The contagion of collapse continues. As I suggested would happen earlier this week, the crazy buyout engineered in Switzerland when one of the oldest banks on Earth collapsed spread to equally ancient, gargantuan and zombified Deutsche Bank, and that’s just what’s happening on the surface as the whole global financial structure shook hard again today.

DB’s shares, going down 11% just this morning, have slid by a fifth this month. And, while Credit Suisse, like Deutsche Bank, was as riddled as that nation’s famous cheese with holes it had created for itself, Switzerland lays the blame for its fall on the US banking crisis.

The European column collapses

Deutsche Bank shares fell on Friday following a spike in credit default swaps Thursday night, as concerns about the stability of European banks persisted….

The emergency rescue of Credit Suisse by UBS, in the wake of the collapse of U.S.-based Silicon Valley Bank, has triggered contagion concern among investors, which was deepened by further monetary policy tightening from the U.S. Federal Reserve on Wednesday.

As some ask if it is fair for Switzerland to blame the fall of Credit Suisse on the US, given CS’s longstanding problems since that hulk of corrupt, stinking Limburger was wrongly bailed out in the last financial crisis, I ask, “Why wouldn’t BOTH the US collapse and the bank’s internal rot be the cause?” The US crisis was simply the straw that broke the camel’s back. That’s all.

In every long downfall, there is that last thing that brings the house of cards finally down. Naturally, the first to catch contagion across the ocean from the US crisis was CS. Who was there that didn’t see that old, creaking institution crumbling all across its beautiful Swiss façade? Now that CS has crumbled into UBS, the speed at which Deutsche is sliding is picking up, which opens abundant room to wonder what the crash of these two leviathans will mean for contagion to other banks around the world.

Swiss and global regulators and central banks had hoped that the brokering of Credit Suisse’s sale to its domestic rival would help calm the markets, but investors clearly remain unconvinced that the deal will be enough to contain the stress in the banking sector.

Of course it won’t. Even Moody’s, which is typically one of the last to see bad things coming in credit markets, says,

In an uncertain economic environment and with investor confidence remaining fragile, there is a risk that policymakers will be unable to curtail the current turmoil without longer-lasting and potentially severe repercussions within and beyond the banking sector….

Even before bank stress became evident, we had expected global credit conditions to continue to weaken in 2023 as a result of significantly higher interest rates and lower growth, including recessions in some countries….

The longer that financial conditions remain tight, the greater the risk that stresses spread beyond the banking sector, unleashing greater financial and economic damage than we anticipated.

And how can they not remain tight longer with already hot inflation back on the rise?

Oh, but …

German Chancellor Olaf Scholz told a news conference in Brussels on Friday that Deutsche Bank had “thoroughly reorganized and modernized its business model and is a very profitable bank,” adding that there is no basis to speculate about its future.

Maybe, but he reminds me a lot of Crazy Cramer pumping SVB’s stock as a bargain barely over a month ago:

A month ago (Feb. 8) Jim Cramer said the Silicon Valley Bank stock (SIVB) is "still cheap" and has "room to run". Today, the bank collapsed.

by u/predictany007 in StockMarket

“Nothing to see here, Folks,” sang the Wall-Street Echo Choir in response to Chancellor Shultz about his favorite Deutschland bank:

“We view this as an irrational market,” Citigroup Inc. analysts including Andrew Coombs wrote in a note. “The risk is if there is a knock on impact from various media headlines on depositors psychologically, regardless of whether the initial reasoning behind this was correct or not.”

“We have no concerns about Deutsche’s viability or asset marks,” Stuart Graham, an analyst at Autonomous Research wrote. “To be crystal clear – Deutsche is NOT the next Credit Suisse.”

“It is a clear case of the market selling first and asking questions later,” said Paul de la Baume, senior market strategist at FlowBank SA.

Eh, give it a few weeks. If there was any surprise in all of this, it was only that Deutsche Bank didn’t go out before Credit Suisse. But the zombie parade isn’t over yet!

