When several of the big money-driving voices in financial media and major financial institutions start saying the same thing I am, I start to wonder about myself. Or is it just becoming that obvious now? Some of the biggest names on Wall Street are now saying the stock market is delusional and is headed for a much deeper fall.

Even if you don’t have money in stocks, you might want to listen. The destruction of trillions of dollars of wealth in the world as the Fed hoses up all the money-slop is changing the world and will continue to do so. So, before you go bargain-scooping for those fire-sale stocks, consider the predictions in this article by market gurus that have finally started sounding a little like yours truly with my predictions of the coming Epocalypse (though they are not quite that crazy yet):

The Daily Doom, during just the first two days of this week, covered a few surprising voices in its headlines that brought forth this message, which I’ll summarize for you in the article that follows:

- Delusional Markets Are Underestimating Inflation Again, BlackRock and Fidelity Warn

- S&P 500 Gravy Train Boarding Now Has Flawed Earnings Assumption

- US banks get ready for shrinking profits and recession

- Jamie Dimon Says Fed May Need to Hike Interest Rates Beyond 5%

- Morgan Stanley: US equities face much sharper declines than many pessimists expect with the specter of recession likely

… and in tomorrow’s edition … one more:

The two-Michael’s madness

I’m not criticizing them. They simply now share my madness, having come into their predictions a few months after I started anticipating this journey back in the summer of 2021.

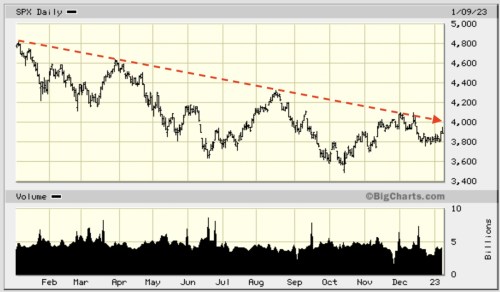

The strongest of these voices is Michael Wilson of Morgan Stanley. While I did criticize Zero Hedge for making so much of the “Two Michaels'” predictions when Michael Wilson and Michael Hartnett of BofA predicted a huge rally for November-January, the market did manage to pound out another perfectly typical bear market rally. That fizzled out at the size of earlier rallies and didn’t as long as the Michaels made it sound, but it is now meagerly attempting to reclaim that height in first part of January, which Wilson had said would still be good for the market up to about January 15, if I recall what he wrote almost three months ago:

This time, the stock market didn’t return to the bottom of its year-long, bear-market channel because Santa Clause, who failed to deliver an actual rally at the end of 2022, did, at least, clip the bottom off the market’s mid-December slip in the snow to where the market slid sideways on its butt through the remainder of December. Now delusional market investors are trying their best to be market makers and drive the market up in their re-inflated hope that a new year may be one of better news and somehow magically wipe away the mess of the last two years.

Not so, says Wilson, who is the only voice from big banks that has been right for an entire year in his bearish cast (as Hartnet joined him a couple of months in). No, the worst fall is yet to come. Wilson predicts another 22% avalanche right up ahead, even though the S&P already managed to finish last year at a 19% recess, leaving it sitting right back at the threshold of that 20% drop-off that put it in this unabating bear market. So, no matter what the market does in the weeks ahead, if you don’t believe me, you might want to pay attention to Wilson who has seen things generally the same way I have all of last year, and who has a lot of math to back his predictions up:

Michael Wilson — long one of the most vocal bears on US stocks — said in a research note that while investors are generally pessimistic about the outlook for economic growth, corporate profit estimates are still too high and the equity risk premium is at its lowest since the run-up to 2008. That suggests the S&P 500 could fall much lower than the 3,500 to 3,600 points the market is currently estimating in the event of a mild recession….

Yahoo!

“The consensus could be right directionally, but wrong in terms of magnitude,” Wilson said, warning that the benchmark could bottom around 3,000 points — about 22% below current levels.

Wilson, for his score of successes all of last year, was ranked #1 in an institutional survey. If he continues to be as right in his trajectory predictions this year as he was all of last year, the market will be approaching the zone (dollar-green box) and glide path I predicted in a Patron Post last January this market would get to:

I’ll note that, while Wilson was right in each of the steps last year the market took, he revised his ultimate bottom for the year as he went along. However, he did, at least keep revising down ahead of the markets moves. So, if you followed him, you would have done well in staying out of harm’s way and catching some rallies along the way.

