Does anyone remember way back to when new jobs came in so bad the report shocked everyone by being far below expectations? Stretch your memory because it was all of three days ago that only 106,000 new jobs were created, well below the 190,000 Dow Jones estimate, and even further below the previous month’s upwardly revised 253,000. Yet, now, they’ve exploded to half a million! Problem’s solved. No need to read on economics anymore.

Naturally, the original cavernous number didn’t phase stock investors because what could be better for investors than to know their businesses were plunging into the abyss of a recession? Right? Isn’t that what everyone who owns part of a business wants to hear? Apparently, it was, because they shrugged the report off without a blink. That’s because, at the same time, what could be better for investors than to know the Fed would stop sucking the float of money out of the economy since almost none of them are buying ownership in a business but just buying chips in a casino that needs abundant cash to keep the play going?

So, the plunge in jobs set the table for Jerome Powell, Father Fed, to deliver a seismic jolt later in the day with mere hints that the Fed’s inflation battle might possibly be going better than he thinks it is. (More on that in another article.) After all, what could be better than the head of the Fed telling you the entire Fed might be wrong about needing to tighten further? So, rather than bet on Powell’s string of hawkish statements in his speech about needing to keep fighting inflation longer by tamping the economy down further, why not bet, based on that the miserable job report, that he was as wrong as he merely hinted he might in the Q&A afterward? Why not bet that, at last, Powell’s knees were buckling, and the phantasm known as the Fed pivot would soon be here?

All was not as it seemed, however, though how it seemed was not, in itself, the least bit clear: As covered in The Daily Doom, “US Job Opening Far Lower Than Reported by Department Of Labor.”

Sure, new job positions came in WAY below expectations, but that got blamed on the weather. (I doubted it, and so did Zero Hedge.) Only half a day ahead of the report, ZH prepared the way for what was to come with an article stating that the number of apparent mistakes and contradictions born of incompetence or lies in various government jobs reports last year (it being an act of generosity to call them “mistakes”) has been so outrageous as to defy belief, making malarky out of Biden’s baloney:

Biden’s labor department is a study in contrasts (and pats on shoulders). One day we get a contraction in PMI employment (both manufacturing and services), the other we get a major beat in employment. Then, one day the Household survey shows a plunge in employment (in fact, there has almost been no employment gain in the past 9 months) and a record in multiple jobholders and part-time workers, and the same day the Establishment Survey signals a spike in payrolls (mostly among waiters and bartenders). Or the day the JOLTS report shows an unexpected jump in job openings even as actual hiring slides to a two year low. Or the straw the breaks the latest trend in the labor market’s back, is when the jobs report finally cracks and shows the fewest jobs added in over a year, and yet initial jobless claims tumble and reverse all recent increases despite daily news of mass layoffs across all tech companies, as the relentless barrage of conflicting data out of the Bureau of Labor Statistics (which is the principal “fact-finding” agency for the Biden Administration and a core pillar of the Dept of Labor) just won’t stop, almost as if to make a very political point.

But while one can certainly appreciate Biden’s desire to paint the glass of US jobs as always half full, reality is starting to make a mockery of the president’s gaslighting ambitions, as one by one core pillars of the administration’s “strong jobs” fabulation collapse. First it was the Philadelphia Fed shockingly stating that contrary to the BLS “goalseeking” of 1.1 million jobs in Q2 2022, the US actually only added a paltry 10,000 jobs (just as the Fed unleashed an unprecedented spree of 75bps rate hikes)….

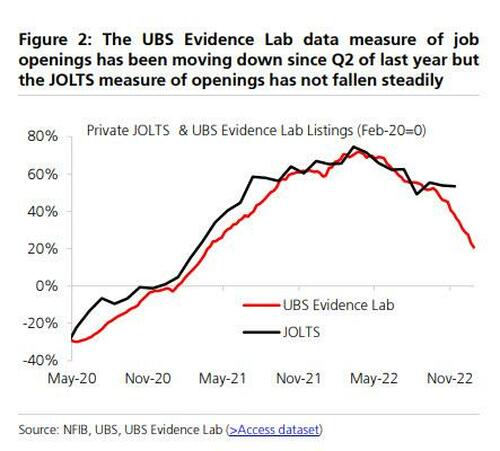

Of course, such a high level of job openings [as reported by the BLS] is alarming to the Fed for the simple reason that it means Powell has failed at his mission at cooling off what appears to be a red hot jobs market…. Whether on purpose or accidentally, the BLS is fabricating data…. As usual there is BLS “data” and everyone else… and as UBS cautions, other measures of openings tell a very different story: “Our UBS Evidence Lab data on job listings is weekly and more timely than the BLS series. The last datapoint is for the week of December 31. It shows openings down 30% from the March 2022 peak and only 25% higher than the 2019 average….”

