NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 50th year in the gold business

FEBRUARY 2023

“Remember what we’re looking at. Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it.” – Alan Greenspan

––––––––––––––––––––––––––––––––––––

GOLD

‘The question is not have you too much, but have you enough.’

At the moment, cash is king, but that might be short-lived. Merryn Somerset Webb, a senior columnist at Bloomberg Opinion, thinks cash holdings, which CNBC reports at near-record levels, might be another dead end for investors. “If you are holding cash,” she says, “it is only a temporary king.” She says that inflation, which erodes the value of cash, will be with us for the long haul and that investors should look to gold as an alternative.

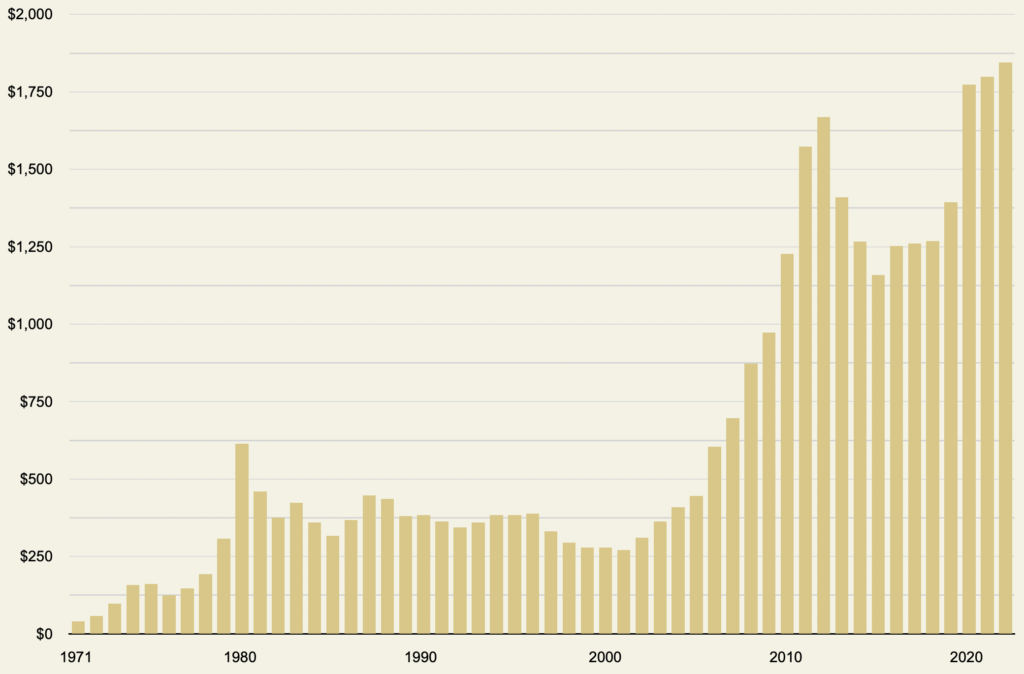

While the mainstream financial media continues to characterize gold as a short-term speculative play, the essential market for the metal is among those who see it as a long-term safe haven against the obvious economic and financial turbulence. That group runs the gamut of participants from private individuals to central banks – all owning the metal for essentially the same reasons, and it has little to do with its speculative potential. As shown in the chart below, gold has consistently kept pace with the decline in the dollar’s purchasing power over the long run and has risen rapidly during times of economic distress. It argues strongly in favor of holding gold as a long-term safe haven.

“As Alex Chartres of Ruffer recently said on my podcast,” continues Webb, “there aren’t many other things you can turn to as a long-term safe haven in today’s markets. A year ago, some thought Bitcoin might be a rival – a digital gold even. The market has now ‘kneecapped’ that idea. These days, if you want gold, you will need to buy, well, gold. That being the case, the question is not have you too much, but have you enough — the very same question the head of the PBoC is clearly asking himself right now.”

