So much has happened with the rise of inflation and so much is continuing to crowd in behind the scenes on the production end that I believe we will see inflation burning hotter for longer in the months ahead. Those saying we are nearing peak inflation are as wrong as they were when they said it months ago and as wrong as they were when they said “inflation is transitory” a year or more ago.

Stay with the person who has consistently been telling you that entire time that inflation would flame up hotter and brighter until it burned the Fed’s backside off, forcing the Fed forward into tightening sooner than it had first implied and then faster and shoving bond yields into the air as soon as the Fed relinquished its fierce grip on the bond market by ending its quantitative easing.

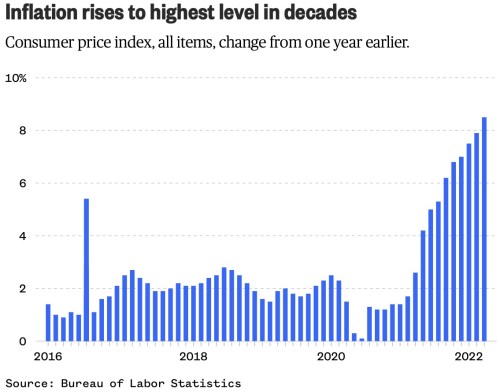

Data released last week by the Bureau of Labor Statistics showed that inflation had climbed 8.5 percent in March compared to a year ago — the largest increase since 1981. There were gains nearly across the board, with energy, shelter and food prices all soaring at record rates.

With consumer inflation having hit a 41 year high, some people must have looked at that and figured by gut instinct that inflation had to be nearing a top. After all, if measured the same way inflation was measured back in the seventies and eighties, that would be around 17-18%, the highest anyone alive today has seen. So, it must be topping out, right?

To support what they wanted to believe, many economists and analysis dug down to look at core inflation (the measure that cuts out the things you feel the most) and noticed its rate of rise had backed off in the last CPI data, providing an easy path to concluding inflation is peaking.

According to a number of Wall Street banks, today’s scorching number was indeed the peak of the inflation wave, and over the past few hours many more have joined them including Goldman…

I, however, see zero real-world support for their wishful thinking, and I don’t write by what I wish were true. It is easy to see why they would like to think we must surely be reaching a top:

I, however, am not going by charts. I’m looking at underlying fundamentals. I started arguing back in Trump’s last summer as president, when consumer inflation was practically invisible, that inflation was growing deep down on the producer end due to shortages that came about from the spring Covid lockdowns combined with the ample spreads of helicopter money during those months. I said that would eventually push up to the consumer end. Some people at the time time told me I was a moron because inflation was almost nil. You couldn’t see any increase at all in the CPI measure. When inflation did start to push above the surface in early 2021 CPI prints, they said the Fed knows a lot more than I ever dreamed of knowing, and the Fed was saying inflation was transitory; so, I only graduated from moron to idiot.

However, the logic I was applying certainly proved to be the reliable way of seeing what was coming, so let’s ignore, as I’ve counseled all along the way, the voices that blithely say this is going away or is peaking due to what is showing up run CPI charts at the moment. They are simply refusing to look at the reality all around them. Let’s look, again, at inflation on the production side because that is the source of consumer inflation. That is the inflation that has not yet hit consumer prices or is only beginning to hit them.

That look up the pipeline and at the fundamentals around us will give us a much clearer view of whether consumer inflation is peaking, rather than looking at the curve of a CPI graph or a one-quarter peak in core inflation to see if overall consumer inflation is rounding off. By looking up the pipeline, we can see what is coming at us. Information in graphs only presents inflation that has already happened, and a rest is no assurance it is over when new fundamental forces are tearing apart the fabric of the entire global economy.

A quick look up the producer pipeline

The Producer Price Index (PPI) measures prices charged by producers to either warehouses or retailers. You don’t have to direct your flashlight far up the pipeline to see the rush that is heading your way.

We haven’t seen anything like that in a long, long time! In fact, I believe this is an all-time high. Now with that bit of staggering you see at the top, the chart looks like it could be slowing down, and and all-time high would give reason to believe this must be topping out. However, slowing down for producer price increases today (IF that is even what the staggering indicates) doesn’t mean slowing down for consumers for, at least, a couple of months lag time as things move through warehouses to store shelves, and things could still stagger higher for a lot longer on the producer side. Those last staggered months, however, show what is about to come out of the pipe as additional inflation at a store near you.