I laid out several paragraphs of explanation for the lines in my chart to my Patrons, and then explained this was not going to be short ride in getting there:

Further down the road, the following graph shows the zone where I think the … S&P is most likely to end when the Everything Bubble finishes imploding based on the stock market’s strongest longterm trends and support levels….

“The Everything Bubble Bust Pt. 1: How Far Will the Stock Avalanche Fall?“

Somewhere in the green box looks like a natural resting point for the S&P. That is, at least, back to the bottom of the 2020 implosion — the steepest on record, but I don’t think it will get there in one shot. I’ve never suggested that.

In the very least, I think we are going to wipe out the absurd rocket ride since the COVID recession. One of the most insane things I’ve heard recently is that this market still needs to form a blow-off top. Really? What on earth do you call that final rise compared to ALL other rises before it if that is not peak market-mania melt-up?…

The longest, steepest, and (because it is happening during a global pandemic) most insane rise the market has ever made supposedly shows no sign of a melt-up yet??? Just put my head in a vice and squeeze it. That is by far the biggest rocket ride anyone has ever seen, and it has been happening while the entire underside of the market corroded away to where more than fifty percent of NASDAQ stocks are now in their own bear markets, leaving no support to the outer skin of the market that remains inflated. (Yet, there are still idiots saying, “Buy the dip.”)

Of course, the market fell more and more from the time I wrote that in January, but the delusional investors that refused to believe in the Big Bear scenario that seemed so apparent to me kept buying the dip all the way down all of last year. So, January did, indeed, turn out to be the top for the S&P and the Dow. Those who were standing where the guy in this photo at the top of the article would have done well not to take the trip over the edge from that cornice on the all-time-spectacular blow-off-top:

But, you know, do as you want. Some people love to ski avalanches, and some of them even live. Depends on the size of the avalanche and the skill of the skier, but this bear has been one of the big ones, and it still has lots of room to roll, and now even the market’s biggest enthusiasts are saying it, not just bearish Wilson (who is far from a permabear). That January summit, of course, was just the beginning of this big bear market for the S&P and Dow. I was merely pointing out we had passed the first mile marker in the Russell 2000 and almost in the NASDAQ to where the other major indices, which were just starting to crack, would be joining the avalanche for the rest of its trip down the mountain.

The view from on top

Clear back then, I pointed out that the problem for the dips who were buying the dips is that they didn’t believe the Fed. From the start of the year, I explained on a number of sites, especially in the comments on ZH, that the pivot mania was hoping for a pivot that would never come:

The big difference here as I’ve said many times for those dip buyers is that the Fed isn’t coming back in as easily this time.

Why did I believe so fervently the Fed was not going to come to rescue this time when it had so many times before? Did I have a crystal ball? Of course not, just a little historic perspective that many of today’s market buyers don’t have:

Most of those buyers have NEVER experienced a Fed that HAS to fight inflation. The dip-pumping Fed never had any significant inflation to even think about. In fact, it’s problem was always (in terms of its own goals) how to get inflation up to the level it likes. This is an entirely different playing field with different rules.

My Patrons started the year with that knowledge, and this year they will be starting with additional predictions that I’ll eventually share with everyone far down the road, as I am with last January’s now. As they are materializing, I want everyone to get some perspective and understanding of where we are heading, which always means understanding where we came from, and what better way to do that than by going back to the view from the top last January?

The always too-quick-to-criticize will jump to say, “But we never hit that green box in your graph;” however, the ride is far from finished. As I explained then, the crash into the green box was not going to be something that would be accomplished in 2022. Nor was the green box what I would quite call a prediction but more of a statement back the of where I think this is ultimately likely to go:

The great stock avalanche and our line of descent

As I’ve long said, the NASDAQ [at the end of 2021] looked like it was forming a bubble as it did in 2000 (with a vastly steeper and higher blow-off top [this time]), and I said the NASDAQ will likely lead the rest of the stock market down. This crash will also likely be protracted like that one, so let’s take a refresher on what the dot-com bust looked like, especially for any who weren’t trading back then.

I, then, laid out a graph showing the pattern of the NASDAQ’s long crash during the infamous dot-com bust and explained why a similar avalanche to today’s was just getting going back in 2000 with lots of pretty pictures of mountain avalanches and cornices begging to fall for effect like this one:

That is a picture of where I believed the S&P stood at the start of January. How much more of a “blow-off top” do you need before the market cracks off and turns into one of these as it races to find the bottom:

Again, not all in one crash. But the Fed’s more-rapid-than-ever reversal from more easing than ever to full tightening mode could speed things up! The funny thing is that anyone thinks the market can survive that, and yet a great many obviously still believe the market can survive that.

