“If it bleeds it leads” is a well-worn expression for describing how the media reports the news, if you can interview a victim/ family member and get them crying, well that’s even better for ratings. But all news isn’t bad, or that good news doesn’t deserve a higher position in the news hierarchy.

Two cases in point: last week’s APEC summit meeting between US President Biden and Chinese President Xi, and a very interesting development coming out of Taiwan.

West-China rapprochement

It’s no secret that US-China relations have been strained over the past several years. Former President Trump started a trade war with America’s largest trading partner, imposing billions worth of tariffs on Chinese imports and accusing Beijing of engaging in longstanding unfair trade practices as well as intellectual property theft.

President Biden has not canceled the Trump tariffs; in fact he increased them. CNBC reported this week that tariffs on select Chinese goods were imposed in three stages between 2018 and 2022. Currently, two-thirds of US imports from China are under tariff, with the average set at 19.3%, more than six times higher than before the trade war began. Chinese tariffs cover 58% of US exports at an average 21.1%.

In October the Biden administration announced plans to halt shipments to China of chips designed by Nvidia and others, to try and stop Beijing from using advanced US technologies to strengthen its military.

Then there’s the controversy over Huawei, the telecom which the US and other countries view as a trojan horse for Chinese espionage; criticism over China’s treatment of its minority Uyghur people; the Israel-Hamas war; Russia’s invasion of Ukraine, North Korea; ongoing conflict between the US and Chinese militaries over control of the South China Sea; and the biggest issue of all — Taiwan.

Despite these trigger points, US President Biden and Chinese President Xi met Wednesday for the first time in a year at a country retreat about 25 miles south of San Francisco, where the APEC summit took place.

According to media reports, the leaders of the two largest economies agreed to re-open military contacts that were closed after then-House Speaker Nancy Pelosi visited Taiwan in 2022. The military communications mean that the US Defense Secretary could meet his Chinese counterpart.

The four hours of talks also led to an agreement to cooperate on tackling the source of the deadly drug fentanyl, with China promising to go after companies that produce the chemicals used to make it. Before the meeting, both countries backed a new renewable energy target, and said they would work to reduce methane and plastic pollution — a renewal of climate cooperation that was also a casualty of Pelosi’s Taiwan visit, Aljazeera said.

Of course, it wasn’t all puppies and rainbows. Biden chided China over its military buildup around Taiwan and asked it to respect Taiwan’s electoral process. Elections are scheduled for January. Xi stressed that the island was part of China and said the US should stop arming Taiwan.

While Biden said the talks with Xi were “some of the most constructive and productive discussions we’ve had,” he also repeated a previous assertion that the Chinese president is a dictator. (What else would you call a politician who appoints himself president for life?)

Biden said Wednesday that he reiterated the US “One China” policy regarding Taiwan, which means the US acknowledges China’s position that Taiwan is part of China but has never officially recognized China’s claim to the island.

Xi has also been making nice with other trading partners China has tangled with, including Indonesia and Australia.

Earlier this month, Australian Prime Minister Anthony Albanese became the first Australian leader since 2016 to visit Beijing. Xi reportedly said stable ties between the two countries serve each other’s interest and both should expand their cooperation, which according to Reuters, sent a clear signal that Beijing was ready to move on from recent tensions.

Australia has accused China of meddling in its politics; banned equipment from Huawei needed for its 5G network, and in 2020, called for an enquiry into the origin of the pandemic. The latter reportedly enraged Beijing and led to blocks on various Australian imports.

Since becoming prime minister in May, Albanese has quietly been trying to repair the relationship. Reuters noted he met Xi on the sidelines of the G20 summit in Indonesia one year ago, after which China soon began lowering trade barriers, allowing imports of coal in January and ending tariffs on barley in August. Last month, Beijing agreed to review dumping tariffs of 218% on Australian wine…

China’s January-September imports from Australia increased 8.1% from a year earlier to $116.9 billion, Chinese customs data show. In 2022, imports plunged 12.7% to $142.1 billion.

At AOTH, we often seek answers by following the money. The easiest way of explaining China’s recent rapprochement with the West is the fact that China’s economic power has declined. It needs Western allies, and global trade, to maintain its economic hegemony. The last thing China wants is for it to be relegated to a regional power. Its leaders covet international recognition and ultimately the restoration of China as the center of world trade, culture, and political/ strategic influence.

