Biden's Replacement

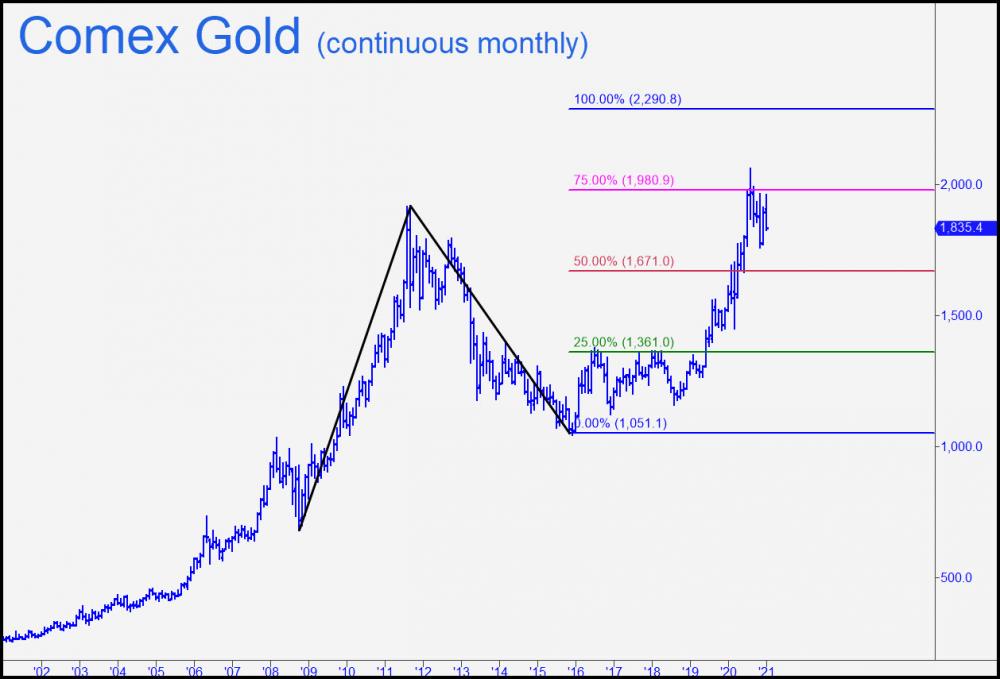

The bottom line is that we should tune out bullion's rigged swoons until the crooks and shysters are ready to let it run. Sometimes it takes courage and conviction to stay the course, and this is one of those times. The chart shows that gold's correction since August has been moderate and that when it ends, there is potential for further appreciation to at least $2290/oz. That's a 25% gain from current levels -- sufficient to outperform the broad stock averages just as bullion has reliably been doing for years.There is just one caveat for gold bugs -- the possibility market forces will make it impossible for the Federal Reserve to continue doing 'whatever it takes' to keep the asset bubble fully pumped. It is one thing to force-feed money into the economy so that consumption does not collapse. But will the central bank be so accommodating when it is a cavernous socialist maw demanding to be fed? Well before then we could see market forces that have been pushing up Treasury rates recently make further easing impossible. Tightening is not even remotely on investors' radar at the moment, but even a small turn of the screw would devastate stocks and bullion. The former would likely be down for the count, while gold and silver might be expected to get second wind once investors figure out that Tesla, bitcoin and junk bonds are poor places to store wealth. Hold onto to your ingots and doubloons in any event, since, in the worst of times, they are certain to hold their purchasing power relative to all other types of investable assets.