Edward Moya and Fred Hickey

The Bank of Canada surprised markets with a lower-than-expected rate increase last week. The sudden dovishness prompted Oanda’s Edward Moya to suggest that “expectations are growing for the Fed to shift to a half-point pace in December and if that seems more likely after next week, gold could have a nice breakout above the $1700 level.” (MarketWatch) Similarly, High Tech Strategist’s Fred Hickey sees gold and the US dollar at turning points based on managed money positioning in futures markets.

“I think we’re in the final innings of peak Fed hawkishness,” he tweeted recently. “Might not take an actual ‘pivot’ for overvalued $ to fall & gold to get going – just a bit of a turn. Everything’s in place: sentiment, investor positioning. Would catch many by surprise.…… COT open interest for gold very low – only 434K contracts – below almost all previous gold bottoms. Levered traders (Managed Money) net short 26K gold futures contracts (only other two times short – around 2015 & 2018 bottoms). Institutions heavily long US $.……Kinda nonsensical gold’s selling off because inflation’s remaining sticky – but that’s the world we’re in – where levered traders (including computers) have correlations to US$ – but no ‘correlation’ to common sense. But when something breaks & Fed pivots with inflation still high….”

Matt Scott

Despite gold’s rangebound pricing thus far this year, Mercer’s Matt Scott sees merit in holding the metal as “one of the few assets that has tended to do well in a stagflationary environment.” He explains the rangebound behavior despite the poor performance of stocks and bonds as the product of an “exceptionally strong dollar” – strength, he believes, that could be “imperiled” in the future as nation-states diversify away from it as a reserve holding.

“So far,” he says in a review published late October, “2022 has been a dramatic year for markets, to say the least, with a 60:40 portfolio returning -15.6% year to date – only the fourth time in a century that stocks and bonds have both fallen over two successive quarters. Gold, by contrast, has had a seemingly placid time of it, significantly up in Q1 but giving back most of those returns more recently (-6.4% year to date ), with its realized volatility subdued relative to equities in recent times. However, anyone who has watched the horror movie Lake Placid knows that the lake is far from placid. Beneath the surface, mighty currents have been playing out a tug-of-war with the gold price.”

Brien Lundin

Gold Newsletter‘s Brien Lundin believes that the greatest impediment to future Fed rate hikes is the intolerable interest expense it would impose on the federal government. He says that there is “no doubt that the costs are going to soon soar well past $1 trillion” and put up a roadblock to any further rate hikes. (By way of perspective, total federal tax revenue for 2021 was $2.76 trillion.) The resulting negative real rate environment, he concludes, will be “extremely positive for precious metals and other tangible assets.”

“This is the direct result of a federal debt that has more than tripled since the Great Financial Crisis of 2008,” he contends, “and is 64% higher than the last time the Fed tried to raise interest rates. But today the Fed is raising rates at more than three times the speed it has at any time since the 1980s. .… If the consensus range were to be reached (4.5% on the Fed funds rate), the yearly cost to service the federal debt would reach toward $1.4 trillion, and rising. This is a stark reality that the market will now be forced to face, as we just received the initial third-quarter estimate of annualized federal interest expenses. The number is buried within the Bureau of Economic Analysis’ first estimate of third-quarter GDP, which was released just this morning. According to that report, the cost has soared to $736.579 billion.”

Craig Hemke

Analyst Craig Hemke advises investors to keep an eye on the dollar index for clues as to when gold and silver might shake their current lethargy. “All bull and bear markets eventually come to an end,” he says in an advisory posted recently at the Sprott website, “and this one in the Dollar Index will end eventually too. When will it end? When the Fed finally halts their rate hike regime, of course. However, you must keep in mind that most’ markets’ are generally forward-looking and proactive, not passive and reactive. With this in mind, perhaps we can look to the Dollar Index for clues before the Fed pauses and reverses. Maybe we should expect the Dollar Index to top and roll over in advance of this eventual policy shift and not as a response to the shift itself.” Hemke sees a break below the 50-day moving average at 110 on the dollar index as an indicator that “the uptrend has been broken.”