[Deutsche Bank] poses as the largest bank in Germany, but it’s actually the largest criminal enterprise in Germany, which is something, because it has to compete with Volkswagen.

Attention: Deutsche Bank is closing its office in Houston, so any fraud normally done there will be moved to the Dallas office.

Part of the problem Switzerland created in how it handled the CS collapse was exercising the legal right in its AT1 CoCo bond contracts to force those bondholders to take the full hit ahead of stockholders. While that caught many bondholders by surprise because they had ignored the fine print, that is no reason to think that exercising that right has not sent panic throughout the many institutions that hold those bonds. It’s not so much that all other AT1 bonds have the same provision — because few if any outside of Switzerland do — but a question of how many institutions throughout Europe and in the US are being damaged, yet another time, by the hit on the CS bonds they held?

The American column collapses

Even if you narrow your focus to just within the US banking collapse, there is plenty of evidence the contagion continues and the whole structure is rumbling with the sounds of collapse. The turmoil continues:

Banks reduced their borrowings only slightly from two Federal Reserve backstop facilities in the most recent week, a sign that institutions are taking advantage of the central bank’s liquidity in the wake of turmoil.

US institutions had a combined $163.9 billion in outstanding borrowings in the week through March 22, compared with $164.8 billion the previous week, according to Fed data Thursday.

Data showed $110.2 billion in borrowing from the Fed’s traditional backstop lending program known as the discount window compared with a record $152.9 billion in outstanding credit the previous week. The loans can be extended for up to 90 days and the window accepts a broad range of collateral.

Outstanding borrowings from the Bank Term Funding Program stood at $53.7 billion, compared with $11.9 billion the previous week. The BTFP was opened March 12 after the Fed declared emergency conditions following the collapse of California’s Silicon Valley Bank and New York’s Signature Bank….

“There’s nothing here, which suggests things aren’t spreading,” said Blake Gwin, head of US interest rates strategy at RBC Capital Markets….

Repurchase agreement rates were elevated for a number of days, cross-currency basis swaps have whipsawed and the gap between direct floating-rate agreements and index-tied ones — often used as a measure of the difficulty banks have in getting access to funds — also swelled.

The shoring for the toppling structure of US finance is going up quickly and everywhere now that Janet Yellen doubled down on spreading chaos.

There’s concerns as to whether deposits will continue fleeing banks for other places in the financial system. Money market funds have been scooping up cash recently, fueled in large part by depositors pulling their money away from US banks.

And now it comes down together

The contagion continues because numerous other important institutions were already weakened under the peril I just mentioned where the problems Silicon Valley Bank had due to Fed tightening are biting deep into the flesh of other institutions as well. So, if any US financial institution’s reserves or holdings were already imperiled for liquidity because of the loss of their Treasury values, the new wipeout from Europe of any CS AT1 bonds they’re holding could be the straw that breaks their backs.

And, so, the stresses shift back and forth between continents, as each piles more on the other until all come down. We can see that happening here:

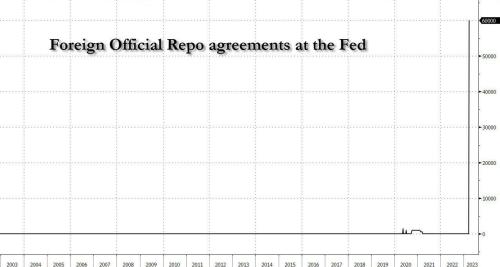

For the first time since November, banks tapped the Fed’s foreign repurchase agreement facility for $60 billion. That’s equivalent to the per counterparty limit for participants.

Would that be foreign like the kind Deutsche bank uses or the kind UBS might need as it is swallowing the rot of Credit Suisse? Just to be clear, here is how that foreign repo usage looks compared to normal:

Just a little bit higher than in the Covid lockdown crisis of 2020! (See blips.)

