Fed Chair Jerome Powell did the best he could with the limited options the Fed has created for itself, and he said nothing unexpected. The Fed will continue its course at a slower rate of interest rate increases but raise interest to a higher level than it has thought it would have to all year and higher than the stock market has believed.

All totally as expected here, but causing the market to lose all of what little lift it got the day before from the improving inflation rate because it didn’t expect enough.

Then The Fed and Powell’s presser smashed the vase of fantasy on the ground of reality with a hawkish statement and projections and an even more hawkish Powell.

So, the S&P and Nasdaq remain bound within the bear-market trading range they have been in all year, and the Dow, which broke out of that range, looks to be headed back down into it.

While there were no surprises, one of the dominant themes was the blind spot I pointed out a few months ago that I said the Fed would get hung up on, causing it to over-tighten as it moves forward. Powell took any doubt off of that by saying multiple times during his prepared speech and his Q&A time afterward that the one signal the Fed will be watching more than any to figure out when to stop raising interest rates is a meaningful move up in unemployment.

The misunderstanding of languishing labor

While Powell continues to say the labor market is strong, he confirmed that that labor force (the number of people ages 16 and older who are employed or actively seeking employment) is badly broken and won’t likely recover for some time. He stated the same numbers I gave months ago, which is that size of the overall labor force is about 4,000,000 workers lower than where it would be if the longstanding and consistent trend for growth in the participating labor force had not been broken by the Covidcrash. For the second time that I’ve heard (his Brookings talk being the first), Powell is now recognizing the contributing cause I pointed out back in September, which is the number of Covid-related deaths and illnesses.

So, Powell is coming along in recognizing the labor market is broken and why; yet, he keeps saying it is strong because there are far more jobs open than there are laborers. I keep hearing that serious misconception all over the place:

AP repeated the error even when it wrote at the start of this week about the serious ramifications of the wounded labor force:

A diminished US workforce could lead Fed to keep rates high

Still eager to hire, America’s employers are posting more job openings than they did before the pandemic struck 2½ years ago. Problem is, there aren’t enough applicants. The nation’s labor force is smaller than when the pandemic struck.

The reasons vary — an unexpected wave of retirements, a drop in legal immigration, the loss of workers to COVID-19 deaths and illnesses. The result, though, is that employers are having to compete for a smaller pool of workers and to offer steadily higher pay to attract them. It’s a trend that could fuel wage growth and high inflation well into 2023.

In a recent speech, Federal Reserve Chair Jerome Powell pointed to the shortfall of workers and the resulting rise in average pay as the primary remaining driver of the price spikes that continue to grip the economy….

Yet with price increases still uncomfortably high, Powell and other Fed officials have underscored that they expect to keep rates at their peak for an extended period, possibly through next year.

So, the leading-edge news I gave months ago about the true situation in the labor market is finally filtering through the mainstream press: part of the cause of the labor shortage is Covid-related deaths and illnesses (without stating that some of what is called “long Covid” could be vaccine injuries). They state that this shortfall in workers is going to continue to fuel wage inflation, which will fuel general inflation well into 2023.

Powell reiterated today the following points, which AP noted he made in recent speeches before this week’s FOMC meeting:

In his recent speech, Powell noted that there are now about 3.5 million fewer people who either have a job or are looking for one compared with pre-pandemic trends. Of the 3.5 million, about 2 million consist of “excess” retirements — an increase in retirements far more than would have been expected based on pre-existing trends. Roughly 400,000 other working-age people have died of COVID-19. And legal immigration has fallen by about 1 million.

Powell is assuming 2-million of these lost laborers are due to “excess retirements,” but the Brookings Institute says, at least 2-million and likely 4-million are due to “long Covid.” Powell is moving into the Covid camp, but not all the way there yet. The importance of this realization is that dead workers clearly will never come back and those with longterm illnesses, regardless of how they got them, may not ever be able to come back either.

So, Powell admitted this shortfall is going to endure, and he also said the numbers may actually be much higher than the 3.5-4-million, which he acknowledged today is the conservative number for the shortfall. He also said there are many other paths by which you can reasonably argue for a much higher shortfall in the participating labor pool.

The impact of this labor crisis on GDP is significant. You may have already seen the reality of what AP reports in your own life, and I know I have seen it at many establishments in my own small farm-town community:

Besides fueling inflation, a smaller workforce is causing other consequences. Some businesses, particularly retailers and restaurants, have had to cut back their hours of operation, losing revenue and frustrating customers.

