“It’s always been right to be skeptical when someone says ‘this is the year that inflation comes back,’” says M&G Investments Jim Leaviss in a recent Financial Times Big Read. “But for the first time, you can say this time is different. The pandemic might be the systemic earthquake that changes the inflation outlook we have been used to for the past 30 years.” To be sure, the FT editorial followed on the heels of government data showing solid gains in wholesale and retail inflation. A week later the Commerce Department reported a much higher than expected increase in the Personal Consumption Expenditure index – the Fed’s favored inflation indicator.

“There is an entire generation of traders,” warns Franklin Templeton’s chief investment officer Sonal Desai in that same editorial, “who have grown up investing in the post-global financial crisis world of no inflation. People shouldn’t underestimate how uncertain things will look if we are entering a new paradigm.” As always, there is the issue of summertime and whether or not the world can be put on hold while thoughts turn to leisurely pursuits. Perhaps this year, as we come out of the pandemic lockdown, that need is more pressing than in most. At the same time, for the reasons just mentioned, this might also be a year to remain on alert. We could be in for more and even nastier inflationary surprises as the summer unfolds.

Will the 2020s be a rerun of the 1970s?

‘The conditions for gold could not be better’

Yale economist Stephen Roach sees Jerome Powell’s Federal Reserve as following along the same path it took during the stagflationary 1970s. “Memories can be tricky,” writes Roach in his essay posted recently at Project Syndicate, “I have long been haunted by the inflation of the 1970s. Fifty years ago, when I had just started my career as a professional economist at the Federal Reserve, I was witness to the birth of the Great Inflation as a Fed insider. That left me with the recurring nightmares of a financial post-traumatic stress disorder. The bad dreams are back. They center on the Fed’s legendary chairman at the time, Arthur F. Burns.” In particular, Roach reminds us that Burns “poured fuel on the [inflation] fire” by allowing real rates to go negative – a policy option the current Fed openly favors.

Similarly, Incrementum’s Ronald Stoferle and Mark Valek believe “it is quite possible that the 2010s will turn out to be the 1960s and the 2020s the 1970s. In our view, at any rate, the indications are clearly intensifying that the entire area of inflation-sensitive assets could be at the beginning of a pronounced bull market. As uncomfortable as the dynamics are in general, the conditions for gold could not be better: massively over-indebted economies that will resort to devaluing their currencies as a last resort to reduce their debts. We believe that real interest rates will remain in negative territory for the next decade.”

‘A broader perspective of big picture patterns and cycles’