Consider: despite the raising of tariffs on both sides, trade in 2022 between the United States and China reached a record $690.6 billion. Trade volumes between China and the European Union rose 23% from 2021 to $910 billion. There will always be tensions, but in the end, it’s commerce that matters. The South China Morning Post ran an opinion piece in June that stated,

“There are clear limitations to how far decoupling can go, given China’s dominance of large parts of global supply chains as well as capital market interdependence.”

Yet hitting last year’s trade numbers let alone exceeding them could be a challenge for China this year. Asia’s suppliers are reportedly seeing the largest rise in idle capacity since June, 2020 as the region’s economy weakens. In August China’s exports fell for the fourth month in a row, putting pressure on the government to boost domestic consumption, which it has so far failed to do.

The GEP Global Supply Chain Volatility Index, produced by S&P Global and GEP, shows a depressed level of demand for raw materials, components, and commodities since manufacturing orders are down, said CNBC.

One of China’s biggest concerns is growing youth unemployment, due to the risk that the younger generation will question the legitimacy of a system that can’t meet its aspirations for gainful employment.

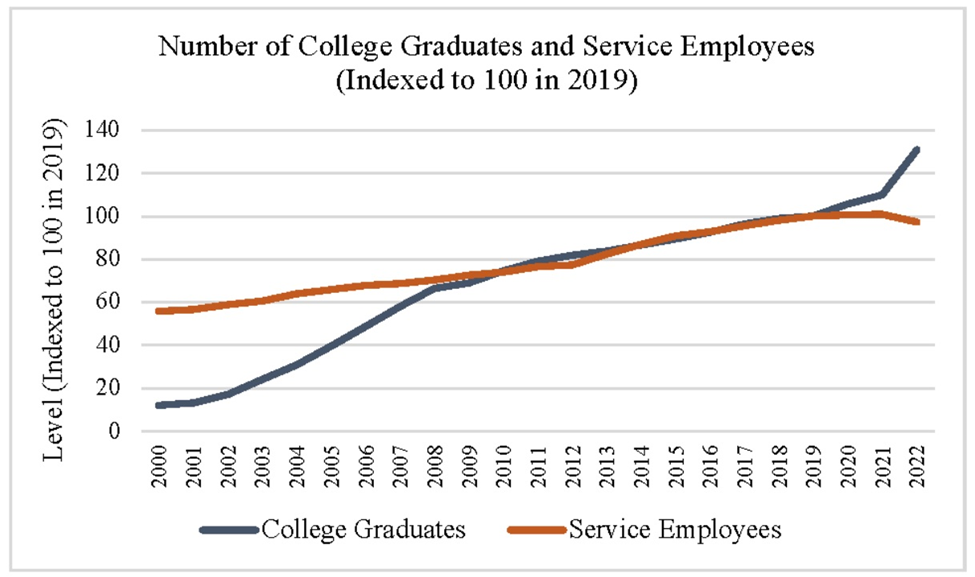

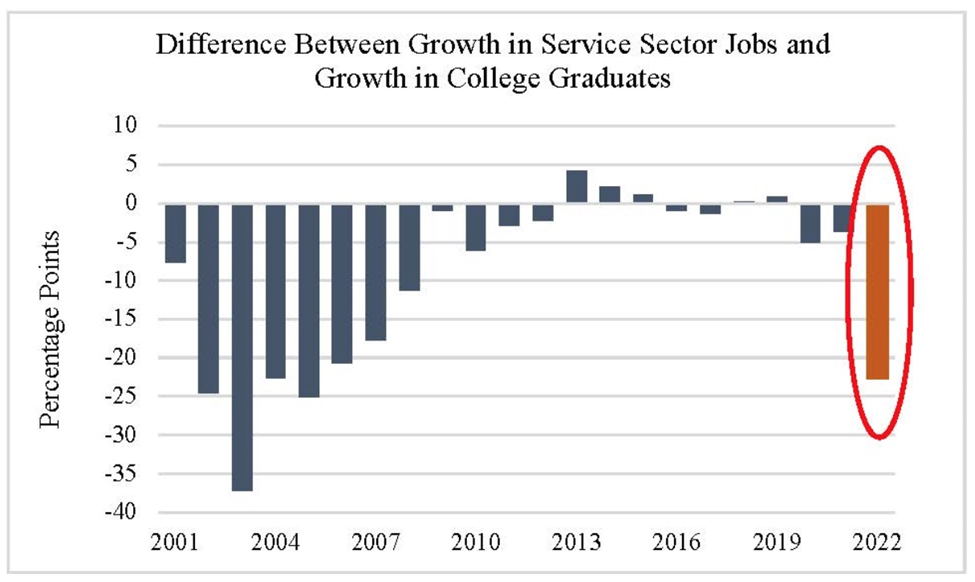

According to the Council on Foreign Relations, the number of jobless youth (16 to 24) hit a record 21.3% in June. Moreover, a huge gap has opened between the number of college graduates and the number of service jobs. A broad measure of services activity fell in August to an eight-month low.