While BLS bureaucrats and Biden sycophants can argue UBS data is inaccurate, other longer dated series also indicate weaker openings…. As the UBS economist puts it, “in short, other surveys of job openings generally suggest that the BLS measure may be overstating labor market tightness…. Whatever the reason for the discrepancy in this latest labor series, the bigger picture is getting troubling… Now, we can also stick a fork in the JOLTS report, whose accuracy has just been steamrolled by UBS with its finding that job openings – a critical component of the US labor market and the Fed’s preferred labor market indiator – are far lower than what the Dept of Labor suggests…. While it is obvious why the Biden admin would try hard to put as much lipstick as it can on US jobs data, the same data when measured with alternative measures shows a far uglier picture, one of a US labor market on the verge of cracking and hardly one meriting consistent rate hikes by the Fed.

The various government reports are so self-contradictory, you might as well throw chicken bowels at the kitchen wall and read the pattern of the splattern because whatever you make of that will be more meaningful than the mess of confusion the government is now heaping out.

Here, for example, is the difference in what UBS (originally Union Bank of Switzerland) calculated for job openings (red line) and what the US government Bureau of Labor Statistics has been reporting (black line):

And, as if that differential isn’t bad enough, the black line took a sharp upturn after this graph was published. A differential of a mere forty percentage points (even before the BLS upturn). Surely any gauge that is only off by forty percentage points and growing worse is something we can bank economic corrections on! The government sees no problem with this. Do you? We have moved to where numbers out of China can be trusted more than US metrics, and I’m not, by that statement, suggesting bragging rights for China.

ZH notes numerous additional bizarre labor reports in that article, if you want granular detail, but the above quote gives the gist of it. I, too, have stated for the past few months that the labor market is badly broken and that labor reports are inadequately reflecting the deeply busted state of the labor market and often seem grossly exaggerated to the positive, as if the Bureau of Lying Statistics is trying to cover how badly broken the labor market is or simply does not understand the breakage it is trying to analyze, so it adjusts the numbers to what it thinks they should be. Because Powell has stated he is particularly looking at the labor market as a gauge for when the Fed has tightened enough (aiming for about 4.5% unemployment), I’ve stated the result will be that the Fed overtightens to a point of extreme economic breakage that could cause big production declines and, therefore, even worse shortages that might actually even backfire in the inflation battle.

It is in that view that the next lines of ZH’s article are crucial:

We wish that we weren’t the only media outlet to lay out the facts as the negative impact of continued policy error and tightening by the Fed will impact tens of millions Americans, not to mention the continued errors – whether premeditated or accidental – by the US Department of Labor. Alas, as so often happens, since nobody else in the “independent US press” is willing to touch the story of manipulated jobs data with a ten foot pole, it is again up to us to explain what is really going on.

In other words, by the time the Fed’s broken gauges get to where the Fed thinks they should be, the underlying destruction in labor will be worse than it knows. (And I certainly know by experience how ZH feels like it is the only one out there pounding this message to try to make it heard.) When all the supposedly bright people in the financial media see absolutely NOTHING wrong with this mess of government data that they report on, you start to wonder if you are crazy or just don’t understand things yourself. You ask yourself, “Why does no one see it?”

So, it brings some mental relief when you read an outfit like ZH also saying this conglomeration of different kinds of job reports is total malarky, which is why I have long called the BLS the Bureau of Lying Statistics. It’s just that it has now gotten so bizarre that you think, They could’t possibly be getting away with lies this huge or mistakes this gross with no one commenting on it at all. So, it must be that I am failing to understand how all this can add up.

Then, the very next day, another government report came out, and ZH wrote another scathing article about how corrupted these labor reports are getting to look, titled, “Just Make it Up: Job Openings Now Unexpectedly Soar as Labor Department Now Guessing What The Number Is“:

What a coincidence: just yesterday we presented the latest report from UBS economists showing that the job openings “data” collected and presented by Biden’s Department of Labor is at best wrong (and at worst, manipulated propaganda meant to make the labor market appear stronger than it is), and that the reality is far worse than the BLS suggests….

Faced with a difficult choice: either come clean about the real labor numbers – now that US corporations are averaging one mass layoff announcement every 45 minutes – or just double down and keep reporting increasingly bigger lies, the Biden admin’s labor department has sadly but predictably decided to do what it does best by picking option two, and as today’s latest JOLTs report shows, it intends to keep digging and making the hole ever bigger.

That was where, having reported the black line in the graph above, which was already way above what UBS calculated, the Biden administration put out a new number that took that black line back up. As ZH noted,

This was the fourth consecutive beat of expectations in the series, and an unprecedented 12 of the past 13 prints, just another garden variety six-sigma event by the “never political” BLS….