The sure did. Many bet up on the market all the way down.

The graphs I presented showed how the NASDAQ’s crash back in the big dot-com bust took twenty-nine months to find its bottom: (Note the graph I found has a typo and says 19 months, but you can count them along the bottom.)

Where are we on that graph right now? I would say today we’re standing on that small rise right after point #3, which was the one-year point for the NASDAQ back then. We’re ready for the next big plunge, which will include more rises and drops to come after this just as it did back then. The NASDAQ worked its ways down another 55% drop to its final resting point where it was ended up 78% below its summit.

I’m not saying we will take that much over the year ahead, but you can see these big crashes can easily take two years or more to find their bottom; and, while the next part of the journey may have another very steep plunge in store when the market finally wakes up to reality, the journey becomes more stretched out because 55% (or 22% or whatever) from the present point is not as many feet of total altitude to fall in the same amount of time as that same percentage from the much higher summit.

Now a chorus of strong voices has joined me

I believed in this crash strongly enough that I bet my blog in 2021 that the stock market would enter a bear market by 2022. As you see, the blog is still here:

In the first half of 2021, I bet my blog that the inflation I had been predicting would rise so hot through the year for so long that it would kill the stock market bull. It’s time to call the bet.

“I Bet My Blog and Won: The Stock Market Collapse of 2022“

Technically, my bet cleared the minimum bar for being cleared off the table when the Russell 2000 index closed in a bear market, down 20.5%, on Thursday, but that is just the start. The NASDAQ closed teetering on edge of the bear precipice, as well — down 17% that same day.

I admitted I had my errors in the past, which is no surprise for anyone, but gave this caveat:

Where I’ve sometimes been off is in the size of the fall … I’ve not so much been wrong in how big the crash would have been if left alone, but wrong in not seeing how big the Fed’s response would be to save the market during the crash.

“The Everything Bubble Bust Pt. 1: How Far Will the Stock Avalanche Fall?“

Well, this time the Fed isn’t coming to the rescue. Those investors who were standing at the top of the cornice last January and decided to jump into the dip and buy found that out all of last year because this time really was different. In all the previous times where the Fed massively intervened in each big fall that I had said would happen, the massive scale of the intervention (at least, in my view) proved how bad the fall would have been without the intervention (and the fall was still bad, regardless); but this time the Fed can’t intervene. There is no safety net here until the economy breaks or inflation is put to rest, and my latest Patron post laid out what that is not likely to be soon.

It is no longer just the Two Michaels who are saying this. Other market leaders are joining them quickly now to say the delusional market is not pricing in the true risk because investors continue to believe the Fed will pivot, which these advisors all say is not about to happen because inflation is not nearly close enough to dead. Let me close with a summary of quotes from the articles referenced at the start of this one about the plunge that even the big market-makers are now predicting, starting with Wilson:

Wilson … warned while a peak in inflation would support bond markets, “it’s also very negative for profitability.” He still expects margins to continue to disappoint through 2023….

Yahoo!

The latest MLIV Pulse survey … showed market participants are bracing for a gloomy season to push the S&P 500 lower over the next few weeks.

Wilson believes the market is grossly missing how dedicated Powell is (warranted or not) to fighting inflation…. His analysis is rational doom and gloom stuff. Less macro and more fundamental at the earnings level as well. And it’s kind of unsettling if you are of the fundamental analysis persuasion as we once upon a time were….

Zero Hedge

If he is right and earnings do compress in no small part from dropping inflation without stimulus, then stock prices could be down even more than 22%.

If you want some of the granular detail of how Wilson comes to his point of view from market fundamentals, I’ll let you refer to ZH’s article; but for my summary view BlackRock’s Fink and others in the high world of finance agree for the same reason Wilson lays out:

Some of the world’s largest asset managers such as BlackRock Inc., Fidelity Investments and Carmignac are warning markets are underestimating both inflation and the ultimate peak of US rates, just like a year ago.

Yahoo!

Uh huh. Just like a year ago. They learned nothing from their first fall, so many will take the rest of the ride.