The council concludes,

“The message for China’s policymakers is clear: boosting graduate numbers while throttling services and subsidizing building is bad economics and worse social policy. It will further distort China’s imbalanced economy, and fuel discontent among an age cohort on which China will depend for its future national vitality.”

Taiwan breakthrough?

Beyond diplomacy, another positive development this week occurred in Taiwan, where political parties are gearing up for an election in January. The territory’s two main opposition parties, which have vowed to renew talks with China, agreed on Wednesday to make a decision on a joint presidential ticket for the elections in January. The decision will be based on opinion polls and announced this Saturday.

Why is this significant? Because the main opposition Kuomintang (KMT) and the Taiwan People’s Party (TPP) have enough votes behind them to defeat the ruling Democratic Progressive Party’s presidential candidate, Vice President Lai Ching-te.

China cut off talks with Taiwan after President Tsai Ing-wen of the DPP took office in 2016. It considers Tsai a separatist.

Reuters quoted an assistant professor at Taiwan’s Tamkang University saying that if opposition presidential candidates Hou and Kou did not work together, vote-splitting would practically guarantee that Lai, of the anti-China DPP would win the election. The professor also said,

“The U.S. and China both want stabilised Taiwan Strait relations. Lai may not be the ideal person for this.”

Another media source said the news of a joint presidential ticket “sharply increases the odds of an opposition victory, an outcome that would be welcomed as good news in Beijing.” While an opposition win is still far from a sure thing, if it happened, it would likely ease US-China tensions over Taiwan, said the source, noting that most experts consider a war with Taiwan unlikely over the next year, despite near-miss encounters involving US and Chinese ships and aircraft.

(It is also unlikely that China could win a war over Taiwan.)

Moreover, the source said that “having a strong dislike to instability in any form, Chinese leadership is likely to welcome sector-specific measures adopting a more conciliatory approach towards Washington on a narrow set of issues in which China stands to benefit.”

On this, I fully agree. China will work with the US in areas where they feel that they cannot be hurt or dominated by the United States.