Gold and the US Dollar Index

(2000 to present)(2000 to present)

Chart courtesy of TradingView.com • • • Click to enlarge

John Hathaway

Sprott’s John Hathaway, an analyst with decades of gold market experience, counsels patience with gold’s current price action. He believes that, like the Bank of England, the Fed will be forced to abort its anti-inflation mission by “exigent circumstances.” When it does, he says, investors will return to gold as a safe haven asset. “The historical precedent,” he says in an analysis posted at Sprott, “is from year-end 1968 (DJII 903.11) to year-end 1981 (DJII 932.95). During the same stretch, gold rose from $39.11 to $460/oz.” “Dollar ‘strength’ is a mirage,” he says. “It is the reverse image of all other paper currencies’ weaknesses. In our view, the dollar ‘wrecking ball’ may well represent the last stand for paper currencies in general, all of which are the ever-increasing issuance of fiscal decay.”

Dominic Frisby

“I remember 2008 like it was yesterday, writes Dominic Frisby in a recent Money Week article. “Gold cratered along with everything else in the second half of that year. It lost around 30% – falling from close to $1,000/oz to $720. The mining companies fell by a lot more. Yet there was a scramble in the physical gold markets. Bullion dealers had never been so busy. The general public were rushing to get their money “outside the system” into an asset that was nobody else’s liability.”

USAGOLD was one of the firms at the center of the 2008-2009 demand storm. The situation today is similar but not what it was then – not yet anyway. It is important, though, for would-be gold investors to understand that the time to buy gold is when market conditions are relatively stable as they are now. When the dam breaks (and the current situation in the United Kingdom is a good example), premiums rise, delivery times lengthen, and sometimes there is zero availability of popular portfolio inclusions. Something to think about if you believe we are in the quiet period before the storm.

Adrian Ash

“Tail wagging dog? Perhaps,” writes Adrian Ash in October’s The Alchemist, “But while solving the mystery of gold pricing may continue to defy a quick sound bite analysis, and while the size of investment plus speculative flows doesn’t show any kind of consistent relationship to the size of price swings, it’s plain that the behaviour of gold ETF investors and Comex speculators, although marginal to physical demand across longer time frames, tends to map if not drive the market’s direction.”

Ash runs through the gamut of influences on the gold price and lands at the place described above. However, he leaves a step yet to be taken. What, in turn, influences the flow in and out of ETF and COMEX positions? Too often, in our view, it is a matter of crowd behavior more than a fundamental shift based on sound reasoning. That is why when the market turns in a meaningful way, so many are at a loss to explain why. The best way for the private investor to capitalize on that shift (when, not if, it comes) is to be well-positioned ahead of its inception.

John Ruffer

“Central to our continuing belief that inflation is the end-game,” writes John Ruffer, the long-time fund manager, “is the central bankers’ extreme reluctance to be harsh with the economy; our views are not changed by Jerome Powell’s recent belligerence – it’s one thing to sound fierce about raising interest rates when they are 3%, but quite another to do it at 20% in the midst of a recession, as his distinguished predecessor Paul Volcker did.” Ruffer says that in his forty-five years as an investor, he “cannot recall a more dangerous period than today.” It is a time when “plentiful liquidity” is “overwhelmingly attractive.” He says opportunities will arise in the aftermath of a crisis, but “first, we have to get through the storm.” Though Ruffer does not mention gold in this particular advisory, the firm has consistently advocated it over the years as a sensible portfolio holding for the times. (Please see Ruffer Radio’s “Gold Matters,” September 2020)

Charlie Morris

Undaunted by weaker prices thus far this year, Atlas Pulse’s Charlie Morris is sticking with his 2020 forecast that gold will reach $7000 by 2030. He bases that bullish outlook on the “massively overvalued” US dollar going into a steady decline over the next decade – a trend, he says, that will provide tailwinds for gold. “The dollar is high enough, the gold regime is fully bullish, and Chinese demand is strong,” he writes in the latest edition of his newsletter. “Yet the valuation poses a risk assuming the Fed follows through with the tightening program to the bitter end. They likely won’t because the financial system will spectacularly blow up if they do.… Furthermore, the evidence builds that the bond market isn’t a great forecaster and inflation expectations are simply wrong. The real conundrum is why investors are selling gold when it is obvious that, at times like these, a little gold in a portfolio is unlikely to be a bad thing.”

