I think Fed Chair Jerome Powell is making a mistake about inflation today just like he did at the start of inflation when he repeatedly said it was “transitory.” He is no smarter about inflation now than he was then, and there is no reason to believe he would be. Why would you give him the benefit of the doubt when he and his coven of banksters did their best to help create this mess we all now suffer through and didn’t see what was coming when they were the ones who created it? Others could see it was coming, yet the Fed kept creating it even when others were saying, “Shouldn’t you be stopping that now since you say you believe the economy is so strong?” But Printer Powell kept right on running the money presses even when their bearings were smoking.

“Inflation is moderating”

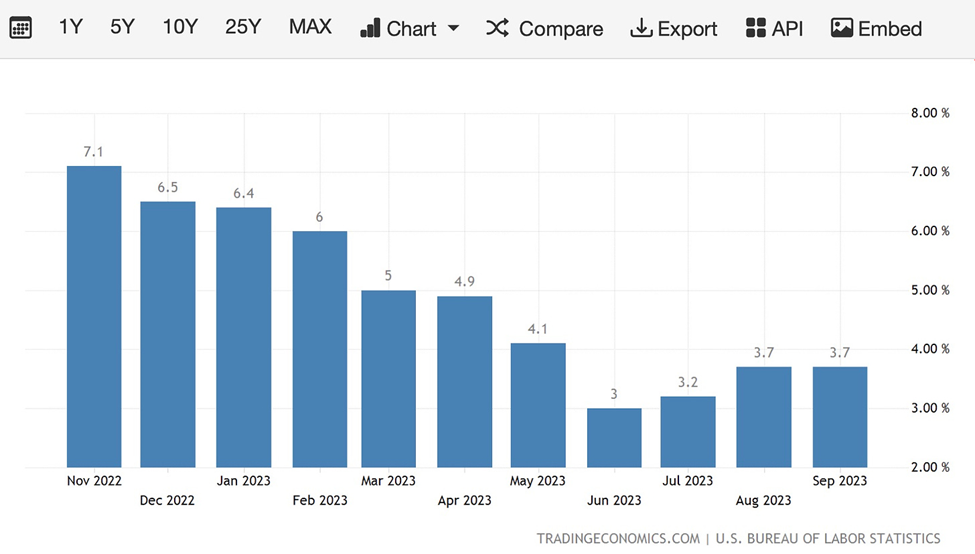

Today, Powell said that inflation has been “moderating” over the summer. That’s not really true, and it misunderstands were inflation is going in a way that could give rise to worse inflation like we saw back in 70’s and 80’s when the Fed backed off from its rate hikes, and inflation went back out of control. The Fed thought it had things about where it wanted them to be headed back then — not that inflation was down to where it needed to be but that they could back off on tightening because it was slowly falling on a year-on-year (YoY) basis and would keep doing so.

Pope Powell, to whom all mainstream financial writers bow or genuflect, believes inflation is still “moderating” for the simplistic reason that year-on-year inflation has gone down each month; i.e., October’s comparison of prices from Sept. 1, 2022, (365 days) through August 31, 2023 is a smaller percentage increase in prices than we saw in September’s comparison of prices from Aug. 1, 2022, through Sept. 30, 2023

That is as simplistic as “transitory” inflation was because it compares one-year periods back to when the decreases from one month to the next, aggregated over a year, were much different than they could be expected to be as we get closer to the target, and the earlier months with the bigger numbers fall off the radar screen as we move the scope of time along. That is called a base effect, which gets too complicated to explain here. (Maybe in a “Deeper Dive.”)

There is no base effect if you look at month-on-month (MoM) inflation because we are only looking back a single step. The last three months of MoM inflation in the PCE index have been growing as have the last three months of annualized inflation in the CPI. As the months ahead keep rising like that over time, the curve for YoY inflation will also start rising again. It depends, of course, on whether you look at CPI or PCE and what categories you include, but the stuff WE all include because we pay for it, food and fuel and healthcare, is rising! I think once again the Fed is looking at the wrong thing.

