Macroeconomists, it is said, have physics envy. Physicists measure how gasses behave as temperature, pressure, and mass of gas molecules are changed, and write an equation to describe the relationship between these variables: PV = nRT (P = pressure, V = volume, n = amount of gas, R = ideal gas constant, and T = temperature). It works reasonably well because particles of a gas do not have reason or volition. They do what they do. If you cram twice as many of them into the same size container, then pressure doubles

The problem with macroeconomic equations is that people are not deterministic particles. Economic value (or many other things) cannot be measured as a single scalar quantity. Output, price level, and other aggregates cannot be predicted (even granting that these are legitimate concepts in the first place).

Failures Along the Way

Nevertheless, the practitioners of economics have put forth equations that purport to be able to measure and predict aggregates. One of them is the Monetarist Equation: MV = PQ (M = amount of money, V = velocity, P = price level, and Q = quantity of goods). The key to this equation is V, which is what any student in a real science lab would call a “fudge factor”. If M doubles, then price level hardly budges and quantity is unchanged, they just say “well velocity dropped”.

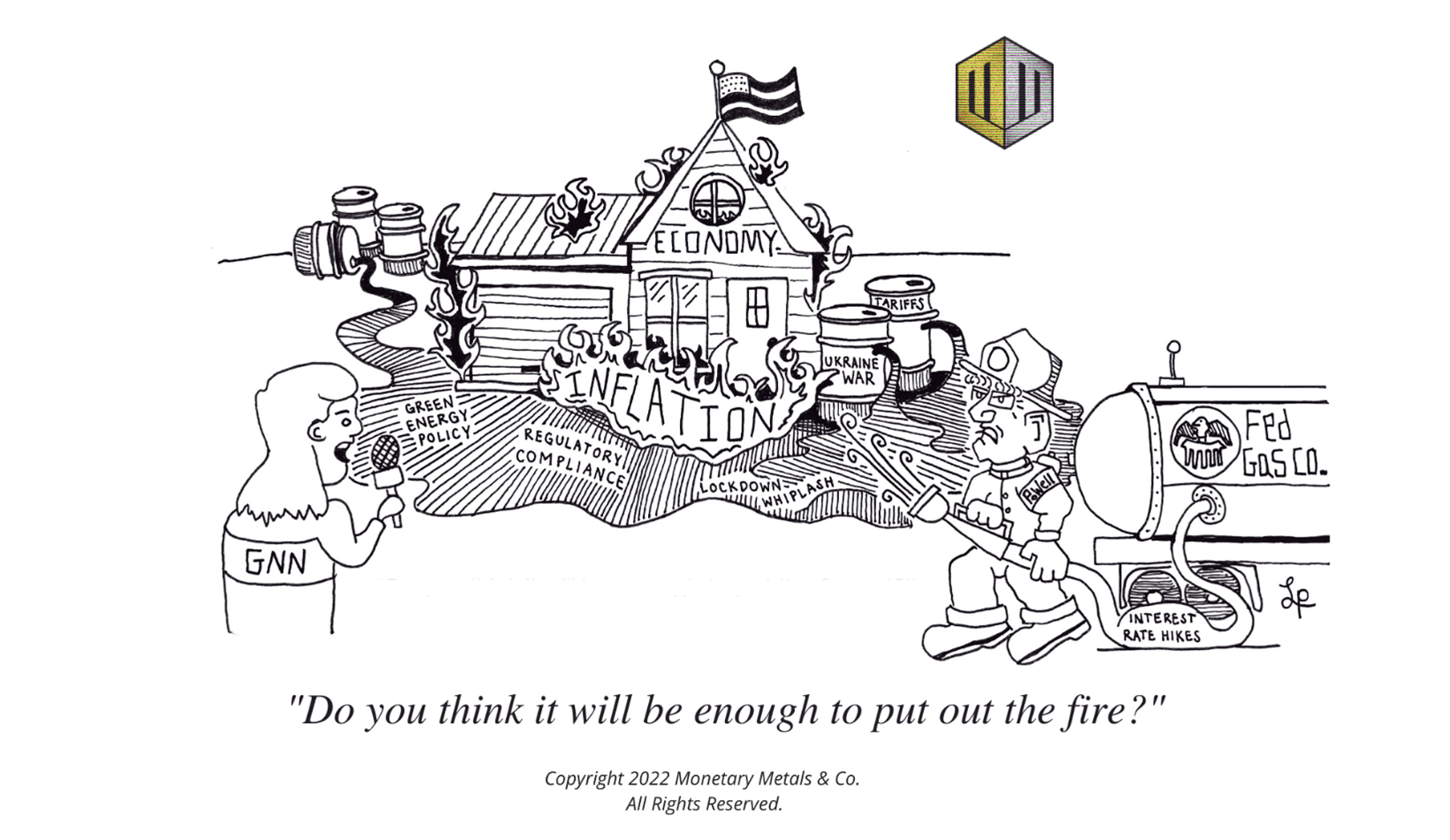

Another is Ir = In – CPI (Ir = real interest rate, In = nominal interest rate, and CPI = inflation). This one doesn’t work if there are any nonmonetary forces pushing up prices. Green Energy Restrictions have pushed up the price of energy, and hence the price of everything that is made, stored, or transported with energy. Which is almost everything.

