Just when bond investors thought they knew something and could relax about inflation because the Fed’s work was over, the job market decided its work wasn’t over and put people back to work. Today’s news tells of hundreds of thousands of laborers entering the labor force and of more new hires than economists anticipated, even though economists had already raised their anticipation because of the end of labor strikes that bedeviled Hollywood and the auto manufacturing industry.

Unemployment, which had risen right up to the level it hits when recession begins tumbled 0.2 percentage points to 3.7%, which is a pretty good step down, given how incrementally it has moved over the past year.

While stocks took the good news for labor as good news for stocks, rising because it indicates to those investors the Fed will achieve a soft landing, bonds took it like a lump on the head, sending yields higher/prices lower. Bond investors went from last month where they flipped their summer bets from “higher for longer” to “sooner to lower” to now flipping them all back again today to “higher for longer.”

That flip-flop appears to have concluded a ridiculous bond rally because the new labor report indicates to bond investors the Fed is not even achieving a landing at all, but a mere touch-and-go on the tarmac that will send the Fed back to bringing its 747 around for another attempted landing. So, bonds took back some of a good part of bets that the Fed was done tightening.

Here were the numbers

Nonfarm payrolls rose by 199,000 in November, following October’s rise of 155,000. The “consensus” was for 183,000.

We know, of course, the numbers get readjusted every month in a manner that has, all of this year, made the government look better with the first report and then showed the not-so-good news when no one is looking in the next month’s (or months’) revision (as sometimes they get revised down even more in subsequent months). The adjustment approach would appear to be — given the consistency of all errors in the same direction — because the Biden Administration wants to show strong jobs reports to prove Bidenomics is working by sending people back to work, even though the Fed desperately hopes to see weak jobs reports to show (and to know) that its tightening is working by sending inflation packing in a parade of pink slips.

The administration’s summary was, therefore, predictable:

Acting Labor Secretary Julie Su said on Bloomberg TV … the report “reflects continued steady growth in our economy.”

The increase over October was due to the return of autoworkers and actors and writers to work after strikes ended, as expected. That accounted for 47,000 of the jobs that rose above October — so all of them. The strikes were a temporary distortion higher in unemployment/lower in payrolls.

Almost all of the new jobs reported were in government work and healthcare, proving, at least, the Bidenomics does employ more people with the government.

The participation rate — the share of the population that is working or looking for work — rose to 62.8%…. A further increase in the labor supply could help alleviate wage gains.