Nouriel Roubini

“The first example is exactly the [Bank of England]. Faced with a financial shock, what’d they do? They totally wimped out and they go back to MMT. So that’s going to happen across the board,” says economist Nouriel Roubini. “I don’t believe central banks when they say ‘we’re going to fight inflation at any cost,’ because they have a delusion of either a soft landing or a hard landing that is short and shallow – two quarters of negative growth and then you return to growth and easing. That’s not going to happen. It’s going to get ugly, the recession, and you’ll have a financial crisis.” Nouriel Roubini told Bloomberg recently his conviction is only growing that the world is headed for disastrous stagflation – the “worst of the 1970s and the Global Financial Crisis” combined. “We’re already in a real time bomb in terms of social and political pressures,” he says. “And an economic crisis and a financial crisis and a geopolitical crisis is gonna make these things much worse.” Roubini is working with a major hedge fund to introduce a digital dollar replacement that features gold, real estate, and short-term US Treasuries.

Short & Sweet

NIALL FERGUSON OFFERS CONSIDERABLE historical perspective on empires in a lengthy Bloomberg essay posted last week. He ends it with a warning that “we must not make the mistake of assuming that the US is an indestructible empire, for there is no such thing.” With that, he echoes the thinking of important historians of the past – Gibbon, Toynbee, Quigley – among others. “History shows,” he says, “that nothing causes fiscal and monetary instability quite like multiple big, long conflicts.”

JAMES TURK PUTS HIS FINGER ON WHY DEMAND FOR GOLD is soaring globally as a store of value in these uncertain times. “If we listen to gold,” he says in an essay posted recently at the Mises Institute, “its message is loud and clear – gold is money. To serve as natural money is gold’s highest purpose.… Although gold these days rarely circulates as currency because of government-imposed restrictions and impediments,” continues the long-time gold market analyst, “gold still retains all the features that explain why humanity in prehistory chose it to be money. Gold is natural money, or stated another way, nature’s money is gold… We can ponder whether this outcome results from fortuitous chance or from the intelligent design of a creator endowing the earth’s resources providentially to equip humanity with natural money. Regardless of gold’s origin, which is unknowable, it cannot be denied that gold is money and is as useful today as any time in history.”

