“[O]ver the long run the Fed will most likely chart a middle course that will take the form of stagflation.”

Ray Dalio, Bridgewater Associates

––––––––––––––––––––––––––––––––––––––––––––––

A market edict delivered from Mount Sinai, or a repeat of the 1970s?

MarshMcClennan urges wealth managers, private banks, and family offices to think gold

In a recent interview with Financial Times, Henry Kaufman, the original “Dr. Doom” who spent most of his career as an economist at Salomon Brothers, expressed his fears that the current Fed under Jerome Powell is failing to combat inflation as Paul Volcker did in the 1980s. “I am still waiting for him to act boldly,” says Kaufman. “Today, the inflation rate is higher than interest rates. Back then, interest rates were higher than inflation rates. It’s quite a juxtaposition. We have a long way to go. Inflation has to come down or interest rates will go higher.” However, this kind of old-world thinking is not what moves Wall Street or other financial centers around the world. The new-world thinking is attached firmly to the notion of a pivot, but what if the Fed never really pivots? Or never really tightens? What if it simply continues to raise rates but never achieves full lift-off?

Perhaps it’s time we developed definitions for the terms dovish and hawkish more suitable for the times. Is it hawkish or dovish to raise rates but keep them a considerable distance from the inflation rate? In our view, it is simplistic to call the Fed hawkish simply because it raises rates. The central banks of Argentina, Venezuela, and Zimbabwe have been raising rates for years, yet their inflation rates are now 70%, 167%, and 257%, respectively, and climbing. No one would be so foolish as to characterize their central banks as hawkish – nor their stock and bond markets as stable. Yet, Wall Street reacts to the act of raising rates as if it were a market edict delivered from atop Mount Sinai when the real effect on inflation might be to moderate rather than throttle it. In short, we may be headed back to the 1970s and a time when central bankers talked the talk on taming inflation but never really walked the walk.

MarshMcClennan, which advises top wealth managers, private banks, and family offices, says it used to be that portfolios were geared to a disinflationary climate well-suited for stock and bond ownership. Now, for the “first time in a generation,” it says in a recently-issued report, investment managers need to seriously consider persistent inflation and stagflation in their planning. “Inflationary scenarios, especially stagflation,” it advises, “leave most portfolios vulnerable. Here, commodity-oriented strategies and gold may prove valuable additions to portfolios.” (Please see chart below.)

“Gold,” it concludes, “is a special case commodity. Historically, it has done well when fear of inflation is high, specifically inflation driven by monetary expansion, having a high sensitivity to inflation when inflation is on a runaway trajectory. Gold may outperform broader commodities in a stagflation scenario (high inflation during a period of stagnating growth), being largely decoupled from industrial demand, and, typically, it has underperformed broader commodities in an inflationary environment that comes with economic growth. That gold often comes into its own in higher inflation scenarios is related to its close relationship to currency debasement.”