Said otherwise, there were 1.92 job openings for every unemployed worker, up from 1.74 last month. Needless to say, this number has a ways to drop to revert to its precovid levels around around 1.20….

So, don’t feel bad if you can’t make sense of where the job market is because clearly the government cannot either, and neither can I because the official numbers, as ZH points out, are a pile of nonsensical garbage. And yet, these employment/unemployment metrics are the big gauges Powell has said he’s watching to get a sense of when the Fed has tightened the economy enough. That’s comforting to know: Powell is looking at numbers that are flying randomly in contradictions all over the planet to gauge when the right point is to stop tightening the financial system, which is to say, stop wounding his rigged economy.

What does one make of this mess?

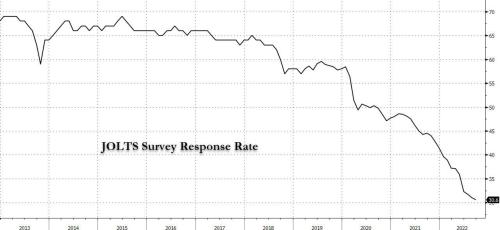

The answer is simple: well over half of it – or some 70% to be specific – is guesswork. As the BLS itself admits, while the response rate to most of its various labor (and other) surveys has collapsed in recent years … nothing is as bad as the JOLTS report where the actual response rate has tumbled to a record low 30.6%!

In other words, more than two thirds, or 70% of the final number of job openings, is estimated!

And it’s not even just that 70% of the reported number is extrapolated from the survey’s raw data, but on top of that, the extrapolated total then gets “adjusted” in every way imaginable by a government that surely wouldn’t be goal seeking. So, why should any business waste its time responding to these government surveys, when the end results are such a garbage heap of politically screwed and hammered numbers? All the numbers get adjusted however the government wants based on the actual weather or even just the color of returning starling feathers this spring because they indicate it was or will be unseasonably warm or unseasonably cold or peculiarly perfect.

And then there was today!

Overnight, jobs scorched into the stratosphere this morning like a rocket leaving Cape Canaveral at a mind-inflating, half-a-million-plus new jobs to cruise at almost twice the altitude of the most outlandish estimate. (517,000 new jobs, well above the average estimate of 183,000.) Yes, we are to believe jobs did this only three days after the abysmal new-jobs report mentioned at the top of this article. If this week’s numbers were taken as factual (akin to reading Hansel and Gretel as German history), we could say based on this week’s reports alone that jobs are way, way down and way, way up at the same time!

Of course that does not even seem incongruous to most financial writers because we now live in a world where we make everything up, anyway. What kind of truth can you expect in a world where a man can compete in women’s sports, and most of society nods in approval, even while he still has dangling male body parts, just because he says he’s a woman, so you better accept it! And the majority who believe that is perfectly normal think the limited few of us who are against it are just absurdly hostile to new forms of sexuality.

Yet, it gets better: Today, the unemployment rate fell to a low (3.4%) not seen in over half a century! Yes, just when Powell assured the world the Fed was getting a hand on things, though there was more battle to go, the very thing he most wants to move up, took yet ANOTHER drop down to an almost historic low.

“It was a phenomenal report,” said Michelle Meyer, chief U.S. economist at the Mastercard Economics Institute. “This brings into question how we’re able to see that level of job growth despite some of the other rumblings in the economy. The reality is it shows there’s still a lot of pent-up demand for workers were companies have really struggled to staff appropriately….”

“Today’s jobs report is almost too good to be true,” wrote Julia Pollak, chief economist at ZipRecruiter. “Like $20 bills on the sidewalk and free lunches, falling inflation paired with falling unemployment is the stuff of economics fiction.”

YA THINK?

The errors are so obvious that these people comment on how stupid the numbers are but then accept the report anyway, and ZipRecruiter is in the jobs business! Pollak continues in her own posting to try to use the numbers.

The stock market fell today because of that report, unable to wrench itself from the good-news-is-bad news idiocy that has been turned into the smart play in stocks due by endless Fed interference in the economy and markets. In a normal world, the market would be exuberant over such a strong jobs report, but we no longer live in anything remotely like a normal world.

Over the full course of the week, the stock market has soared and plunged and soared and then plunged again. Treasuries dove and then blasted off. Market pundits, in fact, praised Friday’s big jobs report as an all-out “WOW, WOW!” The job number ripped the face off of even the most extremely positive expectations, running almost twice as hot as Citi’s prediction for where the report would come, which was already well above everyone else.

But did anyone say, “What the heck is going on here???”

Of course not!

Yet, you couldn’t even have made a wild guess that today’s report might come in this hot:

The number blew away the Wall Street consensus of 190,000 jobs and suggests that the Fed’s efforts to cool the labor market by hiking interest rates at the fastest pace in decades are not yet having the desired impact.