You cannot endlessly knock out supports one or two at a time and expect the structure to keep standing. Sooner or later you have taken out one too many. However, when you see the columns blowing out left and right, it’s probably too late to get out of the building.

Each institution will vary in how many additional assaults it can weather, but clearly the likelihood of the next big boy falling increases with each new large assault like the new CS AT1 losses that were just heaped on, which came in over and above the US Treasury losses and European bond losses that were accruing all of the past year under central-bank tightening. They also came in after the shocks that fractured structures when three US banks fell and two more lined up for a fall.

Any institution that has taken heavy losses in bond values that also holds a lot of CS AT1 bonds, may easily be the next to fall. We’re watching the demolition of the whole faulty structure one or two columns at a time, but you can see cracks forming in adjacent columns as they become stressed under greater loads shifted from the breaking columns around them.

It all comes down due to its own greed

Deutsche is sucking down the Dow with it this morning, but again, “Why wouldn’t it?” Even Bank of America’s Michael Hartnett said Yesterday,

“Credit and stock markets too greedy for rate cuts, not fearful enough of recession,” a team led by Michael Hartnett wrote in a note dated Thursday. The strategist, who was correctly bearish through last year, said investment-grade spreads and stocks will be taking a hit over the next three to six months.

Markets have been on edge amid the collapse of several US lenders and turmoil at Credit Suisse Group AG which led to its government-brokered takeover by UBS Group AG. That hasn’t swayed central banks, with the Federal Reserve, European Central Bank and Bank of England among those that have pressed on with hiking rates to tame inflation even in the face of banking system stress.

I couldn’t agree more. And that means the US stock market is poised to become a third column to fall in this banking collapse, as bank stocks are getting wiped out the worst. That will take more banks down and most of the rest of the market out with them.

While there is nothing novel about stupidity and greed in America’s stock market, I pointed out just a day ago how extraordinarily blind with greed investors showed themselves to be after Powell’s last press conference where once again the market lunatics tried their best to latch onto the faintest glimmer of a “Fed pivot,” even though clearly everything Powell said was the opposite of a pivot. But there it was, back in the news again — the phantom “Fed pivot” lifting the market to a huge rise in the first part of the day Thursday.

The stock market took off like a rocket yesterday morning.

The Fed raised rates by 25 basis points (0.25%). In the morning, investors thought they saw Janet Yellen at work. But by the afternoon they were sure it was Paul Volcker, raised from the dead, and sneaking back into the Fed. The rocket turned its nose down, the Dow gave up all its AM gains…and then bounced at the end of the day.

Such are the gyrations as market maniacs get their heads slammed from ceiling to floor. I mean, these guys are literally all just running full speed with the thin crests of their cranial shells aimed straight at a spike sticking out of a brick wall. They are so far beyond stupid, that I hope they die hard (financially) just to rid the world of their stupidity because these are the same greedy people who have built a lot of rigging into the market. They endlessly lust for the Fed to pump the bubbles back up again:

But the entire elite class is deeply afraid of deflation (which would mean giving up as much as $50 trillion in fake wealth). It will continue with its ‘stealth pivot,’ stick to a tried-and-true way to protect its bubble gains…and rip off the masses with inflation.

The sooner they are made an example of and wiped out, at this point, the better off the market will be in the future. Perhaps their wipeout will be so grand that it forces everyone to look seriously at how the market is rigged by rich marketeers finding ways to play it. (I dream, of course; but shock and awe is what it would take for that to ever happen.) It is time for a reset on the greed and moral hazard the Fed and the other players have built into the market. And the only way that happens is if someone hits the palm-sized red button that shuts down the fuel pumps.

The problem long has been …

Investors who made foolish decisions were generally rewarded instead of punished. Those who used margin, or who kept piling blindly into U.S. equity growth funds in classic Boglehead style, or who simply purchased shares of the best-known big U.S. companies, generally outperformed … especially in years like 2021. When inferior performance is rewarded and careful analysis is not, investors will naturally pile into whatever is “doing well” regardless of merit….