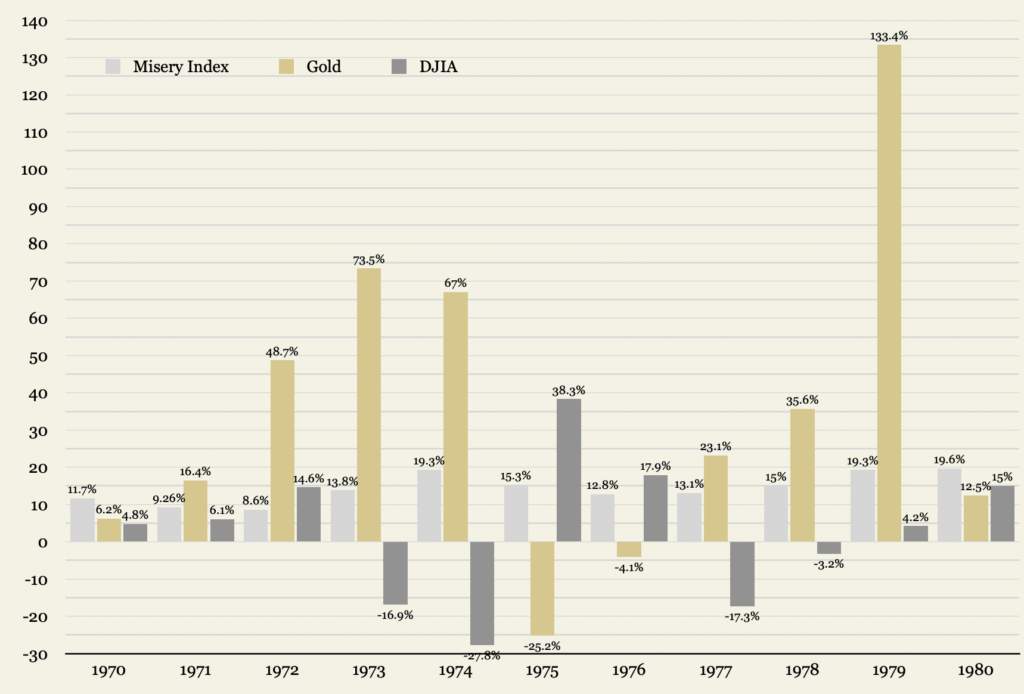

Gold, Stocks, and the Misery Index during the Stagflationary 1970s

(% change, annual; Misery Index = Inflation + Unemployment)

Data sources: St. Louis Federal Reserve [FRED], MacroTrends.net • • • Click to enlarge

Short & Sweet

UNTIL THIS YEAR, INFLATION IN ADVANCED ECONOMIES,” writes Diane Coyle in a MarketWatch article titled The Emotional Scars of Inflation Will Shake the Foundations of Western Societies, “like the United States and the United Kingdom had been so low for so long that one needed to be well into middle age to remember what living through the price surges of the late 1970s was like. It was bad.… But the headline numbers do not reveal the toll that high inflation takes.” Market analysts tend to crunch the numbers without giving much thought to the net effect of economic maladjustment – like inflation – on daily life and the culture in which it occurs. Coyle makes reference to the 1970s and the German nightmare inflation of the 1920s, which continues, she says, to have “an impact on economic policy-making to this day.” Too, we would attribute a large proportion of the robust demand for gold and silver coins over the past year to older investors who remember the debilitating effects of the 1970s stagflation – and how well investors did who purchased those items in the early part of the decade.

IN A CAPTIVATING PROFILE OF GOLD posted at the Data Driven Investor, analyst Dr. Jemeljanov passes along an old Scottish proverb on building financial security: “Get what you can, and keep what you have, that’s the way to get rich.” Gold, he believes, plays a critical role in the second part of that formulation. “[T]he demand for gold persists,” he says “due to the fact that during periods of instability and higher price volatility, the price of gold tends to have a negative correlation with the prices of other assets. This implies that in situations of financial stress, gold prices often rise while prices for other assets fall, thereby increasing the role of gold as a universal ‘diversifier’ of the investment portfolio, regardless of the source of financial stress. This differentiates gold from other ways to protect the value of your portfolio by using, for example, derivative financial instruments since these are focused on protecting the portfolio against some specific risks.”