Here is what is true about annualized CPI inflation in each of the past months:

Clearly, each of the last three months has gone higher than the amount of inflation in the month before or stabilized at the higher level — the annualized inflation rate one month versus the annualized rate the next month. From month to month, they’ve stepped up, even if they are much lower still than a year ago.

The question is whether the monthly rises in CPI will turn back down before they become big enough and happen for enough months to start pushing the YoY curve back up … on all indices. The Fed may be as wrong in ignoring those minor upturns as it was in believing the initial months of inflation nearly two years ago were “transitory.” These present months may not be transitory rises any more than those were. In fact, I don’t think they will be. (Maybe I’ll dig into that in the next “Deeper Dive.” I haven't decided yet.)

In that case, the Fed taking its foot off the brake and coasting for a couple of months could turn into a problem. I’m not saying the Fed is wrong to give pause to see what happens here, but I am concerned that they keep talking about YoY PCE inflation improving and saying nothing about other metrics that are clearly getting worse or about CPI getting worse. It makes me think they will be as slow as they were last time to see what is forming. Their collective eyes do not seem to be on the right number. At least, Powell’s statements are not.

No recession anywhere in sight

Just like we all remember when Powell said over and over that inflation was “transitory,” many of us remember when Ben Burnthebanky infamously said there was no recession anywhere in sight back in the middle of 2008 — some six months into the Great Recession, as it later turned out. These guys like “Let her burn” Ben can’t feel the heat coming when they are already standing in a forest fire.

So, in similar style today, Powell is now saying there is no recession anywhere in sight. He doubled down on that during his comment session by saying the Fed is not revising its “no recession” prediction. Powell went so far as to state there is nothing in the data now that would indicate a recession in the near term. That isn’t true, and you have to wonder how they can be that blind to so much data.

One big story in the news today that got overshadowed by all the attention on the Fed’s FOMC meeting and on the Treasury’s announcement of its new schedule for bond auctions (and the amounts and tenure of each auction) was a major manufacturing survey that now screams stagflation and recession in the same breath. I have consistently said we are cruising into a stagflationary recession – one where will experience prices rising even as jobs are falling, unemployment is rising and GDP is falling.

Apparently the Fed’s data chooses to ignore as indicators of coming recession such tings as the rising number of bankruptcies, rising loan defaults, maximized credit-card debt, limited savings, plunging stocks and plunging bond values and falling home values (huge asset losses) as indicators of coming recession on the basis that they are merely causes of recession. I’m not sure how that makes sense. If a tsunami may cause a boat to swamp, isn’t a visible approaching tsunami a good indicator of the possibility that your boat may soon swamp?

If the Fed really believes the economy is strengthening, as Powell claimed today, you have to wonder how they can simultaneously believing their work so far is doing the job of cooling the economy, which needs to happen to bring inflation down. Their beliefs that the economy is strengthening and they are beating inflation seem at odds. The truth is that the economy is not strengthening:

ISM's Manufacturing survey today printed well below expectations at 46.7 v. 49.0. Any number below 50 is considered recessionary. Demand conditions were noted as historically low, and employers stated on the whole for the first time since July of 2020 that they expect to make employment cuts soon. In conclusion, they noted that a reading 46.7 implies a -0.7% drop in GDP for Q4. That would be a rapid change from the 4.9% increase we just saw reported for Q3. (More data the Fed is ignoring.)

Phantom inflation explains it all

In my opinion, the huge increase in the Q3 GDP growth rate was almost all inflation because all well-studied, thinking people know that the federal government does not count inflation as high as it really is. That, in turn means it does not subtract out enough inflation when it calculates real GDP, which is supposed to cut out all inflation because the goal is to measure production not inflation but production is measured in dollars (and real GDP is the kind of GDP we are talking about all the time).