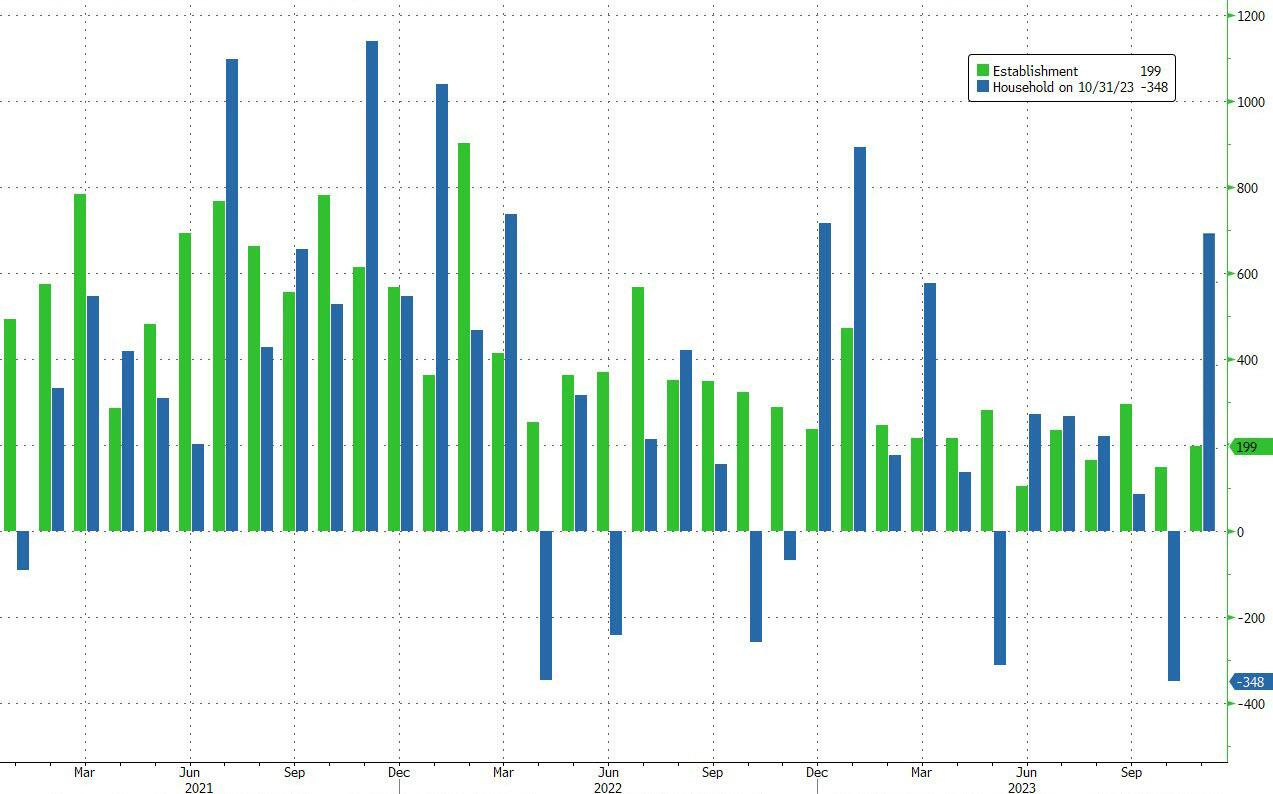

A second part of the report — the “Household Survey” — reported much larger gains but has been in considerable disagreement with the Payroll report all year:

The household survey showed a 747,000 surge in employment, far offsetting a decrease in the prior month. A large number of people previously not in the labor force, as well as those previously unemployed, were able to find jobs.

This was the third-biggest increase in the “Household Survey” this year.

The labor-force participation rate, however, is still far from having recovered from the Covidcrash and far from spectacular:

Not Fed-up enough yet

Here is what one article below has to say about how the report has suddenly caused bond investors to realize maybe the Fed is right about the fight and where it will go next — “higher for longer.”

Fed officials are widely expected to keep borrowing costs at the highest level in two decades when they meet next week. Chair Jerome Powell has repeatedly pushed back against growing bets of rate cuts early next year, stressing that policymakers will move cautiously but retain the option to hike again. Treasury yields rose sharply after the figures.

Suddenly taking their dumb bets off the table over a single jobs report today confirms my statements over the course of the November bond folly that bond investors could no longer be considered the smart money. The Christmas parties must have started early, tipping back the laced nog before Thanksgiving, but some of the partiers are now waking up and shaking off their hangovers:

“All in all, expectations of many cuts next year that begin in the first quarter [the bets] will be pared back,” said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics. “Fed policymakers will seize on this to call for patience and a longer hold.”

It’s back to watching for this:

The solid labor-market figures shift focus to inflation numbers as Fed officials gauge how long to maintain interest rates at this cycle’s peak.

And the unreliable jobs gauge I’ve talked about with its recent head fakes is back to fulfilling the role I said you could expect of causing the Fed to keep tightening deeper into recession. The numbers may be normalizing as more people come (back?) into the labor force, but I think it means all the more that the unemployment gauge will be late in showing the Fed when to stop (or allowing the Fed to stop by engaging its second mandated of maintaining strong employment).

“The totality of the data will allow the Fed to remain patient to make sure inflation is moving back to target,” said Yelena Shulyatyeva, senior US economist at BNP Paribas.

Some are perceiving that labor/unemploymebent is inaccurately reflecting the strength of the economy, but they are still casting their bets the other way from where I place mine:

“Most of the gains in headline nonfarm payrolls came from government, health care, and the resolution of strikes. But those don’t reflect underlying conditions in the labor market, and the Fed will likely look through their strength. Our view remains that the Fed is likely to begin cutting rates in March 2024.”

She gets that the labor gauge no longer reflects the truth about the economy, but I am certain she is wrong about the Fed’s perception due to the usual overly optimistic view of everything the market and its economists seem compelled to drive. She is wrong in thinking the Fed will see through the statistics’ misguidance about the economy to where it will start cutting rates in March anyway. I say “poppycock.” The Fed will see it as reason to maintain the stance it has already told her and everyone else again and again it intends to take, which is to tighten “higher for longer” to make sure it has killed inflation dead by cutting off its head after already draining out all its blood by slicing its jugular.

