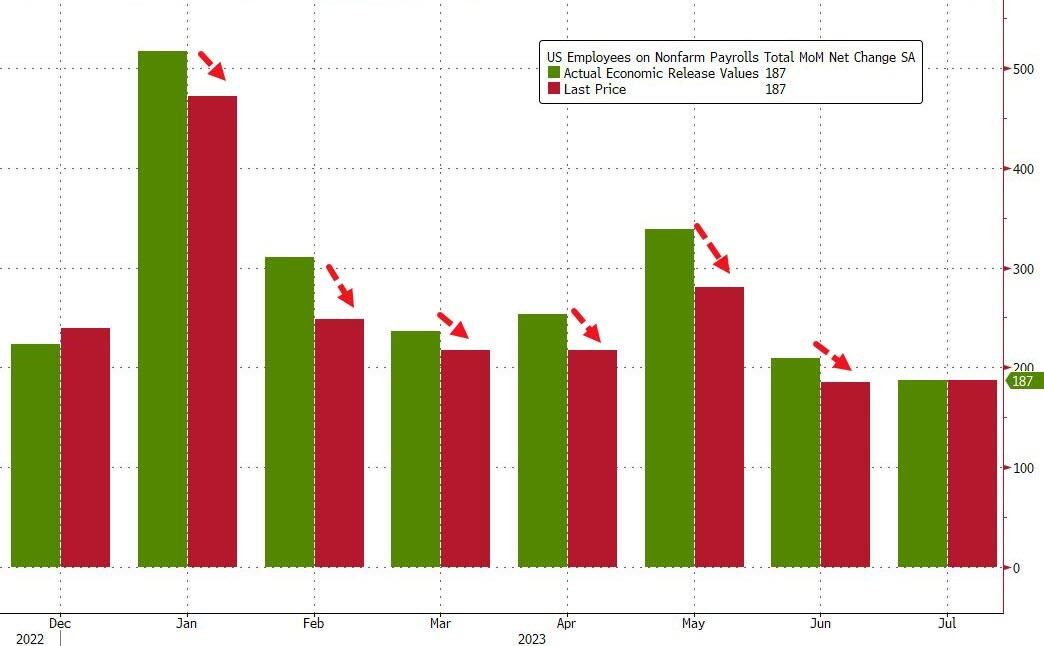

If the government were shining things up like that, it might look like this:

Oh, wait, it does. (The green is what was originally declared. The red is what that same month was revised to a month later when the latest data were released. You would think, if your data were always off in the same direction every month of the year, you might suspect something was wrong with your data collection or your ways of analyzing it and try to fix that. Unless, of course, that is just the plan.

It’s pathetic, though, when the overall picture still looks like it tripped over a sandbag. Regardless of which set of numbers you look at, you can see that the trend is not our friend. This whole year the number of new jobs being added to the economy has stumbled downhill like a president on an airplane loading ramp. No surprise there, however, since that seems to be what Fed Chair Powell wants to achieve in direct opposition to Biden’s goals. So far, it looks like Powell is winning the old-geezer tug-o-war in the championship match of economic destruction v. construction.

I suggested back around May that it appeared we were getting close to where the labor market would start to roll over sometime this summer but that the change to unemployment would come too late to help Powell realize his tightening regime is starting to do economic damage so that it is time to stop. We see that in today’s labor reports. While the number of jobs added came in below expectations (and at the lowest level all year), the unemployment rate still managed to fall yet again, and the news of the day says the labor market is still tight enough due to the shortage in workers that employers are “hoarding” labor, meaning finding ways, even as they are reducing the creation of new jobs, to retain the labor they have.

In Canada, labor is rolling over a little more clearly with unemployment starting to rise. Even in that situation, however, wages are still growing strongly; so there is not any disinflationary effect yet due to the dying/disabled/retiring labor force.

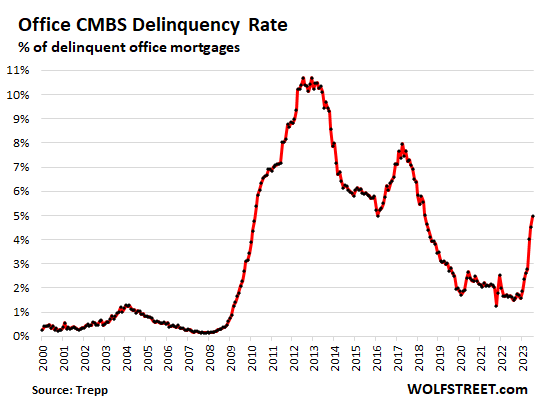

One thing that is rolling over faster than Hunter does from prostitute to prostitute, however, is something the Fed might not want to see if it still hopes to score that fabled inverted soft landing. Commercial real estate defaults are getting higher than the presidents son and are hitting new highs faster than anytime during this millennium. Even the big real-estate bust of 2008 didn’t see defaults rise as sharply as they are moving now.

They are not yet as high as they reached during the Great Recession … or as the White House gets on a Friday night when they leave traces of the party lying around, but we are just getting started, and the delinquencies are rising faster than ever:

Oh well, what are a few delinquencies between friends and their banks? Papa Powell has assured us the banks are in great shape, and so has Gramma Yellen. So, I’m sure everything will be fine. The banks always see these things coming and make sure their reserves are in solid shape anyway. We are, after all, in the hands of experts who oversee these things.

So, with such assurances by people who have been so good at avoiding problems from these kinds of things in the past, no wonder the stock market is barely concerned. Besides, this is playing out in the realm of mortgaged-backed securities, and we know from experience those are well layered in tiers that work to assure no extraordinary problems can emerge.

So, what could wrong? The fact that they’re commercial MBS defaults going straight up like a rocket and their launch was more abrupt than in 2008 shouldn’t concern us. The president has assured us he’ll put Hunter in charge of bank acquisitions for the Biden Business Trust, and they already have Chinese mergers lined up. The deals are wrapped up and ready to go to make sure not a single depositor loses his or her money … nor a single banker.