The Dow tumbled hard September 29 to close off a bad September for stocks. No surprise as I believe the market’s fall is certain and soon, because the overhanging cornice of overpriced stocks are just waiting for the right shock to break the cornice off and start an avalanche.

Citgroup’s CEO says they see signs of cracks emerging in the lower echelons of consumers. No surprise, as The Daily Doom has been reporting evidence of the consumers rapidly weakening condition, even while others kept saying the consumer was resilient. Yeah, until the day the savings run out, which was this month.

Investor Bill Ackman believes ten-year treasuries are going to go higher in a hurry. Obviously, I agree, though I will note that Ackman sometimes talks his book, persuading people in his general conversations to do the exact opposite of what he is going to do so he can make bets against their moves. Not this time though, I think.

With all of that in this morning’s headlines, the more important story is from Pam and Russ Martens as they survey the conditions of US banks.

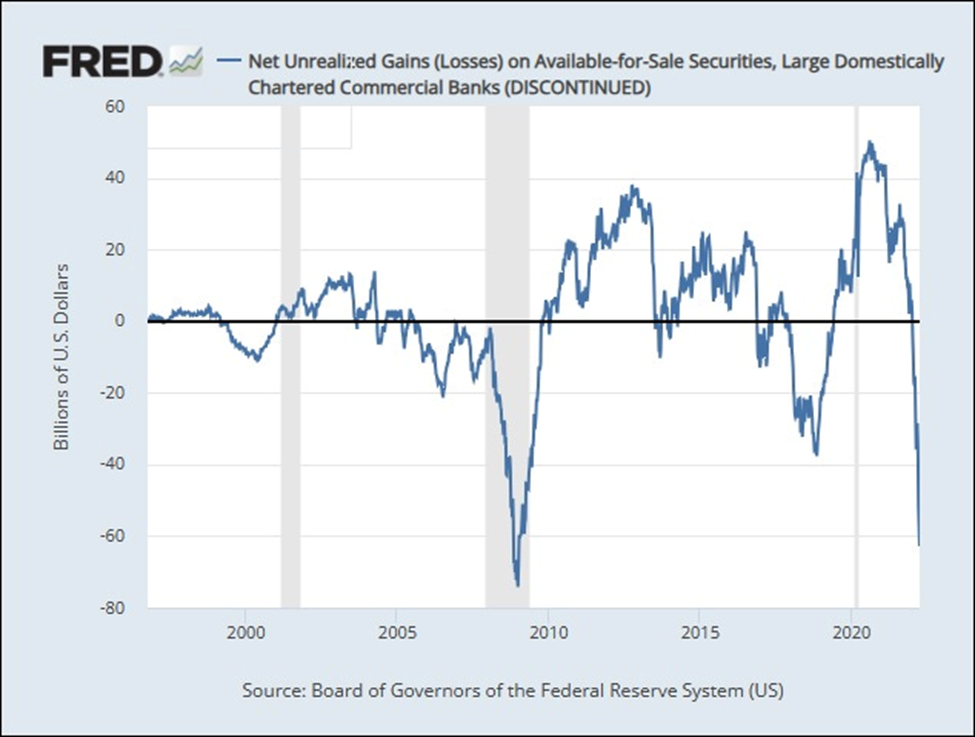

Of course, we know that unrealized losses are mounting in bank reserves as the bonds held in reserves deteriorate in value due to the rapid rise in Treasury interest that will, as Ackman says, continue higher still:

Clearly, you have to go back to the Great Recession to find a time when the unrealized losses in bank reserves have plumbed depths this low. However, that is old news because the graph only runs to March, and that is the bigger concern commented on by the Martenses, which I’ve mentioned briefly once in the past, too: the Fed decided the best thing to do with this horrid news was just to stop tracking it back in March when it went critical. I mean why would we want to track the most critical things.

