- Credit card and auto loans are increasing the risk on bank balance sheets.

- The largest holders of these loans include JP Morgan, Citibank, and Capital One.

- You have to engage in due diligence regarding the banks that house your hard-earned money to make sure you're not caught during a banking crisis.

A month ago, we published an article on consumer debt, which is becoming a huge issue for the banks from a credit quality perspective, as both credit cards and auto loans have posted sharp increases in delinquency ratios.

Recent data published by the NY Fed shows that asset quality metrics have deteriorated even further in the first quarter, particularly in the credit card segment. Moreover, there was a huge increase in the delinquency ratio among low-income borrowers, which looks especially worrisome given the reasons that led to the 2007–2009 GFC.

Despite the fact that forward-looking indicators have pointed to major asset quality issues in credit cards and auto loans for more than 2 years, the NY Fed has changed its rhetoric only now:

In the first quarter of 2024, credit card and auto loan transition rates into serious delinquency continued to rise across all age groups. An increasing number of borrowers missed credit card payments, revealing worsening financial distress among some households.

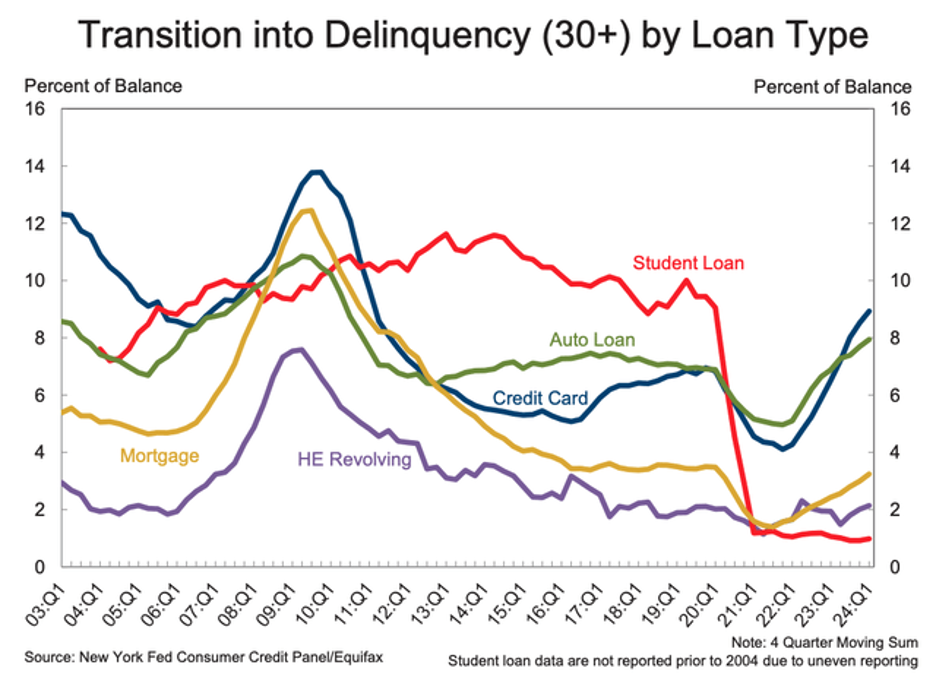

Approximately 8.9% of credit card balances and 7.9% of auto loans transitioned into delinquency in the first quarter. As the chart below shows, the transition rates in these segments have been increasing for several quarters.