That is twenty-three straight months of producer price increases and still climbing; and, while it is staggering a bit at the top, it’s still quite steep and rising. (While I’m not going by CPI graphs, I want to make clear that even the PPI graphs that actually are forward indicators don’t look all that promising.)

The following graph attempts to indicate the extent to which retailers or wholesalers, where there is a middleman, have been able to fully pass along their rising costs to consumers (the green zone) or the extent to which they have had to absorb rising prices from producers (the red zone) that they were not able to fully pass along to consumers (even though they may have raised retail prices quite a bit):

As much as consumer prices have risen in the last two years, this gives you sense of how much more they would have had to rise for wholesalers and retailers to get back to even on their own rising costs of goods sold. This indicates the extent to which they’ve absorbed those costs by way of diminished profit margins. You can see they are looking a bit stretched on the deep end, making them less able to keep absorbing those costs. They absorb them because they’d rather do that than destroy demand, and they don’t feel they could raise prices to consumers much further without destroying demand.

So, something has got to give as you can only stretch along on thinner margins for so long.

How commodities speculators play games with producers that you pay for

From there, you look further down the pipe to what is happening to the costs producers have to pay (as opposed to the prices they are charging wholesalers on the things they produce) to see if that staggering in the prices they are charging at the top is going to slow down or keeping rising. By doing that, you can look way up the pipe — six months to a year.

Here are some recent examples of what is happening on the producers cost side for the materials they buy — commodities:

Corn futures just hit $8 a bushel, which is the highest price since 2012. If you’re making breakfast cereal today, you may be buying corn on futures contracts in order to lock in your supply for the cereal you will be making a a few months from now with the corn scheduled for delivery in six months. Right now, as a producer of breakfast cereal, here is what has happened to your corn prices: The cereal you are making today and sending to warehouses and stores in the next week or two was made from corn you bought, say, three months ago and then had delivered two weeks ago. So, factor that in as you slide along the graph of corn futures:

Obviously, if the cereal you are putting out today was made with corn on a contract you bought near the start of the year, you paid about $6 per bushel for the corn, and that was still higher than what you paid three months before that. Now the price of corn you are paying today for the cereal you will soon be making is $8 per bushel. So, the corn component of your cereal price to the retailer is going up 33% when that cereal goes to market, and then the retailer will mark up that rise in its own costs by its own profit margin. So you get an idea of where the price of your corn flakes will be down the road when the inflation on corn bought today for that time hits the market. Today, the producer can absorb rising costs because today’s cereal is using the corn he contracted for back in January. In a few months when the new corn arrives, he will have to pass along those higher costs.

Commodity prices have been skyrocketing for some time and have started rising again due to the war and sanctions. In the case of corn, the rise is due in part to speculators buying corn they never intend to use. This kind of casino play by the rich is a killer for consumers. Investors get a lock on large volumes of corn and then hope to sell it for a significant gain when some breakfast-cereal manufacturer buys its next corn shipment. These are mostly very large companies that put locks on large amounts of grain. They may be buying futures on corn that hasn’t even been planted yet, just as a big company like Kellogg’s might do to make sure it has locked in what it will need in the future at a price it can accept compared to what it thinks it will pay in the future.

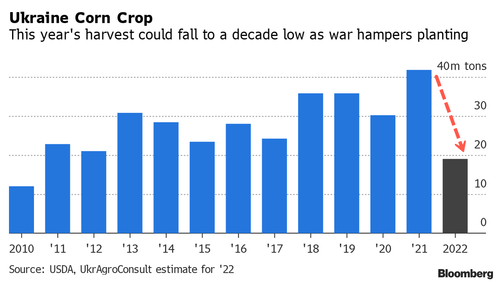

Thus, the commodities market is a highly speculative casino, but, unlike the stock market, it is also filled with a lot of players who actually need the item they are bidding on in order to use it who have to compete with all the speculators that have no intention of using it. As a result, when the breadbasket of Europe, named Ukraine, shuts down its corn exports by decree because it thinks it will barely have enough to feed its own people by the end of the year, and when Russia is shut out by sanctions, then everyone bids the price of corn up, and your cereal rises astronomically down the road due to rampant speculation when that corn is finally delivered, processed and goes out the door as a product you buy.