Why China won’t go to war with Taiwan

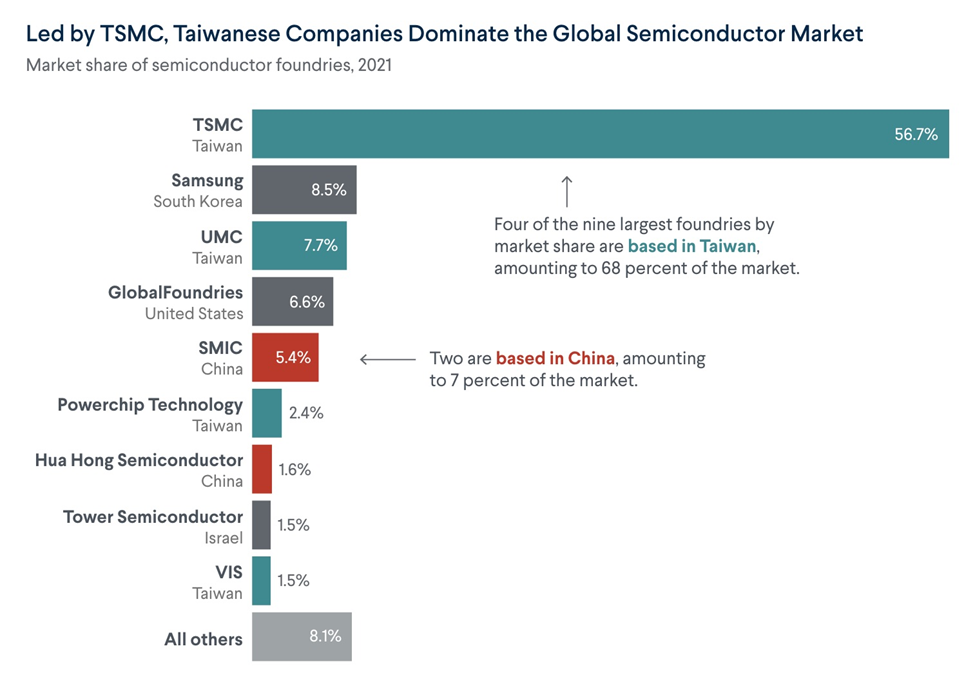

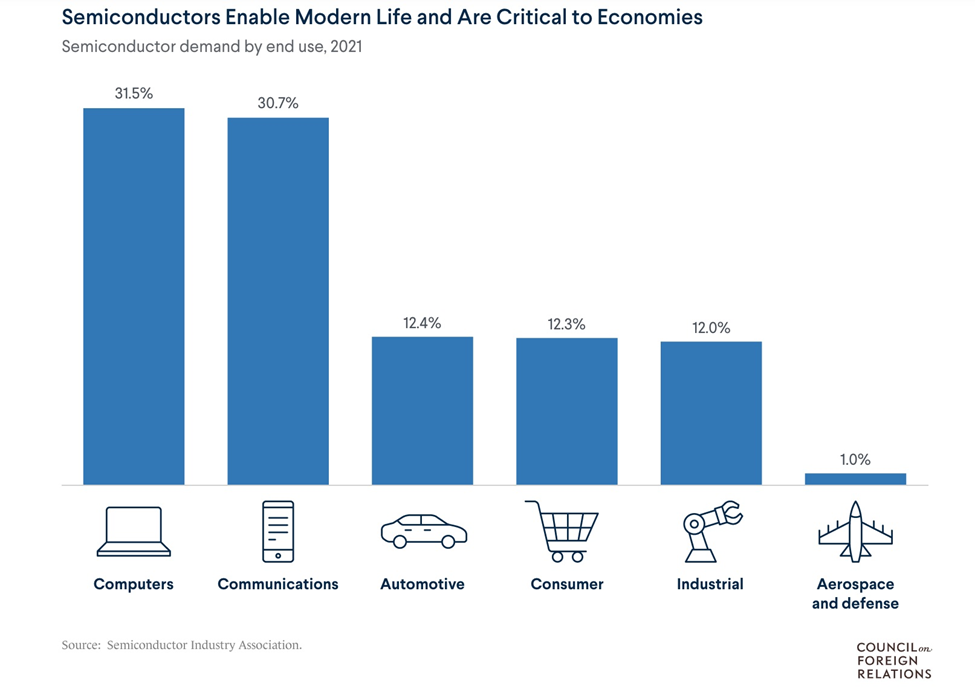

We must remember the chief reason there will be no war between the US and China over Taiwan: semiconductors. I’ve gone on record as saying that China and Taiwan’s economies are highly integrated so any attempt by Beijing to blockade or even restrict trade with Taiwan would likely cause significant blow-back. Semiconductors are extremely technology-intensive, and their manufacture relies heavily on global supply chains. Even if China wanted to take over semiconductor manufacturing from Taiwan, it doesn’t have the capabilities, and would have to rely on other countries, who would immediately rally around Taiwan, like they did Ukraine. China would be sanctioned, and all chip technology transfers halted, if they hadn’t been stopped already.

The loss of chips from Taiwan would crush Chinese industry. China accounts for 60% of world semiconductor demand. More than 90% of semiconductors used in China are imported or manufactured locally by foreign suppliers. A 2021 report by Foreign Policy Analytics found that China is highly unlikely to achieve independent semiconductor manufacturing capabilities in the next five to 10 years. We’ve already seen the destructive impacts of a chip shortage on the auto industry. Well over $2 trillion is at risk in the event of a Taiwan blockade, never mind an invasion force.

The bottom line? China’s need for Taiwan’s semiconductor capacity is greater than its desire to end Taiwan’s independence.

Interest rate pause

Back to the theme of this article, the positive developments happening around the world despite overwhelmingly negative news, in our last article we discussed why the Federal Reserve’s interest-rate pause, due to successfully lowering inflation, and subsequent pivot to reducing interest rates sometime in 2024, is good news for commodities.

AOTH’s interest rate predictions have been bang on

Lower rates will cause the dollar to fall and commodity prices to rise. When positive real interest rates, which favor bond investors, turn negative, it will especially affect gold and silver prices to the upside.

