In recent news, John Rubino puts us on “recession watch,” confirming the things from his perspective that I’ve been saying about our slow slide into recession, despite how the latest “real” GDP report from the Biden administration turned out, which I think was a lot less than “real.”

Several typically reliable signs of recession are now in play

Here are bullet points of the reasons in his article for believing we are sliding into recession:

-

Just as I did recently, Rubino points out that the yield curve is reverting to normal and that reverting to normal is exactly what it does immediately before recession. Many think that the yield curve inverting signals a recession, and it does; but that move just cocks the gun and says “Get ready.” What pulls the trigger for timing is when the curve reverts to normal. We just hit that point where the bond yield curve normalized.

-

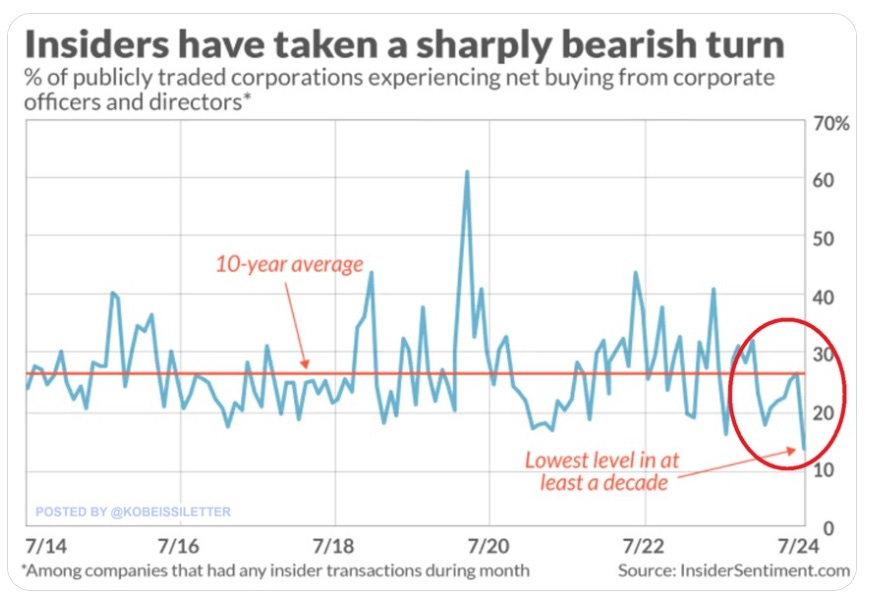

Corporate insiders are selling. Who knows their company’s internals better? Rubino gives the following graph:

That’s uberbearish.

-

Copper prices have been plunging for the past three months. Often called “Dr. Copper” because of how well it diagnoses the state of the industrial economy, copper is watched carefully because it is a fairly expensive metal that is used in many, many things. A long, sharp fall in copper, as we’ve seen, typically indicates a drop in industrial production and construction because both use a lot of copper.

-

Here is one I haven’t heard of tracking before: Copper v Gold. This measures the relative value of copper in a way that has nothing to do with the rise and fall of the dollar. By that standard, either copper has been falling for some time or gold gold rising—one drop being indicative of a lack of production in the general economy; the other’s rise of a lack faith in the general economy.

Jobs are JOLTing downward

I’ve said much about the unreliability of labor metrics and noted that the recent upturn in jobs might be another one-time flash in the pan because it looks to me overall like jobs are finally turning downward (unemployment upward).

I noted last week that the Sahm’s Rule, which says recessions start when unemployment rises 0.5% above its cyclical low, and which had just kicked in, had been slightly undone by last weeks jobs report:

Unemployment went back to falling just when I said it was finally turning…. Initial jobless claims all fell by 10K this week, causing continuing claims to slip back down, too.

So, unemployment may have dipped meagerly below the Sahm’s warning level, but that turns out to be just another head fake in the broken metric as recently went right back to unemployment rising. These head fakes, I said are something I’ve been expecting along the way:

Employment numbers put in head-fakes that made employment the unreliable gauge I said it was, and inflation along with a reportedly “strong and resilient” labor market, kept the Fed from making any rate cuts at all this year as I said would be the case up to this point when nearly everyone else thought otherwise.

So, it is not surprising that the little rise in jobs last week is undone this week, sending things back to the level that means a recession is starting. (If not underway, given the broken metrics involved here.) I’ve always said recession will be underway by the time the labor metrics start showing anything reliably to the Fed.

I didn’t expect to see new unemployment claims fall by 10,000 per week either because it looked like labor really had finally started to put in that turn that I rightly predicted would be VERY long in coming, leaving the Fed no room or legal reason (based on its mandates) to cut interest rates until the turn finally came in; but, at last, I thought the turn was here.

