Gold touched $2000/oz resistance last Friday but has so far held most of its gains in a bullish fashion. It closed Wednesday at $1995/oz.

Next Tuesday marks the monthly close.

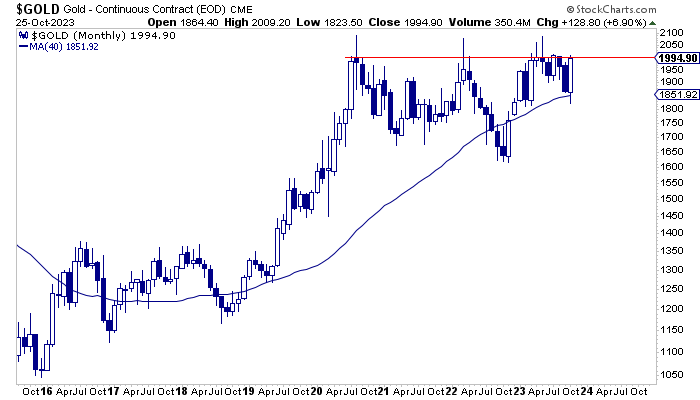

The monthly candle chart of Gold is below, with the resistance line at $2000. Gold has tested $2000/oz in seven of the past eight months.

After many tests of resistance, we need a convincing monthly close to qualify as a breakout. Think of $2020/oz at a minimum.

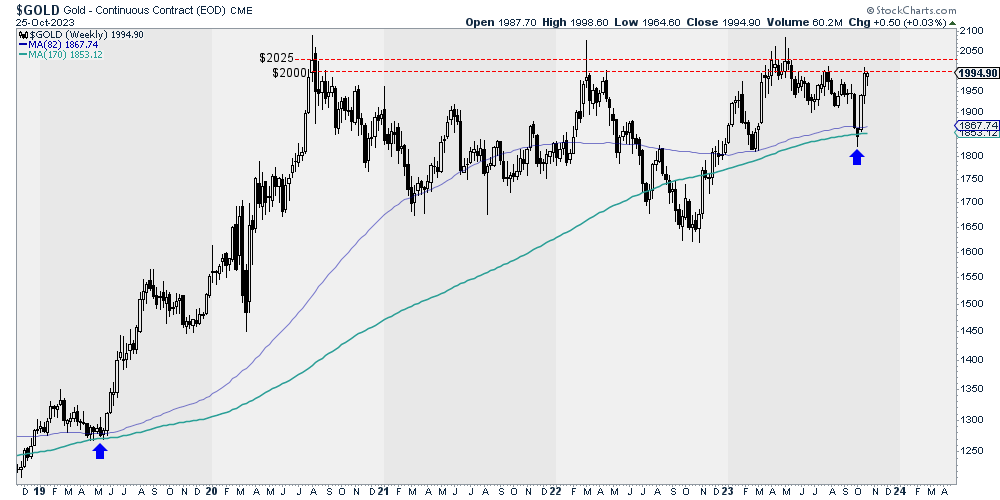

The $2000 level is also important resistance on the weekly chart.

Below, we plot the weekly candle chart with the equivalent to the 20-month and 40-month moving averages.

Weekly resistance is at $2000 and $2025 to $2030. The weekly high in 2020 was $2028; this past spring, Gold tested $2025 in six out of seven weeks.

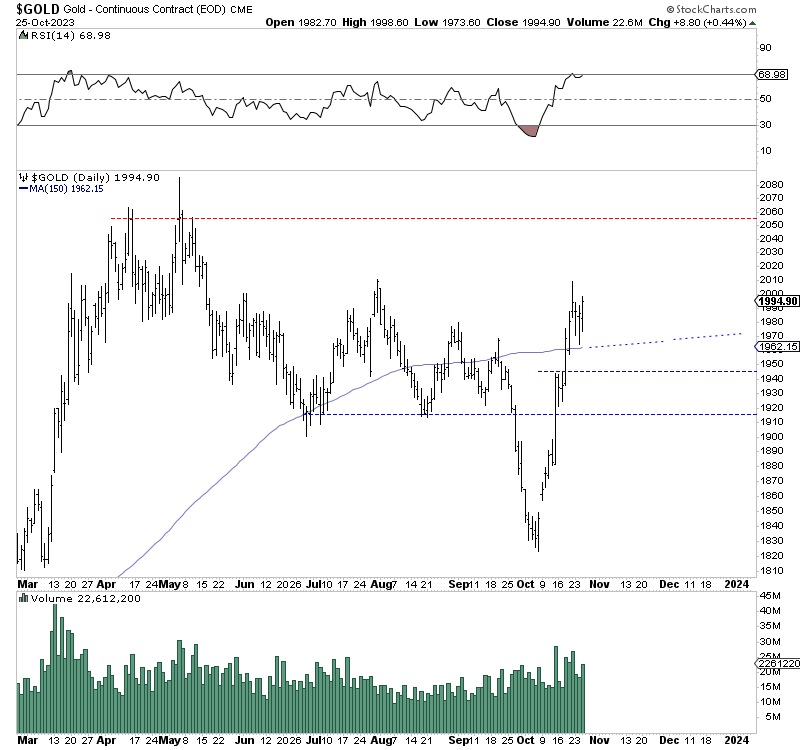

Turning to potential support levels, Gold should find initial support at $1960 or $1940 should it lose more short-term momentum.

Turning to potential support levels, Gold should find initial support at $1960 or $1940 should it lose more short-term momentum.

Gold has often tested its 150-day moving average a few months before major breakouts.

One possibility is Gold trades up to $2030-$2050 before correcting to the 150-day moving average, currently at $1962 and sloping higher.

Gold’s strength in recent days leads me to think it has a chance to test $2030-$2050 before a retracement. If that comes to pass, look for support at the 150-day moving average.

On the other hand, if $2000 resistance holds firm in November, then look for a test of $1940 and perhaps $1920.

Gold rallying back to $2000 so quickly is a positive sign for an eventual breakout. The miners, juniors, and Silver space need Gold to surpass $2100 before they can outperform.

Until then, I will focus on finding high-quality gold and silver juniors with 500% to 1000% upside potential over the next few years.