I’m going to write today’s article with all the vicissitudes I experienced as I read Powell’s statements about the Fed’s predicted moves and watched the market’s responses as they played out.

My first thought, as I read the headline about Powell stating outright that the time was coming when the Fed would have to slow down — even before I looked at what the market was actually doing — was that the stock market was going to fly skyward because it was a tightly wound spring ready to leap at the least hope from Powell that the Fed was going to think about thinking about relaxing its tight grip on the economy via the financial system. Of course, when I checked the market, that is exactly what happened. So, I wrote the following paragraphs, word for word (except the subtitle) as my lead into today’s article:

Part One: The Fed feint

If Powell’s goal of breaking inflation includes ending the “wealth effect” the Fed said it tried to create via the stock market during its days of ease, then he couldn’t have made a dumber statement than today. That’s not to say that I don’t think the Fed should be getting ready to back down, but that even the slightest hint it would be backing down was certain to send today’s market soaring.

Now, it could be that Papa Powell views the market’s present rally as I do — one that, as I said in my last Patron Post, will hit a ceiling and bounce down by mid-November for the following reason:

As you can see, the market has remained within this channel quite tightly all year, other than briefly dipping below in June. I laid out for Patrons a number of reasons why I think it going to stay in that channel. However, if tightening by ending the wealth effect was ever his aim, Powell sure just threw gasoline on the fire to try to burst the market out of the channel.

That was my lead, unchanged, for today’s article. At the point in time when I first looked at the market, stocks had already started coming back down, and so I added the following two short paragraphs:

Upon his word, the market soared straight upward. I figured that would be another one of those rises that might not last through tomorrow when it would flip back down, but I didn’t expect what came next:

The market that flew upward 400 points on the Dow, suddenly did one of those huge intraday swings we talked about here and plunged downward 600 points in barely over fifteen minutes to a negative 200.

After that, I did an interview about what was happening in the market and about my recent stock predictions with Tom Pochari, which you can listen to here if you want to. I watched the market play out as we spoke. During the first half of the interview, the market recovered back to null, but I doubted that would hold. I looked at it as an effort to recover and began to think the market was going to do exactly as I described in my two articles over the last couple of days. It was going to go down hard. I had no idea what Father Powell had said that took his blessing back off the market as I couldn’t listen while doing the interview, but it quickly became clear as we talked that the stock market’s attempt to recover from its sudden plunge was, indeed, failing miserably.

Part Two: In the nip of time

The news I had read at the start of the day, which set the initial upward trajectory of the market, was as follows:

The Fed hiked 75bps as expected (Fed Funds at 4.00%, the highest since Dec 2007 and most aggressive monetary tightening since 1981) but surprised the market somewhat by hinting at a slow-down in the pace of rate-hikes ahead (due to the lagged effect of their cumulative monetary tightening).

That was exactly the news the stock market has been itching to hear; so, as ZH went on to say,

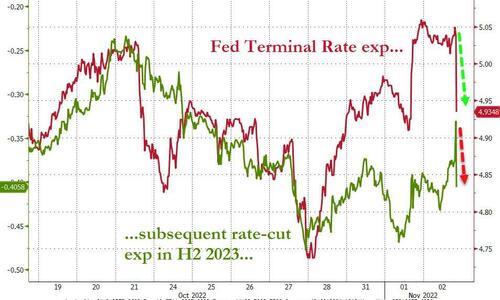

Market participants are describing this as a ‘soft pivot’ but we note that while terminal rate expectations have dropped (dovishly) but rate-cut expectations have also dropped (hawkishly) – [the] market is pricing higher rates for longer.

In other words, the market was suddenly expecting the Fed would quit raising rates sooner and/or at a lower interest level, but also that it would, therefore, not be as inclined to start cutting rates to re-stimulate the economy as soon or as much.

ZH provided the following summary for why the market rose:

“The statement is clear that they would like to slow the pace of hikes. In addition to looking at the data and looking at markets, they are also now considering the cumulative impact of what they have already done. And the lag with with that will hit the economy. Most estimates are that it takes 9-12 months for rate hikes to be felt, and 12-18 months for the maximum effect. We are only just now eight months past the first rate hike, so it makes sense to slow down.”

Such dovishness not withstanding, at the market’s close, which is when I am writing this part of this article at this point, the Dow ended down 505 points (-1.55%), putting in about a 900 point intraday swing, exactly the kind I thought we would see earlier in October. It also appears to be clear that the rally did get nipped off at the neck on the last day of October because clearly stocks have zero stomach for whatever it was Powell said, which I haven’t even looked at yet, beyond what I initially saw above; however, I will look before writing the third and final part of this article. The S&P closed down almost a hundred points (-2.5%), but the NASDAQ truly got its head ripped off, ending down 366 points, which is a 3.36% fall — all on news that, at least, started off sounding like everything the market wanted to hear.

