Central Bank Digital Currency (CBDC, or in America let’s call it “FedCoin”) is a hot topic right now. Articles about it are everywhere, and Monetary Metals’ clients are asking about it. Gold is widely seen as a way to opt out. No doubt this is part of why the price of gold has held up so well.

There is a broad and growing feeling that a FedCoin is inevitable. It certainly fits with other dystopian and totalitarian policies of recent years and many preconditions for a FedCoin have been developing.

The Preconditions for a Central Bank Digital Currency

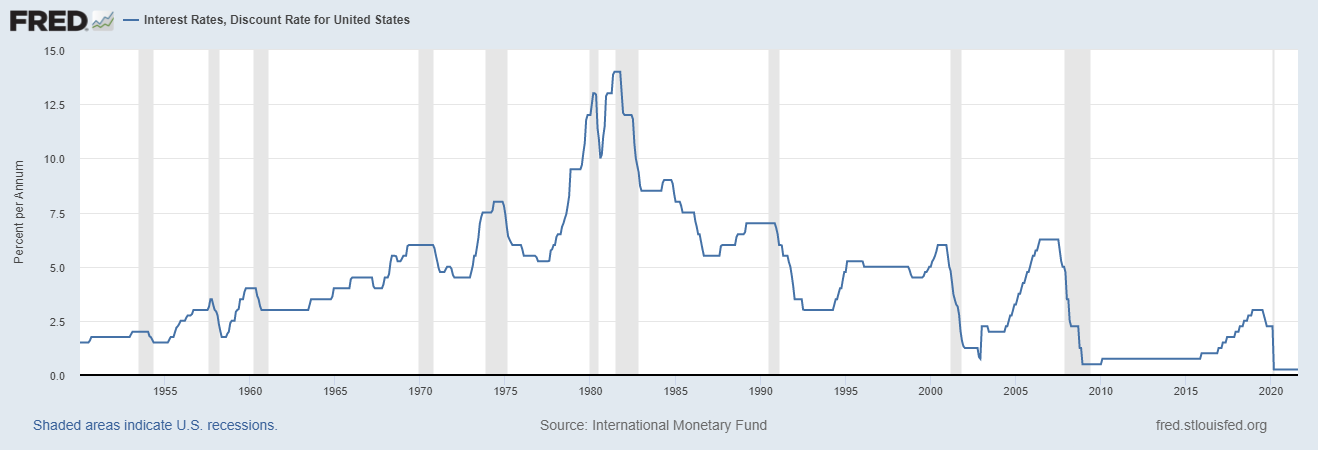

Let’s skim over the prior decades of bad laws creating perverse incentives which motivate perverse behaviors which lead to perverse outcomes which prompted new bad laws. We will start in the 1980s. Beginning in 1981, the interest rate has been steadily falling.

With that epic collapse, a bank’s net interest margin—the spread between what it pays depositors and what it earns—has been compressed. For example, by the summer of 2020, the 1-month Bill paid a mere 0.09% per annum. Even with the bank paying 0.00% on deposits, this margin is far too thin for any bank to survive.

At the same time, the bank’s cost of compliance has long been skyrocketing. The net result is that banks have been forced to buy, not short-maturity Bills but long-dated Bonds. The higher interest rates on long maturity Bonds (most of the time) enabled them to make a bit of profit. The 10-year Note was paying 0.55% and the 30-year was at 1.2% back in Summer of 2020. That is not a fat margin, but it’s better than 0.09%.

However, such an extreme mismatch between a bank’s funding—i.e. demand deposits that could be pulled on a moment’s notice—and its assets—10- or 30-year bonds—creates a risk. What if the short-term rate rises? The long-term Bonds don’t increase in yield, but their market price does fall. The bank can either raise its deposit rate, which means it has a negative net interest margin—it loses money. Or it can face deposit outflows, which means it is forced to sell bonds at a loss.

This risk was under-appreciated until recent bank collapses forced the issue into the public spotlight, most notably Silicon Valley Bank. And then First Republic Bank.

So it seems logical for to everyone with a deposit at risk in a bank to ask "why do banks take such risks with my money?”

A Narrow Bank?

To avoid this risk, some argue we should have a “Narrow Bank”, which accepts deposits and invests them exclusively in short-maturity Treasury Bills. The benefit of a Narrow Bank is that it avoids most of the credit risk of a conventional bank, as it only has Bills.

It is important to see how tempting this is to everyone who holds a cash balance. But there are two immediate problems with this.

One, it exists by legislative fiat, it is a crony corporation from its very design. It will become corrupt in ways that are hard to foresee now.

Two, if it makes sense to have the government control a private bank to avoid credit risk, then it would make even more sense to have the government create a risk-free deposit.

Enter FedCoin, the Federal Reserve’s CBDC

FedCoin is our term for what the Federal Reserve defines as a “a digital liability of a central bank that is widely available to the general public” In other words, it skips the privately owned crony Narrow Bank, and leaps forward to a brave new future in which everyone’s money is on deposit at the Fed. In the Fed’s white paper (linked above), they state that the “safety of commercial bank money is supported by federal deposit insurance (subject to certain limits), a system of prudential regulation and supervision, and access to liquidity from the Federal Reserve.”

However, with each new bank failure, fewer people will believe the white paper’s argument that “commercial bank money is sufficiently safe.” Perhaps when bank failures accelerate, the people will eagerly demand that the Fed offer safer accounts. The thought that one’s cash could disappear overnight will drive away dissonant thoughts, such as concern about possible perverse outcomes, and of course what unholy new power will the government have over our little lives?

An Unholy New Power

Will they be able to audit your lifestyle in real time? Will you get flagged for consuming too much energy? Or hamburgers? Will they deny your right to buy what you want? They have the means, even now, to monitor your payments and to shut down access to your accounts via their supervision of banks.

But FedCoin would take it to the next level.

My writing mostly does not focus on government power and its abuse, per se. Many people do that and do it well. My swim lane is monetary economics. Nevertheless, there are too few of us writing about this at all. Given the stakes, I offer a few concluding thoughts.

First, I foresee broad popular demand for a FedCoin. Not yet, but when fear of bank deposit losses intensifies.

Second, FedCoin will be the next degradation of the monetary system. It will be a leap downward into a coercive mechanism to feed the growing maw of government spending. People will fork over their savings to a central bank in order that the central bank give it to the government, to spend. Because this is less unsafe than depositing it in a bank.

Third, if FedCoin is not the next step of a progression of bad laws creating perverse incentives that motivate perverse behaviors which lead to perverse outcomes which leads to more bad laws—then I do not know what is.

To Consume or Create, that is the Question

Our civilization, the greatest ever to be built on Earth, is on a trajectory that leads to total collapse when we finish consuming the capital we inherited from a prior era. To avoid this fate, we must find a way towards a better system. A system in which capital is accumulated, not consumed.

This is why Monetary Metals exists. Unlike the dollar, where if there is a yield for now, it is increasingly paid by the government for financing its chronic welfare state deficits. Monetary Metals exists to prove that there is an honest yield to be earned by financing productive enterprise. And that yield is paid in honest money—gold and silver.

© Monetary Metals 2023