Thomas Piketty made this one famous: R > G (R = return on capital, and g = growth). He is attempting to say that the rich get richer, that capitalism leads inevitably to ever-increasing concentration of more and more wealth in the hands of fewer and fewer people. He makes many errors, both empirical and theoretical. We don’t have capitalism, so his observations apply to what we actually have—ever-increasing government interventionism and hence cronyism. He assumes a zero-sum, fixed pie. And he ignores that when the world, especially America, moved from the ancient regime (i.e. feudalism) to a market economy, the middle class was created, and the middle class and even the poor got richer than what anyone in feudalism could have imagined.

Economics is NOT Physics

These economists and their formulas assume that they can generalize from their empirical measurements. This seems to be what physics does (which isn’t accurate, but leaving that aside), so why not economics?

The reason why not is that you don’t know—cannot know—that these precise relationships are constant across all economic conditions and all economies. When this assumption inevitably proves false, they say things like “well the price level did not double, because demand for money increased.” OK, fine, but why isn’t demand-for-money a variable in the equation? One reason may be that it can’t be measured.

The Capital Truth

All of this said, I am going to wade in, stick my neck out, and throw my hat into the ring.

R > I

Return on capital must be greater than the interest rate. Stated in other words, return on capital must be greater than the cost of capital. If you think opening a new store will generate 5% return on capital invested, then you will not borrow capital at 8% to finance it. Nor would you put cash into it, even if you didn’t have to borrow; you would be better off putting the cash into a bond paying more than 5% with less risk, not to mention effort and problems.

This principle and hence equation does not come from empirical measurement. It is no mere attempt to generalize an observed correlation to a universal causal relationship. R > I is an absolute truth, for a simple reason. Paying 8% while earning 5% is certain to lead to bankruptcy.

Lags and Nuances

However, there can be long lags in the economy, i.e. between a rise in rates and the consequent rise in returns. There are two reasons for this. One is that the government can distort the market by various means, including direct and indirect subsidies. This is a common modus operandi, the government makes it more expensive to do business and then subsidizes cronies so they can continue in the business. Another mechanism is that a major corporation may have some businesses that generate R > I on their balance sheets, plus others which don’t. A grant of special privileges could either increase R or reduce I.

The other reason is that a business may borrow when R > I, and then interest rates rise later. The eventual outcome may depend on several variables. One is whether the business borrowed at a floating or fixed rate. In a rising rates trend (1947-1981), businesses want to borrow for long terms at fixed rates. But in a falling trend (1981-present), they want to borrow for short terms (tempered by their fear of a 2008-style credit crisis, when they cannot roll their liabilities). Until its cost of debt service jumps up to the market rate and provided that its loan is not called, a business can go on operating profitably even when rates rise.

A business can continue operating, until it must borrow again. Businesses borrow to refresh tired, old storefronts. They borrow to replace worn-out machinery. And they borrow to upgrade to new technologies.

If the rate of interest is now higher than the return on capital, a business cannot borrow. It is forced to liquidate whatever capital assets it has and close its doors.

High Rates = Higher Prices Resolved

One might object, what if a business raises its prices? If it could have done that without causing sales volume to plummet, it would already have done so. Rising interest rates cause higher prices, but not by this facile explanation.

Another factor can extend the lag between a rise in rates and the inevitable increase in return on capital. A capital-intensive business may decide it is better to operate at a relatively small loss than it is to write off a large amount of capital. This is especially so, given the inevitable result of rising rates.

Prices rise, not because firms can arbitrarily raise them. They rise, because one by one producers go out of business. Supply is decreased. Demand is reduced too, as firms lay off workers, so supply must be reduced more. At the end of the process, no matter how much both are reduced, whatever small amount of industry remains must be able to charge high enough prices to generate R > I.

A large firm may analyze its competitors, and decide it has more capital to burn than they do. Hence it can outlast them. Hence will be the last survivor, and finally able to raise prices. Notice this is not an investment strategy—as imagined by proponents of antitrust. This is a survival strategy, when the capital is being yanked out from underneath industry. And the survivor knows that high interest will keep out new competitors.

Supply Crash Outpacing Demand Crash

I have written much more about the destruction of falling rates because we are in a falling rates world. But now that the Fed continues to play at hiking rates, I am compelled to write this article to say two things. One, as I just showed, a rising-rates economy is a destructive one, targeting capital-intensive industries.

Two, the point of this article is to show that hiking rates can only lead to higher consumer prices. It does so by ruining the producers, one by one, causing supply to fall. And demand to fall. But supply must necessarily fall more. Until prices rise. Ironic that they are doing this out of a belief that they will cause consumer prices to fall!

They are probably following one of those pseudo-equations debunked above.

The Solution

While the Fed’s artificial interest rate continues to swing back and forth, destroying businesses and people in its path, more and more people are seeking an alternative to earning in dollars. And more and more of those people are finding their alternative in interest rates that are denominated in gold, paid in gold, and set by a process that respects the individual’s freedom to choose. In other words, more and more people are turning to Monetary Metals. Learn about how you can start earning a yield on gold, paid in gold, today.

© Monetary Metals 2023