More importantly, far too many investors of all ages haven’t been reducing risk by moving into guaranteed U.S. Treasury Bills…. [Note: This is much different than being in bond funds that are loaded with old, low-interest bonds, as those are in the same peril as banks like SVB. The author is talking about buying new-issue bonds to hold them to maturity and collect the interest or to trade them later if rates do fall (prices rise).]

Tragically, far more investors are actually more confident about the U.S. stock market after experiencing a losing year like 2022, because they figure that was the one bad year of the decade and they’ll get even bigger gains from now on. The media have been encouraging this sort of behavior, reporting that something like 90% of all down years for U.S. stocks are followed by up years. The problem is that 100% of all the first years of bubble collapses are followed by down years, and since we had experienced all-time record overvaluations, net inflows, and insider selling in 2021, the current scenario cannot be anything other than a bubble collapse.

The bubbleheads are going to take a lot of punishment, at this late juncture, whichr is full well deserved. We’ll never get the rigging out of markets if the pain isn’t severe. There are too many greedy idiots who won’t learn any other way. The banks that have just fallen are a prime example. They could have easily seen this coming (and were in the best position to see it), but greed kept them in the game for high yields, instead of more conservative preparation for the Fed’s forecasted interest hikes.

Let it go down!

Why not let them fail? Bad restaurants go out of business. Bad poker players lose their money. Mismanaged banks are supposed to go bankrupt, too.

That is the discipline of capitalism. Can committees of bureaucrats and hacks do better? Can central planners improve on the way private markets allocate capital and price assets? Can politicians with no ‘skin in the game’ make better investments than investors with their own money at risk?

If so, it’s news to us. As far as we know, the discipline of capitalism is the driving force of human progress. It rewards successes. And it rejects failures. We learn. We do more of what works and less of what doesn’t. We get richer. Everyone is better off by getting rid of bad chefs and bad bankers….

The future is only allowed to happen at all because the elite don’t see it coming.

Because we have bailed out so many institutions, financial markets are overflowing with greed that needs to be flushed out of them. Many warned long ago this would be the “moral hazard” of the Great-Recession bailouts. Well, it’s all here in plain sight now … but it is still all being protected. Until the protection stops, the learning and reform will not begin. People having near-death experiences wake up!

Now the Silicon Valley companies are here, firmly entrenched…representing billions in new wealth…and part of the elite themselves….

The feds – and indeed today’s whole elite – represent the here and now. They’re the ones with ‘influence.’ They write the newspaper columns. They give campaign contributions and hire lobbyists. They have the money. They have the power. Their goal is to protect it…by preventing the future from ever happening. The future, if it were allowed to happen naturally, would deflate their power and their overpriced assets. Bad banks would go broke….as they should. Speculators would lose money. And the elite, who are responsible for such monstrosities as our monetary policy, $90 trillion of debt, the Covid Hysteria, and the War on Terror, would lose their influence and reputations….

The cost of their ‘mistakes’ is thus borne by ordinary households and businesses. Like a baby whose head is intentionally deformed, the future survives, but misshapen and retarded.

While I would be totally delighted to see the greedy flushed away in a massive market meltdown (because that is what it would take to get through their thick skulls … and it is coming), the sad part is that a lot of innocent people who don’t pay a lot of attention to their retirement funds and don’t even know how, are just trusting their fund managers who may be among the market morons. Mom and pop inevitably get slammed, too. And that is sad!

You cannot expect every mom and dad out there to be taking the time to understand the shaky underpinnings of our financial markets when they have to focus on just feeding the kids. Their retirement funds will be wiped out, and it has nothing to do with greed on their part, but just the simple fact that life has a lot more deeply and personally important things to live and think about than watching markets — such as taking the kids on a picnic and teaching them how to live and bandaging their knees when they fall.