Gold average annual prices

(1971 to 2022)

Chart by USAGOLD [All rights reserved] • • • Data source: MacroTrends.net • • • Click to enlarge

––––––––––––––––––––––––––––––––––––––––––

The six keys to successful gold ownership

“This eye-opening, in-depth introduction to precious metals ownership will help you avoid many of the pitfalls that befall first-time investors. Find out who invests in gold, what role gold plays in serious investors’ portfolios, and the when, where, why, and how of adding precious metals to your holdings. To end right, it is critical that you start right, and the six keys to successful gold ownership will point you in the right direction.” Open Access

––––––––––––––––––––––––––––––––––––––––––

Short & Sweet

“GOING SOFT ON INFLATION WILL PLUNGE economies back into the recessionary depths of the 1970s and have “adverse effect on working people everywhere,” former US Treasury Secretary Larry Summers warned in a recent Bloomberg article.” We have consistently referenced the 1970s Fed strategy that kept interest rates below the inflation rate – a policy that fostered stagflation and a strong gold market. The Fed, in our view, is not going soft; it is already soft on inflation and has been since it first surfaced as a problem several months ago.

“PRICES OF SILVER COULD HIT A NINE-YEAR HIGH of $30 per ounce this year — possibly outpacing gold prices,” says CNBC’s Lee Ying Shan. “Insufficient supplies of silver as well as its tendency to be a better performer than gold in periods of high inflation are key drivers supporting the outlook,” analysts told CNBC. Big rallies in the silver price often come out of the blue without warning, rhyme, or reason. The best approach to owning silver is to accumulate it in physical form sans leverage and wait for the potential price spike. At $30, silver would provide a hefty return for most USAGOLD clientele who own the metal. Even as it is, silver is up 34.5% from September 2022’s bottom at $17.75 per ounce – a more than respectable gain that has not gotten a lot of play in the financial press.

RAY DALIO, WHO FOUNDED THE WORLD’S LARGEST HEDGE FUND, says the world order is shaping up in ways similar to the pre-World War II era, with “each country’s populism and nationalism growing in preparation for greater conflicts.” In the process, he says in an article on the Modern Diplomacy website, “the era of a ‘dollar-dominated world order and a globalized economy was ‘fading away.’ We are now going to have the major powers and their allies form economic, currency, and military blocs.” Mature economies, he says, “have run up very large debts and have developed a dependence on their central banks to print money to buy the government debts,” he said. The increase in debt monetization “will mean that holders of debt assets will get bad inflation-adjusted returns.” Dalio is a long-time advocate of gold ownership.

Cartoon courtesy of MichaelPRamirez.com

Cartoon courtesy of MichaelPRamirez.com

HUMAN FRAILTY AND FINANCIAL BUBBLES go hand in hand. Even Charles Mackay, who wrote the still widely read Extraordinary Popular Delusions and the Madness of Crowds, was drawn into the British railway stocks mania of the 1830s and 1840s, saying that the bubbles’ critics had “somewhat exaggerated the danger,” according to Financial Times columnist Tim Hartford. Shortly thereafter, railroad shares plummeted from their peak by two-thirds. Hartford offers a fascinating look at bubbles past and present and has a somewhat forgiving attitude about the people who get caught up in them. He says Mackay was wrong when he said that you don’t need hindsight to see a bubble, that they are apparent if you keep your head about you. We come down on Mackay’s side.

“YES, THERE WAS TALK OF CATASTROPHIC TAIL RISKS,” reports Bloomberg on the overall mood and discussion at last month’s Davos gathering of the ultra-wealthy and top policymakers, “but there was relatively little said about the most obvious threat to global well-being: stagflation. But the positive developments lightening everyone’s mood are making stagflation—slowing growth combined with rising prices—look increasingly likely.” Like inflation (a component of the stagflation scenario along with economic stagnation), stagflation is a process, not an event. At times, it might be front and center. It can also fade in the face of other concerns. All the while, it is doing subtle damage to the financial markets (and private investment portfolios). Gold and silver were two top-performing assets during the stagflation of the 1970s.

RUSSIAN INVESTORS HAVE PURCHASED A RECORD NUMBER of gold bars over the past year, says The Insider citing a Russian business publication. “Analysts,” it says,” have pointed out that Russian investors and Russian banks’ premium customers do not have any other serious investment options: the Russian stock market is of no interest, the purchase of real estate amid mass emigration is a questionable investment, and making investments in foreign assets and foreign currency is fraught with risk.” Not to mention that the country is at war, which is not going as planned, the rouble is down, and the inflation rate is running at double digits. Russia’s citizens bought 67 tonnes of gold in 2022.

