Back in the Great Financial Crisis era, someone quipped that the federal government had become a giant hedge fund with an army attached. That wasn’t far off. Various agencies and entities were absorbing all kinds of risky assets to stabilize an overleveraged system. It was ugly but worked, more or less…. with a heavy dose of unintended consequences like the distortion of zero interest rates on the markets.

Today we could similarly say the federal government is a colossal pension fund with an army on the side (and now a space force too). But those forces are budgetary afterthoughts. The big money goes to support a fast-growing population of retirees, fulfilling promises made generations ago on the assumption they would be manageable. Whether it is truly manageable or careening out of control is proving questionable, at best.

Washington doesn’t just support the retired population’s living expenses. It also pays for their healthcare, a large and growing cost. Last month we talked about Social Security’s impact on the debt and some possible ways to reduce it. Today we’ll look at healthcare and the debt. As you’ll see, Medicare isn’t the only challenge.

More People Spending More Money

As everyone who participates in the US healthcare system knows (i.e., everyone), it is a vast and incomprehensibly complex web, with you as the patient often helpless in the middle. Reforming this morass is a larger discussion we should have at length, but today I’m looking specifically at the federal government’s financial role and how we can better control healthcare costs.

The first challenge is separating all the components. Many government programs deliver healthcare directly: military and veteran’s hospitals, prison clinics, and so on. The physicians and other staff are government employees and patients pay little or nothing. Add these up and they would be a large healthcare system on their own, but they serve only a sliver of the population.

The federal government’s much bigger role is as insurer or sometimes reinsurer. It collects taxes, borrows money, and redistributes it to help various groups pay for their healthcare needs. Sometimes the recipients share in the cost, sometimes not. (Like I said, it’s complicated.) But the costs are enormous and growing.

A September 2023 Congressional Budget Office report tries to quantify the assorted Federal Subsidies for Health Insurance: 2023 to 2033. They say “subsidies” rather than “spending” because some of it is delivered as tax benefits rather than cash. The budgetary effect is the same, though, at least in theory. (I get the philosophical argument that in practice it is not. That is the discussion for another day.)

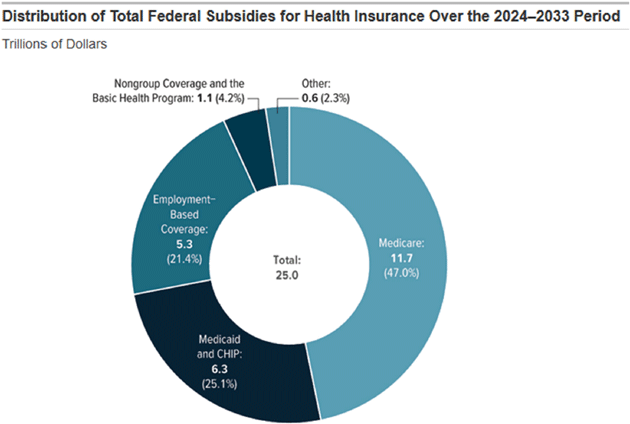

Combining several categories, CBO estimates a total 10-year cost of about $25 trillion, of which 47% is Medicare. This is net of the premiums the government receives from most Medicare beneficiaries.

Source: CBO

The “Employment-Based Coverage” category is an example of indirect spending. The amount CBO calculates there is the value of employers and workers not being taxed on the income they use to purchase health insurance. A long-ago Congress decided it was in the public interest to encourage this and voted to do so via tax deductions. That’s a “subsidy” in fiscal terms. It is tax revenue Congress has “generously” decided not to collect.

Affordable Care Act tax credits show up here as “Nongroup Coverage.” If the amount seems low, remember this is a 10-year total. The tax credits are currently higher due to COVID-era benefits that extend only through 2025. The cost will rise if Congress extends them further.

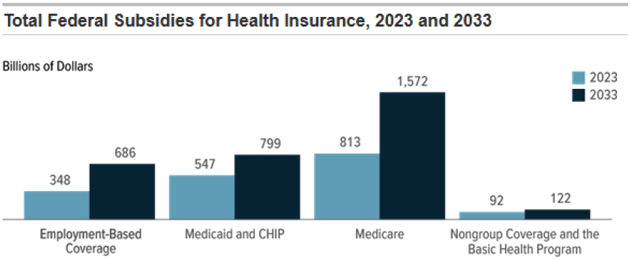

To clarify the growth, here is a comparison of the 2023 and 2033 (estimated) amounts for each category. Add them up and you’ll see the annual spending pace grows from $1.8 trillion to over $3 trillion during this time. This is most evident in Medicare, though in percentage terms the employer-based coverage cost growth is similar.