I’ve gone into a number of local restaurants where I have been told or read over the past year that the menu was cut back due to labor shortages and/or that open hours or days were cut back in order to do what they could with the labor pool available to them. Thus, AP here confirms what I’ve been saying about how you cannot have a serious reduction in the labor force and not have a reduction in production, whether of services or goods. AP notes that improved efficiency could make up the difference, but states that it is not making up the difference and that, in fact, efficiency, such as through automation, has gone down.

Of course a reduction in production (GDP) IS a recession by definition. Typically, the only argument is over how long GDP has to be in decline before we call it a “recession.” Well, that was until the argument recently shifted to say declining GDP simply has to be wrong because “the labor market is strong.”

The irrationality of this argument is that the shortage of labor that is causing production to drop proves we cannot be experiencing a recession (a drop in production). That is, on the face of it, completely irrational, but it comes from entrenched thinking that believes the only cause of a shortfall in labor is an economy that is booming along so strongly that demand for labor is exceeding labor supply due to economic growth running ahead of labor growth.

This misconception is everywhere because we’ve never seen a massive drop-off like this in labor supply, so those writing about it don’t know how to get their heads around it. They interpret it only from the framework they have known all their lives. Thus we see AP, even in this article, which lays out the reasons for the labor shortfall, repeat the exact same mistake:

How the Fed will manage a robust labor market, with its effect on inflation, could prove perilous.

It is mind-boggling to me that they cannot see that labor is languishing even as they describe the internal of causes of labor shortages. How is a labor market that is short, at least, 4,000,000 workers — many of whom died and many of whom now have longterm illnesses — “robust?” Is death robust? Is illness robust? Is a SHORTFALL of 4-million workers “robust?”

They cannot wrap their head around the fact that this is a sick, even dying, labor market that Powell now wants to hit on the head to knock it down further Thus, Powell repeatedly stated today the same point that AP made ahead of today’s meeting:

Powell and other Fed officials have said they hope their rate hikes will slow consumer spending and job growth. Businesses would then remove many of their job openings, easing the demand for labor. With less competition for workers, wages could begin to grow more slowly.

Think all of that through, and you’ll realize the incredible peril involved in thinking the reason we cannot be in a recession after two quarters of receding GDP is that “the labor market is strong.” Powell drove this point home by making it clear the Fed had to see unemployment rise before it will stop increasing interest rates and simply leave them high for longer.

Here is how you think it through:

- Labor shortages are already causing production to fall as is evident even in small towns, such as where I live (and probably evident where you live).

- As a result, there are millions of jobs that have not been filled that remain openly listed.

- As a result of so many unfilled jobs, production fell from the start of the year in exactly the manner that would always in the past have been called a “recession.”

- Because they have so many jobs they would like to fill, companies are clinging to employees as they terminate jobs under Fed tightening by moving employees to other positions that remain open.

- That means, to get unemployment to rise, millions of open jobs have to be eliminated until there are very few open positions for existing labor to transition to. Then some of terminated laborers will start to go on unemployment, instead of moving laterally.

- Eliminating those openings will not impact production because those jobs are just empty placeholders producing nothing at present anyway.

- However, it will take time for the Fed to clamp down on the economy enough to squeeze so many extra open jobs OUT to where available positions realign with available workers, as the Fed says it wants, in order to reduce the pressures of wage inflation.

- Only AFTER available work matches down to available workers will further economic squeezing eliminate jobs that result in a significantly growing unemployment rate.

- The Fed’s policies have a lagged effect, so by the time it squeezes the economy and, hence, jobs down enough to raise unemployment significantly, the squeeze will have become quite severe.

- Reducing jobs and employed workers further when we know efficiency is also falling can only mean a greater drop in production.

- Guaranteed lower production equals even worse shortages.

- Worse shortages put a lot of upward pressure on inflation, possibly making the whole inflation squeeze futile in the first place, depending on whether the Fed catches a break from all the other causes of shortages.

THAT is the great peril here. The Fed could make shortages so much worse at a time when we already have too few workers to produce the goods and services we want or need that we could hit Great Depression levels, especially given the long lag effect between Fed policy and then between job losses and inventory draw downs as shortages in inventory in some businesses result in shortages in inventory in other businesses that cannot get ingredients or parts. Reduced production, worsening shortages, could likely cause a resurgence in inflation before the Fed is even finished battling it. (And will the Fed even understand the resurgence when it hits, or will it continue to think that means it needs to tighten down on employment even harder?)

Misunderstanding the present labor market by thinking it is strong is likely to prove to be the worst mistake the Fed has ever made. And THAT is the scenario I’m predicting for 2023. 2022 was all about shortages leading to inflation leading to Fed tightening, leading to stock and bond market crashes, all of which we saw. 2023 becomes all about the dire failure of the inflation recovery plan, resulting in worse shortages and possibly a resurgent inflation problem that is more deeply entrenched, and an amplified recession because the Fed doesn’t believe in the present recession solely due to its false belief in a robust labor market, rather than a sick and languishing labor market.