NY Fed

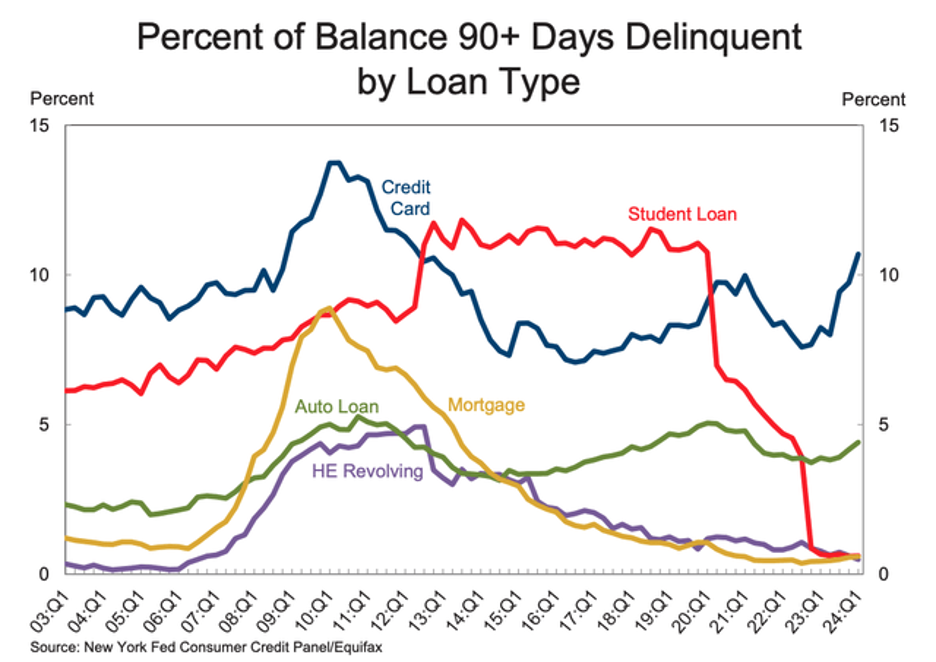

And here’s the chart showing the percentage shares of 90-day plus delinquent loans. As you can see, there was a large increase in credit cards, while car loans have almost reached their GFC peak.

NY Fed

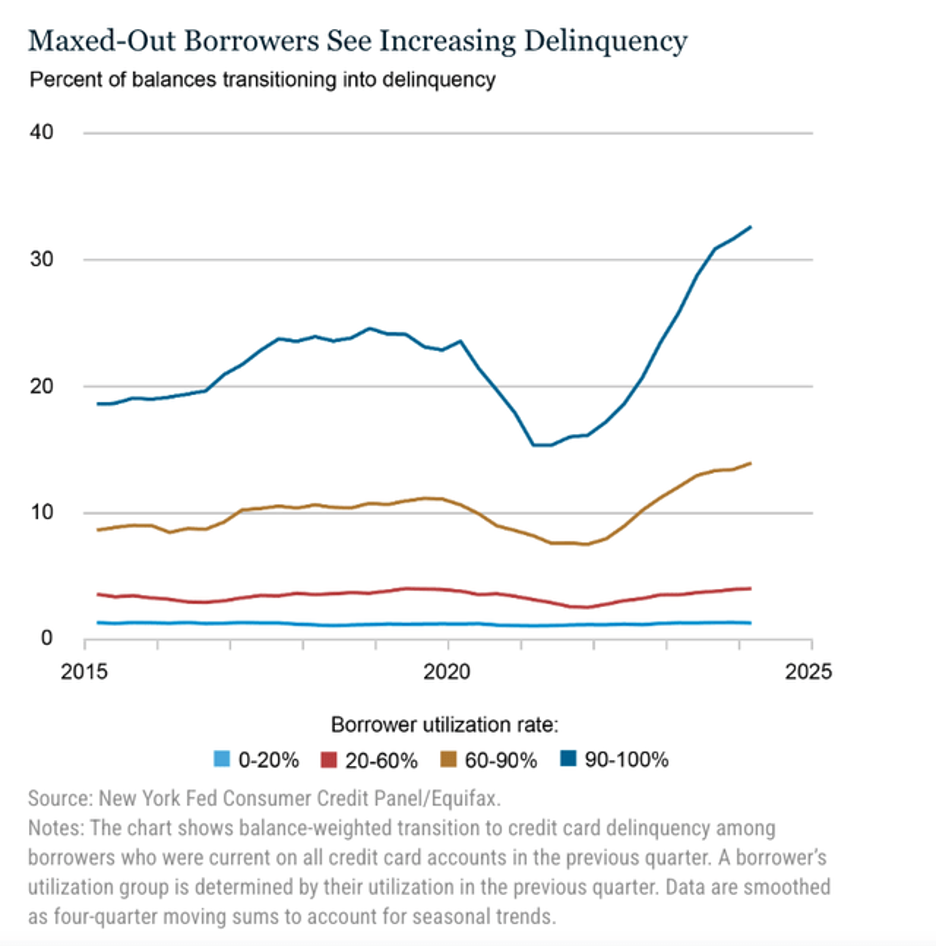

In addition, this quarter, the NY Fed has disclosed very interesting data on the so-called maxed-out borrowers, or borrowers that have a high credit card utilization rate. As a reminder, a high credit card utilization rate is usually a sign that a borrower has a tight cash flow situation and financial issues.

As the chart below shows, there was a huge increase in the transition ratio among borrowers with a 90-100% utilization rate and also quite a remarkable increase among borrowers with a 60-90% utilization rate.

NY Fed

The 30%-plus transition rate looks really horrendous. In our view, these numbers completely refute the mainstream thesis that delinquency ratios “are simply normalizing” following the pandemic. As you can see, transition rates among borrowers with higher utilization rates have reached the peak level since the regulator started to collect this data.