The market managers are supposed to take care of these more tedious financial decisions for us, so others are free to live; and we pay them handsomely to do it. Unfortunately, as the greedy market riggers learn their lesson, a lot of innocent people get crushed in the rubble of rickety structures when the whole colossus collapses, and the people buried in the rubble are not the engineers and contractors who designed and built the monstrosity that fell.

Still, we can see where saving those who were too big to fall got us — right where I said back in 2010 we’d end up. (See Downtime: Why We Fail to Recover from Rinse and Repeat Recession Cycles.)

The reason the banks are collapsing is because depositors have found higher interest rates (and more safety) in money markets and T-bills. So deposits are draining out of the banking system and pouring into the Fed’s reverse repo facility and government debt securities. It’s causing the banking system to wobble, especially at the edges.

It may be the façade we see cracking all around the edges, but the whole thing is sinking from the foundations down and collapsing internally, too, as the Fed undermines the economy it created with nearly endless stimulus by now sucking all that money back out from under it because inflation is finally forcing the Fed to end its gimmickry. The collapse of the colossus is going to be horrendous. Don’t kid yourself.

Since it IS all coming down now as a sinking, stinking mess of twisted bonds and cracked banks and shrinking valuations, why did we see yesterday’s renewed burst of market enthusiasm after the market plunged the day before? Because Powell, the day before, had implied the present rate hike might be the Fed’s last, even though the Fed’s dot plots showed one more rate hike beyond Wednesday’s is likely in store. Powell’s comments caused the market to plunge on Wednesday (with a little help from his colleague in crime, Janet Yellen, who clarified the government is NOT considering sky-is-the-limit deposit insurance for all banks).

So subtle was Powell’s hint of edging mildly back from future increases, that it took until Thursday morning for some financial writer somewhere to tear away that detail and then successfully hatch the pivot narrative for rebirth. The greedy hatchlings grabbed ahold of that dangling scrap of meat like baby eaglets squabbling in the nest for the shred of salmon papa has to offer. It was Easter time again for the egglets as their Fed pivot dream was resurrected and they arose with it.

That rise going to have a short life, for this is more a return of the undead than a resurrection.

What does it matter, really? Even if this rate hike were the Fed’s last — extraordinarily unlikely as that is with Team Powell being still 75 yards from its inflation goal — this economy is clearly going down hard.

BofA’s other report today was that there is a massive rush of money out of stocks and into cash — the biggest surge since everyone flew to the exits during the Covid lockdowns. When people are fleeing for the exits, things are going down hard:

Global cash funds had inflows of nearly $143 billion, the largest since March 2020 in the week through Wednesday — adding up to more than $300 billion over the past four weeks…. Money market funds assets have soared to more than $5.1 trillion, the highest level on record.

As you recall, 2020 was a mammoth exodus. That something bigger is happening now means people who are choosing to remain IN the market and drive up prices now are ravenously bidding up the prices of the many who are EXITING the market — paying more for the stuff the many are running from as the runners rush the doors to get out now that the building is clearly starting to collapse. Those bidding up prices in the face of such mass flight of capital are the market’s greater fools, lining up to take the next huge crash.

I put in The Daily Doom today, a couple of articles that laid out a case for … not a soft landing, not even a hard landing, but … a devastating crash. This collapse is already extremely wide-spread and over a year long, slashing stocks, bashing bonds and crushing cryptos down into bear markets and now slowly sucking the housing and commercial real-estate markets, down into the basement, too.

The latter are the main structures of Main-Street support, yet it feels like it’s all happening in slow motion when you are in it and seeing it happen one or two cracks at a time. However, look broadly at all the damage taken on so far, and the scale of damage is horrifying:

Just to recall, the US housing real estate had witnessed a 40% correction post the 2008 crash over the subsequent 6 years. We will witness an even larger and extended crash in the years ahead. The housing bubble 2.0 is substantially bigger than the 2008 bubble and the Fed back stopping tool of ZIRP is not an option anymore – courtesy, the consumer price inflation.