Here is what is anticipated for Ukraine’s corn harvest this year:

The cereal manufacturers see this coming, so they start raising producer prices to retailers to the point the market will bear as they move toward that date. So, some of the speculation gets priced in fairly soon, but much gets priced in later when there isn’t much choice because it literally becomes baked into the cost of goods sold.

What has the price of Ukrainian corn to do with your American or Canadian corn flakes when America and Canada grow plenty of their own grain? Well, Kellogg’s is more than willing to buy grain from Ukraine if it can actually ship it and still have cheaper corn than buying from US farmers. France is perfectly willing to buy and ship corn from Iowa if it can’t get any at any price from Ukraine. You see how it goes. Prices for these things tend to be globally set because they export in huge bulk shipments. So, if Canadian or American farmers can make more by selling to Europe, which is going hungry, they will. You’ll have to pay more to compete.

Meanwhile, here in the US, the thinking is that farmers might plant less corn and more soybeans because corn requires more fertilizer than soybeans, and a lot of the world’s fertilizer is made from natural gas that also comes from Ukraine and Russia, so the price of fertilizer has gone sky-high right now. Then, off course, if corn prices are already rising, seed prices are rising; so farmers have to factor that into how much they want to plant corn this year. However, farmers will also individually factor in how much they think they can get for their corn to offset that price now that they know, as well as everyone else, there will likely be a shortage or corn later in the year, driving up the prices they can get when their crop is ready to go to the food processors’ market.

That is clearly a complicated and expensive guessing game that is still in play — a gamble that is still being figured out by every individual farmer out there — but it all has the kind of chemistry that says prices for people who consume food (I think that is pretty much all of us) will be going up throughout the year as all of this gets sorted out by the many parties involved. What we know right now is that corn is already up 33% in the futures market today, and seeds for the coming crop in most places haven’t hit the ground yet. Heck, the corn-growing upper midwest and the Canadian Shield is still under snow! Those prices could come down some if farmers outside of Ukraine and Russia decide to plant more corn, in spite of fertilizer costs, in hopes of those high prices, only to create a glut by the end of summer. Or they could go up if they scale back more than expected or if the snow endures or a drought hits.

There is no central planning for that sort of thing in the US and Canada and many other large grain-exporting nations, so we don’t know what farmers and others involved will do. Some of the farmers don’t know what they will do yet; so, to say food inflation, as just one component, has peaked is a little premature. I see a lot more likelihood that prices will still climb by the time all of that plays through than that they will settle back down anytime soon. It will depend on what commodities speculators do and what farmers actually do when planting begins and then on how well crops produce. When markets get this tight, they are a lot less robust for absorbing weather shocks if there are any. That’s all on the producer side, so it is certainly not pushing into CPI charts yet.

Nevertheless, here is what happened to global overall food prices in the latest monthly report based on all that food chemistry, and this is MONTH on MONTH, and it’s not in CPI yet:

We have quite simply never seen anything like that. Obviously, sanctions are playing a big role in that astronomical spike in overall global food prices, but likely so are speculators who are betting up prices as they compete with actual producers, amplifying the effect of cost increases and shortages from both the war, itself, and from the sanctions of war. That could be an overreaction that settles back down, but who can know?

Now, here’s the worst part of that. The FAO Food Price Index measures the price of food commodities; i.e., the cost of food ingredients to producers. When the food industry says “cereals,” they mean corn and wheat and the other basic crops that go into your breakfast “cereal.” So, this is all on the PRODUCER end. That means a good part of that price spike in the raw food ingredients hasn’t made it clear through to the grocery shelf yet. If producer costs for commodities are rising that much, then you know producer prices to wholesalers and retailers are not done rising (on food).

That gives you a sense of the consumer price increases that are COMING, and then you have to add in the percentage markup the retailer applies because many retailers will apply the same percentage they usually do, though some may tighten their margins and still realize more in actual profit (total dollars) by applying a slightly smaller percentage markup to a much input larger cost. If consumers get tight enough, the retailer may even just pass the portion that is an increase along without marking it up, realizing the same number of dollars in profit. However, that doesn’t happen in the real world unless stiff competition or resistant consumers force retailers to sharpen their pencils to write up thinner margins. Even so, that can only go so far.