Source: CBO

Why does CBO think costs will increase so much? Part of it is growth in the over-65 population, which CBO expects to rise from 59 million this year to 73 million in 2033. As too many of us know, older means more health care problems and costs. Other things being equal, that should raise Medicare costs about 24%. But other things aren’t equal. Per-person health care costs are rising, too.

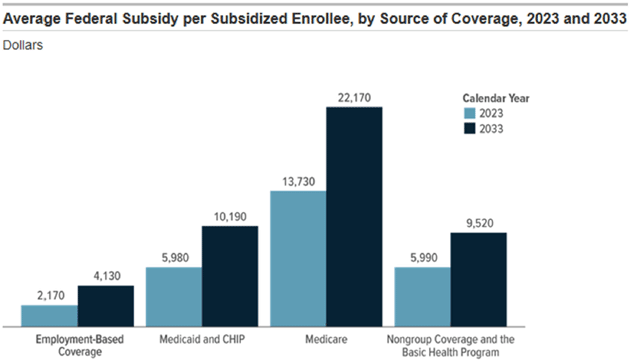

Source: CBO

While this year the average Medicare recipient generates expenses (in excess of their premiums) of about $13,730, CBO expects that number to reach $22,170 in 2033.

More people spending more money when the government is already running a huge deficit means more debt, with all the ill effects we’ve discussed. (Cue interest on debt crisis!)

Obviously, we don’t want to deprive retirees of the healthcare benefits for which they paid taxes throughout their working lives. But, similar to Social Security, the trust fund into which all that tax revenue goes is depleting quickly. We don’t have infinite resources. How to solve this?

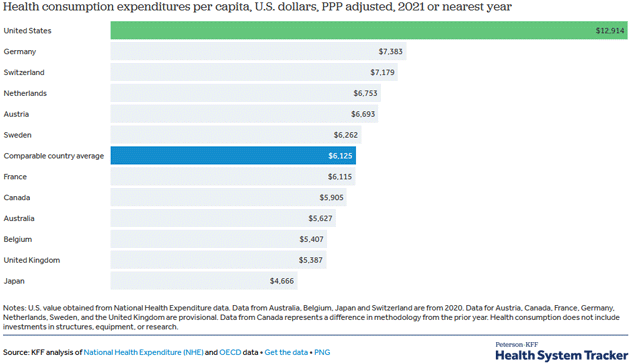

It would certainly help if the US could get healthcare costs in line with our peers. We spend far more per person and still lag behind on life expectancy and other health indicators.

Source: Peterson-KFF

The green bar at the top shows in 2021, US per capita health consumption was $12,914. The next highest bar is Germany at $7,383. Japan was only $4,666. Note also the fine print saying, “Health consumption does not include investments in structures, equipment or research.” It’s not that we are paying for drug development that benefits others, as is often claimed. While true, it is not that big in the scheme of things. We spend more, far more, any way you look at it.

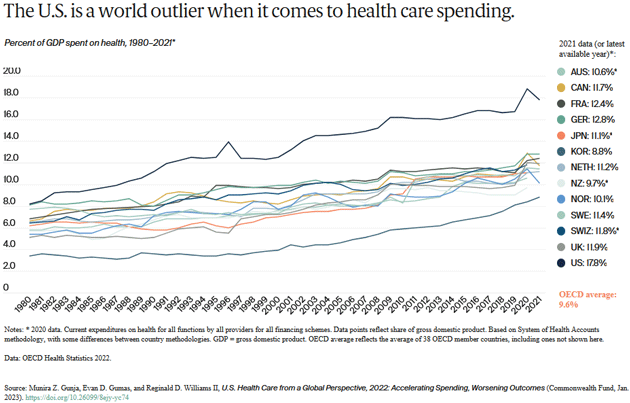

This isn’t new. Here’s another chart showing the trends over time (expressed as percent of GDP rather than per capita spending).