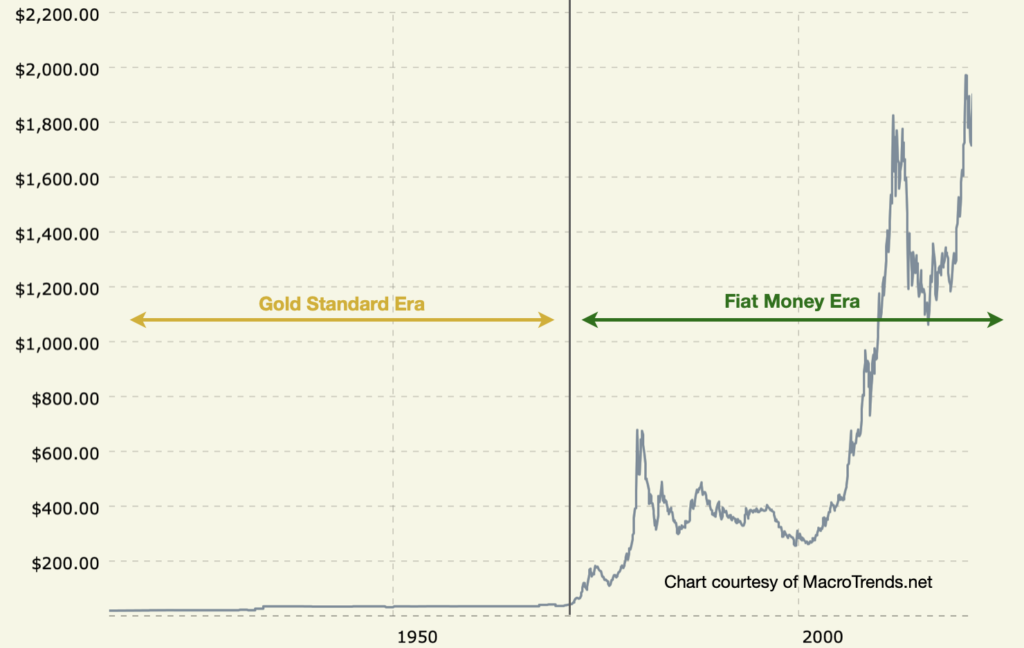

Why private gold ownership makes sense in the fiat money era

This summer we will arrive at a significant milestone – the fiat money system’s golden anniversary. Ray Dalio, who many consider the most successful investor of the present era, has consistently advocated gold ownership for individual investors as a hedge against financial uncertainties, particularly those related to a further debasement of the fiat dollar. His Bridgewater Associates All Weather fund holds a 7.5% stake in gold.

“I believe,” he wrote recently in a LinkedIn article titled The Changing World Order, “that the reason people typically miss the big moments of evolution coming at them in life is that we each experience only tiny pieces of what’s happening. We are like ants preoccupied with our jobs of carrying crumbs in our minuscule lifetimes instead of having a broader perspective of the big-picture patterns and cycles, the important interrelated things driving them, and where we are within the cycles and what’s likely to transpire.”

The chart below speaks to Dalio’s “broader perspective of the big-picture patterns and cycles” – and perhaps the most important big-picture pattern of them all. It offers at a glance a bottom-line understanding of why gold continues to make sense as a long-term portfolio holding.

Gold Price / Monetary Eras

(1915-2021)

Chart courtesy of MacroTrends.net • • • Annotations by USAGOLD

The merger between the Fed and the Treasury Department

Mysteriously strong gold demand surfaces at the Bank of England

Some see the increasingly cozy relationship between Jerome Powell’s Fed and Janet Yellen’s Treasury Department as a dangerous embrace of Modern Monetary Theory. This Weimar-style money printing scheme relies on a merger between the federal government and the central bank as a core principle. “They [the Fed] shouldn’t be getting involved in these things,” says former New York Fed economist Christopher Whalen in a CNBC interview, “even if progressive politicians want to drag them in. They have to have the courage to say ‘no. Since 2008, they have capitulated on so many fronts I don’t even recognize the institution anymore. The bank I worked for is gone.”

Similarly, hedge fund guru Stanley Druckenmiller registered concern on the Treasury-Fed merger, warning that the central bank’s accommodative policies could pose risks to the status of the U.S. dollar as the global reserve currency. Even former Treasury Secretary Larry Summers, a Democrat, has publicly warned of the dangers to the dollar in the print and spend policies of the Biden administration.

Along these lines, Bloomberg reported last week on a somewhat mysterious influx of gold demand at the Bank of England and speculated that the source of that demand might be from the Bank for International Settlements (BIS) representing one or more central banks. The news service cites mobilization of one million ounces or more than 30 metric tonnes – not a small number when you consider Poland’s purchase of 9 tonnes in 2019 was reported as one of the largest ever by an EU member central bank. In fact, Poland might be the mystery source given its public pronouncement this past March that it was in the market for another 100 tonnes of the metal.

At the same time, we will not rule out at this juncture a possible connection – direct or indirect – to the upcoming implementation of Basel 3 accords. (Please see the USAGOLD Special Report: Will Basel 3 boost gold and silver prices?) The Bloomberg report says that the reason for the burgeoning gold demand from central banks is “to diversify their portfolios away from the U.S. dollar to safeguard their finances amid concerns over the Fed’s ultra-loose monetary policy, massive U.S. government spending and inflationary pressures.” We see that as a rational response to current economic circumstances. It is not just the United States that is in the business of debasing its currency, but most, if not all, of the states issuing internationally traded currencies used as reserve assets. Though the Bloomberg article avoids the question, we feel compelled to ask: Who would be the seller in these precarious times? If the source of the demand does indeed turn out to be central banks, the market will consider it manageable. If, on the other, it has to do with Basel 3, it could be just the tip of the iceberg.