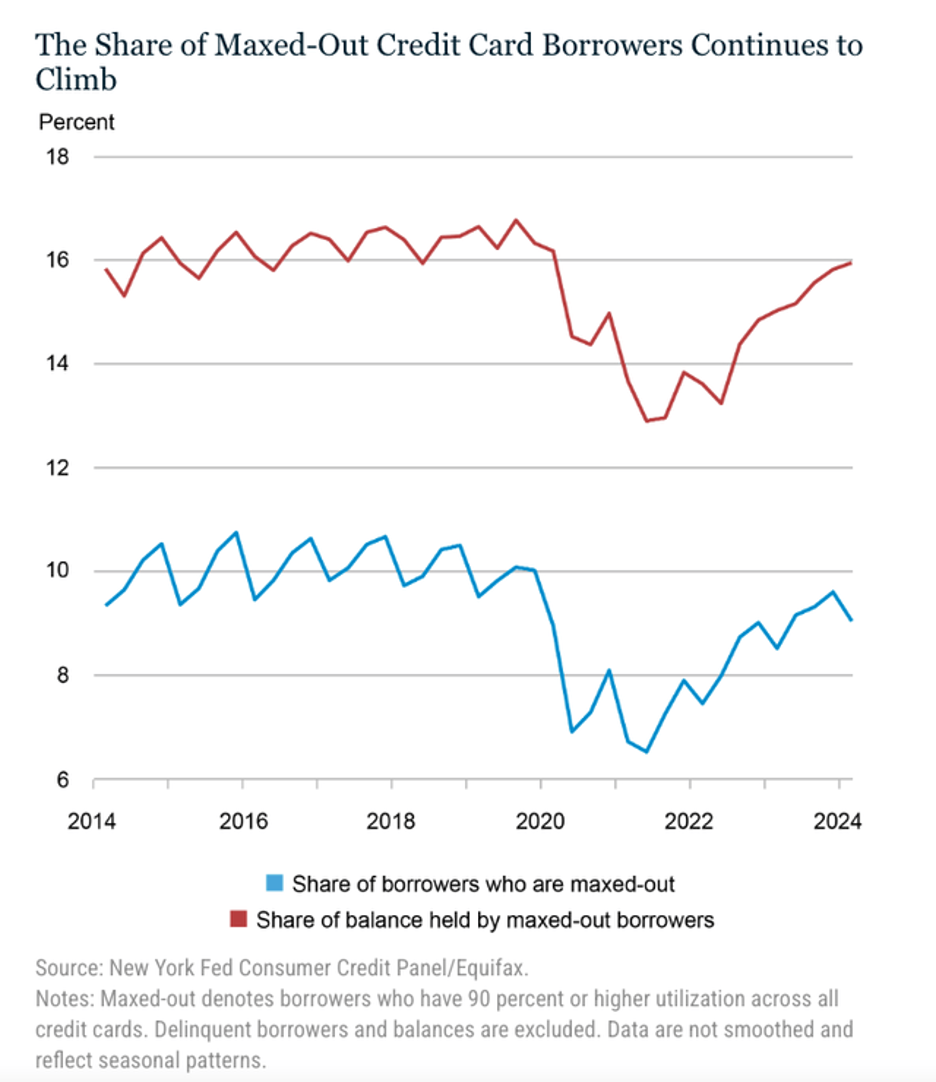

The obvious question here is how high is the share of these maxed-out borrowers? As we can see from the chart below, the NY Fed discloses these numbers. It is important to note that delinquent borrowers (more than 10% of total loans) are excluded from the data shown below.

NY Fed

As shown, the shares are quite high, and these shares exclude delinquent borrowers and borrowers with a utilization rate of 60–90%, which have transition rates of around 15%. Even if we simply approximate the current trends, then the delinquency ratio in the credit card segment is very likely to surpass the GFC level soon. Obviously, even a mild slowdown in the job market would make things much worse.

Notably, the NY Fed, which is usually very optimistic, draws the following conclusion based on all these numbers:

For a positive improvement in credit card delinquency, we would need to see the delinquency transition rate among maxed-out borrowers begin to decline and/or the share of maxed-out borrowers fall. So far, the data shows neither of these trends is moving in the right direction.

Bottom line

As a final note, we would like to remind you that the U.S. credit card market is oligopolistic, as three banks control almost 50% of total outstanding credit card loans: JPMorgan ($181B), Citi ($165B), and Capital One ($142B).

So, I want to take this opportunity to remind you that we have reviewed many larger banks, including the three just noted, in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written. And, as these issues get worse, the risk continues to rise.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bancorp, Inc. (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry's desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive into the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to use our due diligence methodology outlined here.

This article, as well as Saferbankingresearch.com, is a combination of efforts between Avi Gilburt and Renaissance Research, which has been covering U.S., European, LatAm, and CEEMEA banking stocks for more than 15 years.