That tells me, without reading anything but Powell’s opening comments as described in the Zero Hedge quotations above, that the late-October rally really was formed out of nothing but hot air, as I figured it was, so it never even made it close to the top of that channel defined in the graph at the top of this article before petering out on the final day of October. With that prospect in mind, I’m now going to step back and read and listen to what Powell actually said and see what it was the market ultimately responded to that sent it ducking for cover. Before I do, let me add that I think what we are seeing is exactly the action I laid out yesterday:

In my latest Patron Post, I laid out how, even though I appear to have missed my “anticipated” (not predicted) target for the next big leg down in stocks to happen as an October surprise, I have many, many reasons to believe the bear’s revenge against the recent rally is still on track, even if a little slow, and right around the corner.

In fact, the bear may have even broken through the underbrush on the final day of October. Halloween, while not scary in terms of the market’s drop, may have bit off the recent rally at the neck just in the nick of time to start the terrible move that I anticipated would begin in October. The market may be ready to growl in our faces today when Papa Powell returns to face off with it in the Fed’s next move.

After two days down in a row, much will depend on what Papa Bear Powell does on the prowl today. If he duels with the market, the market has shown some fear and will lose. It’s up to him and his gang, however, how roughly they want to engage the market in perilous times.

Regardless — as in, even if the Fed takes a less bearish turn against investors today to knock down their foolish exuberance — there are so many other factors pushing against this market that I believe the recent rally has little room left to run from the lurking bear, and I lay out how little its remaining headroom is, even if Powell decides to back off from a serious fight with investors.

Apparently, the boys decided to rumble, and there was, indeed, VERY LITTLE room to rumble before the bear devoured bullish stock investors. And, yet, I had just read how a large number of shorts were again positioned to create another amazing short squeeze that would drive prices up rapidly if Powell even hinted at being dovish and got the market started upward, which he certainly did. So, now, on to reading Powell, and then I’ll write “Part Three” to describe whether the market pulled this sudden reverse swing for the reasons I have been anticipating because it certainly looks like that kind of volatile action, even when many others thought the bull was going to overtake the bear.

Part Three: Powell’s one-two punch

Ultimately, it would appear the rally was already tired and so the bulls gave in quickly to the bears just because the Fed said it would still keep tightening, albeit slower. No Fed pivot! Apparently, there were a lot of bulls who had still priced their hopes of a Fed pivot into the market who could not find, as they digested the Fed’s words, any hint of a pivot. I think the bulls would not have fled so quickly from the advancing bears if they had not been expecting a full pivot, rather than just a slowing in the rate at which the Fed tightens. They acted surprised. While I thought Powell was foolishly dovish earlier in the day for giving any ground to the bulls for their delirious optimism at all, Powell apparently triggered their worst nightmares, shortly thereafter.

I mean the dovish change in Powell’s tone compared to earlier FOMC meetings is quite clear to me as I now read through Powell’s FOMC speech:

In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

No part of that statement nor anything like it had been in Powell’s closing speeches before. The Fed is finally saying, it will start to consider the fact that there is a lot of lag time between their financial moves and economic responses, meaning they may not go all the way until something breaks and that they will slow down to give time for a response at this point. (They apparently don’t realize they are already almost at the economy’s breaking point, but they’re saying they don’t intend to keep going until they see the full economic/inflation response they need.)

Nevertheless, Powell also said the committee fully intends to keep steamrolling ahead with its quantitative tightening in which it reduces its balance sheet, and with that, the reserves of all of its member banks, bleeding money out of the foundations of total money supply. But we all knew that.

So, Powell’s speech sent the market up euphorically, but it was his press conference that brought it crashing back down. While Powell acknowledged that “at some point” it will be “appropriate to slow the pace of increases,” he also made it clear that the FOMC expressed “significant uncertainty” about when that point will come.

Market goes gulp.

“We have some ways to go,” Powell added, noting that the terminal point for Fed rate hikes may wind up being higher than recently believed.

Market goes gulp again.

“The question of when to moderate the pace of increases is now much less important than the question of how high to raise rates and how long to keep monetary policy restrictive.“

So, maybe higher for longer, even if the pace at which they are raised is moderated some. Gulp and gulp.

“Pausing is not something we’re thinking about.”

And that is when the market puked.

As Bloomberg’s Ed Harrison concluded, “the downshift in the pace of policy tightening is now irrelevant.”