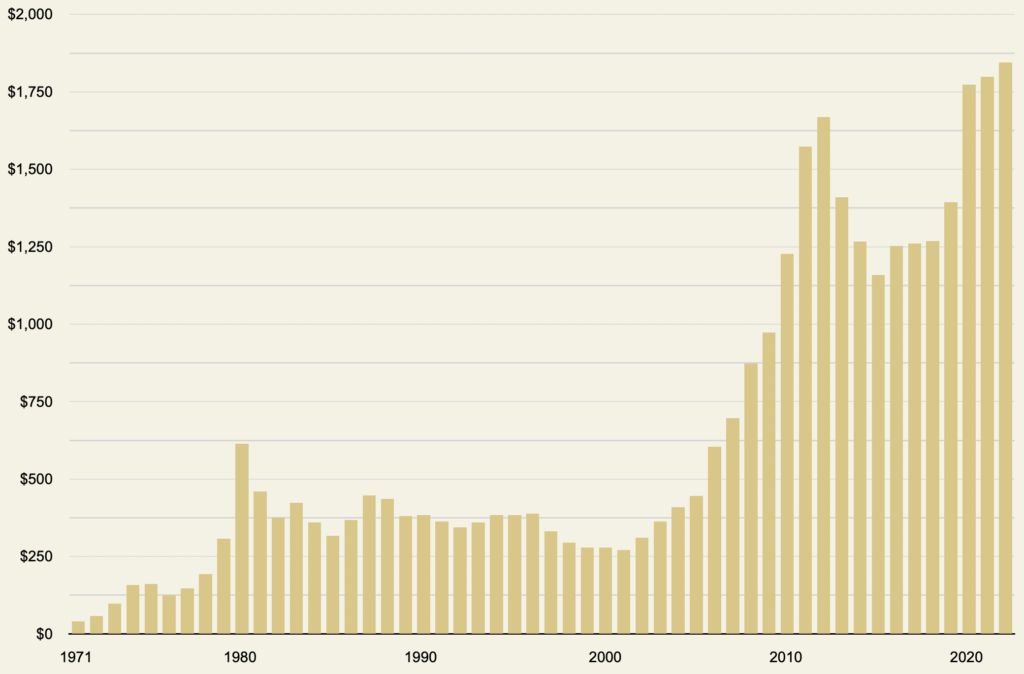

Gold average annual prices

(1971-October 2022)

Data source: MacroTrends.net

THE NEW YORK SUN POSTED AN ENGAGING EDITORIAL recently on the power of central banks to alter the course of economic affairs – a show of force, by the way, that has already presented a raft of unintended consequences in the economy and financial markets. “Such power grabs,” says the Sun, “are enabled, in part, by the abandonment of the gold exchange standard, which imposed a tight discipline on central banks. The convertibility of currency into gold or silver placed a natural limit on how much money the banks could pump into circulation. In the decades of our experiment with fiat currency, [economist Judy] Shelton explains, ‘central banks can create money with no questions asked’ and thus ‘manipulate the cost of capital, or counteract movements in financial markets.’ Central banks created trillions under Quantitative Easing, James Grant writes, calling dollars ‘into existence as a sorcerer might summon the spirits.’ He explains neither wand nor printing press was needed: ‘Taps on a keyboard did the heavy lifting.’ Yet like the hapless sorcerer’s apprentice, the bankers are now unable to control the forces they summoned.”

Editor’s note: While we agree with the Sun’s (and the Shelton/Grant) cause and effect, we do not see, as the publication advises, nation-states returning to the gold standard anytime soon. In line with that assessment, we stick with our long-standing advice that ordinary citizens are best served by putting themselves on the gold standard through private ownership of coins and bullion.

“THIS INFLATION REPORT WAS AN UNMITIGATED DISASTER,” said Christopher S. Rupkey, chief economist at Fwdbonds, a financial markets research company, in a recent CNN Business article. “It shows whatever Fed officials are doing; it is just not working.” This is the 1970s scenario. The central bank talks the talk, but it never walks the walk. It stays behind the inflation curve setting the stage for a stagflationary economy and all it portends. When things go wrong, politicians tend to blame central bankers, but in this case, both are to blame. The government ran huge deficits that the Fed financed with printing press money. Predictably, inflation was the result. As for the present, it is not just the Fed that is losing the war on inflation. With its continued overspending financed with debt, the federal government is also losing it.

TREASURY SECRETARY JANET YELLEN says she “is worried about a loss of adequate liquidity in the [bond] market,” and she should be. With the Fed no longer buying, China and Japan on the sidelines, and US financial institutions disincentivized (as this article outlines), who will buy the ever-expanding bond issuance of the federal government? In 2020, the federal government’s red ink soared, but it has since moderated. However, with a recession on the horizon, it is likely to accelerate again, accentuating the loss of buyers and perhaps heightening the feeling of angst at the Treasury Department.

Final Thought

Can the Fed restore its credibility by causing a recession?