So, just looking at food, I’m not seeing anything close to a peak. I think those prognosticators of an inflation peak are smoking some pretty rich delirium. There is no price peak anywhere in sight on consumer food prices with all of that still in the pipeline on goods just now being produced for later consumption. And that is just following the pure “food” costs from ground to table. But far more goes into food than food, such as labor and fuel.

Feuding with fuel

The number of manufacturing firms worldwide reporting higher prices for raw materials [is] nearly 4.5 times higher than normal…..

The number of manufacturers reporting rising energy costs was the highest since data were first available in January 2005, sending an early warning that escalating oil and gas prices are set to unleash another wave of inflationary pressures around the world.

Reports citing increased energy prices were more than ten times greater than normal in February … and exceeded the previous peak of 8.6 recorded in July 2008.

That’s an “early” warning of “another” wave of inflationary pressures, and most of February happened before the war! So, imagine what the situation is now!

Let’s look at one area where consumers in Europe are already being hit in the face due to sanctions with prices that are knocking them cold … literally cold because the gas is going off and spring weather is barely here. Again, recognize that energy is also a bulk items and a very global market. So, while these effects hit hardest in Europe where gas prices are directly impacted by the war interrupting supplies and sanctions cutting supplies off, the effects will ripple throughout the world. Here, we look at Europe first because they are getting hit first and worst on the energy front of this war. So, they are up the pipeline from many others in the West. What hits them will eventually impact more distant shores, not as hard most likely but everyone will feel some pain that is mostly now a wave washing over Europe.

Bloomberg reports,

Britain’s biggest energy suppliers are warning of a huge increase in the number of customers falling behind on paying their bills as households struggle with soaring costs for gas and electricity.

The amount of money owed by customers is expected to be 50% higher by year’s end, Michael Lewis, chief executive officer of the U.K. arm of E.ON SE, told lawmakers Tuesday. The U.K.’s cap on energy prices surged to a record on April 1 for 22 million people, and it’s predicted to increase again later this year. That could put 40% of the population in fuel poverty, Lewis said.

“Come October, that’s going to get horrific, truly horrific,” Keith Anderson, CEO of Scottish Power Ltd., told the parliamentary panel. “The size and scale of this is beyond what I can deal with, beyond what I think the industry can deal with. It needs a massive shift, significant shift in the government’s approach to this.”

So, 50% cannot pay their bills right now, and they are being protected by government price caps, which will increase later in the year; and …

The wholesale price of U.K. gas has more than tripled in the past year, adding to mounting consumer costs. Regulator Ofgem’s price cap puts a limit on how much bills can rise, but it also contributed to the demise of 26 household suppliers that struggled to pass on costs.

The caps have already had the effect of slamming 26 suppliers out of business. So, what do you think that does to the cost of goods down the road as competition narrows? The wholesale price has tripled, while the supplier-crushing caps that have only partially protected consumers, leaving 50% of them in deep energy debt, have kept the full wholesale increase from being passed along. So, what happens when it is passed along? It’s anticipated the cap could rise another 39%, and it’s not clear that would fully pass along the cost increases energy suppliers are facing.

Does that look anything like “the peak is nearly in?”

UK suppliers have their hands out to the government to pick up the extra tab, or the number out of business will rise above the current 26. When that happens, you start seeing brown-outs and black-outs and areas that can’t get bottled gas or gas stations that have yellow “out of fuel” notices on the petrol hose handles.

Needless to say, this is causing a “massive, massive uplift” in consumer anxiety in the UK.

Prices get shanghaied

Silly, silly are the people who thought the Shanghai shock was over — that the China Virus was done with us. Heck, it’s not even done with China, and they are the ones who have taken the most austere measures to control it! Actually, I might more accurately say China’s austerity measures are not done with China.

CNN refers to this as “the risk to the global economy no one is talking about;” and while it is a risk to all aspects of the global economy, it is perhaps most of all a risk to inflation.