It’s all about a higher terminal rate held in place for longer, even if Fed starts to slow the rate at which it takes us there over the months ahead. The market clearly doesn’t read this blog much. My statements have indicated higher for longer than the market wants ALL YEAR LONG.

I don’t think the Fed Funds Rate will make it past 5.5%, however, before something really big breaks. IN fact, I will be surprised if we make it to the end of this year before something so big breaks that it forces the Fed to stop (but not to pivot). In the very least, things are going to get very shaky.

The worst tremors will be due to QT, however, not the rate hikes. We’ve already seen that showing up as the Bank of England took big emergency measures to save all pension funds from a bond-market implosion and as the US Treasury has started talking about doing its own Operation Twist where it buys back some of its own Treasuries at maturity terms that are experiencing liquidity problems and, presumably, finances those buybacks with issuances of new Treasuries at other maturity terms. I don’t think that bandaid will hold up long before much bigger rescues are demanded.

Meanwhile some of the financial dunces who write in the mainstream media are just catching on to the fact that Fed is serious about fighting inflation after all:

Prior to the pandemic, the Fed’s story line has been that they’d rather let inflation run hot, than allowing inflation to stay too low for too long. It’s easier to deal with inflation than deflation, so goes the argument.

Today, Powell says it’s the other way around. It has tools to clean up over-tightening rather than to let inflation stray from the target for too long.

Times have changed.

If you’re really lame and really slow, you think times just changed “today.” You think this was a pivotal moment (and, so, the market spun on its head today because it has been listening to people like this who say what it wants to hear all year). It is unforgivable for financial writers to be that slow on the uptake. It is unforgivable because it is probably not even possible to be a financial writer and be that naive, so it forces the conclusion that they are lying and just gaming the market; but who know, there are obviously a lot of investors who are that dim, so maybe the writers are, too.

You’ve been reading here all year long in endless repetition that the Fed will fight inflation and will keep tightening until it breaks the economy because it has a legal mandate to fight inflation, which won’t easily go away, and because the Fed’s only other mandate (keeping the job market strong) is not (based on how the Fed is understanding the job market) giving the Fed any latitude for backing down from the inflation-fighting mandate. That’s the story of the year and has been all year long.

The economy will break before the Fed gets anywhere near the level of interest rates I showed in my last Patron Post as necessary to kill inflation with interest alone … at least, in terms of what it has always taken to break inflation’s back in the past.

As ZH summarized,

So the pain will continue until inflationary morale improves…

In the final analysis,

Arguably, one might believe The Fed wanted to get financial conditions back under their control… …and once again stomp on the over-enthusiastic hope of equity market dip-buyers.

It certainly played out as a “raise their hopes then kick their heads in” kind of day — sort of a “let’s give the pivot nuts a little air to breath and then stomp their flame out as quickly as it rises to make the point about who is boss here.” Whether it was or not, it worked that way. At least, for today.

It actually kind of surprises me, though, that it took so little of a kick in the head to do it. Not only did the hope of a pivot vanish because it could not be found anywhere in Powell’s statements, but his statement that the Fed is not even thinking about a pause was probably the big factor. (Which, of course, they are not, and Powell in the question-and-answers strongly emphasized twice that it is “VERY premature to be thinking about pausing;” but we cannot expect the bullheaded to have realized this without hearing Powell say it quite plainly … at least, twice.)

To be even more clear, when asked if Powell was bothered by the market going up after his speech, he added in the comments segment, “There is no sense that inflation is coming down…. We’re exactly where we were a year ago.” That should have gotten to the bullheads. He even reiterated,

I would also say it’s premature to discuss pausing…. It’s not something that we’re thinking about. That’s really not a conversation to be had now. We have a ways to go. And the last thing I would say is I want people to understand our commitment to getting this done…. Our job is going to require some resolve and some patience over time. We’re going to have to stick with this.

(From the video above.)

I think maybe he finally got the point home. Who knows what tomorrow will bring, but my initial claim that the steep late-October rally had fainted away on the last day of the month and would likely be put to final rest today, seems to have played out. I could be wrong, but I also think it’s going to be a little harder for the bulls to get their enthusiasm back this time. Still, they are endlessly dumb, so who knows for sure? At the moment, they appear to be lying on their sides and breathing hard.

Powell still says a soft landing is possible.

The Powell No-Point Landing

The Powell No-Point Landing

Again, the interview with Tom Pochari during Powell’s talk and during the market’s response, as well as about what really needed to be done to avoid the now inevitable collapse, can be listened to here.

Liked it? Take a second to support David Haggith on Patreon!