“GOING FORWARD, THE MORE INVESTORS focus on governments’ need to ensure that interest rates remain below the rate of inflation, the more the price of gold is likely to rise,” writes Russell Napier in an article published by the Toronto Star.” This will be particularly true when central bankers begin to reduce interest rates. Should a financial repression require capital controls to coral investors into local currency government bonds, the rise in the gold price will accelerate.” Napier, a market analyst widely followed by other market analysts, believes gold will blitter in an atmosphere in which central banks keep interest rates below the inflation rate. He describes the process as “financial repression” and predicts it will last for at least a decade.

Notable Quotable

“Inflation in such a system resembles one of these inextinguishable long-burning underground coal mine fires. I’m not sure if you have them in Switzerland, but in Pennsylvania for example there has been such a fire that’s been going on for around fifty years. You don’t always see it, but it flares to the surface from time to time. It’s always there, it’s always latent, leaking smoke, warming the soles of your shoes. To me, that is a good analogy for inflation in a free spending and paper currency issuing social democracy.” – James Grant, the market NZZ interview

“Is gold a frivolous investment or a necessity of the age? Gold produces no stream of income. It has some industrial and ornamental uses, but it is chiefly valued because people expect that they will be able to find someone to take it off their hands, quite likely at a profit. That is almost a textbook definition of a bubble, but if gold is in a bubble it has been in a bubble for several thousand years.” – Tim Harford, Financial Times

“When offered opposing outcomes on each issue, about eight in 10 US adults think 2023 will be a year of economic difficulty with higher rather than lower taxes and a growing rather than shrinking budget deficit. More than six in 10 think prices will rise at a high rate and the stock market will fall in the year ahead, both of which happened in 2022. In addition, just over half of Americans predict that unemployment will increase in 2023, an economic problem the US was spared in 2022.…Americans are greeting 2023 with great skepticism and little expectation that the economic struggles that closed out 2022 will abate.” Meghan Brenan, Gallup

“There are no simple answers for the investment community. Traditional approaches have delivered strongly, but it is doubtful they are fit for purpose in the future. As the outlook for traditional beta has declined and the toolkit for defending portfolio returns has shrunk, institutional investors need to reconsider what they invest in, where they invest, and how they make decisions. A deeper understanding of more nuanced and difficult risks is needed and history is an imperfect guide to how to do this. It is a time for investors to challenge their models and assumptions and explore how they now need to balance risk and return.” – Australia’s sovereign wealth fund (This rationale explains the rationale behind the recent addition of gold to its holdings.)

“We believe the bear market [in stocks and bonds] is far from over, even though investment sentiment is more negative than at the market lows of 2002 and 2008 (AAII Investor Sentiment Survey). With the economy likely to slump into a protracted recession, the Federal Reserve (‘Fed’) will be forced to abort its anti-inflation campaign. A Fed reversal could give temporary respite to financial assets. More importantly, it could underscore the dependency of public policy on money printing and provide a significant boost to the precious metals sector.” – John Hathaway, Sprott

“One observation we would make is that when the policy responses to US have been particularly loose/accommodative, the gold price performance has been most explosive. This was the case in 1973 (when Arthur Burns was Federal Reserve governor) and was also the case in 2008 and 2020. We think policy responses to future US recessions will also be highly accommodative and involve a return to combined fiscal/monetary support.” – James Luke, Schroders

“In finance, everything is about marginal flows. These matter the most for the largest marginal borrower — the US Treasury. If less trade is invoiced in US dollars and there is a dwindling recycling of dollar surpluses into traditional reserve assets such as Treasuries, the “exorbitant privilege” that the dollar holds as the international reserve currency could be under assault.” – Zoltan Pozsar, Financial Times

Final Thought

If central banks are loading up on gold, should you be doing the same in your retirement plan?

Brett Arends believes that what’s good for the central banks is good for private investors saving for retirement. “Here’s another reason why it may not be completely insane to add some gold bullion to your 401(k) or retirement account,” he writes in his regular MarketWatch column. “Central banks are stocking up. Three economists—Serkan Arslanalp and Chima Simpson-Bell at the International Monetary Fund, and Barry Eichengreen at UC Berkeley—have published a new report pointing out that gold, far from being on the way out as an international reserve currency, has been coming back in.” We have many clients who own gold and silver bullion coins in their self-directed retirement plans. It is not a difficult goal to achieve. Contact us, and we can set you up with a solid plan in short order.

Ready to fortify your retirement plan?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ORDER GOLD & SILVER ONLINE 24-7

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such, USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors is solely their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything.

––––––––––––––––––––––––––––––––––––––––––––

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.