Beware the new mantra that stocks are a good inflation hedge

“So, to be clear, this April really was cruel,” writes John Authers in his regular Bloomberg column, “In terms of the basic economic numbers that affect us most, it was the cruelest month for the U.S. in many decades. It was only one month. It is way too soon to proclaim the beginning or end of a major economic trend, on the base of the data we have so far. But April’s data were not only very, very bad, but also very, very surprising. They need to be confronted and understood.” Authers is surprised at the markets’ muted reaction to “a bad unemployment number followed by a bad inflation number.” He warns that if inflation does take root, stocks have plenty of room to fall further.

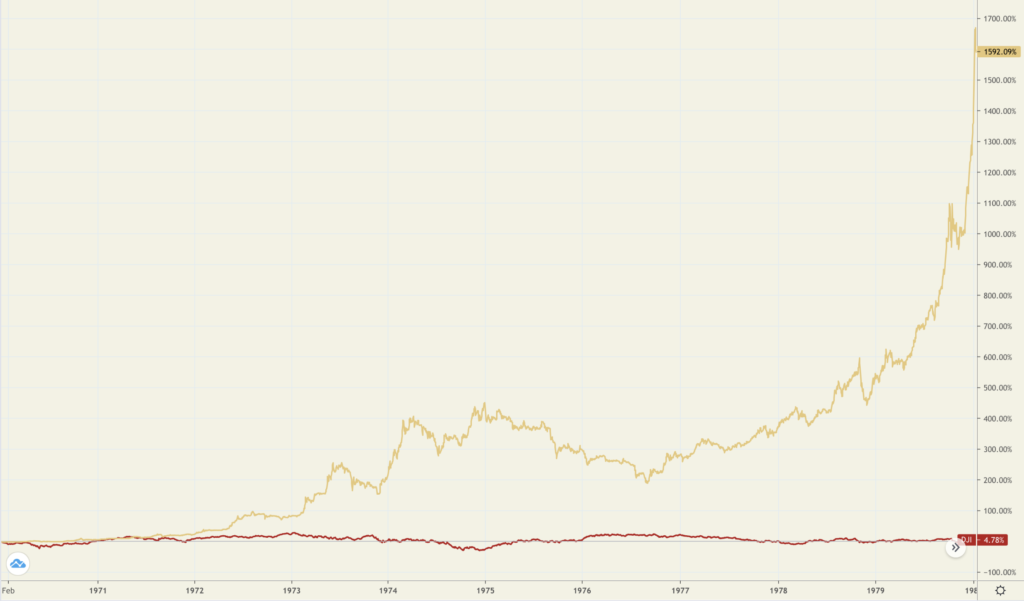

The chart below shows what happened in the 1970s once investors realized that inflation was not “transitory” but entrenched instead. Stocks drifted sideways for most of the decade, managing only a 4.78% gain. Gold, on the other hand, gained 1592%. We sometimes overlook the fact that stocks peaked in the late 1960s, just before the inflation began. Nearly twenty years of sideways to down action followed. Stocks started and ended the 1970s at 1000 while inflation raged.

Gold and Stocks

(In percent, 19790-1979)

Chart courtesy of TradingView.com • • • Click to enlarge

Notable Quotable

“Our economy has entered the twilight zone. Today, economic leaders base policies on a hoped-for utopia with bubbles called ‘growing markets’ and greed termed ‘good valuations.’ The twilight zone economy is a place where fundamentals have disappeared. It is a utopian world of no moral hazard for business, financial or economic mistakes.” – Patrick Hill, Real Investment Advice

“I suspect my readers are more retirement-ready than most, but I still hear horror stories: people who worked hard, did their homework, made good decisions, only to see it all collapse. If you think you’re prepared, or already retired and think yourself secure, I suggest you reexamine your assumptions. Retirement is broken and your dreams could become nightmares.” – John Mauldin, Mauldin Economics

“It was only necessary to buy ‘good’ stocks,’ they said, “regardless of price, and then to let nature take her upward course. The results of such a doctrine could not fail to be tragic.” – Benjamin Grahm and David Todd, Security Analysis (1934)