Well, the gauge is wavering, but it looks this week like the turn is holding.

According to the Biden administration’s GDP report, we are far from in a recession, but according to the most reliable recession indicators known to mankind, such as the Sahm’s Rule and the reversion of the yield curve to normal, we are either just starting a recession or already in one. According to numerous other metrics, some of which I laid out in Friday’s Deeper Dive, we are also already in a recession.

Now jobs fall and unemployment rises, again, back in line with being exactly where we would expect them to be if we were starting into a recession. (Of course, I expect that they arrived a little late due to the broken nature of those metrics because of the Pandemic lockdowns throwing all normal metrics way out of whack. But either way, we’re here now according to most measures.)

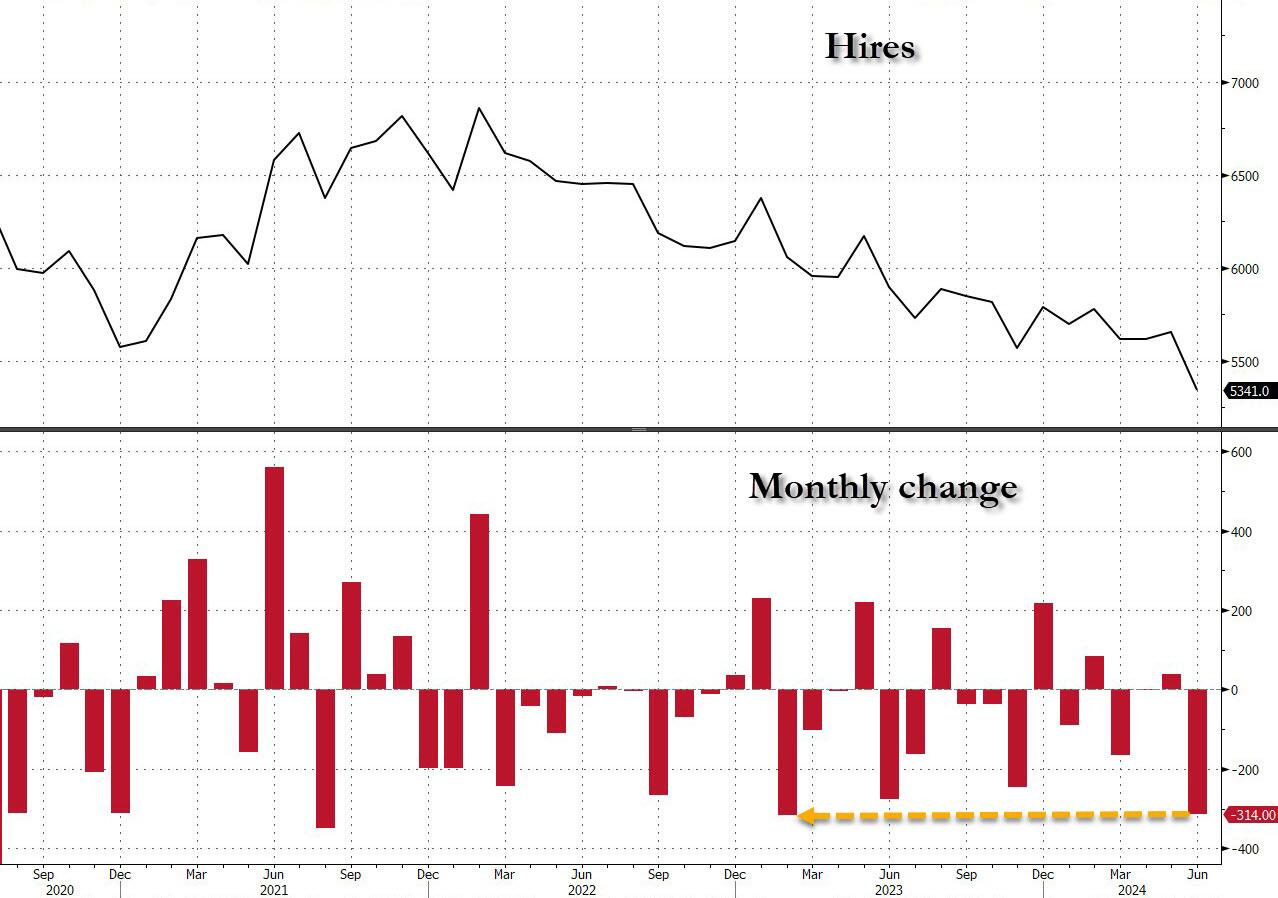

Zero Hedge refers to the JOLTS report on labor as “catastrophic.”