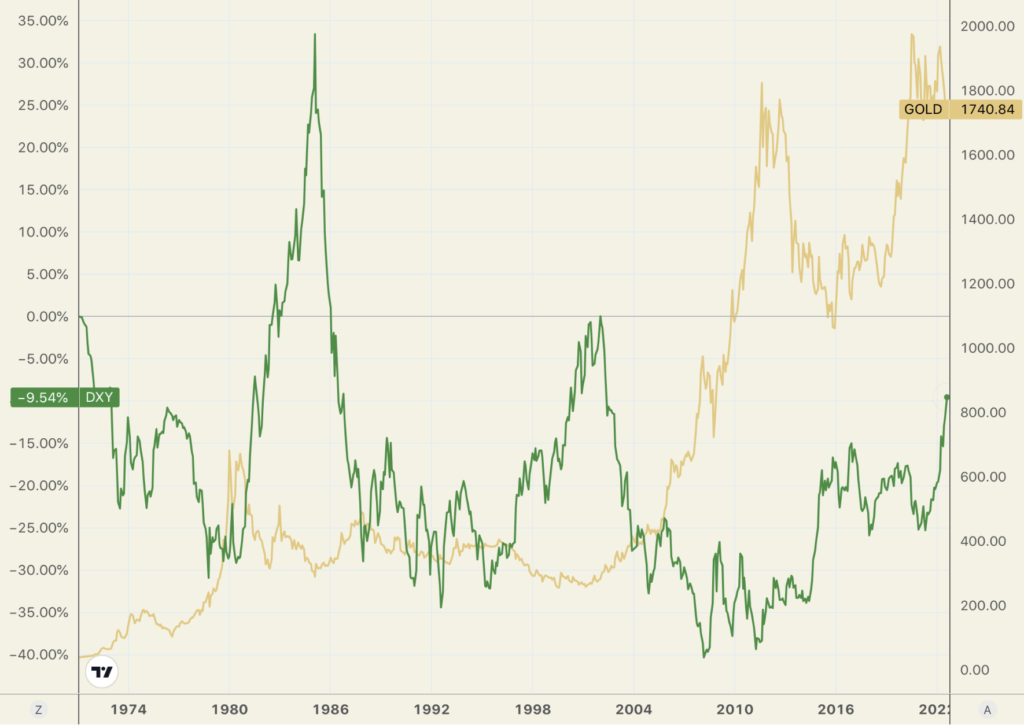

ROCKEFELLER INTERNATIONAL’S RUCHIR SHARMA WARNS that the US dollar might be on the verge of major turnaround based on a confluence of historical factors, much like what occurred under similar circumstances in the early 2000s. “What happened two decades ago,” he writes in a Financial Times editorial, “suggests the dollar is closer to peaking than rallying further. Even as US stocks fell in the dotcom bust, the dollar continued rising, before entering a decline that started in 2002 and lasted six years. A similar turning point may be near. And this time, the US currency’s decline could last even longer.” Kuchir’s editorial is headlined, “A post-dollar world is coming.” If he is correct that the dollar is peaking (and he makes a compelling argument), it will fall in line with the progression of lower highs shown in the long-term chart above. Those long-term lower highs have preceded lower lows, and those lower lows, in turn, have coincided with sharp increases in the gold price, particularly in the period 2000 to 2011.

Gold and the US Dollar Index

(%, 1971-present)

Chart courtesy of TradingView.com

WHAT SHOULD BE NOTED IN THE INVESTMENT COMMUNITY is that inflation, not unemployment, drove the Misery Index in the 1970s, and it is driving it now. It would be a good thing if economists and the financial press began including a modifier to the word recession as a matter of routine – stagflationary, as in stagflationary recession to differentiate it from the traditional kind driven by unemployment, bankruptcies, systemic risks, et al. It would give investors and consumers are more defined sense of what we are up against. “I cannot recall a time during the past 75 years,” writes former German foreign minister Joschka Fischer, “when there has been such a massive accumulation of major and minor shocks. The world today is dealing with intensifying climate change, a pandemic, major wars, surging inflation, disruptions to international trade and supply chains, and acute food and energy shortages.” He says that the West did not anticipate the consequences of its “economic dependencies” on rivals China and Russia. “The bill for this naivete,” he says, “is now coming due and it will be large.” He concludes that we are in the final act of the 75-year Pax Americana that began after World War II. The 2024 election, he says, may be the first American election to have “direct civilizational and planetary consequences.” Echoes of The Fourth Turning ……

TAKING A LONG-TERM VIEW, technical analyst Chris Vermeulen counsels patience as we are now in a period that compares favorably to conditions just before the launch of gold and silver’s secular bull market in 2002-2003. “If Gold/Silver are repeating a 2002-03 setup,” he asks in an analysis posted at MoneyShow after listing the comparisons, “what can we expect in the future? Then the breakout trend starts in gold, which could happen as early as 2023 or 2024, I believe the next rally target for gold will be somewhere above $3100. Then, we start a dedicated climb to levels above $4500 and beyond. It is difficult to predict any date targets for this type of rally, but I’m trying to illustrate what I see related to the similarities of the 1989~2003 market conditions with what I’m seeing right now. If you were around to live through this incredibly exciting time, you may remember many of these events. I’m suggesting we may be starting to move through similar events right now and I suspect we are somewhere near August 2000 right now.”

IN AN ANALYSIS POSTED AT DAILY RECKONING recently, Jeffery Tucker offered an opinion on inflation shared by a good many economists and investors. “Gradually,” he writes, “we’ve come to see the light. There will be no rolling back those price increases in general. There will be declines in the pace of increase here or there but overall prices have shifted upward, permanently.” With that in mind, he shares some family history: “There is nothing we can take for granted in this inflationary crazy economic environment, no rules of thumb that can really guide us. My father was a thrifty man, a truly great man, but also a believer in long-term value and truth. Yes, he loved gold and silver coins too, and very much so. He accumulated them throughout his life. As I look at that today, it is extremely obvious that this was one of his best financial decisions. He was never a day trader or a rah-rah techno champion. He clung to that which he could really trust, really own, really control. That seems like a good way to think even now.”