And that’s why the market plunged. Yesterday’s abundant exuberance over Father Fed’s mere hints that the Fed might be accomplishing more than the Fed thought it was at tightening down labor to squeeze out inflation suddenly evaporated. The phantom Fed pivot disappeared before the bull’s eyes once again. Of course, the non-goal-seeking government’s leader jumped on the report as proof of his government’s good works:

Biden took a victory lap, arguing that the report shows his policies are working.

[What report out of the government doesn’t these days?]

“For the past two years, we’ve heard a chorus of critics write off my economic plan,” the president said in remarks before leaving the White House for a trip to Philadelphia. “They said it’s just not possible to grow the economy from the bottom up and the middle out,” he said. “Today’s data makes crystal clear what I’ve always known in my gut: These critics and cynics are wrong.”

It doesn’t make anything crystal clear to me, other than the fact that the sum total of these reports is a heap of contradictory garbage. Besides, didn’t the critics say his plan would re-ignite inflation?

On the other hand, the report nailed investors with the message that one half of split-personality Powell tried to tell them yesterday, which was that there is lots of inflation fight left to come. So, I guess I can be thankful for that. The permabulls didn’t hear that part of his message yesterday because the mere hints that a wind-down could coming if the Fed was wrong overheated Wall Street’s computers with trades. Today, however, jobs screamed “unrestrained economic expansion,” which the Fed will have to fight while earnings, at the same time, yelled “recession.” What is a market addicted to the Fed’s monetary meth to do?

Any single report can be an outlier and is unlikely to sway the Fed. But Powell is worried about the hot jobs market driving up wages, fueling inflation. So any news showing the market heating rather than cooling could be unwelcome.

And what is poor Father Fed to do when all his gauges are lying to him? He can’t seem to kill the jobs market to save his sorry soul. (Could it be that the labor market is already badly wounded, and the jobs reports are just making stuff up as they go?)

Powell, however, is a high-risk gambler, it would seem:

“My base case is that the economy can return to 2 percent inflation without a really significant downturn or a really big increase in unemployment,” Powell said Wednesday. “I think that’s a possible outcome. I think many, many forecasters would say it’s not the most likely outcome, but I would say there’s a chance of it.”

That’s what I like: Fed policy based on chance. What could go better? Powell’s statement translates into “The very thing almost everyone says is impossible is my base-case scenario because I think there is, at least, a chance we could pull that off.” Let’s bet everyone’s livelihoods on a possible outcome nearly everyone else says is the least-likely, and (the easy part) let’s convince millions of stock investors we can pull that off.

Today, however, made those investors worry that maybe — just maybe – Powell is far from succeeding on the 2% inflation target with unemployment and new jobs both running wildly in the opposite direction of Powell’s stated intentions.

Powell has help, though. Economists rushed to their hero’s rescue:

“The blowout 517,000 increase in total employment was almost certainly a function of seasonal noise and traditional churn in early year job and wage environment and exaggerates what is already a robust trend in hiring,“ Joe Brusuelas, chief economist at consulting firm RSM US, said in a client note.

The survey week that produces the jobs number was also unusually warm, something that could have boosted the total.

Ah, there it is, the perennial weather report that always allows job numbers to be tweaked back to where you want them.

Gee, back when we were getting equally high (and now totally discredited by the Philly Fed) reports of jobs last summer, was that due to normal seasonal warmth in a mid-year job and wage environment? And how odd that usually we hear about labor reports needing to have the raw numbers seasonally adjusted upward due to unseasonably cold weather in winter, keeping companies from opening new positions. So, if this was unseasonably warm in winter, why didn’t they adjust it downward? Maybe Biden needed bragging rights?

It seems all we ever read is excuses to cover for whatever the raw numbers show, instead of investigation of the lies and errors in all the adjustments, which are increasingly obvious because they are stacking up with a lean that looks weirder than the Leaning Tower of Pisa.

Is it any wonder that, after well over a decade of being rigged by the Fed, the stock market has lost all ability to think? With so many rigged jobs reports in the last several months, how can the idiots who are addicted to the Fed’s dopium decide if the Fed is going to back off on tightening or stomp harder on the brakes? So, they are up and they are down on highs that quickly fade. The Fed is still the market maker, and the market now vacillates between simply coming down from a high because of the recession the Fed is shoving us into and betting on which way jobs are going to drive the Fed on any given Sunday, Monday or Tuesday.

Don’t worry, they will just use this Sunday to seasonally adjust it all back into place by Monday. Everything will be fine.

Become a Patron at the $10 level to support this kind of writing, and you gain access to The Daily Doom to stay on top of all the stories that go into articles like this one each weekday morning.

Liked it? Take a second to support David Haggith on Patreon!