Catastrophic JOLTS: Private Sector Job Openings Plunge To 6 Year Low As Both Hiring And Quits Crater

ZH noted at the start of its article that the head-fake improvement in jobs in last month’s JOLTS report was due entirely to government hiring and that this got somewhat revised away. Then they made the following observation about the report:

And yet, the same data rigging observed last month took place once again, because a quick look at the breakdown shows that while private jobs saw another broad drop in openings across private sectors ... this was almost fully offset by the relentless surge in government job openings. Yes, while May was indeed revised lower, June saw another bizarre jump in government job openings, surging to a near record.

And, yet, even with all that government hiring, the Biden Admin. couldn’t offset all the other negativity in the labor market, so the overall JOLTS report still ended “catastrophically” down.

Putting it all together, while private sector job openings plunged to a level seen back in late 2018, government job openings are just shy of a record high!…

But wait there's more: confirming that if one ignores the clearly manipulated jump in government job openings ("quick, let's hire a ton more TSA agents and deep state apparatchiks to make it seems that Kamalanomics is working"), a quick look at the number of quits - an indicator closely associated with labor market strength as it shows workers are confident they can find a better wage elsewhere - showed a plunge in June, dropping by 121K, the most since July 2023, to just 3.282 million, the lowest since August 2020!

However, the worst news was not in new job openings or the declining number of people confident enough to quit in order to find a better job, but in the number of actual hires:

Worst since the Covidcrash.

And then there is this:

Finally, no matter what the "data" shows, let's not forget that it is all just estimated, and it is safe to say that the real number of job openings remains still far lower since half of it - or some 70% to be specific - is guesswork. As the BLS itself admits, while the response rate to most of its various labor (and other) surveys has collapsed in recent years, nothing is as bad as the JOLTS report where the actual response rate remains near a record low 33%

Nearly 70% of the sweetened number of new jobs are government estimates. They wouldn’t lean high, would they?

And at a time when it is critical for Biden, pardon Kamala, to still maintain the illusion that at least the labor market remains strong when everything else in the economy is crashing and burning, we'll let readers decide if the near record number of government job openings at a time when hiring and quitting are both crashing, is an accurate reflection of a strong labor market, or is merely a reflection of a debt-funded deep state gone full tilt.

Revising away the bad news

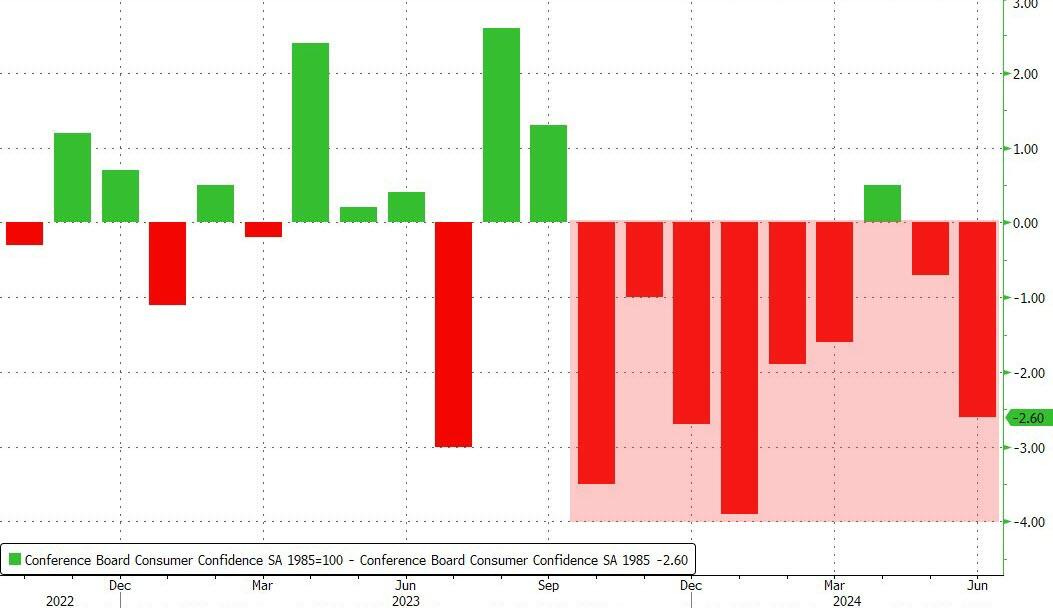

Speaking of endlessly revised numbers—the kind that are reported strong at first but are, for some reason almost always revised to worse when no one is looking anymore, let’s take a look at the government’s report on consumer confidence. Well, actually, let’s just look at how the revisions keep coming in:

Notably, the June revision of consumer confidence, took us out of economic-expansion territory that was first reported and put us clearly into economic contraction. The nice thing about the revision approach is that, besides saving the bad news until no one is really looking at that month any more, the sudden revision in the next makes it easier for that month to go UP, which July did … barely back into expansion to look stable for now. Next month, of course, it will be revised back down into contraction, which will make it easier for August to go up from the newly lowered benchmark of July.