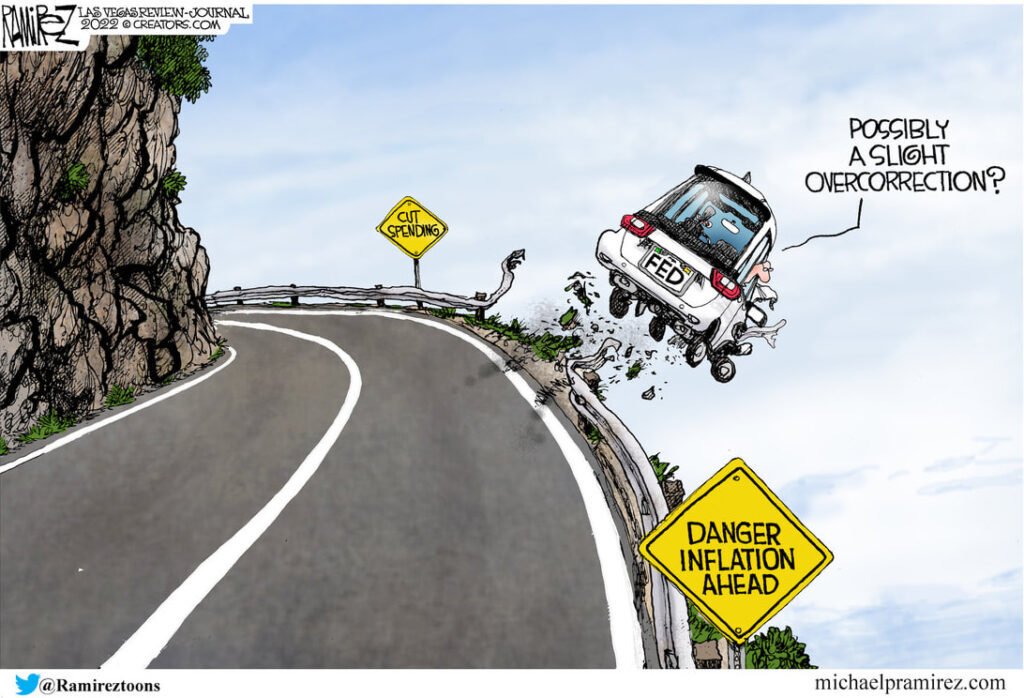

“Three weeks ago,” writes Financial Times’ Martin Sandbau, “Sanna Marin, Finland’s prime minister, retweeted a link to an article by a Finnish academic together with the following quote: ‘There is something seriously wrong with the prevailing ideas of monetary policy when central banks protect their credibility by driving economies into recession.’” Marin’s criticism goes to the heart of the matter and raises the fundamental question of how the Fed got itself into the position of having to defend its credibility in the first place. It wasn’t simply that it printed money, but that it printed money and encouraged fiscal spending, then tried to downplay the resulting inflation as something likely to be short-lived. Now, in the name of restoring its credibility, it is advancing a policy that could damage its credibility even further by causing a recession.

There is a yin and yang to economic life that too many ignore. Economies are not linear but cyclical, and there has been enough in the way of warnings from prominent individuals to warrant being concerned about the next bend in the road. Next year will feel “miserable,” says Business Insider’s Ben Winck and Madison Hoff. “The US economy’s post-pandemic party is over. Strap in for a pretty nasty comedown,” they warn. The stimulus that helped the US economy rocket out of its early 2020s funk came at price – inflation and Fed policies to tame it.

Even so, given the current yield on the 10-year Treasury (even at these elevated numbers) versus the current inflation rate, it is difficult to believe that the Fed will get ahead of the curve anytime soon. Many analysts believe that the trigger for a pivot will be a credit event instigated by tight monetary policy rather than a sharp turnaround on the inflation front. Bloomberg recently advised the Fed that honesty is the best policy. Whether it can or will jump through that hoop remains to be seen.

Cartoon courtesy of MichaelPRamirez.com

Cartoon courtesy of MichaelPRamirez.com

____________________________________________

Worried about the sequel to the Great Financial Crisis?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ORDER GOLD & SILVER ONLINE 24-7