So, understand, when I say the collapse is happening now, I don’t mean it will be “all in” by the end of the month. It will take years to play out, as it is like the building coming down in slow motion; but I mean it is already happening inexorably all around you, and the momentum of new stress fractures is increasing, not slowing down.

Those staying inside these market structures at this point and thinking they’re going up are beyond insane!

Recession has become the base case

I have been making the case that we are going into a period of stagflationary recession where we’ll see an odd combination of high inflation and recession that will make your equilibrium dizzy because that combination doesn’t make sense to most people, who expect recessions to be deflationary. Yet, you can now see that those are the forces that are aligning.

Few there be now who doubt inflation will remain high for some time or even grow again (as per my prediction at the start of the year). Even the Fed doesn’t believe that, and it is the one that started the “inflation is transitory” fantasy. Likewise, few there be now who think we’ll escape a recession … and likely a harder one than the soft landing Papa Powell said he believed he could achieve. Because he was as wrong about that as he was about inflation, the soft-landing hope has just gone like this:

That is the reason money is fleeing to cash faster than ever! Even mainstream Rick Santelli says he sees no hope for anything but recession because this is a crisis the Fed created. “How can ANYBODY be shocked…. This is a crisis built on a crisis we never solved.”

I don’t often — no, EVER — hear that part of my rinse-and-repeat theme stated by people in the mainstream financial media — that this was all baked in by not resolving it in the last major crisis!

CNBC's Rick Santelli: "Many are seeing recession. I don’t see a way to avoid it ... Is this really a banking crisis? It's a Fed crisis, it's a rate hiking crisis, it’s a crisis built on a crisis we never solved ... is it any wonder there's so much volatility in the market?" pic.twitter.com/R9YNBndpPd

— Tom Elliott (@tomselliott) March 24, 2023

If the Fed cannot rescue us from recession because it already has high inflation to fight, then the collapse of the Everything Bubble into recession has to be as great as the Fed’s excesses and the resulting mal-investments that created the bubbles. (I prefer the term “balloons,” as in “hot-air balloons,” because of their size and the thin substance that inflated them.) We’ve got the detritus of the Greenspan, Bernanke, Yellen and Powell years all rolled ahead into the present mess of overstimulated, under-regulated mania.

QE or not QE, That is the question

So far, I am not going with the hyperinflation view, which I have rightly resisted for YEARS; but it is certainly possible that will develop as time goes on, depending on how the Fed responds after it is clear even to them that all the support columns are blowing out; and I’ll point out the hyperinflation signs as it does start to develop if the Fed takes that path, which would be intensely contrary to its congressionally chartered mandate, so would likely require a literal act of congress. High inflation like we have now, and maybe higher, however, isn’t going away soon even with the Fed fighting. So, that bars the Fed from stepping in with its usual fake salvation plans.

As it stands legally now, if the Fed’s new balance-sheet expansion did create much faster-rising inflation, the Fed would have no choice legally but to dial back quickly, not keep pushing on into hyperinflation. That means the Fed isn’t saving anyone from the mess it has made by pivoting back to lower interest or the type of balance-sheet expansion that creates general consumer inflation.

Its present balance-sheet expansion is not likely to contribute much to the ongoing inflation built from past excess because the circulation of the new expansion will remain in banks were it is focused entirely on bank rescues, making good on money the banks already have in deposits. It does not add to their reserves, but makes them more liquid by exchanging Treasuries already in reserves for Fed cash.

That is different than when the Fed entices banks to buy new Treasury issues and then buys them off of the banks with new money added to their reserves. In the present situation, banks are more likely to hoard the cash they need to stop runs and save themselves, not invest it in a falling stock market. Still, it’s somewhat uncharted territory, being different than past QE, so we’ll watch how it goes. (For a fully detailed explanation, you’ll have to read my most recent Patron Post, “QE or not QE, That is the Question.”)