The government’s estimate of housing inflation is ludicrous even in concept, resulting in numbers that look far out of line with many people’s reality, and we know the government number manipulators massively understated health insurance inflation for the entire year, as I wrote about earlier, reporting it as a major negative (i.e., reducing reported inflation) because of adjustments they said they were making for previous years’ mistakes. It was a massive year-long adjustment that means reported real GDP needs to be adjusted down, at least, one full percentage point just over healthcare, maybe more. We should get a better sense of that in the next inflation report when the adjustment/reconciliation of past errors finally goes away.

That reconciliation also means social security benefits did not go up as much this year as actual inflation rose (and they never have in any year), and it means that consumers probably did not spend above inflation, as reported, because they were paying a lot more out of pocket for healthcare that wasn’t included in reported inflation. They were probably paying out more in housing expenses than was included in inflation. So, total sales of goods and services looks like they rose by more than the rate of inflation ONLY because the rate of reported inflation that sales are compared against did not rise as much as the actual inflation that consumers are paying. I believe a major part of GDP was nothing but an unreported inflation effect — inflation that was left in the real GDP numbers because the government is miscalculating by a wide margin.

Consumers are not keeping ahead of inflation. They are not even keeping up with it. The increase in what they are paying out in the reported sales of goods and services is only higher than the reported increase in prices because the reported increase in prices is a bald-faced lie made up of housing calculations that are a total farce and a negative medical costs rate that is just a reconciliation number for past errors. I guarantee you there were very few real people paying less this year for actual health insurance than they did last year.

So, no the consumer is not holding up, and real GDP is NOT as high as reported because it is not REAL at all. Raw GDP is adjusted with fake inflation numbers, making every quarter, making it fake real GDP every step along the way! Yes, “fake real.” And some of it, such as the healthcare numbers and the housing numbers, are so blatantly distorted you have to wonder why no one in the mainstream financial media is pounding the point every time the subject comes up.

The latter, for example, is “scientifically” determined by asking a random sampling of homeowners of unknown brilliance who have not rented a house in years what they THINK their house would rent for in their market today if they were renting it … as if costs of ownership are EVER equal to costs of renting, except rarely by coincidence, anyway.

You might, for example, live in a house you just bought new with high mortgage rates, versus your neighbor renting a similar house that was bought by his landlord ten years ago at a much lower price with lower mortgage rates. That landlord may be able to rent it out for a lot less than what you pay to “own” a house and still make a huge profit, which he might do if you are a longterm, excellent tenant he wants to hang onto. It can go the other way around, too; so, there is no way of knowing if basing ownership costs on rental values is even close to accurate.

Rents also have huge lags in the rate at which they may rise compared to mortgages because they typically are locked in for a year on a lease. So, when mortgage rates are soaring every week, new ownership can rise in cost faster than rents can rise. Of course, not everyone who owns a home bought when rates were this high. So true home ownership costs are a lot more complication than just GUESSING your house’s rental value.

Meanwhile, as for the Fed getting any slack from jobs to justify their rest in rate increases, jobs went back to supposedly rising again, but I’ve given my many reasons in the past for thinking the acronym for the Bureau of Labor Statistics – BLS – actually stands for Biden’s Lying Statistics (but could just as well have been Bush’s Lying Statistics or ‘Bama’s Lying Statistics because it appears they all politically adjust the BLS numbers as much as they can get away with for the benefit of their own administration, putting their now designees in charge to do it). The revisions in labor data as months go by have also been far worse than in GDP; and the adjustments from the raw numbers, every bit as obscene as the healthcare reconciliation number.

Bottom line, we may have to judge when REAL recession hits by how it feels and what we see happening, not by the fake numbers that are built off of other jury-rigged numbers. Real GDP has been fake news for a long time because inflation has been fake news for a long time. (To learn more about how it is always understated, I recommend looking at Shadowstats.com.)