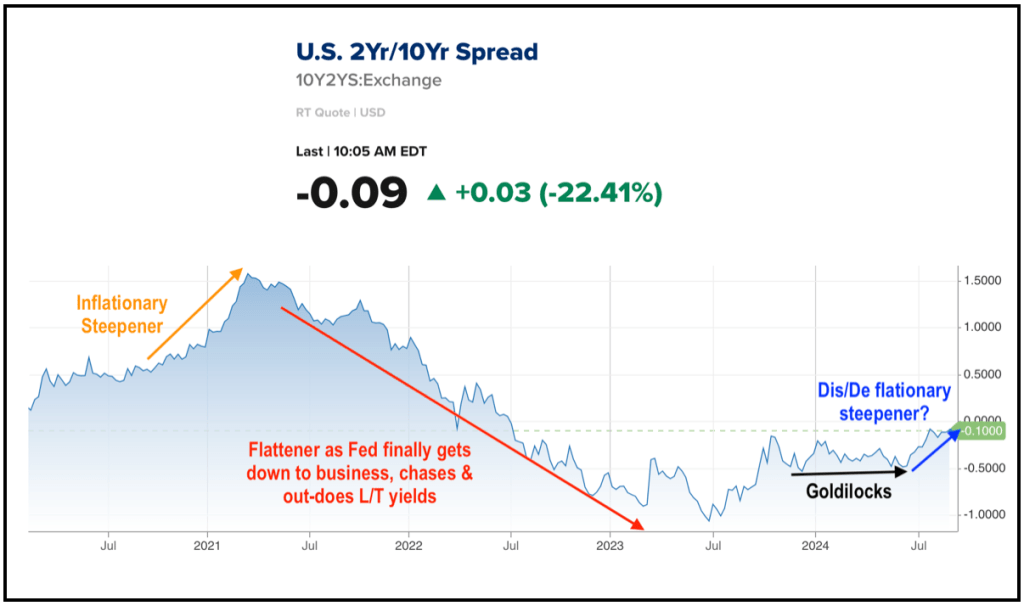

The 10yr-2yr Yield Curve is poised to un-invert under disinflationary, possibly coming deflationary pressure

We know the story. A disgusting virus spread across the world…

…terrorizing society into social and economic lockdown, causing crude oil to go to zero and many markets to begin a crash. The Fed sprang into action with Zero Interest Rate Policy (ZIRP), QE, MMT and whatever other TMM (total market manipulation) it could think of in order to create the inflationary pathway out of the disaster.

The result was an inflationary yield curve steepener, as the Fed lagged the “transitory” (ha ha ha) inflation it had created before finally getting on the hawk, jerking the Fed Funds rate upward and slamming the 10-2 yield curve into a hard flattener and inversion. Tilt Jerome, tilt!

This flattening did not initially work well toward the usual economic boom associated with flatteners because the market was obsessed with the newly hawkish Fed and its implications on a strengthening US dollar, AKA the other side of the trade for most asset markets. Enter the 2022 “bear market” that wasn’t (it was a correction).

Then the yield curve floundered in inversion for a couple more years, to this very day. However, it is now knocking on the door of de-inversion and a future steepening. Contrary to the overwhelming majority of commentators, we once again note that it is the steepener that follows the inversion that tends to bring on economic and market problems, AKA the bust end of the boom/bust equation. It’s not the “inversion” trumpeted so loudly in the media.

Along with several other macro indicators, the 10-2 yield curve is lurking and biding its time. Could it be different this time, with a new boom in the making that the soft-landers, Team Goldilocks and even to a degree, “de-dollarizers” may envision? Yeah, maybe. But these indicators are far from broken. They are just delayed, and they are in warning mode, as they have been for quite some time. Market management is a patience and perspective game.

CNBC.com, my markups

CNBC.com, my markups