It wants inflation really most sincerely dead!

After all, the news also showed average hourly earning going up 0.4%, which was the biggest rise this year. That’s not surprising, given the results of the strikes that were just settled, but it is the very thing the Fed wants to tamp down. The Fed isn’t fighting labor just for the sport of killing jobs; it’s, at least partly, for the sake of diminishing wage gains on the fear they will drive inflation higher. While I don’t think the present report is going to alarm the Fed, it is enough to say, “Yes, stay with higher for longer to make sure the job is done.”

So, the “Fed pivot” is looking like a phantom pivot once again. Pure fantasy by testosterone-driven investors who want to do all they can to ignore reality. But the waking and quaking bond market got the message today, sending yields on the 2-year Treasury note soaring back up 14 basis points today (prices back down).

While economic strength makes many investors less apprehensive about a hard landing, it also means the Fed might have to hold rates higher for longer. For Treasuries, that means an unwinding of the massive dovish trade that made the market bet the Fed would be able to pivot as early as March.

Here are a few market responses

-

Callie Cox at eToro said strong jobs data could be a “heat check for Wall Street.” Hopes have gone a little too far, she said.

-

John Leiper at Titan Asset Management said, “The aggressive decline in US Treasury yields we saw last month, which already looked a little overdone, is going into reverse with bond yields jumping. With markets pricing out rate cuts next year, higher-for-longer is back in vogue.”

-

“These numbers may give the Fed pause that the economy isn’t slowing enough to reach 2% inflation in a timely fashion,” said Louis Navellier at Navellier & Associates.

-

Former Treasury Secretary Lawrence Summers said the Fed should hold off on a shift toward lowering interest rates until there’s decisive evidence showing that inflation is back under control or that the economy is entering a slump.

-

Stock markets will suffer in the first quarter of 2024 as a rally in bonds would signal sputtering economic growth, according to Bank of America Corp.’s Michael Hartnett.

-

“People saying recession need to have their heads examined,” said Neil Dutta at Renaissance Macro Research.

OK, I’ll get mine examined later. You pivotheads believing in the soft landing and pivot have been wrong about everything else, including inflation, so I’ll have mine examined when you finally start proving right. Right now, you’re just readjusting your serious errors to get back on track but still not getting your brain-squeezed heads around how broken the labor gauge is or how one can have a recession and have rising inflation at the same time.

That’s why …

Chair Jerome Powell has repeatedly pushed back against growing bets of rate cuts early next year, stressing that policymakers will move cautiously but retain the option to hike again.

He wouldn’t have to repeatedly push back if investors understood anything outside the narrative they want to believe in because it feeds their fantasy.

As Quincy Krosby at LPL Financial said today,

As long as inflation continues to edge lower, the Fed will likely remain on hold. But if today’s report is a harbinger of continued consumer spending, the Fed may have to issue a considerably more hawkish message and telegraph that they still cannot declare victory on their campaign to quell inflation.

Higher for longer.

What the anti-recessionistas are not thinking about is that holding for longer — as the long lag effect of higher rates continues even after the Fed finally switches — means more and bigger things break. The wall of bonds that have to be refinanced that is sweeping down on us this year that I wrote about yesterday assures a lot of big breakage with yields now back on the rise, as it was certain they would be once bond investors got a grip on reality once again. (This report gave them a little slap on the cheek to wake back up.)

It is the huge breakage in the bond market that will come from so much tightening for so long after so much Fed profligacy that has piled up so much low-interest debt that will assure bond destruction and defaults and crashing banks that will take us deep into recession.

What we’ve felt from tightening so far are, as I said yesterday, merely foreshocks of what is to come from all this tightening as the lag effect of that tightening continues to play through for, at least, a year after the Fed changes course. The Fed is turning the Queen Mary, not spinning on a figure skate. And investors aren’t even talking about QT (just about interest rates), which the Fed promises will continue even longer than high rates.

Those who think there will be no recession from all of that, which is still to come, need to have their heads examined. I’ll save my examination until after we see how all of that actually plays out. So far, my bets are doing as I expected.