Source: Commonwealth Fund

The US is the line by itself at the top, where it has been since the early 1980s. (That outlier on the downside is South Korea, by the way.) The latest year (2021) shows the US spending 17.8% of GDP on healthcare vs an OECD average of 9.6%.

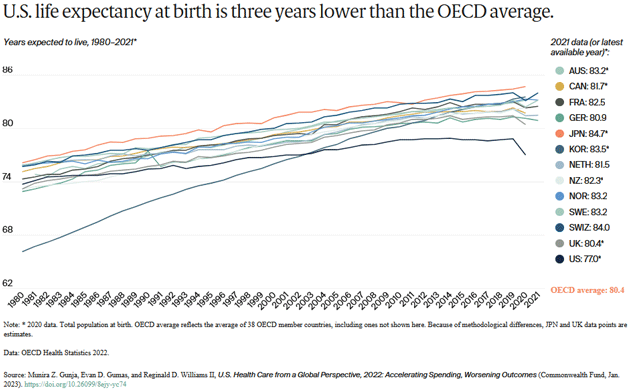

Yet all this extra money isn’t buying us any additional life. US life expectancy has been the lowest in the OECD for decades. We will look at why in a moment.

Source: Commonwealth Fund

You can quibble with these numbers, but the general point is hard to deny. US healthcare spending really is out of line with other developed countries. So are US healthcare outcomes. Closing that gap would go a long way toward solving the government debt problem. Household debt, too, since much of it is for healthcare. And US businesses would be more globally competitive if they could cover their workers at lower cost, probably raising corporate and business income tax revenue.

As noted, the charts show this cost problem isn’t new. Nor can we blame it on any single cause. This is a multifactor mix: demographics, diet, culture, education, and government policy are all in play here. None are easy to change, and certainly not quickly.

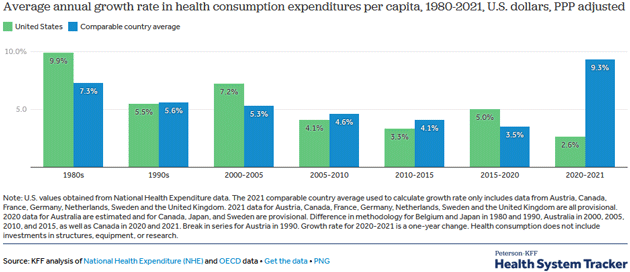

That dismal picture isn’t completely hopeless, though. For one thing, the relative cost growth in the US does seem to be slowing. Here’s a note from Peterson-KFF that accompanied the charts above.

“While the US has long had higher than average health spending, recent years have seen higher spending growth in other nations. Historically, the 1980s saw accelerated growth in health expenditures per capita in the US. The 9.9% average annual growth rate in the US during the 1980s was significantly higher than comparable countries. Comparably wealthy countries saw an average of 7.3% annual growth during this period.

“Looking at 5-year growth rates, during the period from 2005‒2010, the US saw an average annual growth rate in health spending of 4.1%, compared to 7.2% during the previous five-year period. Comparable countries also saw health spending growth slow down on average, from 4.6% average annual growth during the 2005‒2010 period, down from 5.3% during the 2000‒2005 period. The annual growth rate for the average of comparable countries increased between 2020 and 2021 to 9.3% versus a 2.6% increase for the US during the same period.”

And here’s a chart showing the cost growth in various periods.

Source: Peterson-KFF

The most recent data shows healthcare costs increasing far faster in the other developed countries than in the US. This includes the COVID-19 pandemic so possibly it’s a glitch. But it also suggests we can contain cost growth if we try—and that maybe the tools those other countries used to keep costs down are no longer working.

Nonetheless, even the latest 2.6% annual healthcare inflation is too much and will compound over time if it continues. I’m convinced our best shot at stopping it lies in:

- Biotechnology innovation;

- Rewarding healthier lifestyles.

A few weeks ago I described some of my personal investments in biotechnology but they only scratch the surface. New tools like AI and a host of new medical technologies are opening up new possibilities almost faster than anyone can track.

For example, one group is studying a personalized pancreatic cancer treatment using gene sequencing to find proteins that trigger an immune response to that specific cancer. Results in a small study were encouraging and they’re now planning larger trials. Imagine the cost savings if we can treat cancer with precision targeted medicines instead of the “shotgun” approach of chemotherapy/radiation with all the associated side effects.