Nearly 400 million people across 45 cities in China are under full or partial lockdown as part of China’s strict zero-Covid policy. Together they represent 40%, or $7.2 trillion, of annual gross domestic product for the world’s second-largest economy, according to data from Nomura Holdings.

Needless to say, those 400-million people won’t be buying as much. However, they won’t be producing anything at all, other than services that can be transacted over computers; but they will not be making anything, and the things they make go into almost everything else. Anyone now saying that inflation is peaking has just forgotten China exists, and supply shortages that we all experienced as price increases during the Covidcrisis will be made worse by all those people now out of work, producing nothing in one of the most important factory production regions of the world.

Tesla just closed an entire factory. It is down 50,000 cars in production so far. Other factories have closed in China, including Apple parts manufacturers and Sony. Quanta, which makes computer notebooks and Apple’s MacBook, is shut down completely. Plants that are running are barely producing anything in many cases; and it doesn’t much matter if they do because the Port of Shanghai is closed as are others, and a huge percentage of world goods goes through those ports.

Analysts are ringing warning bells, but say investors aren’t properly assessing how serious the global economic fallout might be from these prolonged isolation orders.

Ya think? When they are saying inflation is peaking? The world is glib right now. It doesn’t want to hear this, so it isn’t thinking about it on purpose. Connecting the dots is not hard. The Covidcrisis clearly is not over so long as major parts of the world like China are shutting themselves down. China has grabbed ahold of its own neck and is strangling itself to kill its disease. So far, that doesn’t seem to be working too well.

Whether the economic crisis is a necessity for disease control or just mass hysteria or human contrivance, the result is the same — nearly the same number of people trying to consume (a few dying off from Covid) but a much smaller number producing. Those that are not working will buy less, but they’re producing nothing.

We forgot about Covid for a few weeks because the war took over our thoughts, but the Covidcrisis is still actively undermining the global economy. More shortages to come as production parts at more and more plants run dry, more price increases to come as industry buyers bid up the few remaining parts and raise the price of their goods because they can so long as consumers will bid up the price on the consumer side.

And that is why truly high inflation has two components — too much money and too few goods — because if consumers (or commodity investors) don’t have the money, they cannot bid up the prices. They will live with less and less. By that path, rising prices will eventually cause demand destruction and become self-limiting as people start seriously cutting back on what they buy wherever they can, but that is a long process because we do not like to live with less and only do so as forced to do so, and that results in its own recessionary economic destruction.

Nomi Print explains it succinctly:

Reports in Shanghai have claimed people are jumping out of apartment windows because they are starving to death, so they’d rather die in an act of rebellion than keep starving. Others are supposedly killing their pets. I have no idea how much of this is true, but it is not just oddball sites (like my own) reporting it. It’s mainstream news, too.

Cargo is backed up in Shanghai 75% more than it was before the lockdowns. These are goods and parts that were going to be headed your way, many of them over a period of months as they get processed into new goods. So, it clearly means more shortages coming down the pipe to consumers in the future, and this is not even the beginning of whatever further impact wartime sanctions may have on China. This is almost all due to the continuing impact of China’s Covid responses that never went away. As those shortages show up in a dwindling dribble of products at the consumer end of the pipeline, consumers who can still afford the goods will bid up their price until the number of consumers who remain buying is equal to the number of products available.

Some of what gets stuck in China never will make it to your shelves because some of it is food that will not last that long. CNN reports containers full of unrefrigerated food are rotting in the port.

“The impact on China is major and the knock on effects on the global economy are quite significant,” said Michael Hirson, Eurasia Group’s practice head for China and Northeast Asia. “I think we’re in for more volatility and economic and social disruption for at least the next six months.”

That doesn’t sound like inflation has peaked to me. People saying this stuff must have pulled their coats up over their heads because they are not looking around to see reality. That’s all on the producer side. And the idea that we’ll just shift to making the things we need locally to get out of these supply-chain problems isn’t going to make any difference in price increases this year! That will take five years to work out.

“These are still very intertwined economies,” said Hirson. “That integration is not something that’s going to be easily reversed because it would be incredibly costly for the US and for the global economy.”

Exactly. Those are longterm solutions to the causes of inflation. So, it doesn’t sound like inflation has peaked to me! And that’s without factoring in any worsening that will come from sanctions against Russia if some are extended against China to try keep it from becoming Russia’s savior.

