It was no prediction when I implied that the stock market would likely rise after getting word of hotter inflation—just a penetrating glance into the obvious:

Markets await the reports with bated breath. Still, stocks and bonds have both been steeped in so much unreality that … Never underestimate either market’s ability to wear blinders.

Blinders fully in place, stocks rose, and so did the flames of inflation. Zero Hedge noted in an article about the CPI report that prices are the highest they have ever been, so there has been no overall deflation at all since the Fed started tightening, and prices again rose faster this month than last, including a tiny wiggle upward in year-on-year inflation.

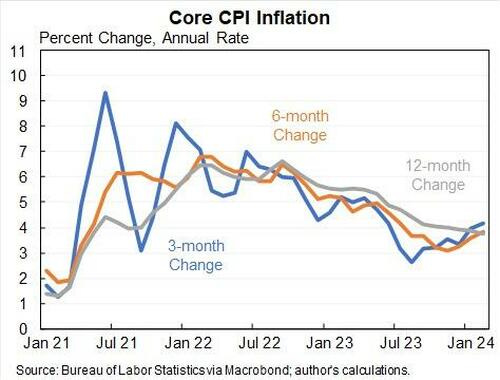

Someone has turned the gas valve up a little on inflation’s money-burning inferno. The three-month annualized inflation rate rose from 1.9% in the last report to 2.8%, and energy costs—particularly gasoline and diesel—surged higher. Month-on-month, shelter inflation rose, instead of falling, as the economists had believed would happen, surprising none of the rest of us who live in the real world.

Annualized core CPI has been rising since the middle of last summer and continued to do so in the report:

Inflation rose again in February, keeping the Federal Reserve on course to wait at least until the summer before starting to lower interest rates.

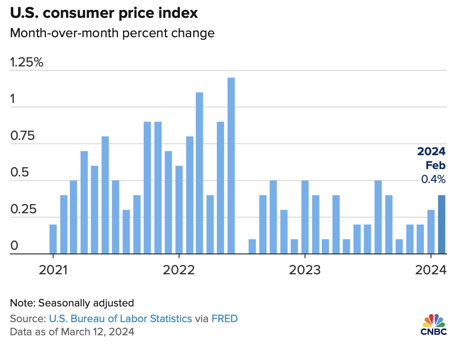

Here is another graph of inflation that shows how overall inflation has been consistently rising more and more on a monthly basis:

The BLS reported that the increases in energy and shelter amounted to more than 60% of the total gain. Gasoline jumped 3.8% on the month while owners’ equivalent rent, a hypothetical gauge of what homeowners could get renting their properties, rose 0.4%….

“With home prices expected to rise this year and rents falling only slowly, the long-awaited fall in shelter prices isn’t coming to the rescue any time soon,” said Robert Frick, corporate economist at Navy Federal Credit Union. “Reports like January’s and February’s aren’t going to prompt the Fed to lower rates quickly.”

So, it wasn’t a huge increase, but it was another month of rising heat, and it came in slightly higher than what was expected by the economic gurus.

Here is a brief rundown of some of the Wall Street summary comments:

“That is not the direction the Fed wants to see." —Brian Coulton, chief economist at Fitch Ratings

“After a brisk January reading, the report adds to evidence that inflation is proving stubborn, which is keeping central bankers wary of easing policy too soon.” —Augusta Saraiva, Bloomberg

“This will probably be seen as a reason to keep policy on hold awhile longer.” —Kathy Jones, Charles Schwab’s chief fixed-income strategist

“We don’t think this print warrants a sustained rally from these levels.” —Bloomberg Intelligence Rates Strategist Ira Jersey

“Fresh upward momentum is building in inflation. Inflation has started to move sideways and remains well above the Fed’s 2% inflation target. This means the Fed will keep rates higher for longer.” —Torsten Slok, Apollo

“The latest data further reinforce the case for a patient and vigilant approach from Fed officials as they consider future policy decisions.” —Rubeela Farooqi, chief US economist at High Frequency Econ

And, of course, the following kind of comment exemplifies the juice that keeps the market roaring upward, regardless of how often its fantasy narrative fails:

“Inflation came in a little hot but the bulls aren’t ready to throw in the towel yet. Investors remain optimistic that shelter costs will come down. We still have three more reports before that key Fed meeting in June to confirm or reverse that hope. Wall Street is keeping the faith for now but that could change if future prints don’t improve. Stocks are still climbing the wall of worry.” —David Russell, Head of Market Strategy at TradeStation

Investors have remained optimistic that shelter costs will start to come down for months. So, up the market went on the lingering fumes of vain hopes as shelter costs continued to rise. The fantasy fumes forward:

More importantly, the reversal of the unusual spike in owners’ equivalent rent showed January’s reading was likely just an aberration, not a signal of stickier housing inflation. We still expect the Fed to gain enough confidence to cut rates as soon as May.

Doesn’t sound like what I read about shelter prices in the reports about the report:

The shelter index increased 0.4 percent in February and was the largest factor in the monthly increase in the index for all items less food and energy.

YoY, shelter came down but that is because of the larger monthly drops nearly a year back. Each month now is getting hotter. But, hey, ignore what is happening now while you ride high on the coattails of yesteryear … as if that is still reality.

The market is now all excited about rate cuts in summer like it was about rate cuts in March. If those summer cuts don’t come, it will likely become excited about the rate cuts this fall because reality doesn’t matter here in Wonderland.

The big stuff still to come

Meanwhile, there are more important things to worry about than Fed rate cuts that are not happening as the market was once almost certain they would. With the confluences of tougher financial forces staring to build in March, the Fed’s quantitative tightening, which effectively sucks money out of the economy, is nearing that point where it will start cause troubles as it did in 2019:

“We’re nearing a point where QT starts to exceed the reduction in the Fed’s reverse repo facility and liquidity starts to drain as a result,” Peter Boockvar, chief investment officer at Bleakley Financial Group wrote in a note to clients. “That is more relevant now than whether the Fed cuts once, twice, three times or not at all this year off a 5.33% effective fed funds rate.”

In other words, the reverse-repo buffer to QT that I’ve written about is getting close to depleted, leaving fewer and fewer banks with any of that buffer left. However, the drainage rate has started slowing quite dramatically as we get closer to the bottom of this tank of stored liquidity. We could easily be set to see another 2019-style repo crisis in September or October as Fed tightening continues, even if it continues at a slowed pace, after the buffer goes dry completely and as bond yields rise due to tougher Treasury auctions with higher issuances and inflation, which pushed bond yields up again. That rise in yields would further reduce the value of bank reserves just as those reserves get called upon for these larger, tougher Treasury auctions (like the one that didn’t go down all that well) and as many companies hit their September tax time, which also hits bank reserves hard each year.