The stakes are immense after Wall Street almost unanimously underestimated inflation’s trajectory. Global stocks saw $18 trillion wiped out, while the US Treasury market suffered its worst year in history. And yet, going by inflation swaps, expectations are again that inflation will be relatively tame and drop toward the Federal Reserve’s 2% target within a year, while money markets are betting the central bank will start cutting rates.

In the summer of 2021, I claimed inflation would be the big story for 2022, and now in 2023 it is still driving the story:

That’s set markets up for another brutal ride, according to Frederic Leroux, a member of the investment committee and head of the cross asset team at €44 billion ($47 billion) French asset manager Carmignac, since worker shortages are likely to fuel higher-than-expected inflation.

I also started saying worker shortages were key further back in this mess than I can keep straight, and I am still saying they are the Fed’s major blind spot and will lead the Fed to overcorrect into an even more cataclysmic recession. (See my last article: “It’s Worse Than it Looks: Beneath the Surface the Bottom is Falling Out, and People are Jumping out of Windows.”)

These are the dangerous forces playing out: Inflation is forcing the Fed to keep tightening, which takes the guard rails off for the market because there will be no rescue. A sick jobs market is not simply raising the cost of labor as the Leroux is thinking about, but also reducing production and services to make all shortages worse, which could drive inflation counter-intuitively higher down the road if the Fed crushes production more, making shortages even worse in its misunderstanding of the jobs market.

“Inflation is here to stay,” said Leroux in a phone interview. “After the crisis central bankers thought they could decide the level of interest rates. In the past two years they realized they don’t: inflation does.”

He added that one of the biggest mispricings in the market today is the expectation that inflation will come down to 2.5% next year, before adding that the world is entering a macroeconomic cycle comparable to between 1966 and 1980. That period saw energy shocks that drove US inflation into double digits twice.

“We have to live in a very different environment than before,” Leroux said….

On Thursday, Fed officials reiterated the central bank’s hawkish stance with comments that sought to dispel hopes for an imminent reversal in the policy path. On Friday the European Central Bank’s Chief economist Philip Lane echoed that sentiment, saying price pressures will remain elevated even if surging energy costs ease….

“Central banks are unlikely to come to the rescue with rapid rate cuts in recessions they engineered to bring down inflation to policy targets. If anything, policy rates may stay higher for longer than the market is expecting,” a team of analysts including Jean Boivin, the head of [BlackRock Investment] Institute, wrote last week.BlackRock Says Traders Betting on Tumbling Inflation Are Wrong

How many times do Fed officials have to say it? Yet, the delusional market, even after a year of financial pounding, refuses to get this message. Regardless of the market’s delusions, the reality of our economic troubles is far from over; the fight by most central banks against inflation is far from over, even if it becomes a little less intense; so plenty more pounding from reality is coming.

Fidelity Investments’ director of global macro Jurrien Timmer told Bloomberg that inflation remains a key risk to markets as the Fed has repeatedly made it clear that it wants to see the measure come down all the way to the 2% target, not just a slowdown in price growth….

Carmignac’s Leroux said the market’s focus on the Fed’s potential pivot is “a sideshow.” “At some point the market will have to understand that more rate hikes are coming,” he said.

Jamie Dimon, the well-named head of JPMorgan Chase, somewhat agrees, too:

Jamie Dimon Says Fed May Need to Hike Interest Rates Beyond 5%

Jamie Dimon said the Federal Reserve’s rate hikes might need to go beyond what’s currently expected, but he’s in favor of a pause to see the full impact of last year’s increases. [Lest the Fed overcorrect.]

Yahoo!

There’s a 50% chance … that the central bank will have to go to 6%, the JPMorgan Chase & Co. chief executive officer said in an interview aired Tuesday on Fox Business.

Dimon, who pulled the plug that triggered the Repo Crisis in 2019 when JPM stopped loaning to other financial institutions from its withering reserves during the Fed’s last quantitative tightening efforts, noted that the effects of quantitative tightening remain a concern of his this time around. As you may recall, JPM gave no public warning before it pulled the plug last time. In fact, it took a few days of digging to figure out what suddenly tripped the market to fall. JPM just got to the point where it had enough and pulled repos away from clearing-house markets and hedge funds.

Banks are prepping for worse times to come, not better

Banks are gearing up for a recession as we start the year, which they were not doing going into the Repo Crisis, so they may become even less willing later this year to loan out from reserves as those tighten more because, even if the Fed stops raising rates, it hasn’t breathed a word about discontinuing the roll-off of its balance sheet, known as quantitative tightening, which tightens bank reserves. That continues at a faster schedule than the Fed set before the Repo Crisis.