“The first step in theorizing correctly about money is to understand that the value of money, like that of commodities, is never fixed and unchanging. Chinese philosophers who published the earlier Mohist Canons(468 B.C.~376 B.C.) grasped this crucial point. They recognized that metallic money, such as the ‘knife coins’ then in wide circulation, was valued and exchanged by weight and argued that the real value of money, despite its fixed face value, was not stable but fluctuated inversely with the prices of commodities. When commodity prices were high, money was ‘light’ or its purchasing power low; when prices were low, money was ‘heavy’ or its purchasing power high. Thus, if monetary conditions were such that the nominal prices of commodities were abnormally high, the real prices of commodities were not high but rather money was ‘light’ or depreciated.” – Joseph T. Salerno, The Mises Institute

“Although there are countless scourges which in general debilitate kingdoms, principalities, and republics, the four most important (in my judgment) are dissension, [abnormal] mortality, barren soil, and debasement of the currency. The first three are so obvious that nobody is unaware of their existence. But the fourth, which concerns money, is taken into account by few persons and only the most perspicacious. For it undermines states, not by a single attack all at once, but gradually and in a certain covert manner.” – Copernicus, Essay on the Coinage of Money (1526)

“If we’re going to monetize our debt and we’re going to enable more and more of this spending, that’s why I’m worried now for the first time that within 15 years we lose reserve currency status and of course all the unbelievable benefits that have accrued with it.” – Stanley Druckenmiller, CNBC interview

Cartoon courtesy of MichaelPRamirez.com

Cartoon courtesy of MichaelPRamirez.com

“I have been making the investment case for gold since 2005. That was the point that the first physical gold ETF was listed, and I bought some. Then I bought some more, then I bought some more, and now I have it coming out of my ears. You could skip this note and just read Alan Greenspan’s 1966 essay Gold and Economic Freedom, but his is a little more dense and ideological.” – Jared Dillian, Mauldin Economics

“While it will take some time for momentum to build in gold given the size of the market, gold will eventually move into an ‘exponential phase,’ $5000 to $10,000 an ounce for gold, ultimately, is in the cards.” – Scott Minerd, Guggenheim Partners

“When I talked about the inflation picture slowly turning before the pandemic, the major reason was that I thought we were moving more towards a helicopter money / MMT world and away from fiscal austerity. The pandemic has accelerated this and a Blue Wave has picked up the baton in its crest.” – Jim Reid, chief credit strategist, Deutsche Bank (at Zero Hedge)

“Gold is a great definer of money, and has been used for thousands of years as a definer, precisely because gold is yet again the commodity ‘least influenced by any of the causes which produce fluctuations of value.…To focus on rising prices when divining inflation is like blaming rain on wet sidewalks. It reverses causation.” – John Tamny, RealClearMarkets

“Markets are full of noise about everything from inflation, risk, leverage and politics, but the reality is we are approaching ‘Peak Speculation’. It doesn’t mean a crash is imminent, but that investment strategies and approaches are going to have to factor in a new reality, and be far more suspicious, questioning and smart as a new reality takes hold. The consequences of QE and other factors that fuelled the speculative age could be with us for decades.” – Bill Blain, Blain’s Morning Porridge

Final Thought

Though we devote this issue to the prospect of returning to the stagflationary 1970s, not everyone believes that is where we are headed. David Rosenberg and James Rickards, two widely followed market analysts, believe that disinflation is in the cards – in other words, the same response we got to the 2007-2008 financial crisis. Gold, we should add, does not need inflation to appreciate in value. In fact, it did quite nicely in the disinflationary aftermath following that event going from $850 at the beginning of 2009 to an all-time record of $2075 per ounce by 2011. “Gold,” says James Grant (Interest Rate Observer), “is not exactly an inflation hedge, he said, but it is an investment in ‘monetary disorder, which is what we have. If I am right, there will be a world that will want tangible monetary stability because it loses confidence in central banks. When the cycles turn, people will want gold and silver. When people consider the shortcomings of the Fed, they will turn to gold.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to prepare your portfolio for whatever uncertainty lies ahead?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/orderdesk@usagold.com

ORDER GOLD & SILVER ONLINE 24-7

Up-to-the-minute gold market news, opinion, and analysis as it happens.

If you appreciate NEWS & VIEWS, you might also take

an interest in our Daily Top Gold News and Opinion page.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such, USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors is solely their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.