So, now we don’t really know from the Fed, anyway, how much worse it is, but we do know it is worse because the rise in Treasury interest keeps killing the value of existing Treasuries (and all other existing bonds)! There are, of course, others who calculate what these unrealized losses would be, such as Wolf Richter, but the Fed wants to hide it because it believes in “transparency.” That is what Fed transparency looks like.

Bank games

One way many banks are getting around this shortfall, applying Fed transparency rules, is by selling bonds from their “available for sale” accounts and using the money to bonds for their “held to maturity” account because, even though those bonds will fall further in value, the Fed does not require them to mark down the values because they are promising to hold them until maturity, when the bond issuer will have to pay back the full face value.

That doesn’t change the FACT, though, that if the banks HAD to sell those bonds ahead of maturity in order to raise emergency cash in a crash, they would have to sell them at the lower value. So, it doesn’t make the banks any stronger in a crisis. It just hides the trouble.

For the bank, there is not much net difference in making this trade because they sell the one kind of bond for a loss, but they buy its replacement for an equal discount off face value because the replacements are not worth any more in today’s market, while the face value will make the bank good if the bond does get held to maturity and paid off by the issuer. If it doesn’t make it that long, that’s an entirely different story that we won’t talk about … if we’re a bank. It is not suitable dinner conversation in mixed company.

The Martenses alluded to this as “the basket case condition of Citigroup,” which Citi exhibited quite profoundly back in 2008, and they have this to say about what Citigroup is doing today:

Moving securities around in a shell game to disguise ongoing losses is not what most Americans want at federally-insured banks backstopped by the U.S. taxpayer….

The HTM accounting treatment is allowing banks to create an illusion on their balance sheet as to what their assets are worth. The bigger the dollar amounts held as HTM investment securities, the bigger the illusion….

The largest bank in the U.S., JPMorgan Chase, has transferred massive amounts of securities into the held-to-maturity category….

Raising more red flags, most of these debt instruments were not designated as HTM at time of purchase, which they are supposed to be, but were transferred to that category in 2020, 2021, and 2022.

You can read the article to get a clearer handle on what the unrealized losses will actually be if a crisis emerges that forces them into “realization.”

“I suddenly realized,” said the bankster, “We’re broke!”

The up and up on oil and inflation

It’s always up right now for those two hand-holding partners. It’s just a question of how much. We got a wee bit of reprieve on two critical fronts in today’s news (sort of) — inflation and the price of oil that is driving it.

First, crude oil prices have relaxed a little ahead of hitting the $100 mark, as I said I thought they might (but they haven’t relaxed much), because traders are capturing some of their profits. My last statement on that was that such a sharp and protracted escalation as we saw this summer might naturally see a little correction. That would be particularly true, as we now close the quarter. However, the analysis done on Oilprice.com today shows all the reasons or causes that were likely to drive oil over the $100/barrel mark in October are still present and still pushing.

Oil did push up overall PCE inflation (the Fed’s favored gauge) with a rise in the energy component of PCE; but oil price increases have not yet started to push up other prices. Nor would I expect them to this soon, as there is a lag time that I’ve noted between the rise in the cost of crude, then the rise in the cost of fuels made from crude, then the rise in the cost of goods made from petroleum products/chemicals/plastics made from crude or made using energy supplied by petroleum, and finally the rise in the cost of shipping those goods or providing those services due to fuel prices. These all work into the final cost of goods sold, and, these will all start feeding through in the final quarter of this year.

That means the lull is nothing but the calm before the storm. Even so, headline inflation did go up, just not much. (Only a tenth of a percentage point higher for the overall annual rate.) It is still another move in the wrong direction, all the same.

Which means the Fed tightens another notch higher this year and holds for longer as it has clearly indicated it will do and maybe finds it has more notches to go next year if the recession hasn’t already caved the economy in during the quarter that begins a couple of days from now. Which means Treasuries rise more in yield, as Ackman has said and probably quickly. Which means banks lose a lot more in the REAL value of their reserves if they need to access them now and don't have the luxury of holding them to maturity.