If we’re right, and we are on the cusp of a global economic revival, the three metals I’d want to be invested in are gold, silver and copper. Even better, the junior resource companies that own large Au, Ag or Cu deposits in safe jurisdictions that would be of interest to larger, deep-pocketed mining companies.

Gold

The case for gold revolves around three main factors: heightened geopolitical tensions, particularly in the Middle East; unsustainably high debt, fueled by excessive government spending; and central bank buying.

Read more at Gold

The US government is over $33 trillion in debt. In fact, the Biden administration managed to add half a trillion dollars to the debt in just 20 days. Meanwhile, with rising interest rates, the federal government is now spending as much to make interest payments on the debt as it is for national defense.

And there is no end to the borrowing and spending in sight.

But the most talked-about source of demand is central banks, which bought a record 1,136 tonnes of gold last year and followed that up with another 228t in Q1, the most ever in a first quarter.

While central bank net buying slowed to 103t in Q2 2023, down 35% y/y from an extremely high base, the selling activity has done little to dent the underlying positive trend in central bank gold demand, which saw its highest first half on record dating back to 2000, the WGC said.

“Record central bank demand has dominated the gold market over the last year and, despite a slower pace in Q2, this trend underscores gold’s importance as a safe haven asset amid ongoing geopolitical tensions and challenging economic conditions around the world,”

Louise Street, senior markets analyst at the WGC, commented.

Silver

Silver is interesting in that there is the same amount of investable silver above ground as there is gold, because 60% of silver goes into industrial uses and 80% of that end up in landfills. Just 40% is used for investing.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. A 2020 Saxo Bank report stated that “potential substitute metals cannot match silver in terms of energy output per solar panel.”

Using silver as conductive ink, photovoltaic cells transform sunlight into electricity. Silver paste within the solar cells ensures the electrons move into storage or towards consumption, depending on the need. It is estimated that approximately 100 million ounces of silver are consumed per year for this purpose alone.

Analysis by BMO Capital Markets has annual silver consumption by the solar industry growing even higher at 85% to about 185 million ounces within a decade.

Copper and silver: the electrical metals

5G technology is set to become another big new driver of silver demand. Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT)-enabled devices.

The Silver Institute expects silver demanded by 5G to more than double, from its current ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206% increase from current levels.

A third major industrial demand driver for silver is the automotive industry. Silver is also found in many car components throughout vehicles’ electronic systems, and despite not being used in batteries, its superior electrical properties make it hard to replace across a wide and growing range of automotive applications.

A Silver Institute report says battery electric vehicles contain up to twice as much silver as ICE-powered vehicles, with autonomous vehicles requiring even more due to their complexity. Charging points and charging stations are also expected to demand a lot more silver.

It estimates the sector’s demand for silver will rise to 88Moz in five years as the transition from traditional cars and trucks to EVs accelerates. Others estimate that by 2040, electric vehicles could demand nearly half of annual silver supply.

In 2021, brazing and soldering alloys used 47.7Moz of silver, representing 9.3% of the total industrial demand for silver that year. Last year brazing and alloys accounted for 49Moz.

By 2030, the demand for silver used in brazing and soldering is forecast to reach 58.8Moz, a 23% increase over 2021, according to a Silver Institute report titled ‘Silver in Brazing and Solder Alloy Materials’.

Finally, silver demand for “printed and flexible electronics” is forecast to increase 54% over the next nine years, rising from 48Moz in 2021 to 74Moz in 2030, meaning a consumption of 615Moz during this time frame.

A Silver Institute news release describes them as “mainstays” in a variety of electronic products, including sensors that measure everything from temperature, pressure and motion, to moisture, relative humidity and carbon monoxide. They are also used in medical devices, mobile phones, appliance displays and consumer electronics.

In 2021, a comprehensive report by Sprott titled ‘Silver’s Clean Energy Future’ found that three areas of growing demand for silver — solar, automotive and 5G — potentially account for more than 125 million ounces in 10 years. This doesn’t include the growth in investment demand for silver, which as mentioned represents about 40% of usage.

Analysts have long been pointing to a severe shortage of silver due to the relentless growth in demand for the metal.

According to the 2023 World Silver Survey, the global silver market was undersupplied by 237.7 million ounces in 2022, which the Institute says is “possibly the most significant deficit on record.”

What’s more unsettling is that it took just two years of undersupply — the 2022 deficit and the 51.1 million oz shortfall from 2021 — to wipe out the cumulative surpluses from the previous decade, and this demand-supply gap is likely to remain for the foreseeable future.