It should be noted as ALWAYS being suspicious when all revisions (but one) go the way that is best for the government’s show-and-tell for months on end. If the revisions were due to errors or better data, we’d expect them to run +/- (both ways).

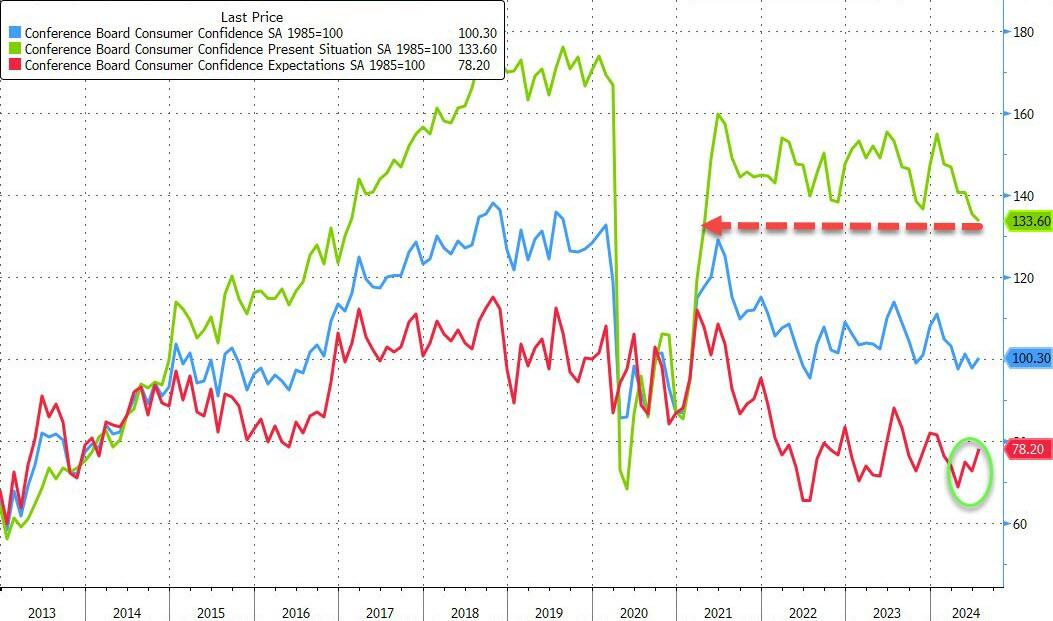

Finally, if you look at the aggregate of various measures of consumer confidence, then by any one of them we are now erasing our recovery out of the Covidcrash:

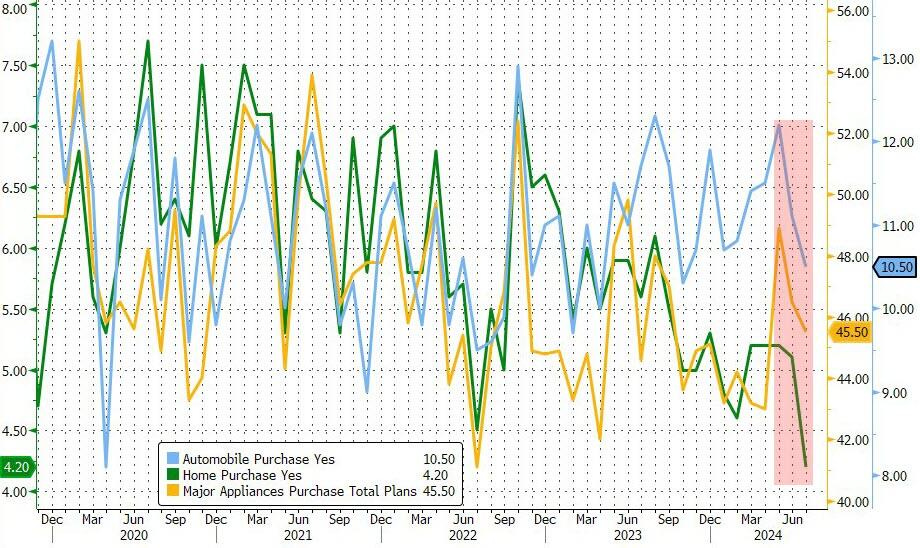

Consumer purchase plans for the big-ticket items are also plunging deep into recession levels, too: (Below 50 is recessionary on this gauge.)