One-third of all of China is now locked in quarantine, and one-third of China is a lot of people! Who is growing and making the food they need to eat? Recent photos showed the Covid cops even forcing farmers off their fields and back inside. If China grows less with all of its mouths to feed because farmers aren’t even allowed out in their fields this is really going to get worse. It’s madness.

The three forces of inflation

NBC says inflation is being rocketed upward by three thrusters right now. I certainly see more, but let’s go with that for the moment because if we cannot argue those three are all now going to start fading, the picture is only worse when you factor in more forces. NBC’s three forces of inflation are… sharply rising labor costs, soaring energy prices and cheap money/low interest. The latter is going away, but the other two are not.

The legion of workers leaving their jobs, especially those in low-wage sectors, has played an enormous role in the rising cost of labor, said Jayson Lusk, a professor and the head of agricultural economics at Purdue University.

“To get enough workers to show up now, you need to pay more, so we’re seeing rising wage rates throughout many food and agricultural sectors,” Lusk said.

Do you think that inflationary thrust is going away anytime soon? I haven’t seen any evidence that all those displaced people who appear to have left the labor force for good are changing their minds, and if we’re really serious about bringing production back home to eliminate the supply shortages that are the biggest driver of inflation, we will certainly need a whole lot more labor at home. That means a whole lot higher labor prices to attract people back into the labor force.

“The labor market needs to get sorted out; you need a solution to the Great Resignation problem,” he said. “There’s no normalcy until that occurs.”

Well, I haven’t heard any solutions forthcoming; and, with the Democrats’ drive right now for guaranteed basic (universal) income, the political direction is pressuring toward creating even more competition for labor because, if the government will pay you to not work, someone else will have to pay you substantially more to get you to work. While universal basic seems to have stalled out, I doubt progressives are giving up that easily. So, I don’t think rising labor costs are going away anytime soon.

Employers are going to have to step up to the plate.

“If these forecasts are correct, the job openings and quits rates are likely to remain elevated and wage growth is likely to remain strong for the rest of the year,” according to Bart Hobijn at the Federal Reserve Bank of San Francisco

If that force isn’t peaking for, at least, the rest of the year, that doesn’t sound like inflation is about to peak to me.

As for those energy prices, the second force, how are they going to stop pushing the inflation of everything upward? Right now President Biden is pumping out of our national reserves and shipping to Europe to keep Europe from collapsing under the sanctions. We already see how badly the UK is struggling. If Biden wants to hold the sanctions together, he has to help allies weather through, who are paying a higher part of the burden — even if due to their energy dependency mistakes. As reserves become depleted, the cost of energy will rise more as speculators see them drawing down.

The final leg in NBC’s picture is interest, and that will certainly be helping to bring inflation down, as it is already soaring, taking away some of the cheap money that thrusts inflation upward.

Right now individual spending remains high, even though people have pretty well used up their stimulus-check savings. They’ve kept up the pace by spending on credit, but the cost of credit, while still low, is rising at one of the fastest rates in history, and the Fed still has credit on training wheels at a mere 0.25% interest for its base rate.

Credit card interest is closely tied to the Fed Funds rate and the shortest-term treasuries, so interest will soar on those credit cards as soon as the Fed takes off the training wheels and combines larger interest hikes with with balance-sheet roll-off on the short-maturity end of the bond spectrum. With all of that still to begin (the first hike was but a teaser), interest rates will rise even faster than they are now, potentially destroying demand and bringing down prices.

Mortgages have already soared from around 3% to 5% in about nine months, and the Fed hasn’t even started hiking longterm interest by rolling long bonds off its balance sheet (which the Fed sucked up originally, it said, to drive down longterm interest rates, such as mortgages). Still housing prices have continued rising, though they are showing some signs of topping.

While all of those rates may go up quickly, consider two things: 1) How far interest has to go up before it has much effect and 2) What rising interest does to the economy.