Notable Quotable

“I can’t help wondering if gold is being held back by Russian sales “Trading partners will not take the paper promises of a warring country, not if they have any sense,” he says. As a result, Russia might be drawing down its stockpile to help finance the Ukraine War. “The Russian war chest may likely be holding gold back and for me the strategy is to accumulate, because either the conflict ends or the war chest empties or both, and with a lot of inflation in the meantime, when that occurs gold will go up a lot. Unless better long term opportunities come by, a fair chunk of my portfolio will be golden.” – Clem Chambers, YLem Capital, Forbes.

Editor’s note: Chambers hunch may have been prescient. Not long after his article was posted at Forbes, Moscow Times reported Russia selling gold directly to China at a 30% discount in order to skirt Western sanctions.

––––––––––––––––––––––––––––––––––––––––––

The six keys to successful gold ownership

This eye-opening, in-depth introduction to precious metals ownership will help you avoid many of the pitfalls that befall first-time investors. Find out who invests in gold, what role gold plays in serious investors’ portfolios, and the when, where, why, and how of adding precious metals to your holdings. To end right, it is critical that you start right, and the six keys to successful gold ownership will point you in the right direction.

––––––––––––––––––––––––––––––––––––––––––––––

“You’ll rarely hear from the mainstream media about central banks loading up on gold. It’s astonishing what central banks have been doing lately. In fact, three of the most certain things about central banks are: they like gold, they are buying gold, and they will continue to buy gold.” – Moe Zulfiqar, Lombardi Letter, on why he thinks gold is going to $3000/ounce

“Any educated person would say that the Fed has to stop what it is doing, lest prices go out of control. But the Fed chair has another concern: keeping his job and not being blamed for a big recession. This year the Fed said it would tighten monetary policy to fight inflation. We have learned over the last 45 years to never trust what the Fed says. What they actually do is often the very opposite of what they say.” Bert Dohmen, Wellington Letter

“This is truly one of the most complex environments we’ve ever seen in our industry to operate in. Because we’re not just dealing with economic issues like inflation and lapping stimulus and things like that. But also the social issues of people returning to mobility after lockdown, working from home and just the change in consumer patterns.” – David Gibbs, CEO, Yum Brands (Taco Bell, KFC, Pizza Hut), CNBC

“A range of indicators suggest a turning point for the gold sector may be close. Importantly, gold has begun to outperform general equities, potentially marking the start of a turnaround after a decade of underperformance. Furthermore, gold’s continued strong performance in major currencies (aside from the US dollar), has proved a bullish signal in previous cycles, and highlights the distorting impact of hawkish Fed policy on the gold market.” – Baker Steel Capital Management, Linked-In

“I don’t really care what the Fed is going to do because the Fed isn’t driving this ship. If I look at what’s happening, we’re already into a brand new easing cycle right now.” – Jim Paulsen, chief investment officer, Leuthold Group, Markets Insider

Final Thought

Who’s buying gold right now and why?

Dominic Frisby reports that over the past two weeks two professional groups in the United Kingdom have emerged as top buyers of gold and silver: doctors and investment bankers. The investment bankers, as indicated above, are worried about systemic risks – the sequel to the Great Financial Crisis. The doctors, he says, have seen the value of their retirement accounts “fall quite dramatically” in recent months and are turning to the metals as alternatives. “Investment bankers’ buying of coins and bars has increased by a – quite astounding, in my view – 59% over the past four weeks,” he reports at Money Week, the UK-based investment magazine. “I have to say, the implications of a 59% jump in investment bankers buying gold for their personal portfolios has some alarm bells ringing. What’s going on at the banks? Are there problems looming? What do they know that we don’t? Something similar was going in the lead up to the Lehman crisis.” Frisby ends by pointing to 67% of pensioners selling stocks within their plans and buying gold. “I don’t think it’s reason alone to go out, sell everything, buy gold and run for the hills. But it’s one of those telling insights, I’d say, to have at the back of your mind as you make your broader macro investment decisions.”

_____________________