Three months ago, the Fed’s policymakers estimated that the unemployment rate would rise to 4.4% next year, from 3.7% now. On Wednesday, the policymakers may forecast a higher unemployment rate by the end of 2023. If so, that would suggest that they foresee more layoffs and likely a recession.

They did. Powell said the new normal unemployment rate, given the labor shortage, might be 4.5%, and that it might take a higher rate than that to get inflation down. Don’t ask me why that makes sense because it doesn’t in a time where too few jobs are producing anything. (Remember, an unfilled job produces nothing.)

Terminal interest may be terminal indeed

More important than the employment rate Powell is looking for to drive wage-based inflation down is the terminal interest rate he sees as necessary to get there because that will upset every market.

In his speech today, Powell showed graphs of the Fed’s dot plots and stated repeatedly — just as AP reported the Fed has said in the recent past — that the Fed will not lower interest rates at all in 2023. No pivot! While the Fed will make its interest-rate decisions based on the data available to it at each meeting, Powell spelled out that he did not see any chance the Fed would lower interest rates in 2023, nor did any other Fed FOMC member.

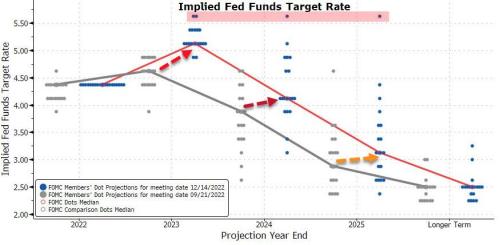

Here is how Fed members revised their collective dot-plot projections for interest rate changes higher up and extending further out at today’s meeting from where they were at the last meeting: (Each blue dot is one Fed member’s projection at the present meeting of where the Fed’s highest base rate will be in each year ahead, while the red line tracks the median level in each column. The gray line and gray dots show what Fed members had projected at their September meeting.)

Powell admitted that ALL of of the Fed’s dot plots for terminal interest rates had been too low all year long so they were revised upward at each subsequent meeting. Then he admitted the Fed had to revise them upward again at this meeting to a projected terminal rate around 5.25%. Moreover, he said he could not say with any confidence the Fed was not underestimating this time by just as much as all the previous times.

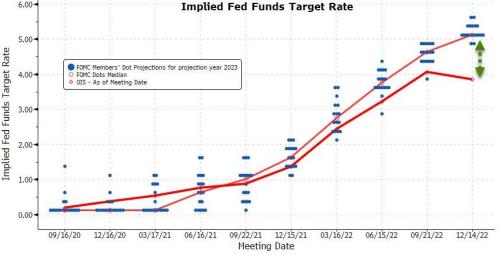

In fact, it’s been longer than all year long that Fed members have had to revise their projections upward. Here is where the Fed set its overnight-interest-rate projections for the year 2023 at each Fed meeting (blue dots) in past months. You can see how, at each meeting since March, 2021, the Fed has had to raise its projections (thin red line) higher for the highest interest level it believes the Fed Funds Rate will need to reach in 2023: (Each column of dot clusters are the member’s projections for that month as to where interest would peak in 2023.)

That is a lot of serious underestimation for 2023’s terminal interest rate at each meeting along the way, and Powell looked a little embarrassed in saying today they all had to revise upward again at this meeting, and that he couldn’t promise they wouldn’t have to do so again at the next meeting.

Stocks still have it wrong, but they will get it right if it kills them … and it will!

Blackrock, the Fed’s agent for everything these days, warned the stock market yesterday,

Don’t expect the Fed to save the day – it’ll keep interest rates high even if a recession crushes stocks next year

Don’t assume the Federal Reserve will bail out US stock markets and bonds next year if they get hammered by a severe recession, a team of BlackRock strategists has warned….

The Fed’s actions are likely to fuel a selloff in stocks in 2023, as its tightening campaign plunges the US into a recession, the strategists at BlackRock’s Investment Institute said….

“Major central banks will hike rates again this week: getting inflation down means they need to crush demand, making recession foretold….”

The Fed, the BoE and the ECB are so focused on restoring price stability that they are unlikely to support financial markets and the economy by slashing interest rates, even if there’s a recession….

“Markets are wrong to expect them to later come to the rescue….”

BlackRock’s bearishness comes even though stock markets have rallied in recent weeks, buoyed by the idea the Fed might “pivot” — or switch back its course — to begin easing up on tightening in the second half of 2023….