As to number 1, Fed Chair Paul Volcker had to raise the Fed Funds Rate to just over 19% to finally get inflation that was this same height in the eighties to fall (same height if we measured now in the same way as back then). Even if we assume inflation really is only about half what the late seventies and early eighties experienced, Volcker had to raise interest to where the Fed Funds Rate was as high or higher than inflation to drive inflation down. So, that would mean the Fed needs to get its lowest rate up to 9%, which means we have a long way to go! However, inflation continues rising as the Fed is working its way up there, so it’s a race to find the top as the amount it will take to curb that rising inflation grows along with the inflation.

Let’s assume for the sake or argument that inflation doesn’t keep rising, so the Fed only has to hit 9% to get it to start falling, and let’s even assume that it doesn’t take that high or a rate because there is so much debt we’ll crash the whole economy and put half the nation into default well before we get there. What does that tell you about number 2? Rising interest kills inflation by killing the economy. It destroys demand. That shuts down production because no one is going to produce what they cannot sell. It also raises the cost of production, another reason to shut down in a situation of falling demand. So, the economy sinks rapidly into recession. With such a debt-soaked economy that is already so fragile, how much of a rise do you think it takes to do that? I am certain the Fed could not even get its base rate halfway to my already minimized 9% without crashing everything. So, that’s how you suffocate the flames of inflation by raising interest — by killing the economy.

So, the idea that the Fed is going to kill inflation before inflation kills the economy? No, the Fed will do the job of killing the economy for us long before it gets to the point of killing inflation, which means a deep stagflationary recession, worse than any recession you’ve ever experienced unless you are nearly a hundred years old. Even if you’re practically a centenarian, you didn’t experience one like this one will be because the Great Depression was highly deflationary. This one will happen while inflation is hot until lack of easy money turns off the flames of inflation and the receding economy reverts to deflationary destruction.

I predict the Fed will be pressed to rush back to QE before the Fed Funds Rate hits 4.5%. If the Fed does what it hasn’t done for well over a decade and refuses the pressure to return to QE, the deep recession will finish off inflation; but if the Fed goes back to enough QE to pull us out of the recession it creates, that will take us to rapid hyperinflation because the economy isn’t producing, neither is anyone else, while sanctions and trade wars have shut off a lot of trade. That means massive money printing in the face of severe shortages. If the money goes to the people as Democrats will be inclined to assure it does, that will create a mad bidding frenzy by everyone who has money to get what they need. If you thought the bidding war in the housing market was intense, wait until you see the inanity that comes when people are bidding for food and fuel to get to work and to heat their homes next winter!

So, either path is going to be difficult. And banksters above don’t think all the wartime sanctions that have barely begun to show up in those historic price charts above are going to make things worse?

When you have no food to cook, cook the books

There is, of course, one other way that inflation will stop rising so quickly. This may be where those banks predicting inflation has peaked may know something I don’t — some insider information. The desire of the government’s inflation bean counters to massage the numbers down is directly proportional to the amount of inflation and might receive a little pressure from on high during a mid-term election year.

The Bureau of Lying Statistics, as I have long been inclined to call them, has massaged housing prices down for decades because housing prices wouldn’t cooperate on their own. Now they are talking about massaging used car prices because they have been a major component of soaring CPI for a number of months because used cars were in short supply. Clearly, we cannot have that, so clearly we must must do something about that. After all, if there are no Chevys for people to buy, let them drive Cadillacs.

A shortage of cheap and affordable cars, you say? Then let them drive Cadillacs.

A shortage of cheap and affordable cars, you say? Then let them drive Cadillacs.

It’s just like how the BS department (I mean BLS) refined core inflation by stripping fuel out a long time ago as if fuel doesn’t really affect you when it rises. It’s too volatile, they said, so we can’t figure it into the inflation we use for calculating your Social Security check because it distorts the picture — never mind that you will be paying it, whether they count it or not. (I thought fuel was supposed to be volatile; that’s what makes it work! No volatile, no bang.) So, let the people run their new Cadillacs on water I guess.

I don’t know how the bean counters are actually going to do it, especially when they have no beans left to count with, but they’ve done it before; so look under the hood if the next CPI print appears to agree a little too nicely with those banksters at the top of this article. I’ll be here to help you, and thanks to those who continue their support to keep this endeavor running so I can keep my old car running a little while longer and buy a gallon of fuel now and again. We’re in this together.

Liked it? Take a second to support David Haggith on Patreon!