Copper

Copper is one of the most important metals with more than 20 million tonnes consumed each year across a variety of industries, including building construction (wiring & piping,) power generation/ transmission, and electronic product manufacturing.

In recent years, the global transition towards clean energy has stretched the need for the tawny-colored metal even further.

Simply put, electrification doesn’t happen without copper, the heartbeat of the global energy economy.

Along with the usual applications in construction wiring and plumbing, transportation, power transmission and communications, there is now an added demand for copper in electric vehicles and renewable energy systems.

Millions of feet of copper wiring will be required for strengthening the world’s power grids, and hundreds of thousands of tonnes more are needed to build wind and solar farms. Electric vehicles use triple the amount of copper as gasoline-powered cars. There is more than 180 kg of copper in the average home.

However, some of the world’s largest mining companies, market analysis firms and banks, are warning that by 2025, a massive shortfall will emerge for copper, which is now the world’s most critical metal due to its essential role in the green economy.

The deficit will be so large, The Financial Post stated last September, that it could itself hold back global growth, stoke inflation by raising manufacturing costs and throw global climate goals off course.

How big are we talking? Well, the speed at which copper demand outpaces supply will depend on the successful meeting of net-zero emission goals. According to a 2022 study by S&P Global, these goals will double the demand for copper to 50 million tonnes annually by 2035. Only about 20 million tonnes of copper per year is currently mined.

BloombergNEF predicts demand will increase by more than 50% from 2022 to 2040.

If Europe meets its goal of 30 million electric cars by 2030, the amount of copper required @ 85 kg per EV, is 2,550,000,000 kg, or 2,550,000 tonnes. This is nearly double US copper production in 2022 of 1,300,000 tonnes, or almost half of Chile’s annual production.

S&P Global Mobility forecasts 28.3 million EVs in the US by 2030. That’s 28,300,000 x 85 kg per EV.

Remember we are only talking about copper demand for electric vehicles sold in the US and Europe — we aren’t counting higher EV sales in other countries, along with millions more public and private charging stations to service them, all needing copper, plus supplying all the other copper markets, for construction, power transmission, telecommunications, etc.

This equates to nearly five Escondida mines (the largest in the world), with each producing 1 million tonnes per year. Just to provide enough copper for EVs in the United States and Europe. And not including charging stations, which add another nearly 10,000 tonnes combined.

Even more, copper will be required for wind power, energy storage and electricity transmission.

(most copper production, for the foreseeable future, is slated to come from just 5 mines, all 5 of these mines have offtake agreements in place with Asian buyers, meaning that a large majority of new copper ore will not flow to Western markets to offset the coming copper supply deficit.)

A recent development in China bodes well for the upstream copper market. To ensure self-sufficiency, the country is expanding its network of copper smelters, meaning it will import more copper ore than refined copper, for processing domestically. According to CRU, China will account for about 45% of global refined copper output this year.

China’s copper smelting capacity is expected to increase 45% by 2027, turning China into a net copper exporter by 2025 or ‘26. With so many smelters requiring copper concentrate, the market for concentrate is tightening. According to Bloomberg,

The treatment charges that miners pay smelters to process ore drops when concentrate is scarce. That dynamic is likely to be reflected in a fall in fees for next year to $84 a ton from $88, according to an estimate from Shanghai Metals Market.

Peak metal

Gold, silver and copper all have supply challenges in common that suggest each has reached a peak level of mine production. For gold and silver, the mining industry is currently unable to mine enough to meet annual demand, without recycling.

The case for peak gold, silver and copper

As for copper, we are quickly approaching the lower limits of cut-off grades, meaning that we are almost at the point where reserves cannot be grown at all. In other words, peak copper.

The copper industry is in the grips of a structural supply deficit that, combined with inflationary cost pressures and resource nationalism in some of the world’s largest copper producers, is only expected to get worse.

Global shortages of the metal could reach 8 million tonnes by 2032, as soaring demand fails to be matched by new copper mines. The rate of supply increases required, is equivalent to building eight copper mines the size of Escondida, the largest in the world, per year, for the next eight years. That’s insane.

When you combine the expected deficits for these three metals with increasing industrial demand for copper and silver (due to the greening of the world economy) and higher investment demand for silver and gold, once the Federal Reserve realizes it can’t raise interest rates any more without breaking the Treasury, causing the US dollar to slide, the prices of gold, silver and copper are all but guaranteed to go up.