We saw from 2008 to 2020 that QE that goes directly to banks did not create consumer inflation. Most of that time, the Fed could not even get inflation up to its target no matter how much money it created. Only when the Fed’s QE was dumped into consumer hands by the federal government and came up against massive supply shortages did it create consumer inflation. Still, between 2008 and 2020 we didn’t have product and service shortages either.

Nevertheless, at the present time of collapse, I doubt the Fed can even create asset inflation via its balance sheet, and it CANNOT lower interest in the face of an inflation-enraged public, which could create consumer inflation by making consumer credit and mortgages cheaper.

So, it’s all coming down

I agree with the Raven on this one (QTR):

This crisis isn’t going away anytime soon – it may shape-shift, but it’s not going away…. This crisis is going to be unlike anything that’s ever occurred in history….

Even though Central Bank bailouts look as though they’re going to be ubiquitous in coming weeks (as we’re already seeing with the Fed and the Swiss National Bank), it doesn’t mean that the crisis isn’t going to persist in another form.…

But no matter what the Fed does now, it’s going to be on a lag. This means they can’t just cut rates tomorrow and have the problem fixed by Wednesday. They’re now in a “dead zone” where the seeds for the next several months have already been sown no matter what action they take with rates.

I have guessed that the blowups we are seeing now are result of rate hikes that took place last year. That means that the consequences of current rates won’t be felt for another several quarters to come….

If you don’t think other funds were taking similar bets, including continuing to buy bonds as yields became more attractive, you’re crazy.

This means that as the Fed “stayed the course” the last 12 months, others likely suffered similar-style losses as SVB’s. We just haven’t heard about them yet.

Rate expectations are moving lower now, but it’s too little too late for others whose fates have been sealed already, in my opinion. We may hear about these names in coming days.

Plain and simple, the case for the problems of the moment is this: It took almost a year of Fed tightening before SVB crumbled into the dust. Who is crazy enough to think hundreds of institutions are not being hurt by the same tightening? Now, with big institutions like CS falling into each other, the trouble gets more complicated. Another big institution will soon fall, and then there is no way of knowing what additional already-hurting institutions that collapse will weigh too heavily on.

Now that the collapse has moved into banks, this is the start of a cascade — the Everything Bubble Bust Phase Two. Phase one was the global fall of assets as central banks raised interest rates and reduced money supply, and now the banks have started going down, even some of the largest. That means it is collapsing at the core now, which means implosion. And, as the Raven said, anyone who thinks many banks have not been weakened as SVB was, at least to the point where they will not withstand any additional stress placed on them, is “crazy.”

Stock investors can keep pretending it’s not all coming down, but it is all coming down all the same. Years of internal rot and cheap, inferior construction throughout the structures of finance won’t be denied, nor will they be shored up for long by fantasies like the pivot that is not coming because inflation has spread throughout the world, uniting central banks in fighting inflation’s towering inferno. The cracks are appearing everywhere throughout the world now as the global edifice central banks have built collapses in on itself.

(This article was built from the intro to today’s Daily Doom and the related articles contained in today’s edition. Those who have become my Patrons at a level that gives them access to The Daily Doom see my thoughts first thing in the morning ever weekday — and get a great, organized collection of daily news stories. Of course that means they sometimes see them before the typos are cleared away and before my head has fully cleared because I rush to TRY to get the news headlines out by 8AM (PDT) after reading through the news and collecting stories since 5AM or earlier. Patrons may not get the cleanest form sometimes (apologies for speed over quality on days like these when there are so many headlines that the clock runs out on me), but they get to see where the news is taking my thoughts before anyone else, AND they get a lot more focused articles like the intro that became the seed for this article than those who provide no support for my writing because almost every edition contains an intro that tries to see the big story that is a common thread in the news that day — sometimes economic, sometimes political or cultural … whatever is screaming through the loudest in my mind.)

Liked it? Take a second to support David Haggith on Patreon!