Of course, all such ideas need to be thoroughly vetted for their own potential side effects. This takes time and can’t really be rushed. Or can it? AI technology is advancing at a furious pace and may soon be able to simulate the results of large-scale clinical trials in minutes rather than years.

Even better, AI could actually help detect cancers before they cause symptoms, making treatment relatively simple. Researchers at Massachusetts General Hospital trained an AI model on 147,497 routine chest X-rays, from which it learned to recognize the patterns associated with lung cancer.

Think about how this could help. People get chest X-rays all the time for many different reasons. Each one contains a wealth of data no one currently considers. But AI could easily give them all a much deeper review and maybe detect early-stage cancers no one even suspected.

I believe we really are on the cusp of a medical revolution that will keep us healthier longer and at lower cost. The budgetary impact depends on how quickly it happens. The challenge isn’t simply in developing the technology, but in making it affordable and widely available.

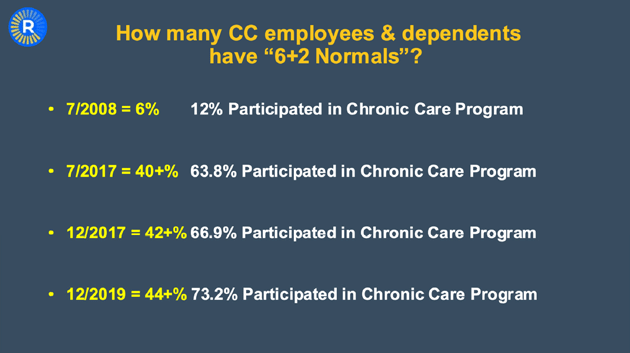

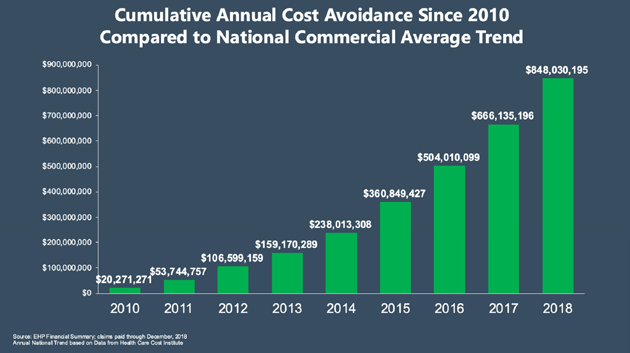

There are simpler things we can do, too. My friend Dr. Michael Roizen initiated a program for employees of the Cleveland Clinic and saw significant, if not monster, improvement in health care costs. Essentially, Cleveland Clinic pays workers to adopt healthy lifestyles. Control your blood pressure (meds if needed), don't smoke, exercise, control your weight, reduce your fasting blood sugar and cholesterol, and do something to relieve stress. It cut their costs relative to the national average by 38% and rising.

The program is optional and participating employees received significantly reduced healthcare costs. Those who don’t participate pay the difference on their own. Not surprisingly, the participation rate soared over the last decade, from 12% to now over 75%. (Table only goes to 2019.)

Source: Cleveland Clinic

Cleveland Clinic saved almost a billion dollars in 2018 and it’s now over $1.5 billion a year, according to Mike. That is huge for a company with “just” 40,000 employees.

Source: Cleveland Clinic

Other companies are following this example. What if we did something similar nationally?

Remember that $22,000 per person projected Medicare cost in 2033? What if we dropped it 40%? Plus have everyone on any form of government-subsidized insurance adopt the same program? Do some simple things and pay less for your insurance or live an unhealthy lifestyle and pay more.

Any healthcare reform will mean higher costs for those with higher incomes. Not an unreasonable request. If we ask “the rich” to pay more, is it that much of a stretch to ask someone to adopt a healthier lifestyle, paying them to do so, and if they elect to not develop simple healthy habits (take your meds, mild exercise, smoking, eat healthier, etc.) then why shouldn't they pay more? Their refusal to make small lifestyle adjustments is a cost and a tax on everyone else.

Technology is coming to the rescue here. The new weight loss drugs are going to make a monster difference in diabetes and lifestyle health issues. Not to mention the anti-inflammatory drugs that will be revolutionary in extending health spans, not to mention lifespans.

There is bipartisan support for a program similar to what Cleveland Clinic is doing right now. It would be nice to see a presidential candidate make this a feature in their campaign. Who can be against better health?