“Never going to happen,” said I. “No pivot!”

Powell pounded that point in the Q&A today since the idiot market refuses to accept it, saying he saw no situation in which that would possibly happen or even be considered.

Boivin’s team said that they’d stay clear of both equities and fixed income. They believe the markets’ recent overperformance is based on an assumption the Fed will return to its “old playbook” of low interest rates and loose monetary policy, which it used after the 2008 financial crisis and other earlier recessions….

“Not going to happen,” said Powell … and Blackrock … and they both ought to know as they work hand-in-hand right at the core of all of this. Not going to happen.

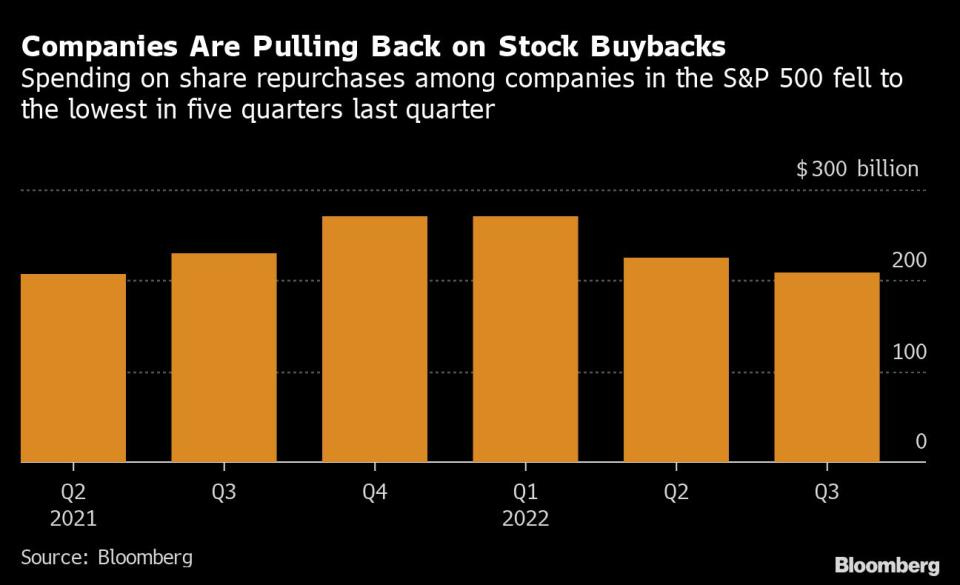

One other thing that I said was likely to weigh on stocks in the final quarter of 2022 was contrary to what Zero Hedge was saying. They said buybacks would start back up and carry the market higher, but I said buybacks were going to diminish because corporate leaders do not like to buy back their stocks in a recession. And, today that was confirmed by Bloomberg:

Corporate America Buys Back Fewer Shares as Recession Fears Rise

US companies are cutting share buybacks to conserve cash in the face of economic uncertainty, which threatens to add another weight to the equity market’s attempted rebound.

S&P 500 Index firms bought back just over $200 billion of their own shares during the third quarter, marking the slowest quarter for repurchases since the middle of last year and coming in roughly 25% below the levels seen in late 2021 and early 2022, according to data compiled by Bloomberg….

The moves reflects mounting anxiety that growth will stall because of the Federal Reserve’s most aggressive interest-rate hikes since the 1980s….

Already, some companies are trying to figure out how best to slice up a shrinking cash pie. Goldman Sachs Group Inc. Chief Executive Officer David Solomon said this month that management teams have to prepare for “bumpy times ahead,” and several big banks recently joined technology giants like Meta and Amazon.com in reducing their payrolls….

Buybacks are a far less disruptive cost to cut than headcount.

Bloomberg via Yahoo!

Bloomberg presented the following graph of their data:

I’m sure you’ll see those stair steps go down another notch in Q4 now that Powell stated today the Fed has finally gotten into “restrictive territory,” which is why it is slowing the rate at which it raises interest in order to ease deeper into that restrictive territory with a little more caution.

And, of course, “restrictive territory” is where you see the breakdowns start to occur as emerged first in crypto markets recently, but the Fed is taking us deeper into a recession Blackrock now says is a “foretold” conclusion and one that might easily become “severe” because there will be no Fed support possible when the deeper crash hits due to inflation.

“Foretold,” indeed. This is right where I said many months ago all of this would end up this year. In fact, every step of the way, was foretold here; and I’m going to lay that all out tomorrow as a path of stepping stones the Fed apparently could not resist and neither could the stock market. Every step of the way.

The full Powell Presser

Liked it? Take a second to support David Haggith on Patreon!