US banking giants are forecast to report lower fourth quarter profits this week as lenders stockpile rainy-day funds to prepare for an economic slowdown that is battering investment banking….

The Business Standard

The six largest lenders [are] expected to amass a combined $5.7 billion in reserves to prepare for soured loans, according to average projections by Refinitiv. That is more than double the $2.37 billion set aside a year earlier.

That may not be a huge sum for six major banks combined, but it shows the move of retaining bank reserves is getting started. It’s that crack in the cornice of banking.

The six banks are also expected to report an average 17% drop in net profit in the fourth quarter from a year earlier….

A parade of executives has warned in recent weeks of the tougher business environment, which has prompted firms to slash compensation or eliminate jobs….

“We’re exiting a period of extraordinarily strong credit quality,” said David Fanger, senior vice president, financial institutions group, at Moody’s Investors Service.

The job losses noted in that article, too, have barely begun; but that is why this is the start of that next run down from point #3 on the graph above in terms of gauging where we likely are in this collapse process, which I believe will ultimately be worse than the dot-com bust or the Great Recession because this is the collapse of the Everything Bubble — bigger bubbles and more of them popping all around the world, not just in the US.

Into the abyss

This is happening during a time of our first European war with Russia since World War II, massive global sanctions, scorching worldwide inflation, a badly damaged labor force around the world due to a continuing global pandemic that may be worse than the Spanish Flu, global economic lockdowns that we’ve never seen before, which come and go like bad weather … oh, and more than the usual amount of bad weather from an extreme global drought going right into massive coastal flooding as was also reported in The Daily Doom with links to stories and numerous photos and videos:

After years of record drought, California continues to get deluged with more water than it can possibly handle. Fourteen people have died so far. Entire towns have been evacuated. Los Angeles gets over five inches of rain, while some mountain areas see fourteen inches. Meanwhile, crypto billionaires are dying like flies, giving new meaning to the word cryptocurrency….

The Daily Doom

Do you think, with all of that, the reality that has spread across this earth in the past two years doesn’t have more punishment to deliver to this delirious stock market?

It needs to get a grip.

For the ride to come.

Take a loaf of hope, knead it with oodles of optimism, add a generous sprinkling of speculation and definitely avoid even a hint of reality. Bake the concoction carefully, and what do you get? The current state of mind of investors positioning for runaway gains in US stocks.

Ven Ram, Bloomberg markets live reporter and commentator via Zero Hedge

Good luck with that!

At the heart of stocks’ recent optimism is speculation that the Federal Reserve will pivot enough to cut rates this year — a scenario that is largely predicated on inflation and the US economy alike crumbling like a soggy winter cookie.

Good luck with that, too!

Every time I said the stock market is going to go down more, the majority of writers I’ve corresponded with have said I’m wrong, and a small minority of my readers tell me the same; but I can only say what I believe, and I see no way the market is going to rise through that boiling mess as all the bubbles that the central banks of the world inflated are now busting in a world that seems plagued with more than the usual share of major problems and when politics have never been more acrimonious (at least, in my lifetime), even within parties, as well as the Fed crushing down on a work force that is already crippled because it never recovered to the size it was before Covid, and so its underproduction is likely a bigger pressure on inflation than those wage hikes the diminished workforce is requiring if its going to keep doing the job of caring a larger share of the load on the backs of fewer people.

Our central banks and leaders don’t even begin to understand the problems within the labor market, let alone all these other things these same leaders make worse with lockdowns, vaccine mandates that strip away scarce laborers, continuing tariffs, and, yes, sanctions on top of it all; and they are too busy in internecine battles within their parties and investigations of the other party to ever spend time on solving the problems IF they even knew how to do anything other than compound them with their misguided ideas.

In normal times, you could write much of that off as cynicism, but it’s hard to deny now if you look at all the historic dysfunction in the US government I’ve been covering in the news section of this site and similar dysfunction in Brazil and you weigh in the fact that the Fed is still trying to create a recession when we are already technically in one that we are simply denying. Our leaders are blind and dysfunctional and at war with each other.

And the stock market? Well, investors are flying around like drunken birds inside of a falling cage.

Liked it? Take a second to support David Haggith on Patreon!