But What Happens if We Live Longer?

However, we then have another quandary. If we succeed in extending healthspans along with lifespans, it might solve the Medicare problem but aggravate the Social Security problem. Average lifetime benefits rise in line with average lifetimes.

This gets to the structural flaw in Social Security. The original plan set full retirement age at 65 at a time when few people would live more than a few years beyond that point. It was never intended to routinely support decades of non-working life. Even a wealthy economy like the US can’t sustain that indefinitely—particularly when the younger generations aren’t growing fast enough to maintain the workforce.

Yet raising the full retirement age (it’s currently 67 for anyone born in 1960 or later) is politically toxic even if it’s the best answer. If that does happen, it will only apply to younger workers, which means it won’t help the immediate problem. The fix will have to be some combination of lower benefits and higher taxes, neither of which is widely palatable.

Fixing healthcare, as tough as it will be, is actually the easy part of our debt problem.

Energy Might Help Offset Your Taxes

Longtime readers will know that I am bullish on oil and gas in the medium and long term, precisely because the ESG movement, including numerous governments, is limiting both the amount of money and places that can be drilled for oil and gas. Economics 101 says that if you reduce a supply of something that has an increasing demand the price is going to rise. Felix Zulauf and others at my conference were talking about $120‒$150 oil next year. In a normal world, that shouldn't happen, yet it is.

For some, investing in oil and gas may provide significant tax benefits. Of course, you should consult your tax advisors on this.

For those with true risk capital, I would invite you to see what we are doing at King Operating. We are physically drilling for oil and gas in older, underdeveloped fields, planning to improve their value. Typically, the older fields were all vertical wells, but you can improve the value of that old field by using modern technology and doing horizontal drilling and fracking. It is similar to buying an older apartment complex in a great neighborhood, upgrading and renovating it, raising rents and then selling it to someone who wants to be in the apartment management business.

I will be doing a webinar next Tuesday, December 5, at 6 pm ET (and two more the following Tuesday so you can register for this one but also get invitations for the 12th and 19th if those fit better into your schedule. We will of course discuss energy, price movements, taxes, where we are in our drilling process, oil and gas production, and so much more, and answer your questions! You can register below. It will be fun and informative, and you want to be there!

Important disclosures: Note that John Mauldin’s association with King Operating is completely separate, legally and financially, from his involvement with Mauldin Economics. The opportunity presented above by John Mauldin in TFTF is not endorsed by Mauldin Economics, ME Research LLC, or any of its other partners nor do any of them have any financial or other interest in the described venture.

John Mauldin will be receiving significant financial benefits from investments made in this venture by investors. More specifically, as chief economist of King Operating, John is entitled to receive consulting fees as well as a significant interest in the fund’s general partner.

This opportunity is offered by King Operating and it is limited to accredited investors. Prospective investors should carefully review the offering memorandum and risks disclosure before proceeding.

To register for the webinar click here.

Christmas, New Year’s, and Personal Healthcare Costs

Shane and I will be staying in Dorado for Christmas and New Year's. December is always fun with neighborhood parties and time spent with old and new friends. We throw our own party on New Year's Day featuring Shane’s world-famous black-eyed peas, my Texas chili, and maybe even a prime rib this year. It’s open to anyone!

There are some who might suggest I live in a kind of healthcare cost ivory tower. It’s true that I am relatively well off and can absorb more than most. Watching my children’s experience keeps me well-connected to reality, though.

Number one son Henry has type 1 diabetes despite a very healthy lifestyle. This means constant meds and problems. Number two son Chad has been diagnosed with cancer, thankfully now in remission, but he constantly needs expensive drugs and procedures just to stay alive. His legs are a network of blood clots. It is difficult for him to find work that allows him time to go to the doctor two to three times a week, not to mention over $100,000 in debt that insurance is arguing about. Another child is on drugs to stall a disease that would otherwise kill them. Amanda is still recovering from her stroke (and doing well). My two biological children have inherited some of our family female issues.

Without modern medicine, I could be down half my children. And I am really pulling for new meds and technology that will let them live even longer. Not to mention myself and Shane.

And with that, it is time to hit the send button and wish you a great week. Lots of changes are happening at the Mauldin household and businesses this time of year (stay tuned). And don’t forget to follow me on X.

Your grateful for health and more analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.